Here’s When Bitcoin Can Hit $318,000.

It’s Anton here, SIMETRI’s Lead Analyst with the scoop on the market. Based on feedback from all of you, we decided to start writing a regular newsletter to help members stay on top of the latest market trends.

If you like this newsletter or have other topics you’d like us to analyze, please feel free to respond to this email! Now onto today’s topic…

This week kicked off with a mouthwatering prediction of $318,000 Bitcoin from one of Citibank’s analysts. While the number seems unrealistic, historic data shows that it’s possible.

The History of Bitcoin’s Growth

Since its inception in 2009, Bitcoin has gone through several boom and bust cycles. This kind of behavior is common, and the ongoing cycle will not be much different.

In 2013, BTC saw two bubbles, each continuing for over 200 days. The major difference between them is that the first parabolic wave launched Bitcoin from $16 to $259 (1,480%), while the second wave was less meteoric, taking Bitcoin from $259 to $1,163 (348%).

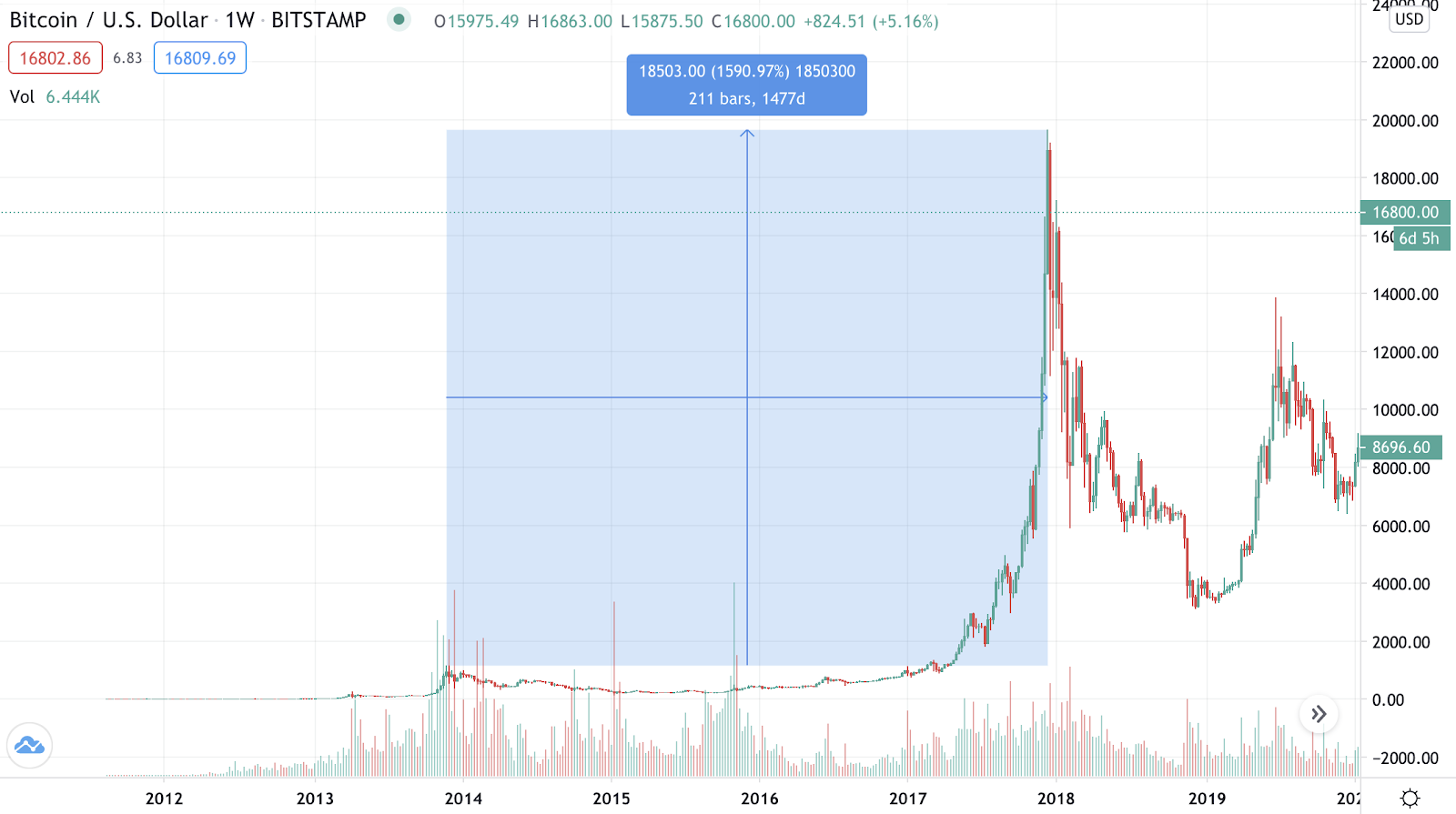

The next cycle continued from 2014 to the end of 2017. It took Bitcoin over three years to go up from $1,163 to $1,966 (1,590%). While the percentage gain was similar to the 2013 cycle, the timeframe was much longer.

Extrapolating previous BTC gains of around 1,500% from the previous all-time high leads to a price of over $300,000 per one coin. However, it may take a while before Bitcoin reaches this price target.

As the chart above shows, extrapolating based on historical data shows Bitcoin potentially surpassing the $300,000 mark on a five to ten-year horizon.

What if Bitcoin Replaces Gold?

Citibank analyst, Tom Fitzpatrick, compares Bitcoin to Gold in his latest report. This narrative has been circulating since Bitcoin’s emergence, but what do numbers say about BTC as a store of value?

Another institutional investor, John Pfeffer, wrote a piece titled “An (Institutional) Investor’s Take on Cryptoassets” back in 2017, shortly after Bitcoin reached the top. John’s article attempts to estimate Bitcoin’s potential upside if it replaces gold after the heavy speculation is over.

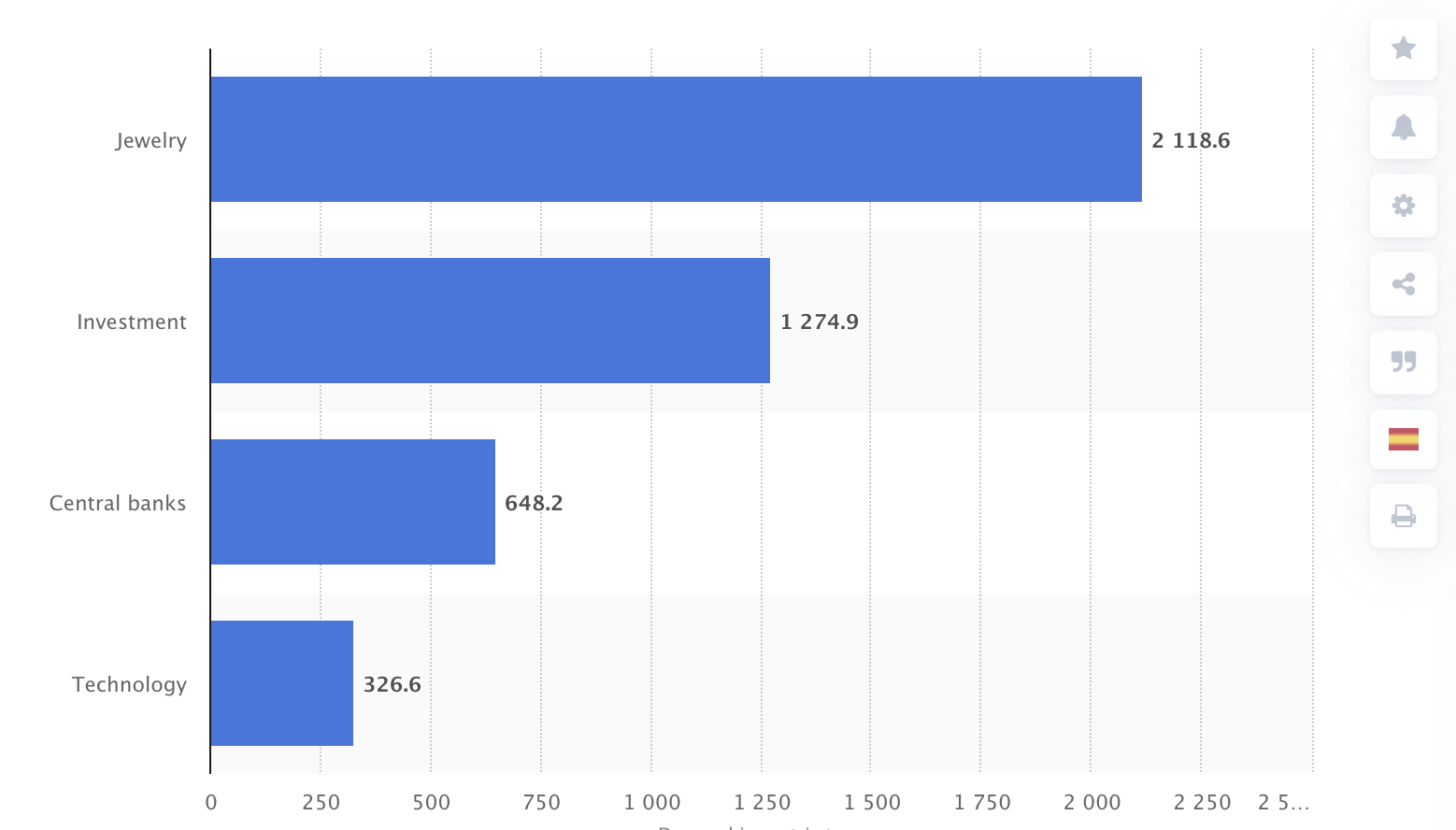

The total value of the above-ground gold stocks by the end of 2019 was almost $12 billion by today’s prices. However, much of this demand goes to jewelry and some of it is required for the tech sector for use in electronics.

Demand for gold by sector in metric tons. Source: Statista

For obvious reasons, Bitcoin can’t address these industries, so its potential market is narrower. According to Pfeffer’s assumptions, if Bitcoin were to replace gold bullion, its market cap on a ten-year horizon will be $1.9 to $6.1 trillion.

The current Bitcoin’s market cap is $311 billion, which means that reaching Pfeffer’s prediction would mean a 6.1x to 19.6x increase in BTC price. That’s $102,000 to $328,515 per one Bitcoin extrapolating from today’s prices.

It’s Not Going to Be a Straight Line

While Bitcoin holds immense potential as an investment, any predictions should be taken with a grain of salt. Previous results don’t guarantee future returns, and it’s more challenging to move crypto prices today than it was in 2013 due to the amount of liquidity that has entered the market.

As Bitcoin matures, it takes longer for it to go through its market cycles. On the way to the top, there will be multiple drawdowns, which may last for years. It took gold ten years to reach an all-time-high in the 1970s, so if BTC repeats this pattern, it will take a while.

On the other hand, the crypto market is relatively small compared to the traditional one. Hence, it may be impulsive. Speculation may induce a parabolic move, which will rapidly bring Bitcoin to new highs. Still, it’s unlikely that a speculative bubble will be enough to get BTC to over $300,000.

Think of who will buy Bitcoin during this up-trend. In 2017, it was mostly retail investors without clear investment strategies or price targets. In 2020, the market is dominated by intuitional investors, who are executing on a longer-term vision for BTC.

Closing Thoughts on BTC’s Next Move

The crypto market is still nascent, but it’s much more mature than it was just a few years ago. As a consequence, the investment approach has become more complex.

While Bitcoin may eventually go up to $300,000, it’s ascent will not be entirely parabolic. There will be sharp ups and downs. So those invested in crypto need to be mentally prepared for a marathon, not a sprint.

Keep your expectations realistic and your asset management on point. Once BTC goes above $20,000, you will see extreme positivity and exaggerated expectations. It will be time to remain calm, observe, and take some money off the table.

SIMETRI will help you navigate when to secure the profits because it’s essential to have dry powder to re-enter the market when it retraces. It’s a long game, and you need to play it right.

We just booked considerable profits with the latest signal on Pro BTC Trader. Entering BTC at $14,585 and riding it to $17,850 brought our subscribers over 22% profit. With 5x leverage, a $100 position on this trade would realize $110. Stay tuned by following Nathan’s Batchelor’s daily trading emails.

In other news, because of unexpected demand, SIMETRI will be increasing its prices to make sure we attract subscribers who have a long-term mindset toward crypto.

On Dec. 1, the price of a yearly SIMETRI subscription will go from $695 to $1,295. We will also be removing the monthly subscription option for new subscribers.

Current SIMETRI subscribers do not need to take further action and your current rate will be locked-in so long as you remain subscribed. You can read more about this here.

I’ll leave you with this for today. Wishing you a productive week ahead.