The opportunity cost

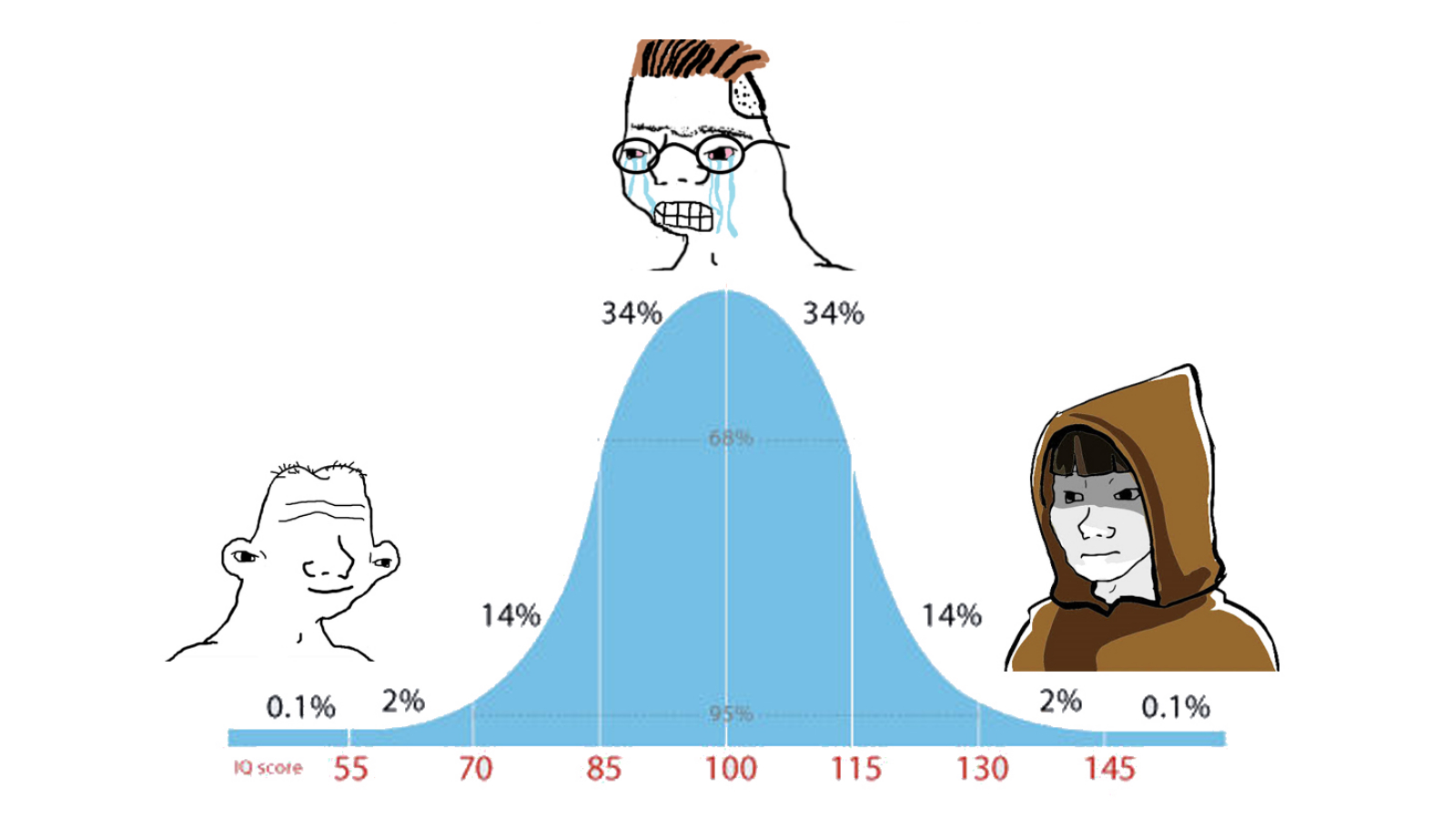

We’re either on the left or the right side of the curve with the macroeconomic conditions. “What’s the curve?” you might ask? Here’s a meme.

People who still think the worst is yet to come are in the middle of the curve. Although the macroeconomic environment is pretty grim, it doesn’t necessarily go down even further, especially given that the European Union and Japan are already testing their limits.

The Fed has to pivot to printing money at some point, at least to help its overseas allies stay afloat. Meanwhile, the market has already gotten used to high CPI prints, poor earnings reports, and high rate hikes.

Being entirely out of the market in this environment has an opportunity cost. While it can go down, the upcoming events in the traditional and crypto space point to growth. Among them are the upcoming U.S. elections and Ethereum’s Merge.

As Morgan Housel pointed out in his book “Psychology of Money”: everything has a price. If you’re afraid of a potential downturn (which is very well possible) and try to nail the bottom, you’re trying to get the market’s upside almost for free. I hope you know that nothing is free.

Staying safe from the market’s volatility means giving up on the opportunity and risking that the market will not go your way. So, having at least some exposure is reasonable.

Forcing one’s thoughts on the market doesn’t work.

The question then is: “which projects are worthwhile?” Let me share some of the good ones that are worth your attention.

Decentralized exchanges

Curve

Curve is a DeFi staple that facilitates low slippage exchange between stablecoins and other assets. The exchange has attracted ample liquidity across several blockchains.

The project’s key advantage is its tokenomics. It enables other protocols to use CRV, Curve’s governance token, to pay liquidity providers. Don’t worry if you don’t understand it. The overall point is that Curve saves other projects maintenance money, which is valuable.

For the end user, Curve is good because its internal mechanism ensures minimal loss of money, even for large transactions. In some instances, there can be no loss (except for fees).

dYdX

dYdX is the leading decentralized exchange with ~$1 billion daily trading volume vs. $100 million on the second best platform. Until recently, its native token, DYDX, did not capture any trading or transaction fees, and the inflation was high to incentivize trading volume. However, that will change soon.

The platform’s new version will launch as a separate application chain on Cosmos, with the DYDX token likely being its native token. Although there are concerns about unlocks in 2023, migration to Cosmos should make DYDX a productive and, therefore, more attractive asset.

Lending platforms

Aave

Aave is the leading lending platform. It was conceived during the 2018 bear market and evolved thanks to an outstanding team of developers. Currently, the project stands out because of its expansion to traditional finance with institutional products like Aave Arc.

AAVE token acts as a backstop for the debt in the system. Holders can stake their tokens to protect the platform if it incurs losses. In return, they receive rewards. The current yield on AAVE is over 9%.

Kava

Kava is a cross-chain lending platform built using Cosmos SDK, which enables interaction with different blockchains such as Bitcoin, Ripple, and Binance Chain. It allows Kava to capture these largely untapped DeFi markets.

While the platform faces challenges such as the security risk of cross-chain bridges, the team has constantly rolled out new updates to improve the user experience and performance, instilling confidence in the project.

Its native token, $KAVA, is used to reward lending on the platform and acts as a governance token to direct protocol earned fees to validators.

Yield aggregators

Yearn Finance

Yield aggregators are essential to the DeFi ecosystem because they let users get passive income without being DeFi ninjas. Yearn Finance is the first of its kind and to this day remains the leader in its niche.

The key differentiating factor of Yearn is that its strategies are hand-made by researchers the project hires. This makes them non-trivial and sometimes creates higher yields than competitors.

YFI, the project’s native token, accrues fees from yield farmers. On top of that, staking YFI generates additional rewards.

Beefy Finance

Beefy Finance’s advantage is its multichain presence. The project offers services across 16 blockchains.

BIFI token holders can earn the protocol fees by staking. The good thing about BIFI is that its inflation recently ended, which means no more new tokens will enter circulation.

Although Beefy’s strategies aren’t as sophisticated as Yearn’s, the project is a solid bet given its tokenomics and multichain presence.

Metaverse

Sandbox

Sandbox is the leading metaverse gaming project, where big names like Atari, and Snoop Dogg, among others, have acquired lands. SAND is the project’s native token and is actively used in the project’s vibrant marketplace.

The team is experienced, and the product has already been made available for users and testers. Sandbox is well-positioned to capitalize on its product and partners.

Metaverse Index

Metaverse Index consists of several metaverse-based projects with more than $50 million in market capitalization.

MVI provides an opportunity to catch the upside in many tokens, which is advantageous for a sector where it’s still challenging to identify potential leaders.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Nivesh, and my colleagues: Anton, Sergey, and Anthony.

Stay safe!