The gambler mentality

As the infamous Three Arrows Capital founders appeared in the New York Magazine and the first post-crash interview with Do Kwon got released, I think it’s time to reflect on the gambler’s mentality in crypto. But as examples, I’ll be using some history and memes instead of Do and 3AC.

A blockchain is merely a form of a database. A powerful one. But it’s rather a tool than a product. Ergo, someone has to make blockchain-based products that people value to increase the value of the underlying technology. SMTP may have been replaced by something else, and you wouldn’t even notice because you don’t even know that it is what enables you to send emails.

Crypto-focused teams come up with all sorts of ways to tell you that their product is the best, and some of them will end up being the best, disrupting the world’s biggest traditional businesses. However, this is not why retail is here.

Retail primarily treats crypto as a lottery or a casino. Otherwise, Dogechain wouldn’t get so much traction so fast.

This chain is only a few days old.

Compare the speed of Dogechain growth with, say, Polkadot. Its mainnet launched in 2020, and so far, it has around 8.5 million transfers on the network.

Dogechain is nothing new, though. After the 2018-2019 bear market, DeFi struggled until Compound launched a liquidity incentive program in 2020. What followed was the so-called DeFi summer.

A vivid example of APYs during the DeFi summer of 2020. Note the name of the project. Source: DappRadar.

The DeFi summer led to significant growth of legitimate projects like Synthetix and Yearn. But the reason for the growth wasn’t that they were great. It was exuberance and the gambler mentality.

Gamblers want to make outsized gains in the shortest time possible. That’s why the echoes of DeFi summer were even more exaggerated.

Look at these APYs on Fantom. Source: HyperSwap.

But, as for any gamblers, the risk for crypto-native ones is ultra-high. The problem here is that the few survivors either forget about how traders got wrecked or don’t bother warning newbies about what can happen.

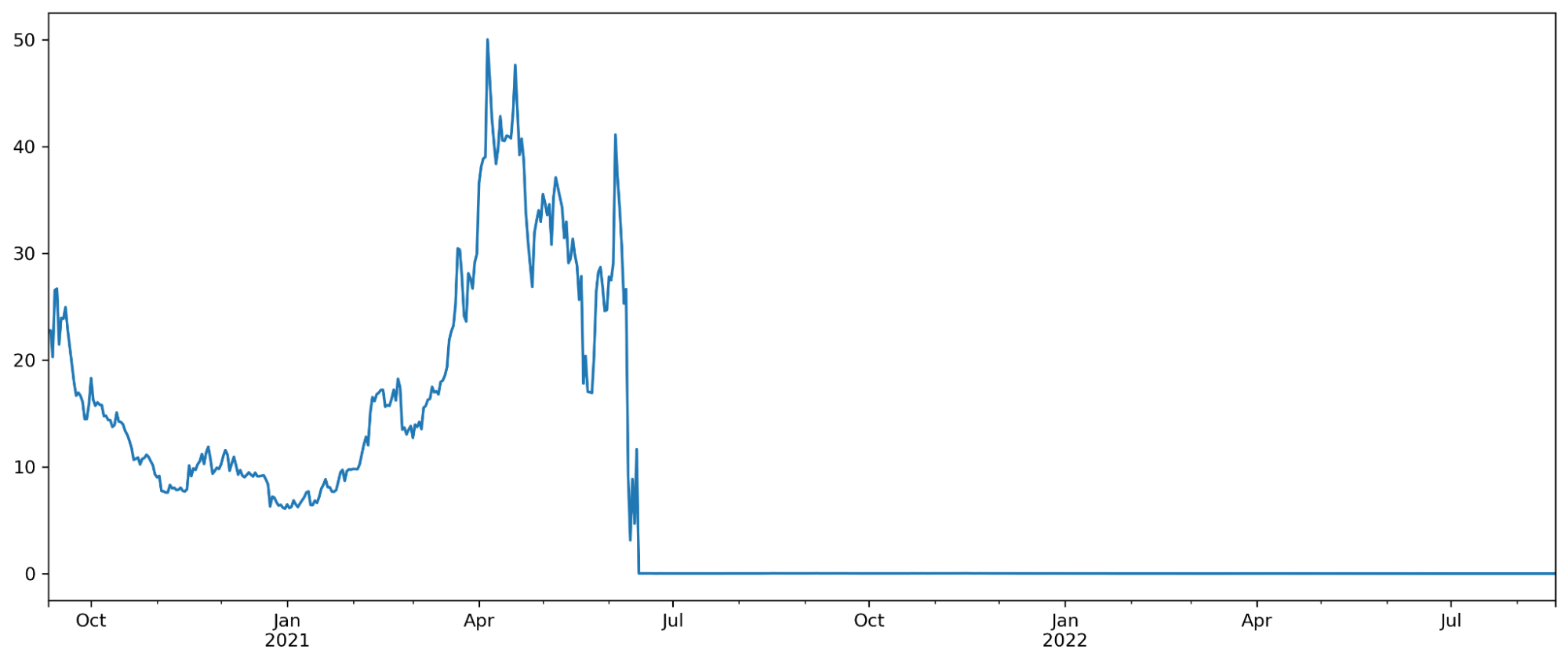

Are you OG enough to remember SUN by his majesty Justin Sun? Source: CoinGecko.

People trade ultra-low caps with 50 members in Telegram, lever up 100x, and watch YouTube crypto-focused videos with people opening their mouths. They lose it all to the revenge trade again and again.

Source: YouTube.

The market listens and responds. Why build something legitimate and potentially end up in a rut if you can make a quick buck by forking Uniswap on a new shiny chain?

The same goes for NFTs. This week we had the conversation captured below. The success of platforms like Sudoswap and Sudo Inu proves Cobie’s point. Why build anything if you can just launch the next 10,000 NFT collection?

Don’t be discouraged by all the above. It doesn’t make our industry worse. The point I want to make is that it’s important to understand what retail is about, why narratives matter, etc. It’s important to know how to survive (which is essentially doing the opposite of retail).

Investing is boring. It shouldn’t give dopamine hits. It’s not about making a gazillion in a day and then getting liquidated a day after. It’s about building a foundation and keeping moving forward wherever the market takes us.

Disclosure: The author of this newsletter holds ETH. Crypto Briefing and members of the research team hold some of the Pick of the Month coins mentioned in the table above. Read our trading policy to see how SIMETRI protects its members against insider trading.