Sushi and the Horse

SushiSwap has been going from one struggle to another for quite some time. I won’t lie, I don’t like how rocky it is for the project, but I also want to give you some context about the latest news and our vision going forward.

If you haven’t already heard, SushiSwap has finally elected a CEO. We’ve waited for this event for several months, and we had anticipated that a CEO appointment would bring more structure to the decentralized mess.

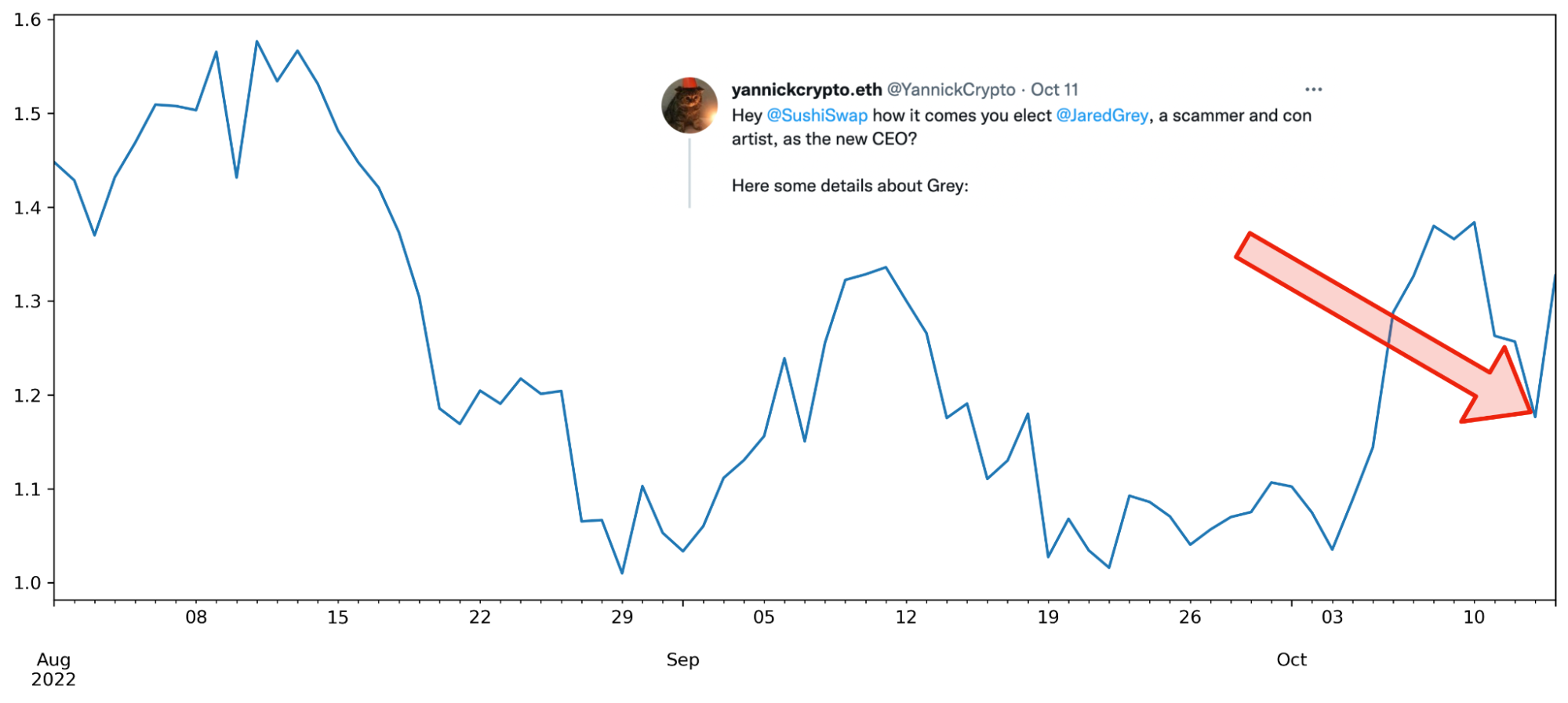

We didn’t have much time to celebrate, though. On Monday, yannickcrypto.eth posted a tweet storm alleging that the new head chef has previously been involved in multiple scams and removed all traces. I won’t go into the horse meme; if you know about it, I hope you had a good laugh, but it doesn’t bring much substance to the discussion.

Source: @docborderline

The gist is that accusations are pretty strong, and from what I read in the links Yannick referenced, his claims might not be baseless. Jared, the new head chef, didn’t deny involvement in failed projects, but he expectedly stated that he wasn’t intentionally scamming anyone. The way he framed it: it’s a startup business, and bad things can happen. I see nothing wrong with such a stance. Just this week, multiple projects suffered major exploits. It doesn’t mean their teams are scammers.

Twitter and SushiSwap’s Discord have no shortage of drama, and the opinions on the matter are mixed. There’s a very high likelihood that the crowd will soon forget about these accusations, as is often the case in crypto. There’s too much information to follow.

We think a leader with a questionable past is better than no leader. While everybody discusses how a “scammer” CEO can drain SushiSwap’s treasury, they overlook how Uniswap’s treasury is being abused because Uniswap Labs doesn’t act as a managing party.

So far, SushiSwap hasn’t been doing well, but that’s most likely because of the market. While its volumes dropped, so did Uniswap’s volumes. Sushiswap is still a top 10 DEX by trading volume.

Sushiswap and Uniswap’s trading volumes (30-day simple moving average) (Source: CoinGecko)

The project still provides a decent APY, and people didn’t rush to unstake after the accusations surfaced.

Note that SushiSwap’s TVL value is calculated in dollar terms. Its volatility on the chart doesn’t mean that people unstaked and restaked their tokens. The SUSHI-denominated TVL has remained almost flat. (Source: Dune Analytics)

The same can be said about SUSHI’s price. Although we’ve seen a drop, it wasn’t exaggerated. Plus, the price has rebounded since.

SUSHI/USD (Source: CoinGecko)

To summarize, SushiSwap suffered from the broader market’s negative trend. Plus, its road so far has been filled with drama. But the project continues to chug along, which is what matters. We won’t attempt to justify the new head chef’s past, and we’ll watch how good a CEO he is. But, so far, we don’t see reasons to overreact.

SIMETRI Portfolio – Driven by the macro

Disclosure: The author of this newsletter holds ETH. Crypto Briefing and members of the research team hold some of the Pick of the Month coins mentioned in the table above. Read our trading policy to see how SIMETRI protects its members against insider trading.