Sit on the revenue pipe

Crypto market activity has subsided after a period of exuberance. Previously, during periods of sluggish growth, miners and exchanges were among the few businesses that continued generating revenue despite a marketwide downturn. Now, things have changed.

Due to the emergence of DeFi, users can extract value from applications like Uniwap or Aave by providing liquidity. When DeFi platforms conduct business, they charge user fees. On many platforms, a chunk (or the entirety) of these fees goes to liquidity providers.

Synthetix Network has recently started to gain usage, generating decent revenue for SNX stakers. This presents an opportunity to capture some of the revenue, but as it requires borrowing funds, you have to be OK with SNX volatility.

Notice the increase in Synthetix Network’s revenue while SNX’s price holds. At some point, there may be a nice bonus bounce in SNX on top of the fee cut. (Source: Token Terminal)

The top applications generating revenue for Synthetix Network are atomic swaps on 1inch, perpetual swaps on Kwenta, and to some extent, the options platforms Lyra and Polynomial Finance. Atomic swaps on Ethereum’s Layer 1 are currently generating the most revenue for the platform.

Atomic swaps let users exchange tokens with synthetic assets and oracles to avoid slippage. This feature is particularly useful for high-volume traders.

The protocol separates fees on Ethereum and Optimism. As atomic swaps take place on Ethereum mainnet, that’s where rewards are higher. Thankfully, the fees on Ethereum are relatively low at the minute, so staking should not require paying an arm and a leg.

The total fees generated on Ethereum from atomic swaps comes in significantly higher than Optimism’s revenue. (Source: Dune)

Besides the sUSD-denominated fee cut, stakers can also receive inflationary rewards in SNX. The token is currently inflating at 46.1% annually. This figure is relatively high compared to other DeFi tokens like Curve’s CRV, which has an annual inflation rate of 12.86%, or Compound and Aave, which respectively emit 5.62% and 1.41% annually. However, the inflationary rewards are locked for a year, reducing the dilution in the supply of the token.

It’s worth noting that SNX has been beaten up due to the recent price downturn, and the accumulation of SNX shorts since May 2022 has increased the chances of a short squeeze. Such moves occur when most traders are shorting an asset, increasing the funding rates (or borrowing rate) on perpetual swaps to negative percentages. This could create a situation where SNX jumps due to short order liquidations, forcing short sellers to buy it and close positions.

Notice the accumulation of green lines, signaling negative funding rates after the prices started declining in May. Negative funding rates signify that shorts are paying borrowing fees to longs, creating the possibility of a short-squeeze. (Source: Coinglass)

How to stake SNX

Staking SNX is not as straightforward as other DeFi platforms, where you only need to deposit tokens. On Synthetix, stakers have to take out debt in sUSD with a maximum collateral ratio of 350%.

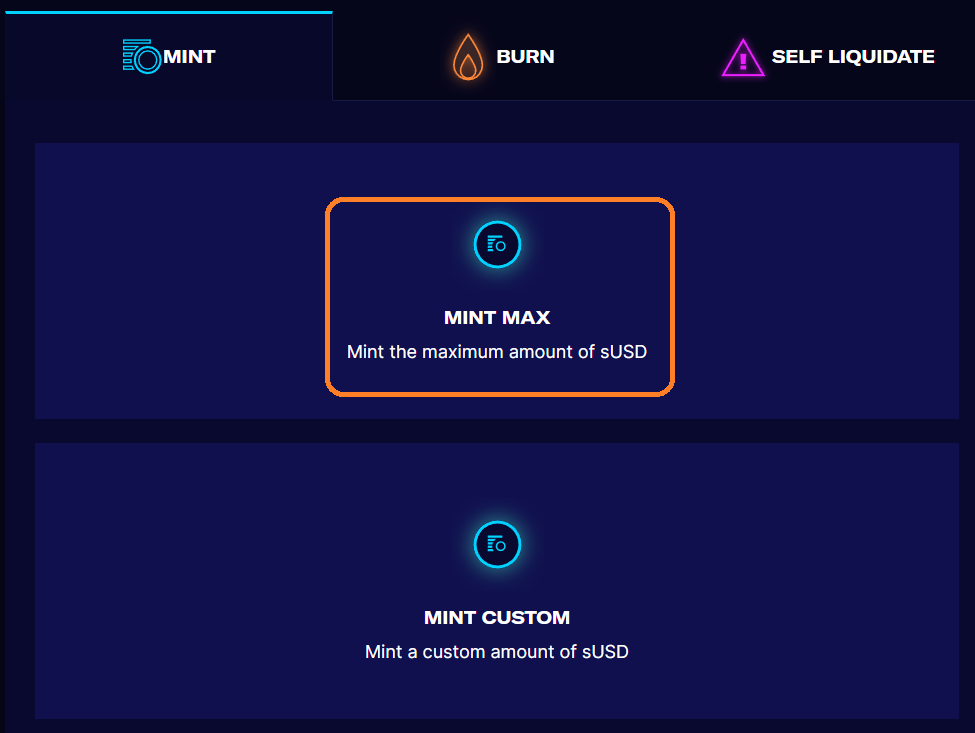

To begin, buy some SNX from a centralized platform or decentralized exchange like Uniswap. Then, go to Synthetix Network’s staking page and mint the maximum amount of sUSD according to the collateral ratio of 350%.

The liquidation threshold on the platform is 150%. If SNX declines too much after you stake, the platform will give you 12 hours to add more collateral and protect the position from liquidation. If you don’t do it, you could lose your SNX.

Minting sUSD on Synthetix. (Source: Synthetix Network)

Staking rewards are calculated and distributed every Wednesday from 15:00 to 16:00 UTC. You can claim them here.

Lastly, debt on SNX includes other tokens such as synthetic ETH (sETH) and synthetic BTC (sBTC). Let’s say the price of ETH rises, increasing the system’s total debt. Since your debt share on Synthetix remains constant, it effectively requires you to pay more in sUSD than you borrowed.

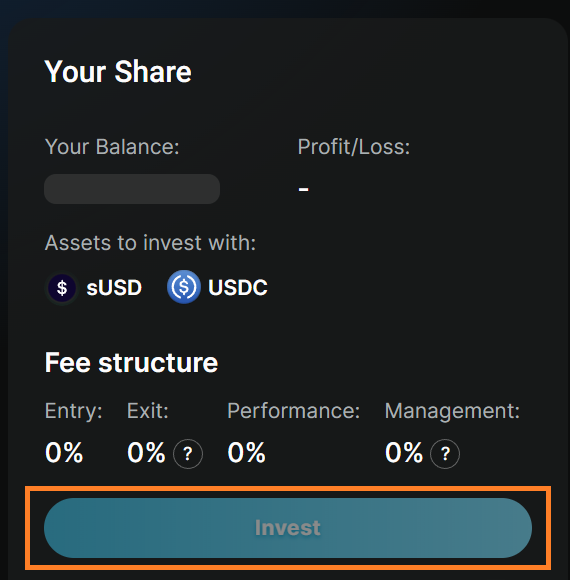

It might be a good idea to hedge your sUSD debt to mirror the system’s debt so that even if individual Synths fluctuate, you do not have to pay more than you borrowed. You can convert your sUSD to follow the active debt on Synthetix using the dHedge platform here.

Hedging sUSD debt on dHedge protocol(Source: dHedge)

During periods of slow growth like this one, Synthetix Network’s newfound revenue stream presents a viable opportunity for users to benefit directly from it by staking SNX. However, due to potential SNX volatility, the strategy is not risk-free. But for those who feel adventurous, it can provide a great source of passive income at a time when the market is at its most unforgiving.

Thanks for reading, everyone. Good luck.