Good news is bad news

Macroeconomic conditions define the current markets. They constantly influence the markets, but due to how debt cycles work, periods of relative calmness and positivity are longer than periods of uncertainty, making the macro go to the background most of the time.

The global economy moves slower than crypto. Therefore, it becomes more difficult to navigate crypto because it moves erratically, and signals might be mixed. Let’s consider two pieces of news.

First, the nonfarm payrolls indicator turned out to be higher than forecast. Nonfarm payrolls reflect how well the U.S. labor market is doing. If it’s doing well, people are making money and are ready to spend more.

Meanwhile, energy consumption remains a concern in an environment where we don’t have high enough expenditures on extracting and distributing energy. This leads to entire countries like Germany starting to limit consumption.

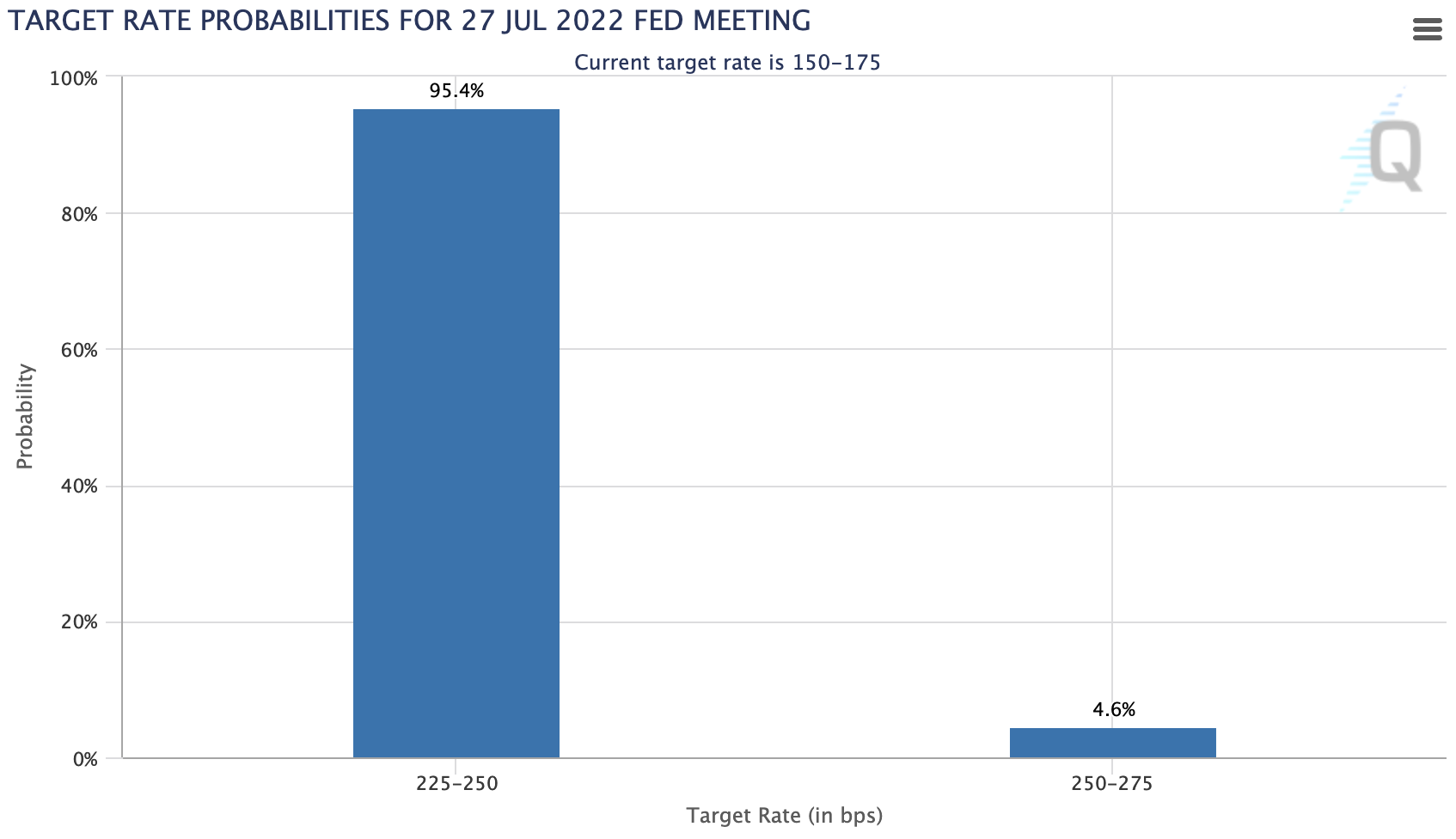

A combination of lack of resources and strong demand due to a strong labor market suggests inflation. That’s not what the Fed wants. Therefore, the expectancy of another severe rate hike increases.

The current rate is 175 bps, and the expectation is that it will get raised to 225-250. Source: CME.

If rates increase, that doesn’t sound too good for assets. But, it’s difficult to keep thinking about this when BTC has already pierced the 200-day moving average, which has proven to be a great long-term indicator over the years. Also, a relief rally is going near key support / resistance levels.

200-week simple and exponential moving averages have served well as support level indicators. However, the data set is rather limited, and it’s crypto’s first time encountering poor macro. Source: TradingView.

The key is to keep being aware that crypto and equities are risk-on assets. If the Fed forces workers to lose jobs to destroy demand, this will not be good for risk-on bets. Similarly, if people in Europe have to think about keeping their house warm and having access to water, they won’t think much about crypto, if ever.

If a relief rally comes, worsening macroeconomic conditions may quickly end it. That’s because they have a stronger influence on peoples’ lives. In the meantime, as Chuck Price said, “as long as the music is playing, you’ve got to get up and dance.”

Disclosure: The author of this newsletter holds ETH. Crypto Briefing and members of the research team hold some of the Pick of the Month coins mentioned in the table above. Read our trading policy to see how SIMETRI protects its members against insider trading.