Flipping NFTs on Solana

After Ethereum, Solana probably has the most-developed NFT tools and market for trading profile picture (PFP) projects. Played the right way, Solana PFPs remain capable of yielding good returns – allowing you to combine quick, cheap trades with long-term holds.

Solana’s highest-value collections show the PFP market’s potential value. Projects such as Okay Bears, Solana Monkey Business (SMB), and Degenerate Ape Academy have made over $140 million in total sales, while SMB #1355 is the most expensive PFP to have been sold so far at approximately $462,000.

SMB: #1355, the highest-selling PFP on Solana. Looks rare.

Although these stats aren’t as high as those of top-tier Ethereum projects and trading volume has fallen in the bear market, the interest remains. PFP traders are still looking for affordable entry prices, proven upside potential, and a market of buyers, making Solana an increasingly convenient place to trade.

This can be seen in the chart below, with the pink bars representing sellers having higher volume than the buyers’ green bars, pushing down floor prices. Those holding for long periods will probably be watching the value of their NFT portfolios fall.

30-day traders, buyers, and sellers on Solana. Source: SolanaFloor.

On the other hand, those who buy cheap and sell quickly are probably making profits. An idea backed up by the number of traders remaining relatively constant. The number of traders closely matches peaks in buyers’ and sellers’ volume, implying people are flipping NFTs to increase their SOL stacks.

Solana is not alone in overall NFT sales being down. Comparing its data to Ethereum’s yields further insights into the logic of trading here at the moment.

First of all, Ethereum continues to have more buyers, volume, and overall value. The 90-day moving average of buyers on Ethereum is trending lower, while Solana’s is at its all-time high, suggesting Solana is more popular at the moment.

Unique buyers with 90-day moving average. Ethereum (orange), Solana (blue). Source: CryptoSlam.

In terms of sales, the two chains share a trend of falling USD value. However, the total number of NFT transactions on Solana has been rising for the last four months. This is likely to be because buyers are less willing or able to deploy capital, want lower-risk entries into the market, and see Solana as a source of projects that meet their needs. We’ve also seen this trend on Ethereum and written about the popularity of free mint NFTs here.

90 Day sales of NFTs on Ethereum and Solana in $USD. Source: CryptoSlam.

One Solana project currently performing well is Gothic Degens. Since launching just under a month ago, the floor price has risen from zero to approximately 15 SOL (around $500), a nice return for anyone that leveraged the growth by purchasing multiple NFTs, an idea we’ll look at.

Gothic Degens trades. Source: Magic Eden.

Gothic Degens has a great look. The medieval elements have a slightly dark and sometimes grotesque but funny feel that has worked well for many projects during the bear market.

Another Gothic Degens strength is building partnerships with notable projects. This ongoing process has already resulted in airdrops for NFT holders. There are more in the pipeline, meaning the collection may still be a worthwhile purchase even at about 15 SOL.

A prior SIMETRI Radar pick from Solana that is well worth mentioning is Frakt – a dapp that allows loans to be taken out against Solana NFTs. The project has hit the nail on the head by opening up DeFi to Solana NFT holders, and it may even be fueling Solana’s current market strength.

Let’s look at how we can put a trade together on Solana. Firstly, check out some of the Solana bots on Twitter to find projects in demand. SolanaSh33t tweets about collections selling in high numbers, which are usually new and cheap. Alternatively, Solbot tweets high-value transactions over 10 SOL, showing you in-demand established projects.

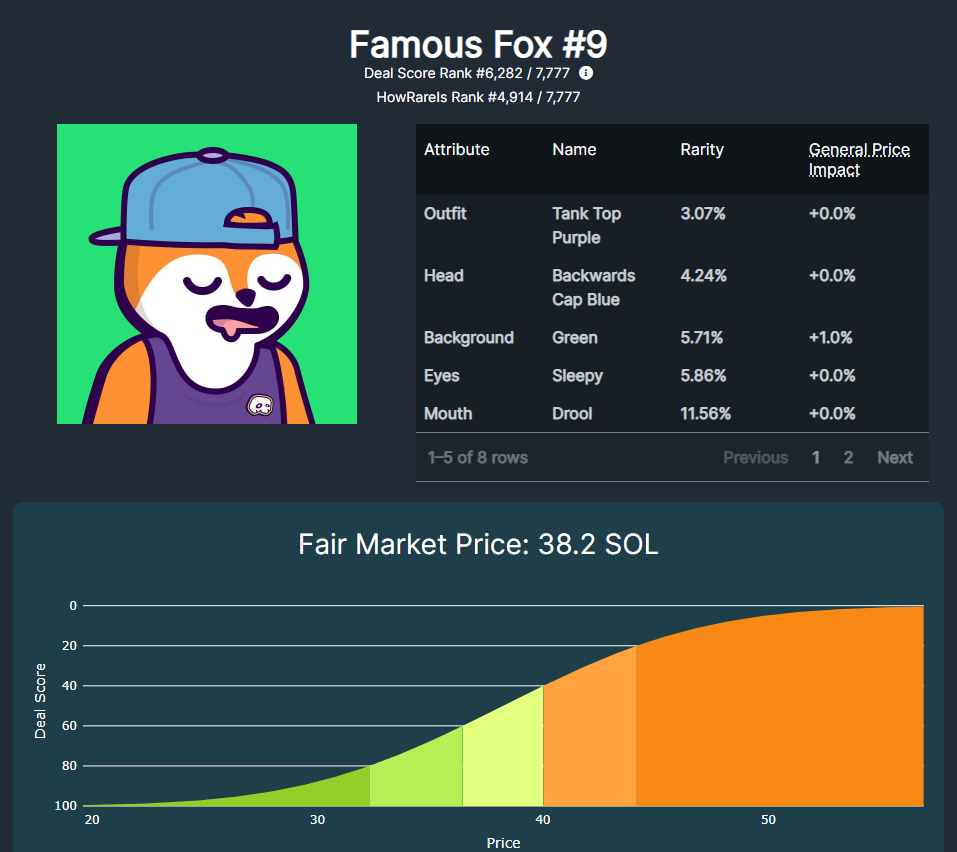

The trick is to use both NFT Deal Score and Frakt in combination. NFT Deal Score combines historical transaction information with rarity data to help identify under-priced NFTs. You can use this information to snag bargains from Frakt’s list of accepted collateral. This will take a bit of coordination, but the pay-off is potentially brilliant.

NFT Deal Score.

This is because you can use the NFT as collateral to borrow funds from Frakt. These funds then become your trading funds, which you use to purchase and trade NFTs that are minting cheaply – as identified by the SolanaSh33t bot. The key is to get in quickly, sell the NFTs at a profit, and ensure that the Frakt loan is repaid on time.

The trade is not without risk – the greatest of which would be the liquidation of the Frakt loan, which leads to the loss of your NFT. However, successfully repeating the trade can grow your funds to recoup your initial investment, effectively giving you an NFT for free. Now, you just have to choose whether to hold the NFT long-term or sell it for SOL.

Magic Eden is the go-to marketplace. It has more listings than any other site, as well as bulk-bid and floor-sweep functions that streamline the purchase of multiple NFTs in a collection.

Overall, Solana has a good set of tools that you can combine to shift the odds in your favor. Add to this a market that remains ready to buy, and all it takes is some time to familiarise yourself with how the tools work and what is popular in the market.