Alphaverse

I hope this rally has been treating you well and that today’s ideas will make it even better.

DigiDaigaku Free Mint

The phrase “DigiDaigaku free mint” will cause nasty flashbacks for some. The previous free mint went beyond a 15 ETH floor at some point. The painful part was that it didn’t go there instantly: there was plenty of time to buy under 1 ETH, then under 4 ETH, and so on.

The project recently announced that it would conduct another round of free mints: villains. It will be crowded, but walking past this isn’t an option. Here’s what to do:

That’s it. Keep an eye out for what Gabriel posts. Details should come out very soon.

The Legend of CØCKPUNCH Reimagined

Like DigiDaigaku, CØCKPUNCH was pretty easy to take advantage of. You just needed to be subscribed to the project’s email updates. The collection did very well for those who subscribed.

CØCKPUNCH’s name might sound inappropriate. But does naming matter if we only care about profits? I don’t think so, which is why I will not hesitate to recommend you subscribe to Joi City.

Joi City is Brazzers’ shot at Metaverse. Whatever you think about the adult industry, Brazzers is one of its heavyweights, and its collection will most likely generate substantial attention. Hence, it’s reasonable to expect early minters to enjoy multiples on their investments.

All you need to do is put your email address here.

Farming Hook Airdrop

NFTs plus DeFi is always good. This time, we look at options with Hook.

Options are complex, and their inner workings are beyond the scope of this email. I’ll explain what matters, and you can safely ignore the rest.

A couple of things to remember. First, you will need some ETH and might spend a tiny amount of it. Second, there’s a risk that you won’t get anything out of this activity because the app uses signing instead of transactions. Therefore, if the team doesn’t track in-app activities, they won’t know you did anything.

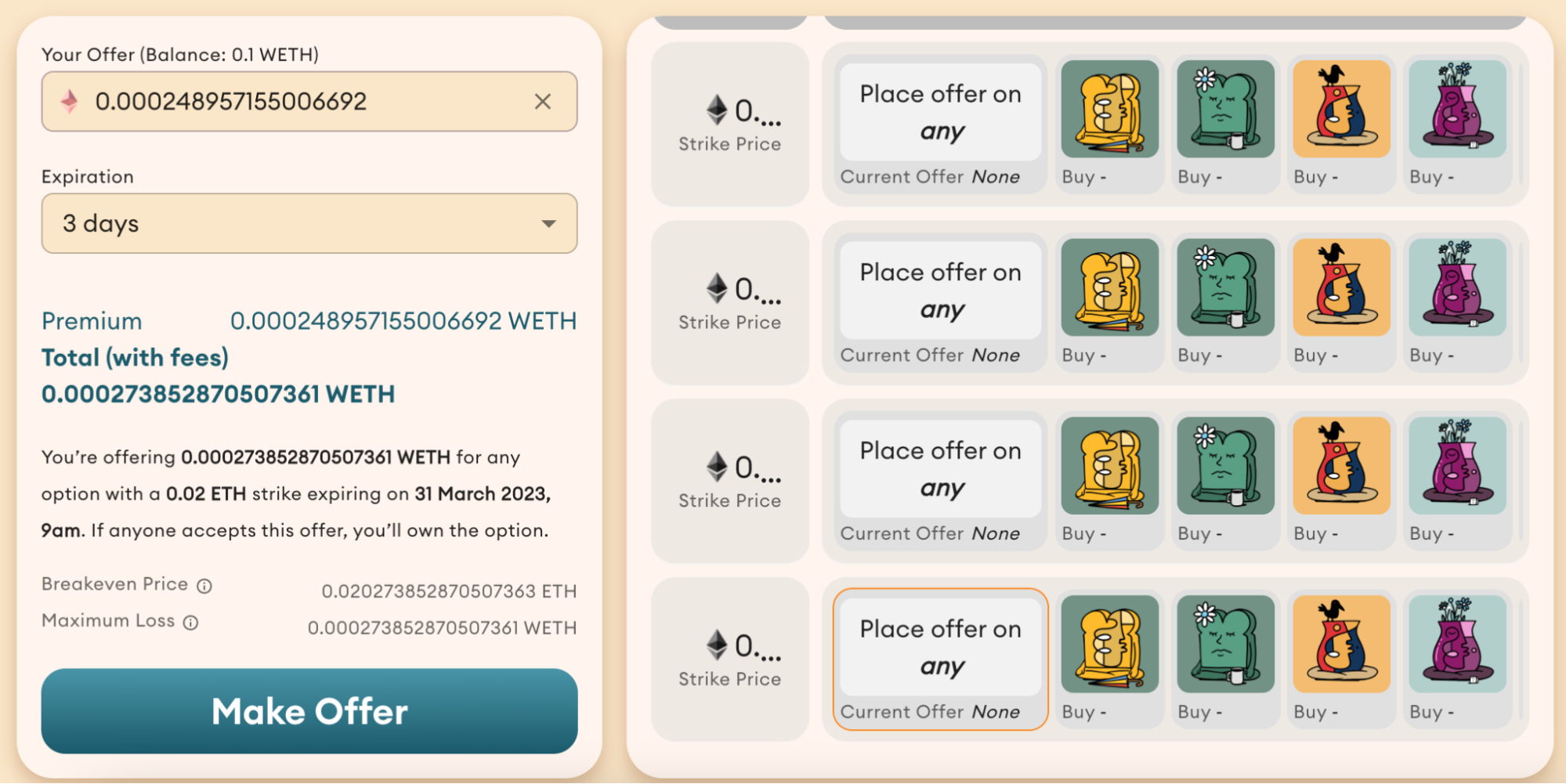

Buying an option on Hook means betting that a certain NFT will increase in price, preferably beyond a predefined level (strike price). If that happens, the option’s buyer gets the difference between the current and strike prices. However, they have to pay for this option (premium), which eats away a portion of the profit.

If your head hurts, don’t fret. You don’t need to understand what’s going on entirely. All you need to know is that you will need a tiny amount of money to buy an option, which might expire worthless (you lose this tiny amount).

You will need to buy options from NFT holders. The market, expectedly, is very illiquid, so your offer might not get filled. Hence, there’s a risk that your participation on the platform won’t be recorded. On the other hand, if it doesn’t get filled, you won’t pay any money for the premium.

Here’s what you can do:

- Get some WETH by wrapping ETH on Uniswap.

- Go to this collection, and in the sidebar, set the strike price to 0.024 (it will reduce your premium price because the price will most likely not be reached). Then, click on “Make Offer.” You might need to scroll down a bit.

- Sign a pop-up message in MetaMask.

That’s it for today. Thank you for reading.