Alphaverse

On-chain trades have become the El Dorado for active crypto players. While the rest of the market has been moving sideways for the past few weeks, on-chain plays have made millionaires.

I’m talking about coins like PEPE and UNIBOT that active degens bought for pennies. Some flipped these tokens for a quick 10x, and others rode the wave to 1000x. Regardless of the outcome, they ended up in a much better place than the rest of the market.

Why hasn’t everyone been doing this, then? On-chain speculation is rapid and extremely risky. The vast majority of tokens degens ape into not only don’t make much sense (e.g., HarryPotterObamaSonic10Inu, a.k.a. BITCOIN) but also die hours or minutes after launch.

Given the above, the need for good on-chain analytics tools is acute. One of our Discord members shared chainEDGE, and we think that if you’re serious about on-chain trading, this tool will be valuable for you.

We’re not affiliated with Onchain Wizard, chainEDGE’s development team. It’s not a paid review. The tool is just good, so we decided to share it with the broader audience.

Before we dive in, let’s talk about pricing. The app’s monthly fee is $49.99, a reasonable price considering that a swap transaction on Ethereum is half of that.

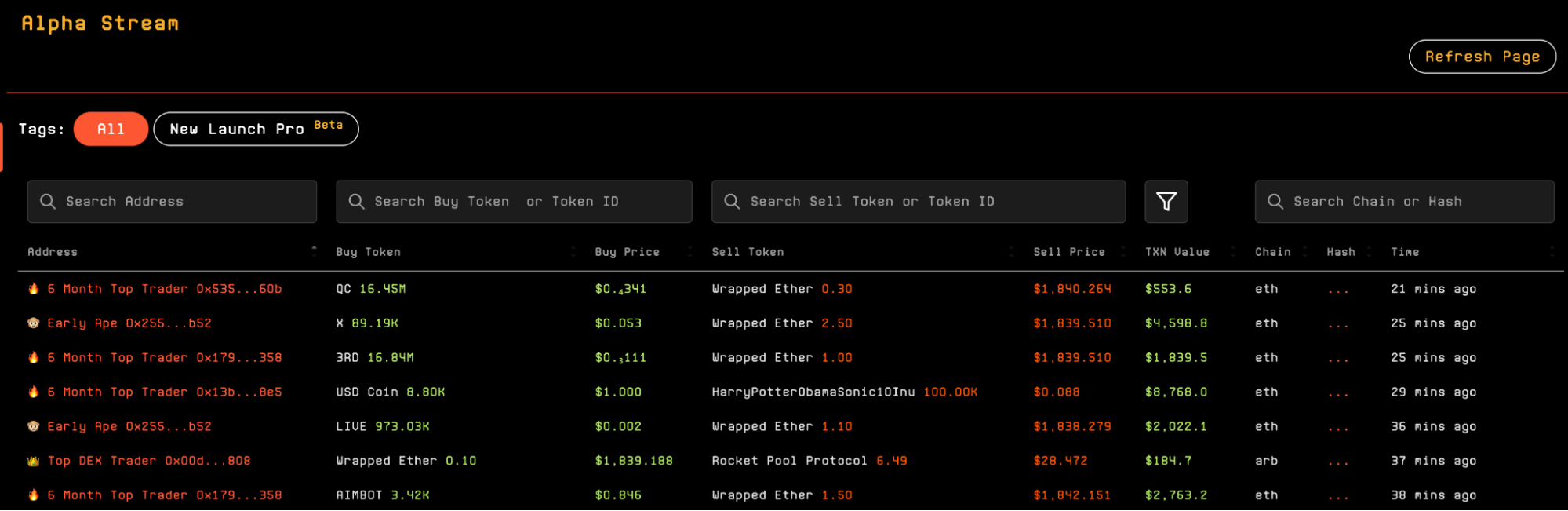

The first tool is Alpha Stream. It shows you what top-tier traders are doing in real-time. That’s a potential goldmine for active on-chain players: you can see who bought some token and for how much. This dashboard opens a solid opportunity for tail-riding pros.

Source: chainEDGE.

Next goes the Token Summary, which will show you the net flows (buys and sells) of a given token, plus a detailed analysis of swaps. It can be used to track your recent buys or make an aping decision after you spotted a token in the Alpha Stream.

Source: chainEDGE.

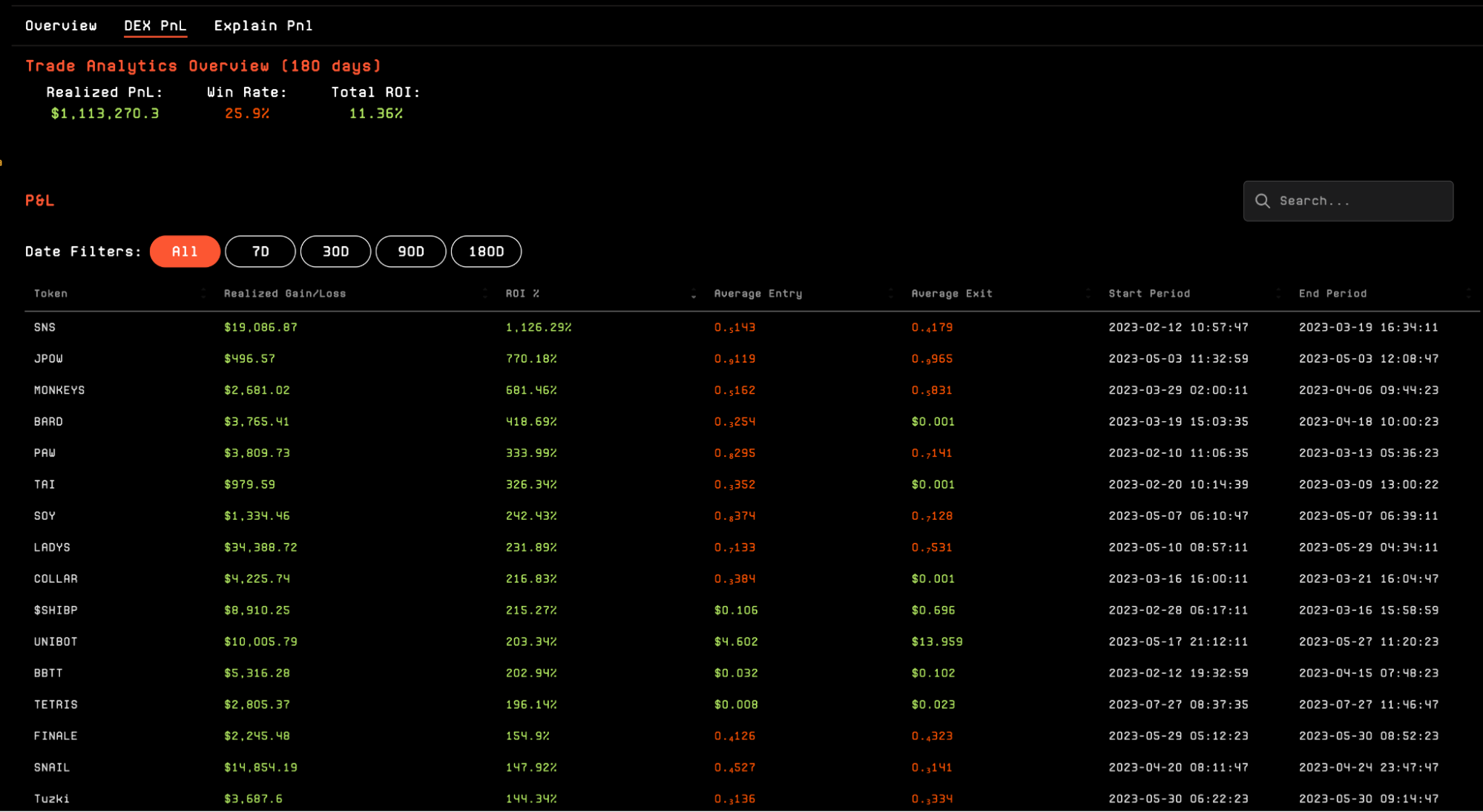

Now, we move on to Wallet Explorer, a tool that provides insights about wallets. I took a wallet that sold X, mentioned in the screenshot above, for another token with the same name. Why did they do it? Are they smart?

Their win rate is ~25%, which is decent for on-chain trades. Realized PnL is over $1 million. Maybe I can follow this whale in their X-shuffle play.

Source: chainEDGE.

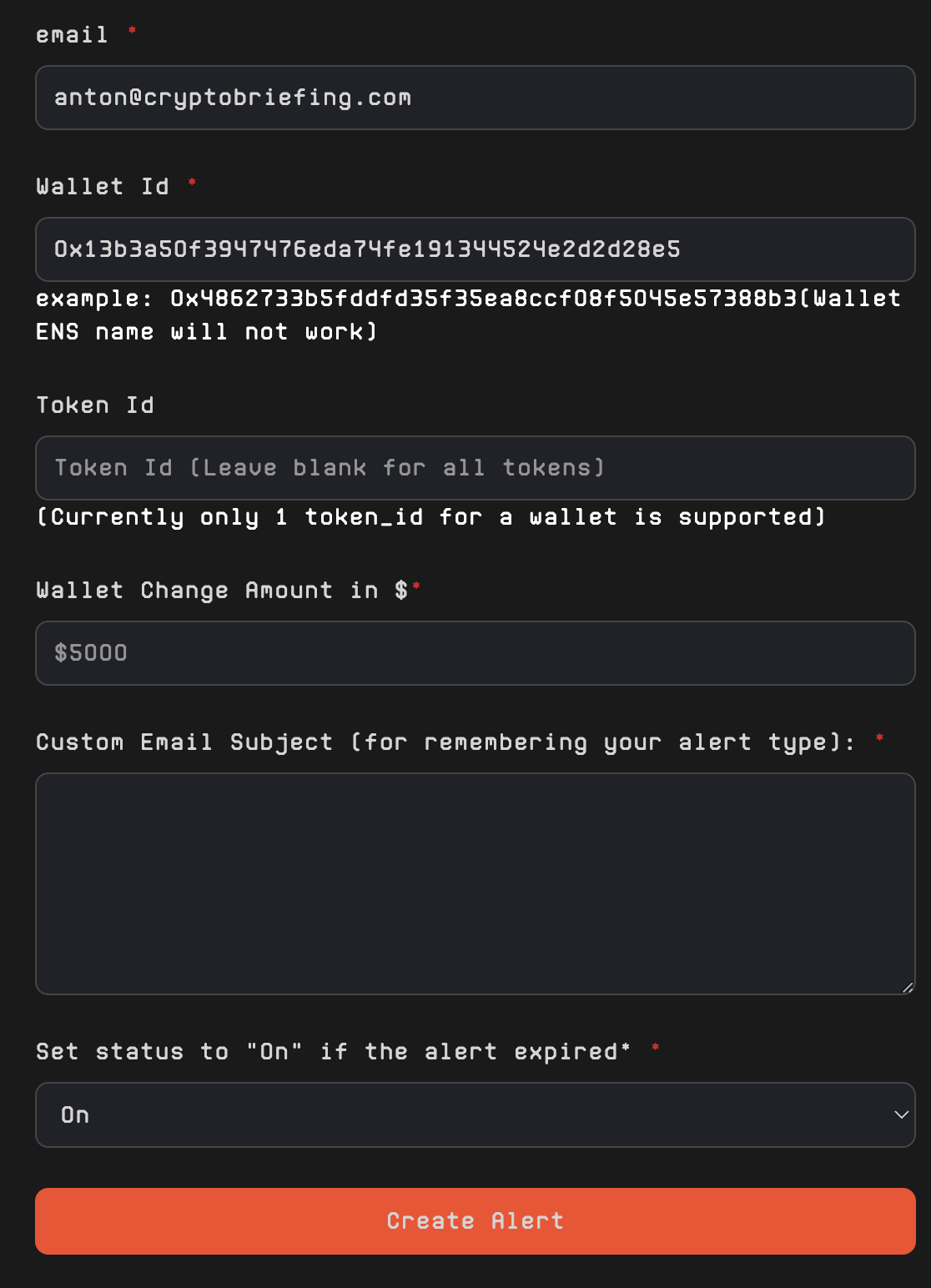

You can add up to 10 interesting wallets to a watchlist and get extensive insights about their activity. Plus, you can have customized alerts based on transaction size.

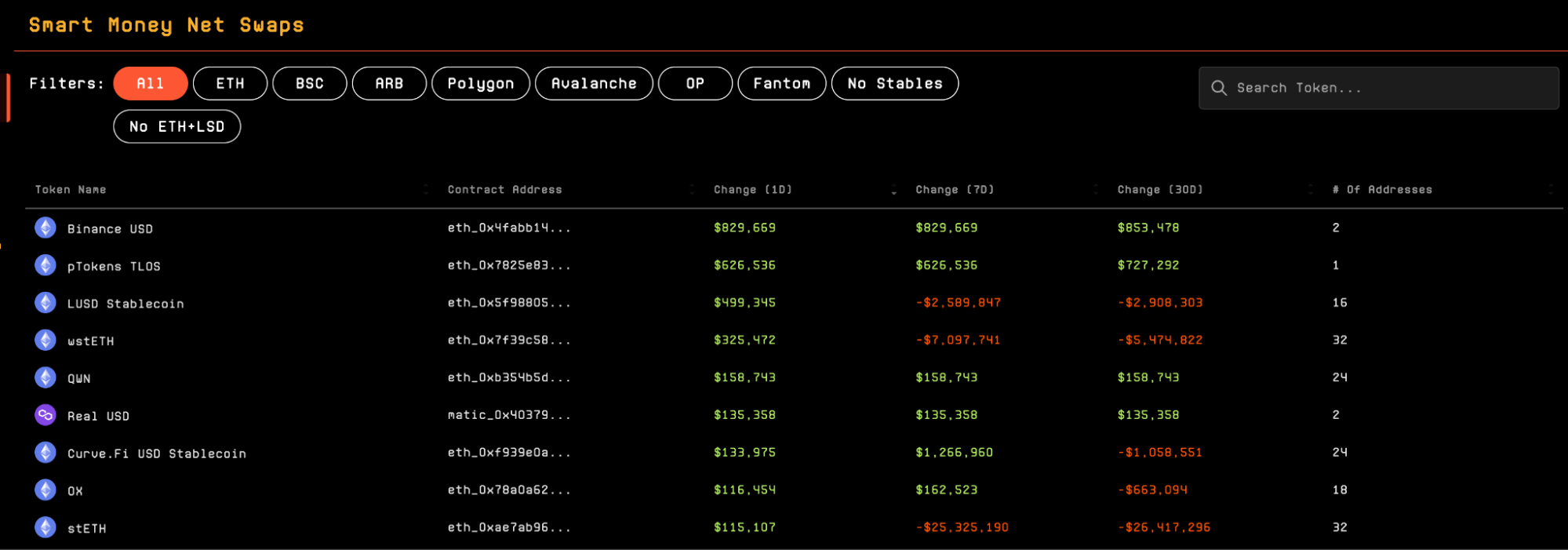

Finally, there’s a Swap Summary. It shows you what the top-tier traders have been doing with their tokens. If the number is positive, the top on-chain traders are buying a given asset. Conversely, a negative number means that they’re selling.

You can use this information to monitor your portfolio holdings. If more top-tier players are flowing in, that’s good news. The downside is that currently, the tool doesn’t track all tokens, including low-caps, so there isn’t much value for degen trades in this one.

Source: chainEDGE.

That’s it for today. I wish you the best of luck in your hunt.