Alphaverse

This Alphaverse issue might not be for everyone. I will show you how to go deep into the on-chain trenches and potentially make 10-100x fast.

That’s one of the riskiest forms of crypto investing, requiring significant time and effort. So, if you’re a more safe or passive player, you might as well skip this one. It’s ok; not everyone should be a “degen” and for good reasons. But, maybe it will still be an interesting read.

Before we start, the following guide is for Ethereum. Still, you can adapt it to other networks by finding specific tools (mainly Telegram bots) that perform similar functions on your target chain.

First, you need to get comfortable with using Telegram. If you don’t actively use pins, it’s time to learn how to do it. Right-click (tap and hold on mobile) on a channel or bot and click “Pin.”

The free Telegram version gives you only five pin slots, so we can only pin five useful things. Let’s start with the Uniswap listings bot. It will alert you when new pairs are added.

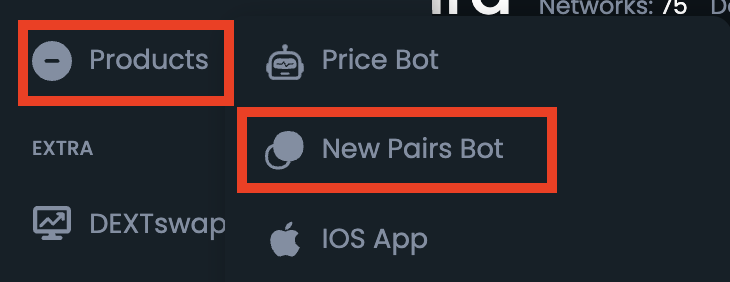

Go to Dextools. In the left-side menu, select “Products,” then “New Pairs Bot.” The bot will start posting new pairs immediately. There’s no need to activate it.

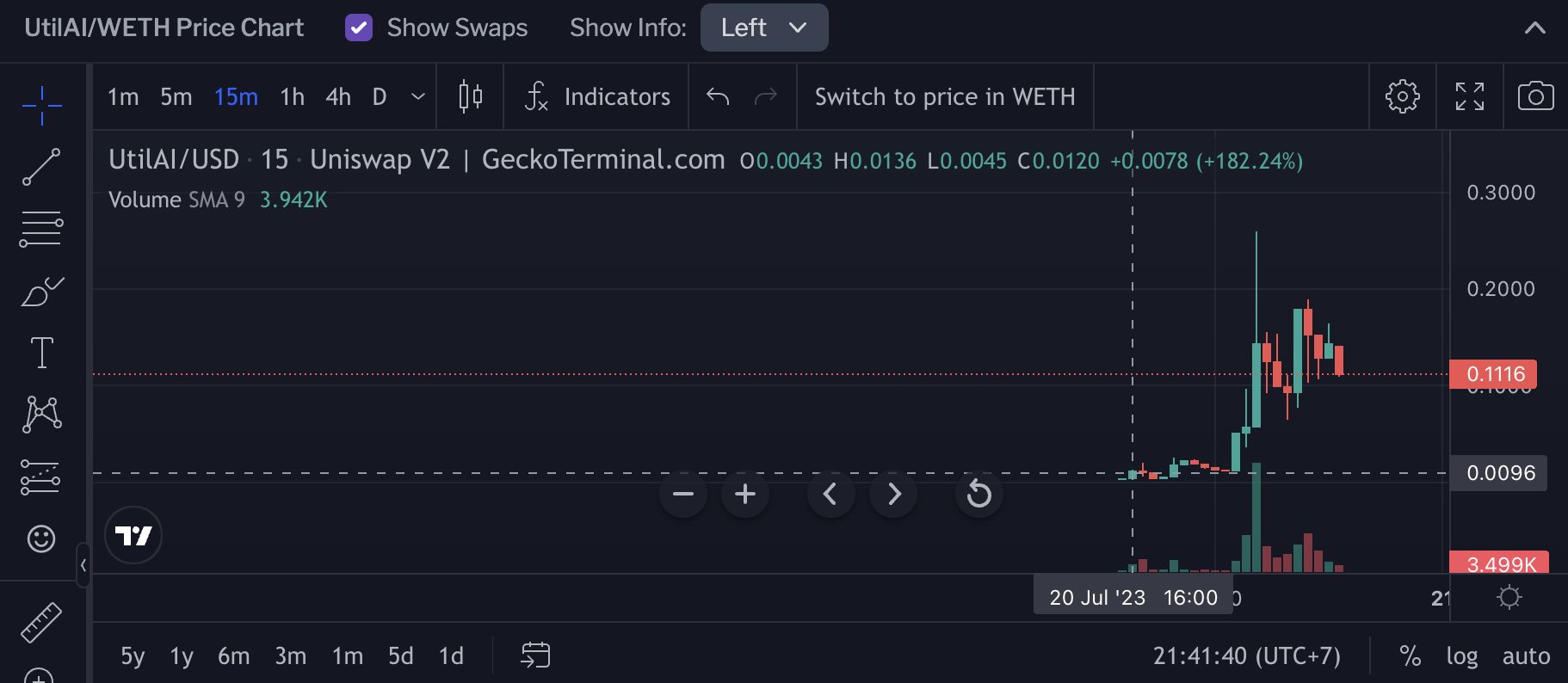

Many added pairs will be garbage: scams, honeypots (tokens you can buy but can’t sell), rug pulls, etc. However, some will be gems with potential 10x+ performance on very low liquidity.

Early buyers made ~10x, and some made ~20x.

You will need to train intuition with these new listings and pair it with data. First, it’s crucial to get the project’s socials. You can quickly check the project’s Twitter and Telegram to understand what it does and check the temperature of its community.

Add the EyeLabs Socials bot and pin it. When you see an interesting pair (at least called something reasonable, not “Pepe 5.0”), you can look up the token’s socials by writing “/s <TokenAddress>” in the bot.

Sometimes, the bot finds only a website, but it’s still enough to find the project’s socials.

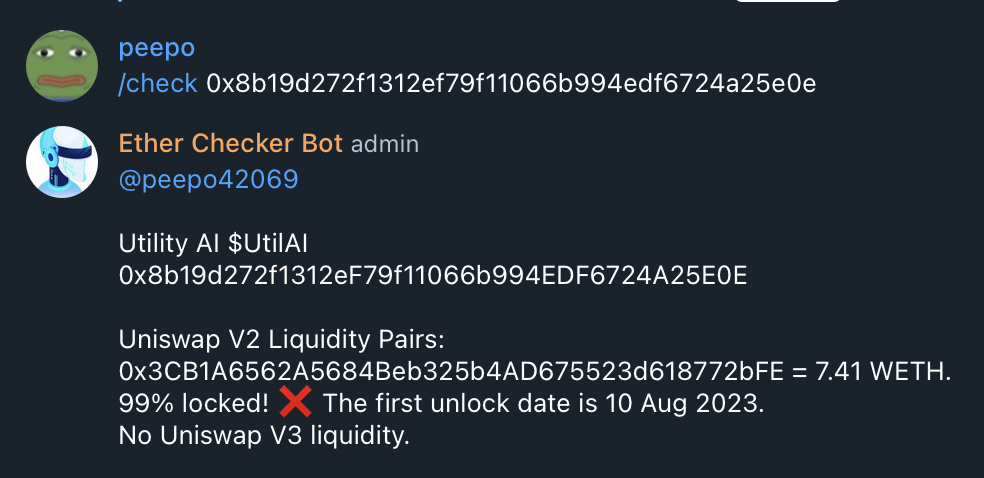

If you like the socials, it’s time to check the pair itself. The less control an owner has over the pair, the better. The rule of thumb is that liquidity should be locked, the contract renounced, and it shouldn’t be a honeypot. If these criteria aren’t met, I suggest skipping the coin.

To get this data, use EtherChecker. Add it, pin it, then type “/check <TokenAddress>” to get the pair’s data.

The actual response is longer. It contains all the important information.

If everything checks out and the token looks good for aping, it’s time to act. For this purpose, you can use Maestro or Unibot. They don’t differ much from the user experience standpoint.

I’m using Unibot. On first launch it creates three wallets for you. Top one of them up (use tiny amounts because the private keys that you didn’t generate and store securely are very unsafe), then click “Buy Tokens,” submit the token’s address and the bot will send a transaction.

The advantage of using bots is that they’re fast. You don’t want to bother with token approvals, Uniswap loading times, etc. when liquidity is low and the price is highly volatile. A single buy can send the price 2x+ up. Telegram bots are fast and convenient, albeit not very secure.

Finally, you can customize your buying bot to buy with specific amounts and fees, and the settings will be applied to all subsequent transactions. This strategy implies that you will split your degen budget between many potential plays, so customizability will come in handy.

If you make substantial profits, withdraw them to a wallet only you created and control immediately. Good luck hunting.