A sleuth of bears

Bitcoin’s price closed the weekly candle above the 2017 peak of around $20,000, providing a glimmer of hope for buyers as sellers failed to break this crucial support level.

On a monthly scale, Bitcoin officially sealed its worst August performance since 2015—down by nearly 14 percent. However, bears could not close the monthly candle below $20,000. While the technical signs are encouraging, rising geopolitical tension and a poor macroeconomic environment continue to weigh upon risk assets.

The stock and crypto markets started the previous week under pressure after the Taiwan military fired warning shots at a Chinese drone. This set about a quick drop in prices for risk-on assets as the market feared retaliation from the Chinese military.

Tensions between Taiwan and China have recently soared to their highest level in decades, with China conducting live fire drills and other military exercises around Taiwan.

The conflict between Russia and the European Union escalated over a gas pipeline from St. Petersburg to Germany during the weekend. The European energy crisis has strengthened the dollar considerably against the euro, putting further pressure on Bitcoin and other risk assets.

A few other negative catalysts emerged during the weeks, with the U.S. authorities charging Michael Saylor for tax fraud. The news of Michael Saylor’s lawsuit weighed on the market sentiment, as Microstrategy is the largest public holder of Bitcoin. Analysts speculate that if the charge on Saylor extends to the company’s activities, it could act as a potent negative catalyst for BTC.

Lastly, the economic data from the U.S. in purchaser’s manufacturing index and non-farm payroll pushed back fears of a recession. This will likely enable the Federal Reserve to pursue its hawkish monetary policy—further weighing down risk assets.

While the overarching trend is bearish, some contrarian signals emerged over the week, indicating the probability of a short-term relief rally in the first half of September. However, the deteriorating geopolitical situation continues to hurt bullish changes.

Watch out for the Dollar

The U.S. dollar strengthened over the weekend due to a relative weakness in the euro. The DXY index, a benchmark index of the U.S. dollar against a basket of other currencies, reached a new yearly high as the euro fell due to escalating energy prices.

Russia is attempting to force the European Union to revert economic sanctions against them by stifling Europe’s energy supply. The government-run monopoly Gazprom shut down the Nord Stream 1 pipeline, which is the primary source of gas for Germany and other European countries.

The German government responded by rolling out a 65 million euro relief package this morning. However, government stimulus packages will only worsen the inflation situation and add more pain to the economy.

The DXY index. Source: Trading View.

As mentioned last week, the DXY index is eyeing the range between 114.00 and 120.00. Having broken above this year’s high of 109.29, it looks like the dollar is heading for its bullish targets. Since Bitcoin and the DXY index have an inverse relationship, further rise in DXY would certainly weigh up on the crypto market.

Correlation coefficient between DXY and Bitcoin. Source: Trading View.

This week’s critical market-moving events include a Wednesday speech from Federal Reserve Chairman Jerome Powell.

Chair Powell’s speech will be closely watched because he will give his opinion on Fed policy for the first time since the central bank has viewed the latest jobs and manufacturing figures from the United States economy. It will also be interesting to see if he addresses the European energy crisis.

Economic calendar for this week. Source: Forexlive

The Cramer Effect

I want to touch upon “the Cramer effect” and lay out why I think it may be well worth paying attention to Bitcoin and the crypto market over the coming weeks and months.

My thoughts and opinions here are my own, and this is certainly not a personal dig at Jim Cramer but rather a recognition of his incredibly poor market timing.

In short, we all get market calls wrong sometimes, but fading Jim Cramer’s calls is now a bonafide market trading strategy. Aside from a long list of poorly timed market calls in stocks, we are talking multi-month and year trends here. Cramer gave the illustrious September 2021 market call of telling everyone who would listen to “get out of crypto” just weeks before it rallied from $40,000 to $69,000.

Cramer also has a nasty habit of telling anyone who would listen, “I told you so,” as the market moves his way marginally after his calls are issued, only for some days later, the market to move totally against him in spectacular fashion.

His latest market call is that Federal Reserve Chair Jerome Powell is “going to bring the pain until it puts an end to the gambling.” With Cramer making this call arguable late into the Fed tightening cycle, I am becoming nervous that a market rally could likely follow. The market currently has very few reasons to rally. However, I fear his legendary poor market timing could come back to haunt him yet again.

Additionally, most traders are positioning themselves for a downside, which could act as a contrarian signal.

The funding rate for perpetual futures is negative, meaning there are more short orders than longs. A bearish inclination in the futures market has often resulted in a short squeeze. There is a good chance that history will also repeat itself this time.

Bitcoin futures perpetual swaps funding rate. Source: Twitter.

The holdings of retail investors—wallets with less than 1 BTC—have been on a downtrend, serving as a potential buy signal because the market usually reacts opposite to retail movements.

However, the rise in their holdings has been significant since the start of this year, and there’s room for more pain for these investors. Lastly, the whale holdings have not changed much, with small additions of $9 million into institutional portfolios.

The retail holdings of Bitcoin. Source: Santiment.

In conclusion, traders’ positioning and sentiment readings suggest that a bounce is likely. However, positive buying from institutional players is still missing, which raises concerns about the sustainability of all future rallies.

BTC’s Do or Die Moment

Bitcoin honestly has no fundamental justification for rallying this week. Still, a contrarian rally is possible due to the “Cramer effect” and negative funding in the futures market.

In terms of possible price moves, I think any counter-move against the negative price trend could target $22,500 or somewhere in that region.

Personally, I would not be a buyer of any rallies at this stage. The way that Bitcoin collapsed from the $25,000 level is a testament to the strength of the bear market and how entrenched crypto is in negative sentiment.

Most likely, any rallies will be met with selling until we see real buying volumes return. We probably need to see a significant bullish catalyst return to the market to justify a positive price action.

In terms of technicals, I think gains above $20,700 would be a clue the market is about to take off to $21,800. On the downside, a series of daily price closes below $19,891 would be a negative for me, which could open up selling towards $18,700.

BTC/USD Weekly chart. Source: Trading View

ETH Hurdles

ETH/USD certainly appears stronger than BTC/USD right now, and this is also very apparent if we look at the long green price candle on the ETH/BTC weekly chart.

Additionally, it was very encouraging to see buyers hold the price above the former all-time high from 2017, around $1,420. However, bulls still have much work to do this week.

With the Merge approaching in about ten days, some investors may rush to buy ETH at the last minute to capitalize on the Ethereum PoW fork.

The Parabolic SAR indicator shows that the daily trend turns bullish above the $1,680 level, while the weekly trend is once again bullish only once the price crosses $2,100.

However, a head and shoulders pattern surrounds the ETH/USD pair, threatening to send the price back towards the $1,000 level and possibly much, much lower even. Personally, I favor more downside this week.

ETH/USD Weekly chart. Source: Trading View

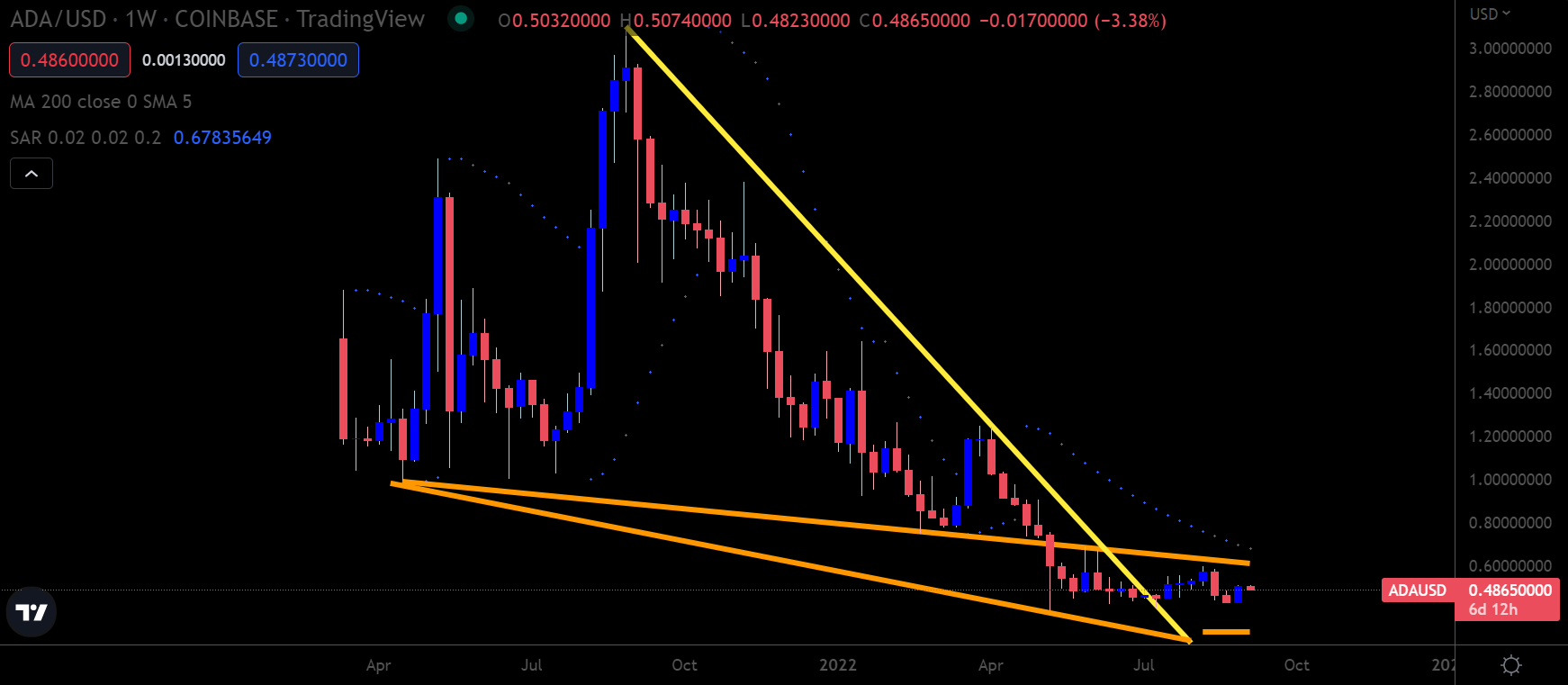

ADA Is Not That Straightforward

Charles Hoskinson has announced September 22 as the release date of the Vasil hard fork, an upgrade that aims to increase the scalability of Cardano.

Logic would dictate with the most significant upgrade ever just around the corner, the price of ADA should pump leading up to the event. However, the overall market conditions are weighing upon a potential rally.

I suspect that if the entire market heads lower before the upgrade, then so will the price of Cardano. We should not assume it will be a one-way journey in the coming weeks ahead.

Putting potential scenarios and price targets on the table, I would say that if ADA/USD trades above $0.60, then expect a rally to at least $0.75. On the flip side, if ADA starts to become a victim of a downturn in the market, then I could see a new yearly low forming close to $0.27.

ADA/USD Weekly chart. Source: Trading View

Reaching a Climax

The cryptocurrency market looks particularly bearish as this trading week begins, with the energy crisis in Europe and the shutting down of Nord Stream 1 becoming a significant drag on risk-on sentiment.

Should the U.S. dollar index and energy prices continue rising, it will create a challenging environment for cryptocurrencies to move higher. I suspect the possibility of a new yearly low for Bitcoin is very much on the table.

With that said, any positive news surrounding the re-opening of Nord Stream 1 could help improve Bitcoin’s short-term prospects. I am cautious about becoming overly bearish due to the “Cramer effect,” as outlined earlier in this article. A rally towards the $22,500 to $23,000 area is still a long shot, but not beyond the realm of possibility.