Let’s Bond.

DeFi is dynamic. It has moved a long way since the first projects were introduced. Multiple concepts have been tested, and some of the earlier ones have been improved by new projects. The overall improvement in the niche is commonly called DeFi 2.0.

One of the new features introduced in DeFi is protocol-owned liquidity that Olympus Dao originally introduced through OHM bonding mechanics.

Since then, many other protocols realized the benefits of this concept and subsequently started selling discounted tokens via bonds through Olympus Pro, a bonding platform for other projects built by Olympus Dao.

I’m sure many of you overlooked Olympus because, with such high APYs, it appeared as a degen Ponzi scheme. While that assumption was reasonable during the project’s early stages, it’s not the case now as it reached a certain size. So, let’s see how Olympus got there.

Bonding Mechanics

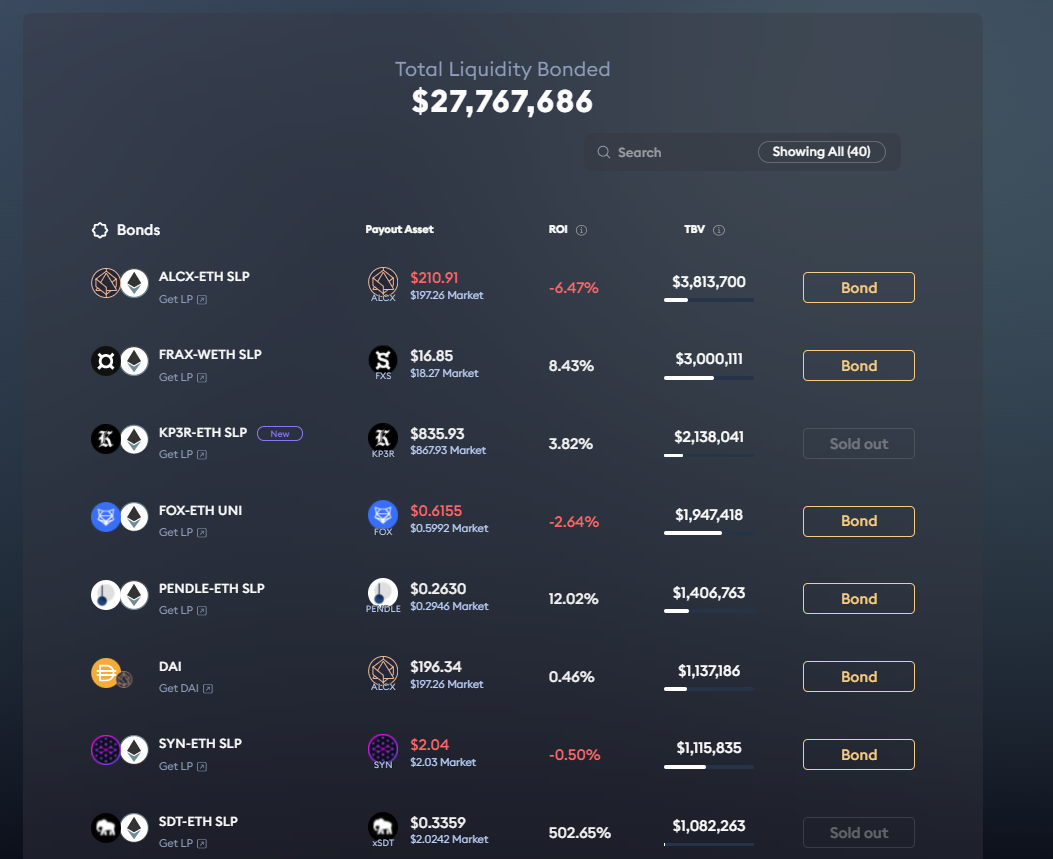

Olympus Pro launched in mid-September 2021, and since then, over $27 million was bonded through the platform.

What is “bonding,” you may ask? It has the same concept as traditional zero-coupon bonds. The protocol offers its governance token vested over seven days with a discount to spot price. It’s like T-bills.

The discounted asset can be purchased through Sushi LP tokens. For example, you can buy discounted ALCX if you bond ALCX/ETH Sushi LP and receive the full amount of ALCX after seven days of vesting.

Bonds enable protocols to accumulate liquidity of their tokens in exchange for their native tokens. Instead of renting liquidity of third-party liquidity providers – farmers, protocols purchase and own the liquidity as part of their treasuries. In the meantime, users who bond and buy assets with discounts can sell tokens after seven days with profits assuming the price has not declined.

With bonding, the selling pressure is drastically reduced as liquidity goes back to the protocol, which is not looking for constant gains from selling its governance tokens. This contrasts with the traditional liquidity mining, where mercenary farmers dump tokens constantly, affecting the value of DeFi protocols and the overall DeFi industry.

One of the most prominent supporters of bonding is the founder of Alchemix, Scoopy Trooples. Alchemix used to incentivize liquidity providers with a high amount of ALCX as rewards, causing selling pressure from farming whale mercenaries.

Since they started using Olympus Pro, they accumulated 4.5% of total ALCX/ETH Liquidity on Sushiswap in less than three months, and this liquidity will stay with the protocol permanently.

Despite bonding LP tokens, Alchemix has also started offering bonds via ETH, DAI, CVX to further diversify treasury and use these tokens for farming other protocols’ tokens and have voting power in Curve.

Let’s Bond

So how can you take advantage of these bonds consistently? Even when we purchase discounted assets via bonds, the asset value may decrease in seven days. The bonding is quite a long-term game and may not always be profitable in the short term.

There are over 40 different bonds available via Olympus Pro. Currently, you can buy discounted assets like ALCX, ANGLE, and QUARTZ.

Let’s assume you own ALCX long-term and saw a 5% discount on ETH/ALCX LP. You can sell 50% of your ALCX into ETH, add ALCX/ETH liquidity into SushiSwap, bond the LP tokens via Olympus Pro, which equates to purchasing ALCX with a 5% discount.

At the end of the vesting period (7 days), you will have more ALCX as compared to 1 week ago. Once you receive vested ALCX, you can repeat the same steps and slowly accumulate more ALCX over time.

If you notice higher discounts with DAI, ETH, or CVX, you can always buy spot and bond to take advantage of better pricing. So essentially, bonding gives you better pricing to accumulate assets long term. However, you can always sell tokens in 7 days and realize a profit.

The discounts vary for different tokens depending on how many tokens are available through bonding and the actual demand for bonds. Remember, since protocols aren’t renting liquidity, they may not need that much liquidity as they may have had a few months ago.

Sometimes you will see negative discounts. It costs more to bond than buy a spot in the market. That’s the function of reduced demand for liquidity from the protocols.

You should also consider gas fees when you need to add LP into SushiSwap and bond assets via Olympus. Hence, small discounts may not be enough to offset transaction fees.

So there you have it. Now you know that Olympus has a value proposition, which is helping projects to buy liquidity instead of renting it and destroying their tokens’ price.

As I said, bonding is a long-term strategic endeavor that works the best for asset accumulation versus making a quick buck. Consider that when thinking about diving into it.