Investment approach that works.

Not that long ago, Ran NeuNer published a video on his YouTube channel with quite a controversial topic “INVESTING IN CRYPTOCURRENCY – HOW I TURNED $30K INTO $35M!!”

The video generated a lot of negative buzz in the crypto community. Some people were not convinced that he was telling the truth. I personally don’t really care whether he has made this money or not. However, I like this video because of the investment approach that he described. It resonated with me since I use a similar strategy.

So, in this article, I want to share this investment strategy. Hopefully, it will help you make money in this market long term.

Crypto is here to stay, so focus on the big picture

Many crypto traders have the same problem: they focus too much on short-term price fluctuations and completely ignore the big picture.

If you are just starting your crypto journey and thinking that day trading will make you more money than simply HODLing, there is a 99% chance that you are wrong.

Throughout the years, people who held Bitcoin during its ups and downs likely made more money than people who tried to spot the cycle and actively traded it. The same goes for every other large cryptocurrency project that brought real innovation to the space and changed how this market operates.

Looking at the last bear cycle, it is clear that even though a portfolio might be down 90% in the short term, in the long term, it could still produce enormous gains (assuming you invested in the right assets).

So what is the big picture?

The big picture is that the cryptocurrency market is growing enormously, and I am not talking about crypto prices here. A huge amount of money and human capital are flowing into crypto startups daily. The industry is growing by quantity and quality of new projects.

So does it matter that Bitcoin is down 10-20% in a day? Absolutely not, because there is a high chance that in 3-5 years it will be worth much more.

So, whether you are investing in Bitcoin or altcoins, try to focus on the big picture, predict how the industry will evolve and what projects will shape it.

Altcoin investments with a focus on the long term

The investment strategy described by Ran NeuNer is quite simple: divide the market by sectors and then invest in the top project (or projects) in that sector. This strategy has worked well throughout the years. I will give you a few examples.

When Ethereum appeared on the market, it was the first project that offered smart contracts. This was a needed breakthrough in the market. The dominance of Ethereum as a smart contract platform has never really been in question, and the project remains the leader in its sector. So if you hold Ethereum in your portfolio for over a year, highly likely you are in profit.

It is a similar story with Chainlink. This was the first oracle project in the market. Blockchains need oracles to receive information from the outside world. The project remains a leader in the market, and its price has risen significantly since it was launched.

BNB is another good example. The project quickly gained the leading position in the exchange sector. Binance was innovating much faster than other exchanges and still maintains the top spot in the market. This is reflected in the price of its native token.

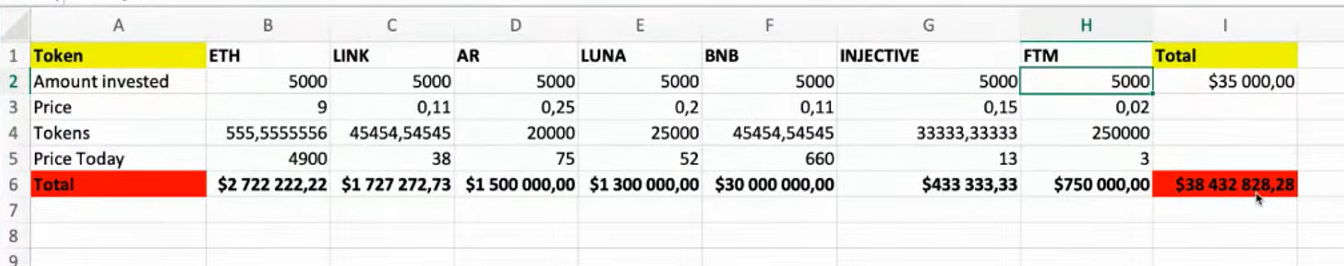

Ran NeuNer altcoin investments. Source: youtube.com

So before making your next altcoin investment, I would pay attention to two important fundamental aspects:

- Market size and its potential

- Whether or not the project is the leader within the chosen sector

Ideally, investors need to find a newly-forming sector within the crypto space with big potential and invest in leading projects in that space. Today’s examples of such markets are cross-chain communication, metaverse/gaming, and NFTs.

The beauty of the crypto space is that it is still young, and new sectors appear quite often. So all you need to do is identify the narrative and make a lot of small bets.

Don’t try to spot the cycle after making your investments, just HODL and see how your assets grow with the rest of the market.

When is it time to sell or readjust your position?

Not all of your investments are going to be profitable long term. Sometimes you could overvalue the importance of the sector you invested in; sometimes, the project you invested in might start losing the competition to its contenders.

So if you see that the market you invested in is stagnating, and you don’t see the future for it anymore, it is likely the time to get out. Similarly, if you see that the project you are invested in has problems with management and strategy and is losing the market share to its contenders, it can be a good time to sell.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing alpha. So feel free to follow me: Alexander Mardar, and my colleagues: Anton Tarasov, Sergey Yakovenko, and Nivesh Rustgi.