December 7 Crypto Market Roundup

After nearly three years of waiting, Bitcoin finally hit a new all-time high on a number of crypto exchanges last week, as the number one cryptocurrency rallied towards the $19,900 levels.

BTC received a major price boost on the news that Guggenheim Partners were preparing to invest $500 million into Grayscale’s GBTC fund.

The announcement that S&P Dow Jones Indices will be launching a cryptocurrency indices in 2021, and legendary trader Paul Tudor Jones stating in an interview that Bitcoin is still “undervalued” also helped to underpin the bid-tone in BTC.

BTC/USD 15-Minute Chart

Source: Tradingview

Data from crypto behavioral platform Santiment showed that whales continued to buy dips, and retail traders failed to participate in last week’s rally.

Ki Young Ju, the CEO of data provider Crypto Quant, noted last week that a battle between “BTC OG whales versus retail investors,” was underway, making him short-term bearish.

BTC social volume data from Santiment also recorded a notable decline last week, despite the bellwether cryptocurrency advancing to a new multi-year high.

Funding costs surrounding BTC on the cryptocurrency exchange Bitfinex also hit levels not seen since August 2020 last week.

Source: Santiment

The Crypto Fear and Greed Index issued a warning that the recent bull market was starting to get overheated as it reached its joint highest ever level last week.

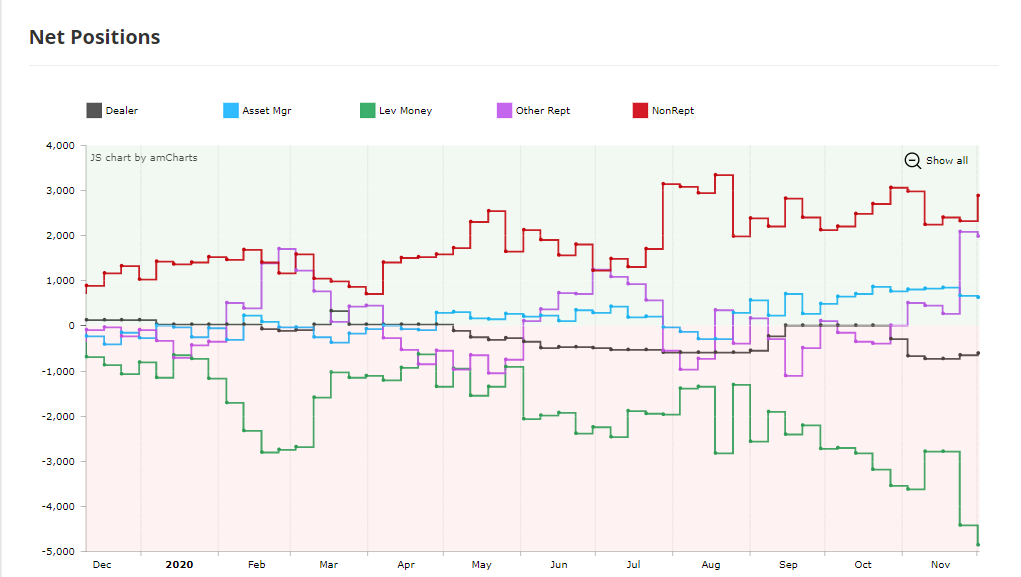

Last week’s Commitment of Traders report provided a fascinating insight to how futures traders and investors currently view Bitcoin.

The first Bitcoin CoT report of December revealed that leverage funds, professional traders, and institutions all reduced BTC long positions.

Source: Tradingster

The crypto total market capitalization reversed sharply from the $589 billion level last week, as buyers failed to break above the current yearly high, at $593 billion.

Bitcoin’s network hash rate fell to its weakest trading level since mid-November last week, despite the number one cryptocurrency hitting a new multi-year high.

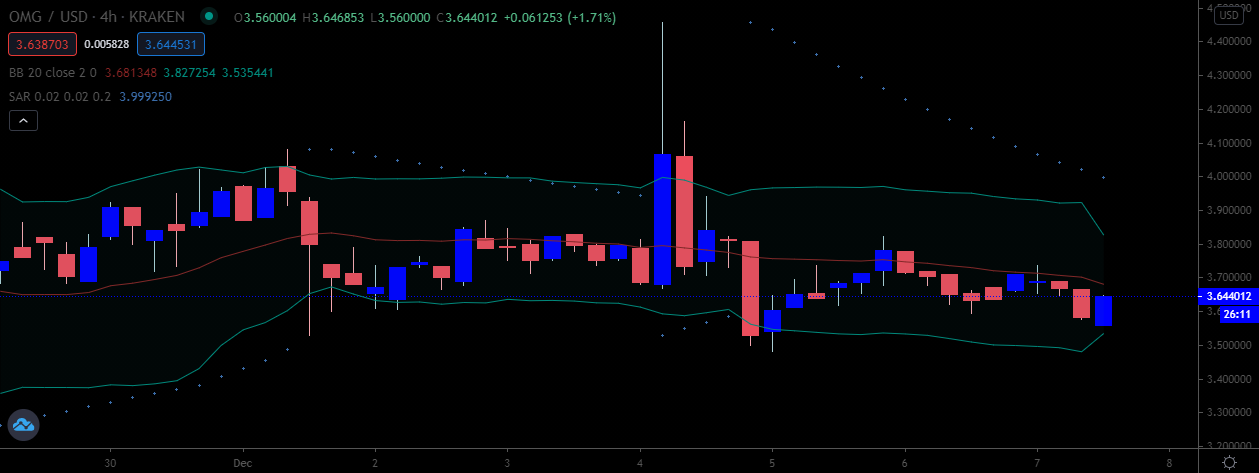

Ethereum moved to a new multi-year last week, although a number of other top cons failed to hit new yearly highs. OMG network spiked by around 20% last week, after Genesis Block Ventures announced the acquisition of OMG Network.

During my upcoming webinar I will be looking at Fibonacci retracements, and also I will be charting Bitcoin (BTC), Theta (THETA), Litecoin (LTC), and Cosmos (ATOM).

Source: Tradingview

The Week Ahead

This week could be a make or break week for BTC, as bulls run the risk of running into more profit taking and technical selling if Bitcoin fails to make a new weekly, monthly and yearly high.

A warning shot was fired last week when BTC failed to break the $20,000 level on the extremely bullish news that S&P Dow Jones Indices will be launching a crypto index next year.

Worryingly, BTC has also failed to form a sustainable rally on a number of other bullish headlines surrounding institutional adoption and new regulation.

My overall feeling is BTC may need to head lower before it can head higher again. Professional and retail traders may be itching to enter in BTC from $17,000 to $16,000, alongside institutional money.

Something else to watch is the ongoing weakness in the U.S. dollar index. The index has fallen to a 30-month low, and still looks on shaky ground. This trend looks far from done, and has been exacerbated by the second wave of U.S. COVID-19 lockdowns.

It is also worth mentioning that BTC has broken it’s correlation with the S&P 500, and is largely marching to the beat of its drum. I also saw a wonderful headline last week that Bitcoin and gold are no longer friends, this is certainly true at the moment, although watch for this correlation to return if we do see a new U.S. stimulus bill agreed upon.

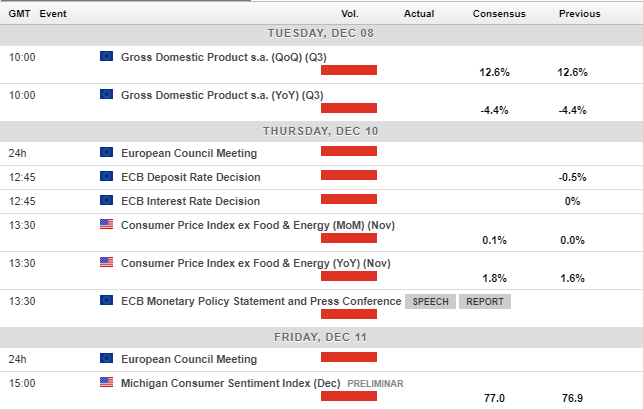

Looking at the economic calendar this week, traders will be focused on the ECB policy decision, where the European Central Bank is expected to announce new stimulus measures.

This could be a market mover for BTC, and crypto traders will be watching this event closely, and especially if the central bank over delivers on stimulus.

Following last week’s not so solid U.S. monthly jobs report, traders will also turn their attention back to U.S. economic data. CPI inflation for November, and preliminary sentiment figures for December are the two main releases this week, aside from U.S. weekly jobs numbers.

Economic Calendar

Source: Forexlive

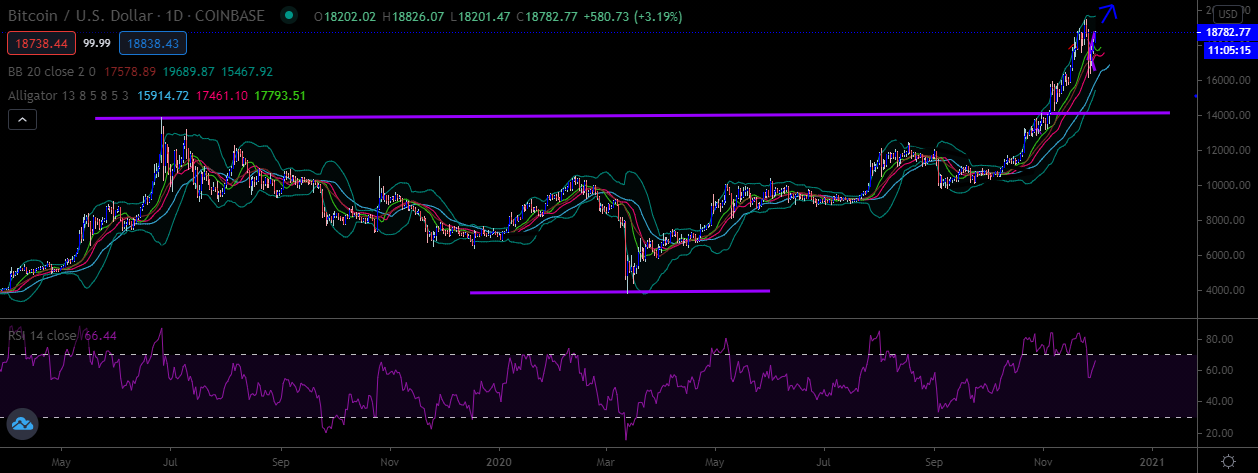

The technicals surrounding Bitcoin (BTC) are not as strong as you would expect, given that the cryptocurrency recently made a new multi-year high.

Lower time frame analysis is fairly clear that BTC will move into a new short-term trading range once price starts to settle either side of the $19,500 to $18,400 levels.

The fairly reliable TD Sequential indicator is also flagging a potential sell signal on the weekly time frame, which is a concern for bulls, alongside bearish divergences which have been forming since October.

If we do see a pullback, BTC is either likely to explode higher from the $17,500 to $16,500 area, or see some form of outright capitulation back towards the $14,800 area.

Personally, I am hoping for the first scenario, as dip-buying still makes sense at this stage if the November 27th low holds. Additionally, a bullish inverted head and shoulders pattern is also flagging a rally towards $23,000 still remains valid while BTC holds above the $23,000 level.

If we do see BTC comfortably trading above the $19,500 level with limited price retracements this week, then I suspect traders may have to wait until next year to catch Bitcoin at bargain levels around the $14,000 to $13,000 region.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) set a new yearly high last week, completing the initial target of a bullish head and shoulders pattern that has been in the making for months.

I think the risk of an over extension towards the $770.00 level is still fairly high, and I would not be surprised to see ETH breaking the $640.00 resistance level sooner rather than later.

This is also confirmed by the total market cap chart (excluding BTC) which is still showing more upside, and has yet to meet its overall target of $248 billion.

Traders looking to pick ETH up at a bargain price may get lucky if we see BTC heading lower in the short-term. The question becomes where to buy the second-largest cryptocurrency if we do see a solid pullback.

I believe buying as close to the former swing-low, at $480.00, makes sense, and also offers a solid risk-reward opportunity. Just how close to $480.00 ETH can get remains to be seen if a pullback occurs, although somewhere between $525.00 to $500.00 would probably be a good buy.

Sustained weakness under the $480 level on a daily basis may encourage a stronger technical pullback towards the $460.00 area, however, I do not envision ETH/USD falling below $440.00 if a strong pullback does occur.

ETH/USD Daily Chart

Source: Tradingview