November 23 Crypto Market Roundup

BTC posted its seventh-straight week of gains last week, as the number one cryptocurrency moved within touching distance of the $19,000 level.

Bitcoin also performed its second highest ever weekly price close, and it’s third highest daily price close ever.

Data showed that Grayscale investment continued to purchase large amounts of Bitcoins around the $18,000 level, bringing the company’s BTC holdings close to 500,000.

Grayscale also revealed data showing that they now have $11.3 billion Net Assets Under Management.

BTC/USD Weekly Chart

Source: Tradingview

Bitcoin benefited from the positive news developments surrounding COVID-19 stimulus talks, as Republican and Democratic congressional aides went back to the negotiating table.

Bullish comments from Blackrock, and news surrounding a potential BTC supply shortage also helped the pioneer cryptocurrency move towards new multi-year highs.

A report from Pantera Capital noted that PayPal’s recent move into cryptocurrencies is starting to cause a shortage of Bitcoins.

BTC Bitcoin on Exchanged

Source: Glassnode

Data from on-chain analytics provider Glassnode also revealed that BTC on exchanges had fallen to a new all-time record low last week.

The number of Bitcoin addresses created in one-hour reached its highest level since 2018 last week, as 25,000 new addresses were created in just one-hour on November 18th.

Glassnode also released data that showed that 98% of BTC addresses were currently in profit.

Source: Glassnode

Top trader data from the cryptocurrency exchanges Binance and Huobi showed that traders remained nervous about Bitcoin trading above the $18,000 level.

Last week’s Commitment of Traders report also showed that professional traders ramped up bearish bets towards BTC, while small players increased bullish bets.

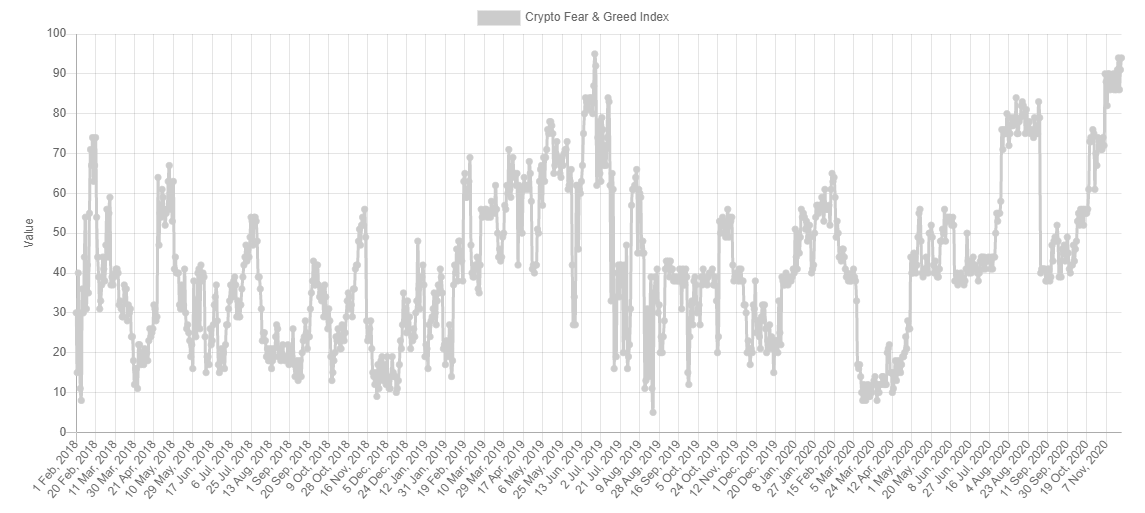

The Crypto Fear and Greed Index remained in “extreme greed”moved within one point of its all-time high last week, with a 94 reading.

Source: Alternative.me

The crypto total market capitalization advanced towards the $544 billion level last week, marking an increase of $100 billion from the start of the last week.

An ongoing technical breakout on the crypto total market cap chart (excluding BTC), helped altcoins stage a substantial upside breakout last week.

Ethereum, Ripple, Litecoin, Polkadot, and a number of other top coins staged major upside breakouts last week.

During my upcoming webinar, I will be charting Vechain (VET), Zash (ZEC), and Polkadot (DOT).

Source: Tradingview

The Week Ahead

During the upcoming trading week Bitcoin’s bull will need to crack the $19,000 resistance level to keep the recent multi-week winning streak alive. Order book data suggests that the $19,000 level is stacked with sell orders, so it’s certainly going to be interesting.

After seven straight weeks of gains, and seven days of gains over the last eight trading days, I would not be surprised to see BTC posting a down week before bouncing back.

Currently, on-chain data shows few hints that a sell-off is going to take place, however, that could quickly change if traders start to book some of their massive profits over the last few weeks.

Technically, a number of bearish divergences are building which indicate that a sharp correction could take place at any time.It remains to be seen how institutions will react if price reaches the $16,000 to $17,000 region again.

I happen to believe that BTC could see a major pullback if the $16,000 level is broken with conviction.

Still, we have to factor in that BTC could still head higher, and if the $19,000 resistance level, and the firewall of sell orders is overcome, then BTC is probably going to test towards the $20,000 level this week.

I would just add that any positive news surroundingU.S. stimulus talks has the ability to derail any potential short-term setback for BTC, and catapult riskier asset classes higher.

Also, something big is about to go down with the greenback my charts are telling me. Some patterns suggest that the U.S. Dollar Index could stage a strong recovery over the coming week’s. It remains to be seen what implications this may also have for BTC.

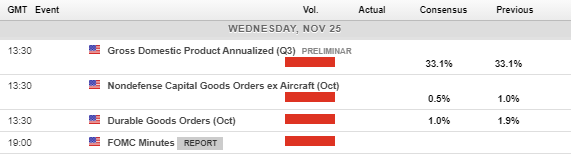

Looking at the economic calendar this week, the U.S. data docket is once again fairly light, although the FOMC meeting minutes are worth watching out for. As is COVID-19 vaccine new, and the previously mentioned U.S. stimulus talks.

Economic Calendar

Source: Forexlive

Bitcoin (BTC) Last week I mentioned that I was not expecting a significant pullback until at least $18,000 or $19,000. Now that we are here it really is a now or never moment for BTC in regard to breaking $20,000.

Technical analysis highlights key trendline resistance on the weekly time frame is located around the $20,600 level. If the $20,000 level is broken then I expect we will quickly see a quick test of the $20,600 level for sure.

In the near-term, a break above $19,000 is likely to see BTC quickly testing towards the $19,300, and then $19,800 level.

Failure to overcome the $19,000 level and the $18,400 and $17,700 levels are the immediate bearish targets.

Below $17,700, the key former breakout area, at $17,200 offers formidable support, alongside the $16,500 level.

Should we see an over extension to the downside, the $16,000 to $15,500 area offer a very good risk-reward opportunity for short and medium-term bulls.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) has the potential to rally towards the $630 level this week according to the large inverted head and shoulders pattern on the weekly time frame that is now close to reach its full upside target.

An over extension in the ETH/USD pair towards the $680 resistance level is also possible looking at the weekly time frame.

Traders looking for a pullback in the ETH/USD pair, or a safe entry to get back into the prevailing trend may have to wait for a retest of the former 2020 high, around the $490 zone.

It is also noteworthy that the odds of getting a strong recovery from the $490 area, if we do see a sudden pullback, is dramatically increased if we see $490 hit before $630. This is due to the fact that these bullish reversal patterns rarely miss their overall upside targets, and are very historically very precise.

In the near-term, sustained weakness under the $590 on a daily basis may encourage bears to target $540, and finally $490.

To the upside, watch out for a strong run higher towards the mentioned upside targets if price starts to settle above the $600 with few price retracements.

ETH/USD Daily Chart

Source: Tradingview