November 16 Crypto Market Roundup

BTC posted its sixth-straight week of gains last week, marking the bellwether cryptocurrencies longest winning streak since April this year.

Bitcoin also performed its third highest ever weekly price close, after breaking through the $16,000 resistance level in spectacular fashion.

Data showed that demand from institutional investors continued to drive the breakout rally, further highlighting the difference between the 2017 bull run and the ongoing up move.

Grayscale Investment’s CEO also said that the company managed to attract the largest daily amount of funds raised ever for their BTC fund last week.

BTC/USD Weekly Chart

Source: Tradingview

Bitcoin benefitted from a slew of positive news developments last week, following the previous week’s sharp price retracement towards the $14,280 level.

BTC headed higher alongside other riskier asset classes on that news that Pfizer Inc. and BioNTech SE have developed a COVID-19 vaccine that has proved to be 90% effective in initial trials

Legendary investor and hedge fund manager Stan Drukenmiller also announced that he has been investing in Bitcoin. Drukenmiller also predicted a gradual four-year downtrend in the U.S. dollar.

Bullish news surrounding China’s second-largest commercial bank, and PayPal’s recent move into cryptocurrencies also help to underpin the positive sentiment towards BTC.

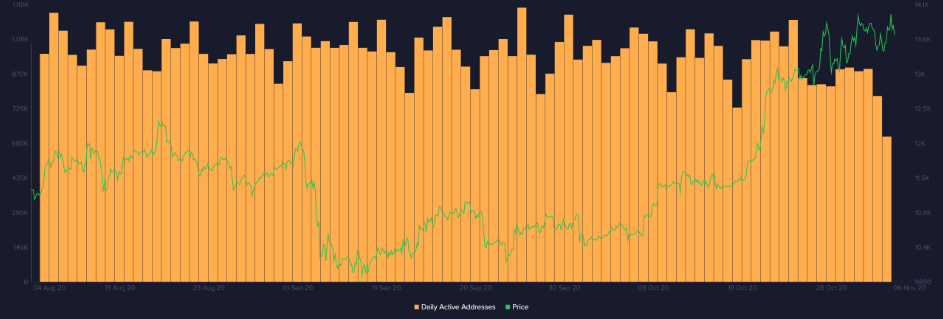

BTC Daily Active Addresses

Source: Glassnode

Data from on-chain analytics provider Glassnode revealed that BTC Active Sender Addresses hit a new all-time record high last week.

Glassnode also released BTC exchange supply data, which showed that active BTC one and two year supply on exchanges had fallen to an all-time low.

Source: Glassnode

Bitcoin’s network hash rate started to recover higher last week, after suffering an extended price plugge last week. Analysts noted that the increase could be due to Chinese miners going back to work after recently migrating from Sichuan.

Last week’s Commitment of Traders report showed that institutions increased bullish bets towards BTC, while professional traders and leveraged funds ramped up bearish bets towards BTC.

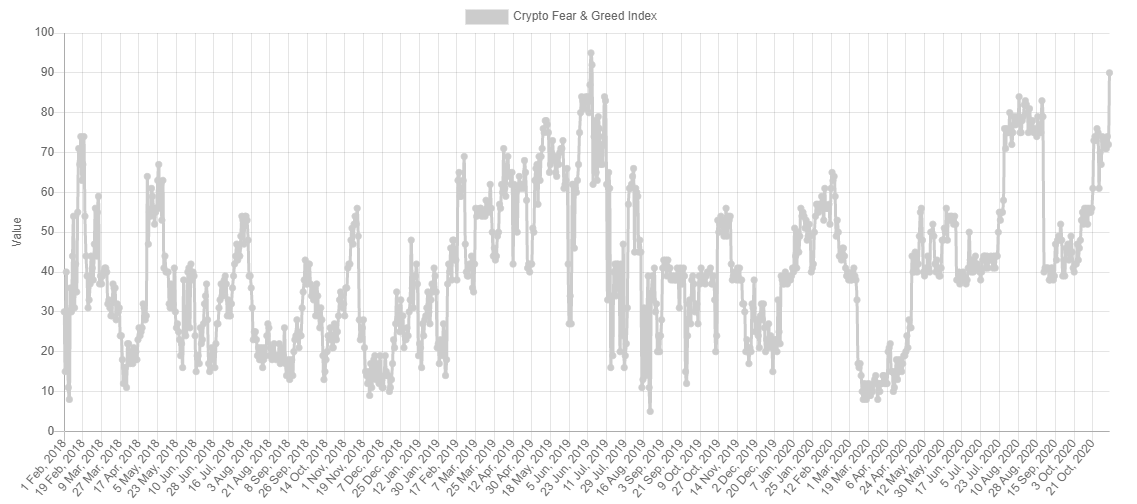

The Crypto Fear and Greed Index showed that traders remained in a state of “extreme greed”. Keeping the index within touching distance of its record 95 reading.

Source: Alternative.me

The crypto total market capitalization advanced towards the $471 billion level last week, marking an increase of $50 billion from the start of the last week.

A technical breakout also took place on the crypto total market cap chart (excluding BTC), as a number of altcoins finally started to turn higher.

Kusama, DASH, Uniswap, Litecoin, and Yearn finance were amongst some of the top gainers in the cryptocurrency market last week.

During my upcoming webinar, I will be charting Ethereum (ETH), DASH (DASH), and Monero (XMR).

Source: Tradingview

The Week Ahead

During the upcoming trading week Bitcoin will need to start to set a new monthly high, and test towards the $17,000 area to avoid traders becoming nervous about large-scale profit taking, and a potential drop towards the $15,000 area.

Ultimately, the fact that institutional investors continue to aggressively buy into price dips towards $15,000 should give short and medium-term traders a degree of confidence that BTC will rally into the end of the month. And possibly December.

While the fundamentals for BTC remain overwhelmingly positive, the technicals for BTC remain rock-solid while price trades above the $16,174 level. More on this later.

Some analysts are suggesting that BTC may start to consolidate around the $15,000 to $16,000 range while alts start to play catch up. Personally, I don’t think that will be the case this time.

I happen to believe that BTC will continue to truck higher, while altcoins will simply match or outpace BTC in terms of gains. This scenario would bode well for traders that have missed the latest run higher in BTC, and are seeking exposure to a quick double-digit run higher in the altcoin space.

Recent data has shown that the ongoing rise in Bitcoin is being driven by institutional demand, rather than speculative, which was almost certainly the case in 2017.

Again, this could also be positive for some of the top alts, as institutional investors and crypto hedge funds may start to diversify into altcoins, as they become more accustomed to crypto trading, and the fundamentals behind some of the top tokens.

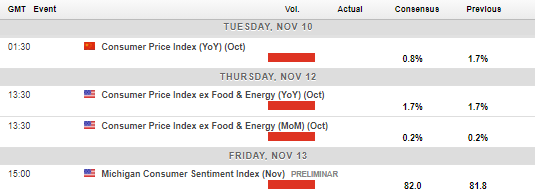

Looking at the economic calendar this week, the U.S. data docket is fairly light with Retail Sales and Weekly data headlining. Market participants are likely to focus on any COVID-19 vaccine, and U.S. political news.

Economic Calendar

Source: Forexlive

Bitcoin (BTC) has started the week on the front foot with bulls aggressively buying dips below the $16,000 level. This set the stage for a coming test of the $17,250 or $18,000 level this week.

Last week I mentioned that BTC had staged a breakout from a large broadening wedge pattern, this remains the case, and still suggests that BTC is headed towards the $19,000 to $20,000 resistance area.

Technically, BTC bulls has very little to worry about while price trades above the $15,500 level this week. Minor bearish RSI divergence has formed during last week’s run higher, however, it could take some while for this to reverse.

Should we see the $15,500 level broken, for whatever reason, that BTC could easily slip back towards the $14,800 and $14,580 area. However, I am not expecting a significant pullback until at least $18,000 or $19,000.

In the near-term, watch out for BTC bulls to pick up the pace while price trades above the $16,490 level. The $16,170 level is now acting as former key resistance turned support.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) has the potential to rally towards the $500.00 level and possibly higher this week after surviving a technical sell-off towards the $440.00 level over the weekend.

ETH/USD bulls look poised to take out the $470.00 and challenge towards the current yearly higher, around the $490.00 level. If bulls are able to achieve this then Etheruem could start to settle into a much-higher trading range between the $550.00 and $600.00 levels.

Indeed, a bullish inverted head and shoulders pattern breakout that has been developing over recent weeks suggests that Ethereum is headed towards the $600.00 benchmark level.

Given the positive fundamentals and ongoing rally in BTC it is not surprising. In the near-term, bulls need to hold price above the $440.00 area to give ETH/USD a realistic shot at achieving $500.00 this week.

If we see ETH/USD trading below $440.00 then a much steeper price decline towards the $420.00 to $415.00 area seems likely.

Overall, I would not be surprised to see Ethereum posting serious gains this week if bulls can slice through the former weekly high, and the current yearly high this week.

ETH/USD Daily Chart

Source: Tradingview