November 9 Crypto Market Roundup

BTC posted another week of double-digit gains last week, as uncertainty towards the U.S. Presidential election result caused traders to sell the U.S. dollar and buy Bitcoin.

Bitcoin rallied above the $15,000 resistance level for the first-time since January 2018, with the pioneer cryptocurrency hitting a 33-month trading high, of $15,977, on the cryptocurrency exchange Coinbase.

The number one digital asset also benefited from bullish news surrounding the payment provider PayPal’s recent move into cryptocurrencies.

BTC/USD Weekly Chart

Source: Tradingview

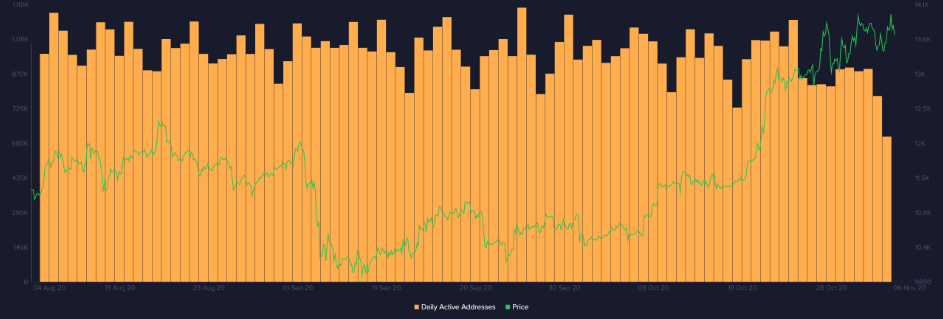

In the run-up to the U.S. Presidential election the number of daily active addresses continued to drop for BTC as holders and traders attempted to hedge against downside risks. Traders also flooded exchanges with BTC ahead of the U.S. election result.

Data from on-chain analytics provider Glassnode revealed an 18% increase in BTC entering exchanges in the days before the election.

A massive BTC whale transaction and a large spike in BTC Token Age Consumed also took place just prior to the day of the U.S. election.

Figures from Square, PayPal, and Grayscale showed that consumer demand for Bitcoin surged also last week, with demand for BTC now easily outstripping new supply from Bitcoin mining.

BTC Daily Active Addresses

Source: Santiment

Last week’s Commitment of Traders report showed that professional traders and hedge funds increased bearish bets towards BTC ahead of the U.S. election.

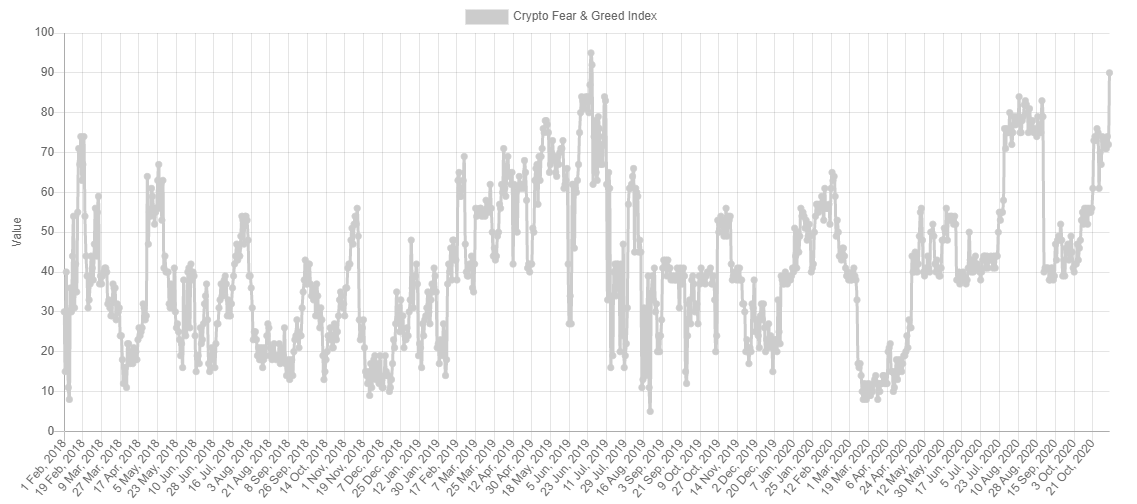

As Bitcoin surged after the U.S. election The Crypto Fear and Greed Index showed that traders had entered a state of “extreme greed”. The index recorded its third highest ever official reading.

Source: Alternative.me

Bitcoin’s on-chain metrics continued to show a number bearish divergences, including relatively low network activity, concerningly high profit margins, shifts in HODLer behavior and a pivot towards bullish social sentiment.

A report from crypto behavioral platform, Santiment, showed that Bitcoin’s 30-day MVRV (which calculates the average ROI of all addresses that have acquired BTC in the past 30 days) ballooned to +18.8% last week.

Technical indicators surrounding BTC continued to generate strong buy signals, despite some worrying on-chain divergences.

Source: Tradingview

|

The crypto total market capitalization rallied towards the $455 billion level last week, as the surge in Bitcoin helped cause the total market cap hit levels not seen since February 2018. A number of exchanges also saw record amounts of BTC trading activity after the U.S. election. Over $400 million in trading volumes were recorded for BTC pairs on the cryptocurrency exchange, Bitfinex. Altcoins started to gain strength after the U.S. election, as a number of coins, such as Hedge Trade, NEM, and Celsius posted major gains alongside BTC. During my upcoming webinar, I will be charting Ripple (XRP), Litecoin (LTC), and Tezos (XTZ). |

Source: Tradingview

The Week Ahead

This week Bitcoin is well-placed to build on this month’s gains, and post a six-straight week of gains, following the announcement that Joe Biden has now officially been declared the winner of the U.S. election.

The perception that the Democrat party will push for a large COVID-19 stimulus package, increase taxes, and strive to improve its fragmented trade relationship with China supports the case for more U.S.dollar depreciation, and further BTC gains.

Crypto traders will also be looking to further comments from Joe Biden on how he plans to transform the U.S. economy, and indeed elaborate on his administration’s way of dealing with the COVID-19 crisis.

As previously stated, BTC has major scope to move into a much-higher trading range now the $14,200 level has been broken. The scope of gains for Bitcoin certainly has the potential to shock crypto traders and investors, given the fact that demand is fast outstripping supply, and institutions are piling into BTC like never before.

Retail investors waiting for a pullback to $10,000 may be left at the starting gate. If Bitcoin holds above the $14,200 level, then a new trading range between $14,200 to $20,000 could be carved out over the next few weeks or even months.

Given that a considerable political risk event is now out the way, traders can go back to focusing on the underlying fundamentals that are currently underway and the multi-year range break currently underway in BTC.

The only caveat to add this week is the announcement of a 90% successful COVID-19 vaccine from Pfizer during trials; the reaction so far from the crypto market has not been good.

It really remains to be seen how BTC will take this news, although it is undoubtedly positive for U.S. equity markets and the global economy, if indeed the claims from Pfizer are correct.

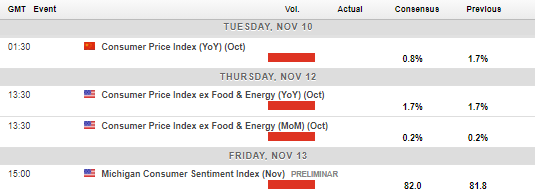

Looking at the economic calendar this week, Chinese and U.S. economic data points are heavily in focus. As previously stated, with the election result now confirmed, speeches from Joe Biden are likely to be closely watched by market participants, particularly in regard to his fiscal and COVID policies.

Economic Calendar

Source: Forexlive

Bitcoin (BTC) staged a huge breakout above a broadening wedge pattern last week after storming through the $14,200 resistance level with relatively ease.

The mentioned pattern holds a $5,000 point upside projection, which means that BTC could be headed towards the $19,000 to $20,000 resistance area at any time in the near future.

Technically, BTC is more bullish than at any point over the last two years. Technical traders should consider the fact that if BTC trades towards the $20,000 level then a huge inverted head and shoulders pattern will form on the monthly time frame.

According to the size of this potential bullish price pattern, BTC could rally all the way to $36,000 if the $20,000 level is surpassed. This is obviously a huge upside target, one that is also actually attainable, according to the current technicals.

In order for bulls to keep the upside pressure intact in the near-term they must keep price above the $14,300 to $14,200 area. The $14,800 and $14,580 levels now offer the strongest forms of near-term technical support below $15,000.

A number of technical indicators are currently bullish, and leave very little room to question the validity of the rally while price trades above the $14,200 level.

Should the $14,200 support level break, don’t be surprised to see BTC falling sharply, and possibly even collapsing towards the $12,700 level.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) gained solid upside momentum last week following the Ethereum 2.0 and PayPal news, giving the second-largest cryptocurrency its highest weekly price close since July 2018.

Further gains should be expected as long as bulls can maintain price above last weeks key breakout area, which is located around the $420.00 level.

Should we see the ETH/USD pair starting to gain upside traction I would expect that a move above the $500.00 level would not be unreasonable to expect, and a key area bulls need to break to start the next major leg higher in the cryptocurrency.

A bullish inverted head and shoulders pattern on the weekly time frame is now in play, and is projecting an eventual move towards the $600.00 level.

Additionally, lower time frame analysis is showing and a triangle breakout is currently in play, placing the $500.00 as an ever probable near-term upside target.

In terms of technical indicators, the Williams Alligator indicator is flashing its first major buy signal in the daily time frame since early-August this year.

ETH/USD Daily Chart

Source: Tradingview