November 2 Crypto Market Roundup

BTC rallied above the $14,000 level for the first-time since January 2018 last week, marking a 33-month trading high for the pioneer cryptocurrency.

Bitcoin also celebrated the 12th anniversary of the Bitcoin white paper, which was created by the pseudonymous inventor Satoshi Nakamoto.

The number one digital asset continued to decouple from traditional financial markets last week, as U.S. equity markets and gold succumbed to heavy selling while BTC rallied for a fifth straight week.

BTC/USD Monthly Chart

Source: Tradingview

BTC also received a boost from the news that Singapore’s largest commercial bank, DBS, announced that they are launching a Bitcoin exchange.

Bitcoin incurred significant market volatility as $750 million worth of options expirations took place last week. The CME exchange also recorded the second-highest monthly closing for Bitcoin futures at $13,735.

Data showed that the amount of BTC entering into exchanges hit a three-low last week, while the number of BTC retail addresses hit a new all-time record high.

BTC Addresses holding 0.01 Bitcoins

Source: Glassnode

Last week’s Commitment of Traders report showed that leverage funds increased bearish bets towards BTC, while institutions decreased bullish bets towards BTC ahead of the U.S. election.

Combined retail positioning data from Binance, BitMex, and Bitfinex cryptocurrency exchanges showed that 75% traders remained bullish towards BTC.

The Crypto Fear and Greed Index also showed that traders remained in a state of “greed”, as the index hovered around 8-week highs.

Source: Alternative.me

Bitcoin’s on-chain metrics continued to show a number bearish divergences, despite the cryptocurrency rising to a multi-year trading high.

A report from crypto behavioral platform, Santiment, showed Bitcoin’s network activity declining, alongside its social media volume. Additionally, Bitcoin’s Mean Dollar Invested Age continued to decline.

The Relative Strength Indicator on the daily time frame showed that Bitcoin traded at its most overbought level since July 2019 last week.

Source: Santiment

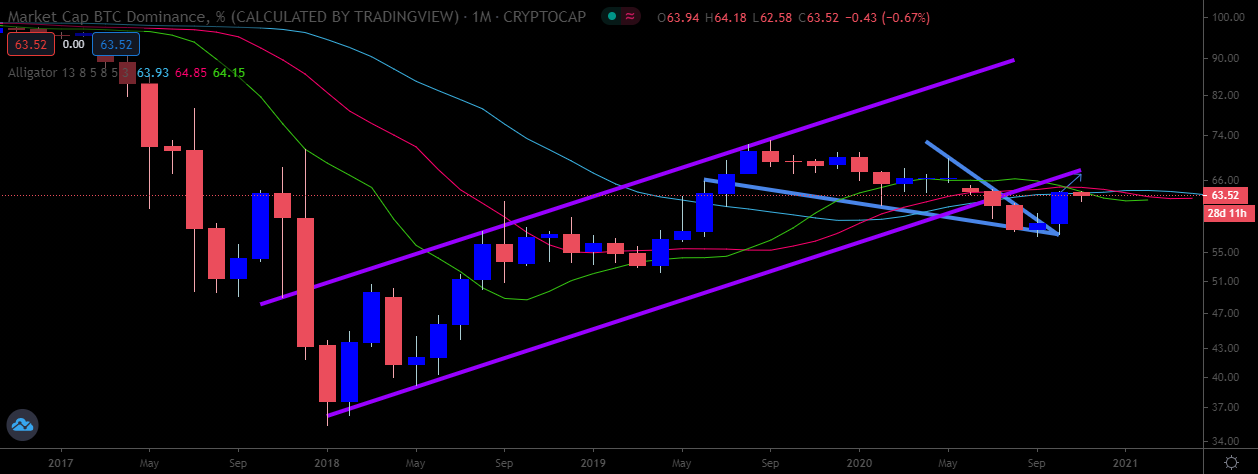

Bitcoin’s market dominance continued to breakout to the upside last week, and traded at the 64% level for the first-time in sixteen weeks.

Altcoins continued to decline last week, and remained largely out-of-favor with investors. The DeFi space continued to suffer last week with Yearn.finance and Compound amongst the worst affected.

During my upcoming webinar, I will be charting Monero (XLM), Maker (MKR), Ethereum (ETH), and Bitcoin.

Source: Tradingview

The Week Ahead

This week could be a defining moment for Bitcoin, and with that said I will get straight into the possible outcomes for BTC in regard to the U.S. election result.

Should we see Joe Biden win, as widely expected, I would expect Bitcoin to continue to rally over the coming weeks. The perception that a Biden administration would be more likely to impose a COVID-19 lockdown, approve a larger stimulus package, and increase taxes should all play into Bitcoin’s favor.

Should we see President Trump be elected for a second term, I would expect Bitcoin to spike initially, and then fade lower towards the $11,000 area until the next stimulus package is approved.

This is because markets are likely to pile into the U.S. dollar and equity markets, in the same manner they did in 2016, as they anticipate an America first agenda being implemented over the next four-years.

I think the worst case scenario for Bitcoin would be a contested election, and this could generate a massive move lower in financial markets, as investors and traders price-in weeks or uncertainty, and potential civil unrest.

Personally, and quite controversially, I would expect BTC to trade between the $14,000 to $8,500 price range this month if that scenario unfolded, as the prospect of the coming political chaos, and undoubted flight into traditional safe-haven asset classes takes hold.

One thing is for sure, this week we are going to see significant market volatility in cryptos: so stay safe out there, and pick your spots extremely carefully.

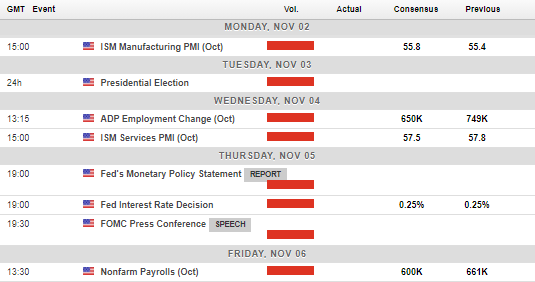

Looking at the economic calendar this week, central bank rate decisions, and the releases of the U.S. monthly jobs report are going to be main events traders are watching, although they will be largely overshadowed by the U.S. election.

Economic Calendar

Source: Forexlive

Bitcoin (BTC) incurred a strong technical rejection from the top of the massive broadening wedge pattern I have been mentioning over recent week’s over the weekend.

Historically, broadening wedge patterns have been very accurate in predicting the upcoming price movements, as asset classes typically test either side of the wedge pattern numerous times, before an explosive breakout finally takes place.

With this in mind, we could see BTC capitulating towards the bottom of the wedge pattern, currently located around $8,700, or indeed testing, and eventually breaking above the wedge pattern.

Either scenario is very exciting for BTC, and implies that a potential $5,000 directional move could take place in the aftermath of the U.S. election.

Technically, BTC still has some unfinished business with the $11,100 level, which acted as formidable support and resistance for BTC over recent months. This is the area where traders may assess the strength of Bitcoin’s bullish trend if a major pullback does occur.

However, the bigger picture still shows that an extremely large inverted head and shoulders pattern has formed, with an upside target of at least $20,000.

A large corrective drop from current levels to form a final right-hand shoulder also plays in the mentioned scenario with broadening wedge pattern; i.e BTC will stage a large impulsive drop before surging back above $14,000.

Overall, the current technicals suggest buying a dip below $9,000 or buying an eventual breakout above $14,100 could prove very lucrative this month.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) remains trapped between the $380.00 to $420.00 trading range, with the next major directional move in the cryptocurrency likely to take place once a breakout from this range is confirmed.

A quick $60.00 breakout is likely to take place once we see Ethereum finally picking a direction, however, if Bitcoin were to fall substantially lower, then ETH could easily suffer a much larger decline.

Technical analysis continues to highlight the $270.00, and possibly the $230.00 levels as extreme bearish targets, and potential long-term buy areas for traders who still expect significant ETH price appreciation this and next year.

Ethereum could easily follow BTC higher if we see a confirmed technical breakout in Bitcoin above $14,100. If this scenario were to unfold I would expect to see Ethereum trading in between the $475.00 to $600.00 price before year-end.

I still believe the far more enticing scenario would be a protracted decline towards the mentioned levels sub-$300.00, which would indeed shake-out the weak hands, and create a tremendous buying opportunity.

In the near-term, keep a close watch on the $380.00 to $420.00 price range between now and the U.S. election result.

ETH/USD Daily Chart

Source: Tradingview