October 26 Crypto Market Roundup

Bitcoin staged its largest one-week rally since April 2020 last week, following the news that PayPal will enable buying, selling, and holding crypto for U.S. customers in the coming weeks.

BTC also rallied to a new 2020 trading high last week, hitting $13,336, as the pioneer cryptocurrency performed its highest weekly price close since January 2018.

The major breakout in Bitcoin had telegraphed over recent weeks, due to increased demand from institutional investors, positive on-chain data, and the increasingly bullish technicals backdrop.

Bitcoin also started to de-couple from traditional asset classes such as gold and the S&P 500 last week. Infact, data showed that Bitcoin’s 30-day correlation with the S&P 500 fell towards zero.

BTC/USD H1 Chart

Source: Tradingview

On-chain analyst Willy Woo added “The decoupling is upon us

Former Goldman Sachs trader, Raol Pal, added that Bitcoin was currently the “biggest trade in the world at present”. Pal added “the next thing I’m expecting is the correlations between BTC and the dollar and BTC vs equities to break down too… let’s see. #Bitcoin”

Hedge fund manager, Paul Tudor continued to talk-up the recent breakout in BTC, with the legendary trader noting that the move towards $13,000 in BTC was likely just “the first innings”

Matt Blom, from cryptocurrency firm Diginex, struck a more cautious tone towards the recent run at $13,000. Mr Blom noted “A continuation would probably require more positive news”.

Source: Twitter

Last week’s Commitment of Traders report showed the disparity between institutional investments and hedge funds grew, as leverage funds placed record bearish bets towards BTC.

Margin retail positioning data on selection of popular cryptocurrency exchanges showed that traders remained bullish towards BTC, despite price sitting a 16-month high.

A number of key on-chain metrics suggested that a price correction from current levels could happen at any time, ahead of the upcoming U.S. election.

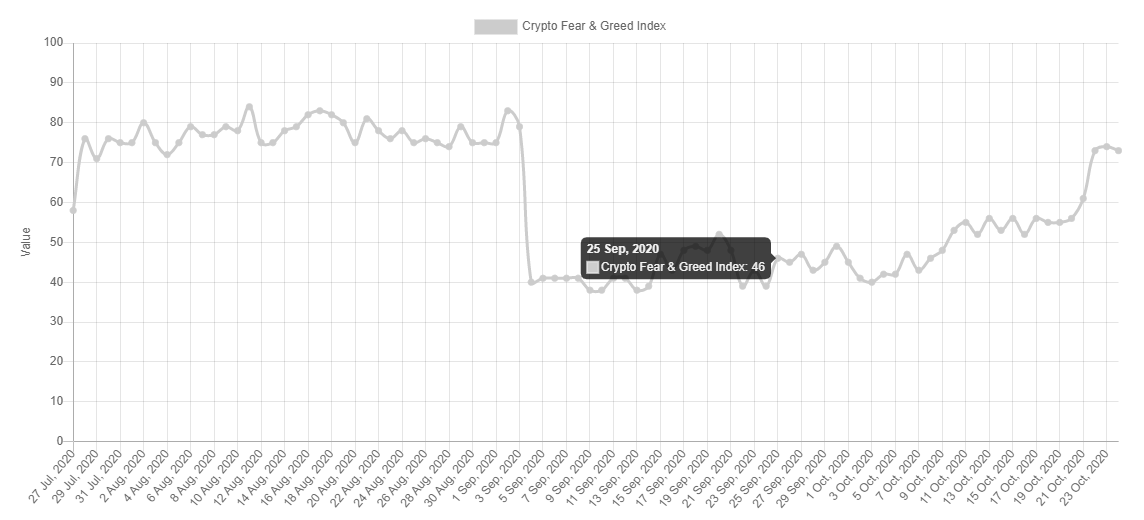

The Crypto Fear and Greed Index also showed that traders had moved into a state of “greed”, with the index trading at levels not seen since the September 1st flash crash.

Source: Alternative.me

The cryptocurrency total market capitalization traded between the $345 and 400 billion levels last week, as Bitcoin’s rally continued to power the crypto market cap higher

Spot volumes for BTC exploded to levels not seen since July 27th last week, while data showed that the CME became the second-largest Bitcoin futures exchange.

Litecoin led the pack in terms of gains amongst the top altcoins last week, while Etheruem managed to overcome the $395.00 level. Chainlink, and Bitcoin Cash also enjoyed strong weekly gains.

During my upcoming webinar, I will be charting Chainlink (LINK), Litecoin (LTC), Zilliqa (ZIL), and Bitcoin.

Source: Tradingview

The Week Ahead

Bitcoin had a huge week last week, and by all measures, this week could be equally as important to gauge whether the ongoing breakout is the real deal or just a major squeeze higher ahead of the upcoming U.S. election.

One thing to note about the current rally is that positive news is driving BTC higher, while bearish news is having a relatively limited impact. This is exactly how assets classes behave during bull markets, so the last weeks move higher could indeed be genuine.

The main point of contention is now whether Bitcoin stages a major pullback before or after the election. Personally, I think the odds of a strong pullback during election day is fairly high.

If the election polls begin to tighten this week the greenback could come under severe pressure, as markets fear a contested election result.

I think Bitcoin could benefit from this initially, however, if the S&P 500 starts to take a major hit below 3,395, then BTC could start to give back some gains.

Admittedly, U.S. equity markets have been taking the delay in the coronavirus stimulus remarkably well, however, a contested election may cause severe risk-off sentiment to return.

Something else to watch is the alarming rise in global coronavirus infections, with various European nations going back into lockdown. If this trend continues then risk-off could definitely return.

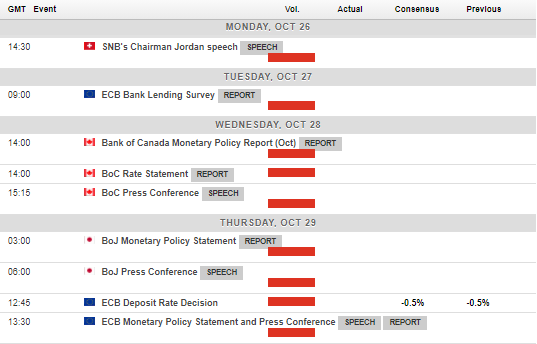

Looking at the economic calendar this week traders have a slew of global central bank rate decisions to watch out for, and United States GDP, Inflation and Jobs figures.

Economic Calendar

Source: Forexlive

Bitcoin (BTC) has finally moved towards the June 2019 trading high, which has confirmed the structure of a massive inverted head and shoulders pattern on the weekly time frame.

This is extremely bullish over the long-term, as it suggests that Bitcoin will eventually rally above the $20,000 level, and form a new-all time high in the near-future.

It should be said that while the pattern has been confirmed, a sharp bearish correction can still take place to form a final right-hand shoulder before the explosion towards $20,000 takes place.

According to technical analysis, a move below the $11,100 and then $10,300 levels are required to start the expected corrective drop will likely reach the $9,200 to $8,600 price area.

Interestingly, a broadening wedge pattern on the daily time frame is suggesting that BTC/USD will trade between the $14,200 and $8,800 level before a massive $5,000 breakout takes place.

In the near-term, short-term traders are likely to focus on the $11,900 to $13,360 price range, a major $1,400 move is expected once we see this important range broken.

BTC/USD Daily Chart

Source: Tradingview

Ethereum (ETH) has all to play for this week after finally staging a meaningful range breakout above the $390.00 resistance level last week, which was largely spurred on by the bullish PayPal news, and the massive move in BTC.

It is fair to say that ETH has a lot of catching up to do in order to match BTC in terms of monthly gains. With this in mind, the next major push higher should come if ETH bulls can anchor price above the $420.00 level.

Looking at the upside for ETH/USD pair this week bulls may be satisfied with a run towards the $450.00 to $500.00 area. Especially since the U.S. election is almost one-week away: it is hard to imagine too many large ETH players being fully positioned on election day.

Medium-term analysis is also bullish, as the ETH/USD recently bounced from the neckline of a massive inverted head and shoulders pattern, which suggests an eventual rally towards $600.00.

Should we see upside failure or exhaustion this week bears will look for sustained weakness under the $380.00 level as a technical sell signal. Bear may then target towards the $330.00 or possibly the $300.00 area.

Traders should remember that ETH/USD is unlikely to see significant downside while BTC/USD is in full-on bull mode, or indeed if BTC has yet to reach its medium-term bullish target before profit taking kicks-in.

Ultimately, it is hard to be bearish towards Ethereum while Bitcoin is in such tremendous form. Only a major correction in BTC is likely to dampen the near-term prospect for ETH.

ETH/USD Daily Chart

Source: Tradingview