Know Your NFT Meme

“I can right click and save that JPEG, so why pay for that?”—that’s what you would usually hear from people not involved in the NFT space. What they don’t know is that the value is not in the pixels.

Owning exclusive rights to online images has got to be the most memorable meme of the 21st century. But not all of them are jokes. Years of work has gone into some—like Beeple’s “The First 5000 Days” collection was auctioned for $69 million.

Music composers, movie producers, sports teams, and many other celebrities have sold exclusive items, rights, and merchandise via NFTs. But the hunt for value doesn’t end with an auction at Sotheby’s or Christie’s or an autograph of a celebrity.

NFT creators found innovative ways to expand the value proposition of their works beyond art. In this edition of SIMETRI Edge, I will explain a few of them.

Generative Art

Generative art is when you take a set of predefined elements and feed it to an algorithm that spits out random combinations of those elements. Crypto Punks is arguably the most iconic generative art on Ethereum.

A random Crypto Punk

As the NFT summer hit, numerous generative art projects emerged on the market. The floors on these collections went up several times immediately after mint. For example, Brotchain started selling for over 10 ETH immediately, while the mint price was less than one ETH. It became a staple that generative art is expensive.

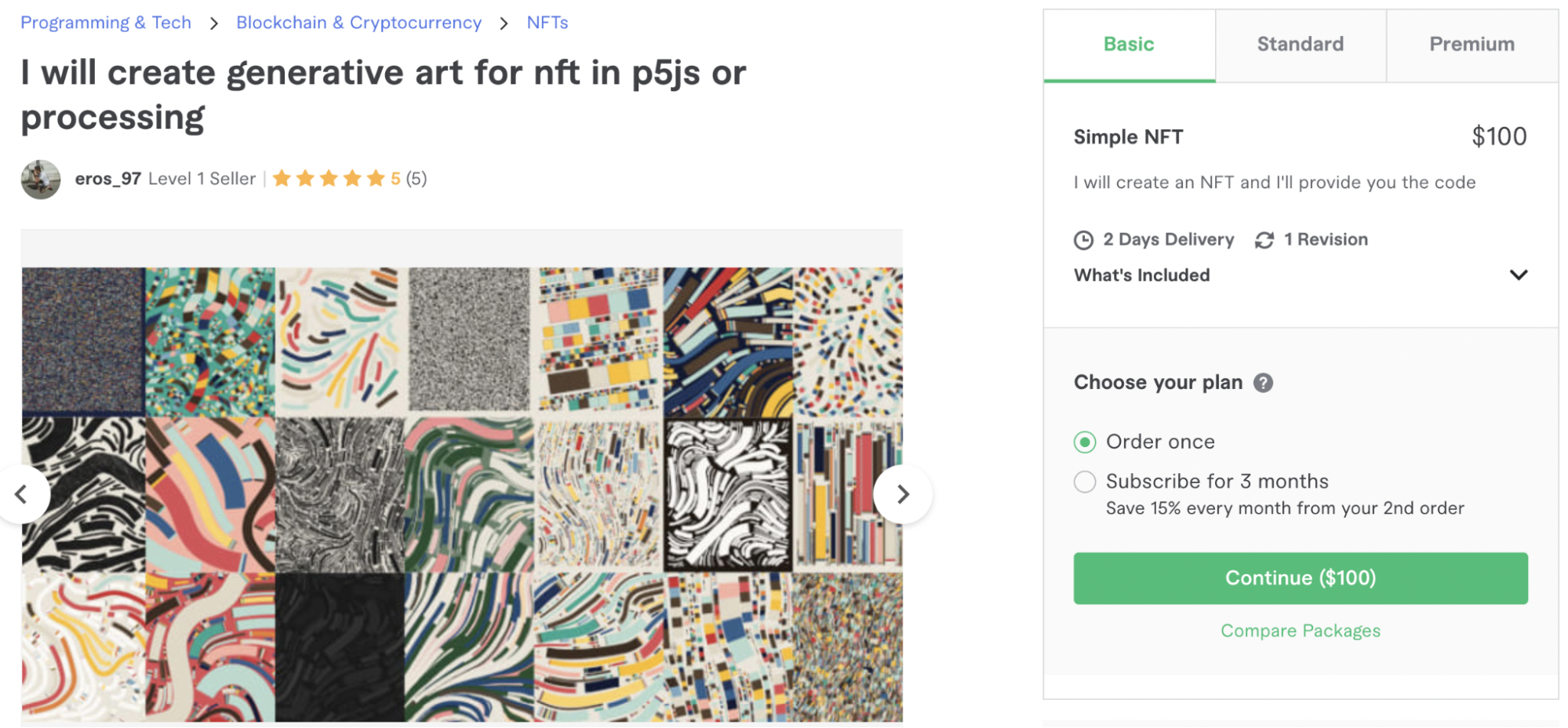

Ironically, it isn’t difficult to produce generative art. You can go on Fiverr and get a collection for a reasonable amount of money. You can then sell it if you want.

Why buy Fidenza for 300 ETH if you can have it for $100?

However, you probably won’t be able to make a quick buck. While making such art is trivial, promoting it and creating demand is difficult, even in this exuberant market. If your art isn’t on Art Blocks, you’re not going to make it.

So, making money on generative art involves identifying the influencers first. Subscribe to people talking about this stuff like Kevin Rose and try to ride on their tails.

The generative art movement became so strong that creators offered memberships to exclusive communities in which members get access to unique NFTs.

Access to Exclusive Drops and Clubs

Gen.Art once sold membership NFTs for 0.1 ETH. The tokens provide access to minting generative art from various artists. Apparently, people value the opportunity to do so very high because the floor price of the membership right now is over 2 ETH.

It doesn’t stop on generative art. Stoner Cats, a TV show produced by Mila Kunis and Ashton Kutcher, offers lifetime membership access. In a sense, it’s like subscribing to a series on Netflix.

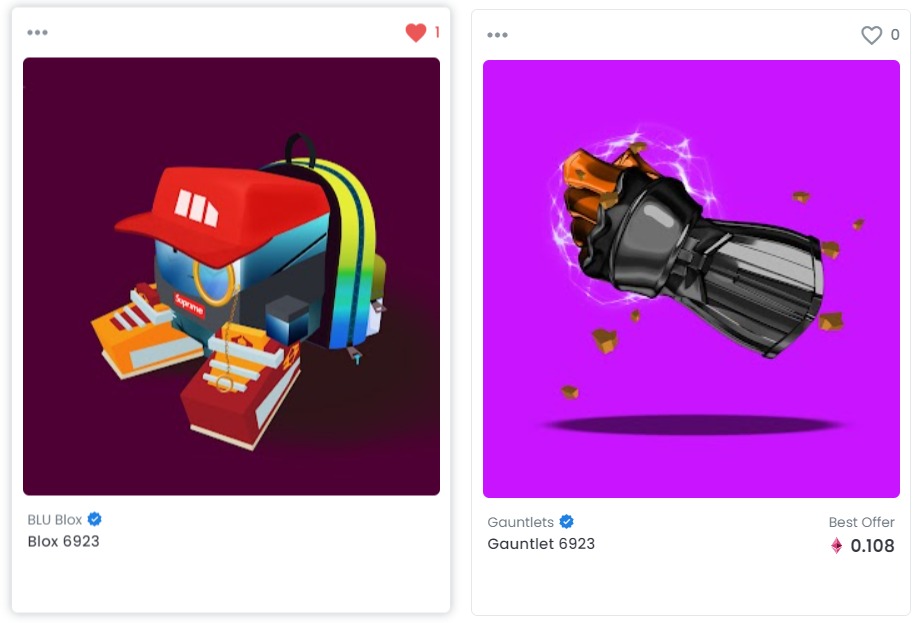

Similarly, BossLogic released a Marvel-inspired NFT collection, Gauntlets. The original sale came with a roadmap that begins with a superhero glove but also grants access to airdrops of BLOX characters, a complete superhero avatar, and online games along the way.

Last but not least, Bored Ape Yacht Club, currently selling at a floor price of 37 ETH (~$114,800), gave holders rights to mint Mutant Ape Yacht Club NFTs, whose floor is now 4.5 ETH (~$12,500).

If you correctly identify prolific NFT creators, you may get a pretty solid free ride. Pay for membership once, and you may get several times more than what you paid for it.

Amorphous NFTs

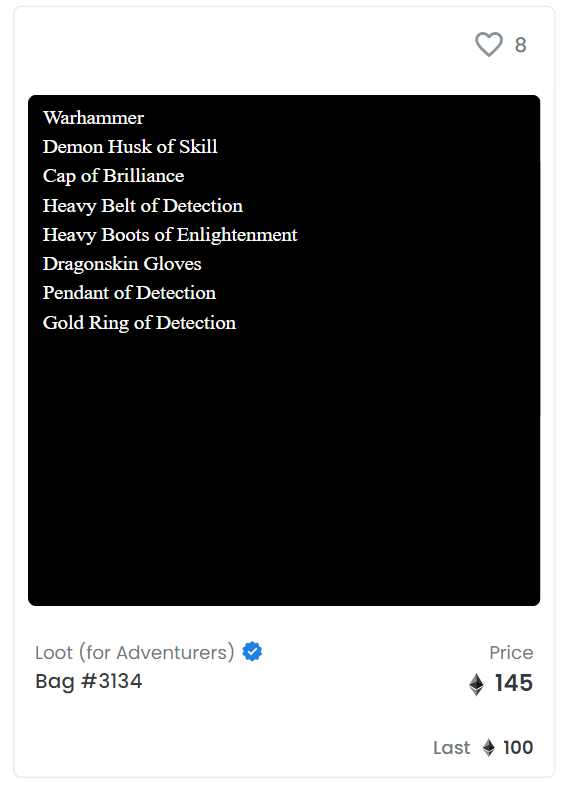

If you haven’t been living under a rock for the past several weeks, you most likely heard about Loot, and it most likely made you confused. I mean, who would pay 8 ETH for a bunch of white letters on a black background.

However, if you look through the lens of the metaverse, these Loot items can easily find application in numerous role-playing games (RPG). Since there are no restrictions on how Loot items should look, they can be integrated into various visual settings without disrupting them.

Think about it this way: if a cartoon character gets into a real movie, it would most likely feel off unless it’s Space Jam. However, if a person dressed as a cartoon character will be in the same movie, you will not be concerned. Loot enables it.

People like Loot.

As you may know, I rambled about blockchain games quite a bit last week. This is because we at SIMETRI think gaming is the next big thing in crypto. Rarity, an RPG game on Fantom, which you might recall from last week’s Insights, was inspired by Loot. Games also added a layer of value accrual for NFTs: breeding.

NFT Moms and Dads

NFT breeding may sound stupid and childish but think of the implications in the metaverse, where each item has a value.

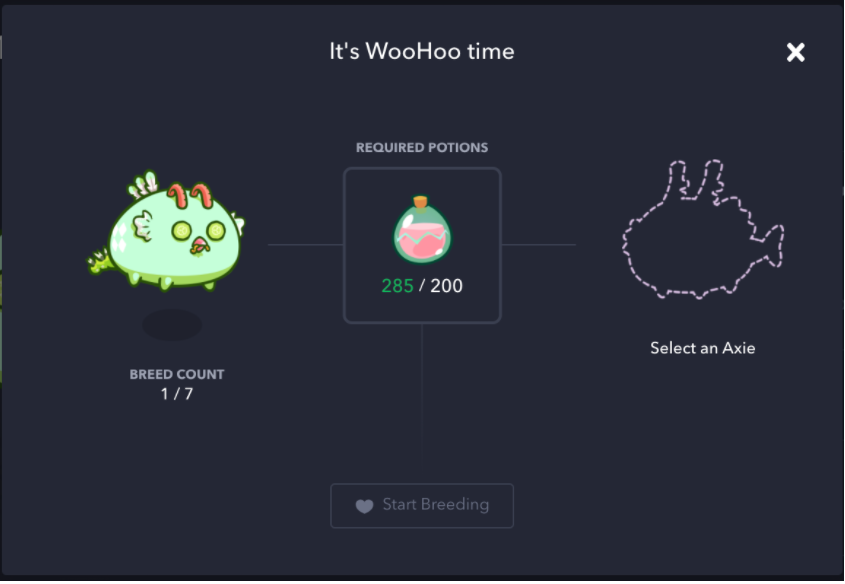

Axie Infinity arguably popularized breeding. Its owners can breed their Axies with others. This feature costs AXS tokens and some Smooth Love Potions but gives them an additional Axie to play with or sell on the secondary market. It’s like breeding and selling cats or dogs. Some people have businesses built around it.

They don’t meow, but they cost money.

Besides Axie Infinity, a notable example of building value on top of the breeding feature is Fluf, which ironically features rabbits. Also, Fewmans by Molly Wintermute, the creator of Hegic and a few other DeFi applications, combined the Loot concept and breeding.

By this point, you should understand that NFT value doesn’t come from what’s on JPEGs. Their narratives, creators, communities, and interactive features weigh much more. And, as an aspiring NFT investor, that’s what you should look for.

Did you like the content of this Email? Follow us on Twitter.

Our research team at SIMETRI is also constantly sharing useful information. So feel free to follow me and my colleagues: Anton Tarasov, Sergey Yakovenko, and Alexander Mardar.