Focus on fundamentals instead of prices

Many of us regret not knowing about Bitcoin or not taking it seriously back in its early days. Even $1000 invested in it at that time would produce gigantic profits today.

However, even if you were smart enough and bought bitcoin in 2009, would you HODL until the present time? For the vast majority of people, the answer is probably not.

There are numerous stories, on the internet, about how people sold their BTC for pennies, bought a pizza for it, or threw out a hard drive with bitcoins in the trash.

The problem of many crypto investors is that they usually solely focus on price, ignoring the fundamentals. When the price is small, no one cares about the asset, but everyone suddenly starts paying attention when the price goes up.

I’ve seen that happening during the last bear market. Many investors, who were in the market during 2016-2017, sold everything and left crypto in 2018-2019.

And I understand them. It’s hard for a person with minimum understanding of the crypto market to HODL when your investment decreases in value by 90%.

At that time, I was already working full-time in crypto and had a much different perspective on the market. Yes, price drops were also painful for me. However, I understood that the market is growing fundamentally: more talented people joining the ecosystem, more products developing on a daily basis, and more capital flowing into the crypto projects.

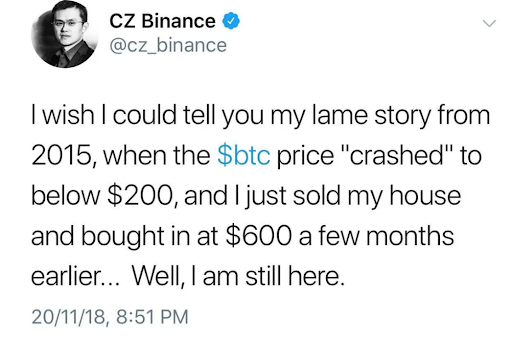

So, for me, it was absolutely crystal clear that crypto is not going away anytime soon, and the new ATH is just a matter of time. I was not alone in this belief.

So in SIMETRI, we also focus on fundamentals. Although the market conditions might not be favorable from time to time, affecting the short-term returns, our long-term returns are overwhelmingly positive.

I think you get my point, so the next time you see your portfolio dropping in value, ask yourself has anything changed for it on a fundamental level.

SIMETRI Portfolio – Patience is Always Rewarded

The first thing a crypto enthusiast probably does in the morning is checking Coingecko.

I am sure it irks you when you see over 50% gains in a 7-day period in numerous coins under the top 100 while your SIMETRI portfolio sits comparatively idle. Why didn’t I choose top Layer-1s, go for a DeFi blue-chips, or follow institutional indices like Bitwise’s 10 Crypto Index Fund?

That’s because our picks might look “smol” now, but in our opinion, they have not only robust technicals but also a strong community and vision for the future. We truly believe in their long-term potential and think that they are likely to stand through time and earn handsome rewards.

Looking at our last six picks, Terra, Karura, and Sushi are doing well as more users join the DeFi space on the other chains. The other three are in the green too, but their performance is still below par compared to the rest of the market.