War Profiteering

In 1961, president Eisenhower warned about the threat of the so-called military-industrial complex to the wellbeing of American citizens. In short, potentially unnecessary military spending was beneficial for producers of guns and equipment but took away money that could’ve been spent on public goods.

The Military-industrial complex is an example of how various parties of some ecosystem do all they can to pursue their agendas. They don’t have any sympathy for others, which makes an average Joe the least protected. The same is true about crypto.

Although the crypto space is still nascent and small compared to web 2.0, it already has a substantial number of parties that influence cryptocurrencies and startups. They only do what’s best for them, essentially forming a crypto-industrial complex.

For some, it’s merely about extracting quick and large profits no matter how. Pump and dump and Ponzi schemes, scams and hacks, or rug pulls—anything works as long as it’s quick to bootstrap. These people don’t care about the aftermath of their actions.

Carlos Matos, the leader of the infamous crypto Ponzi scheme Bitconnect. These days, we have a less charismatic TechLead and his MM coin.

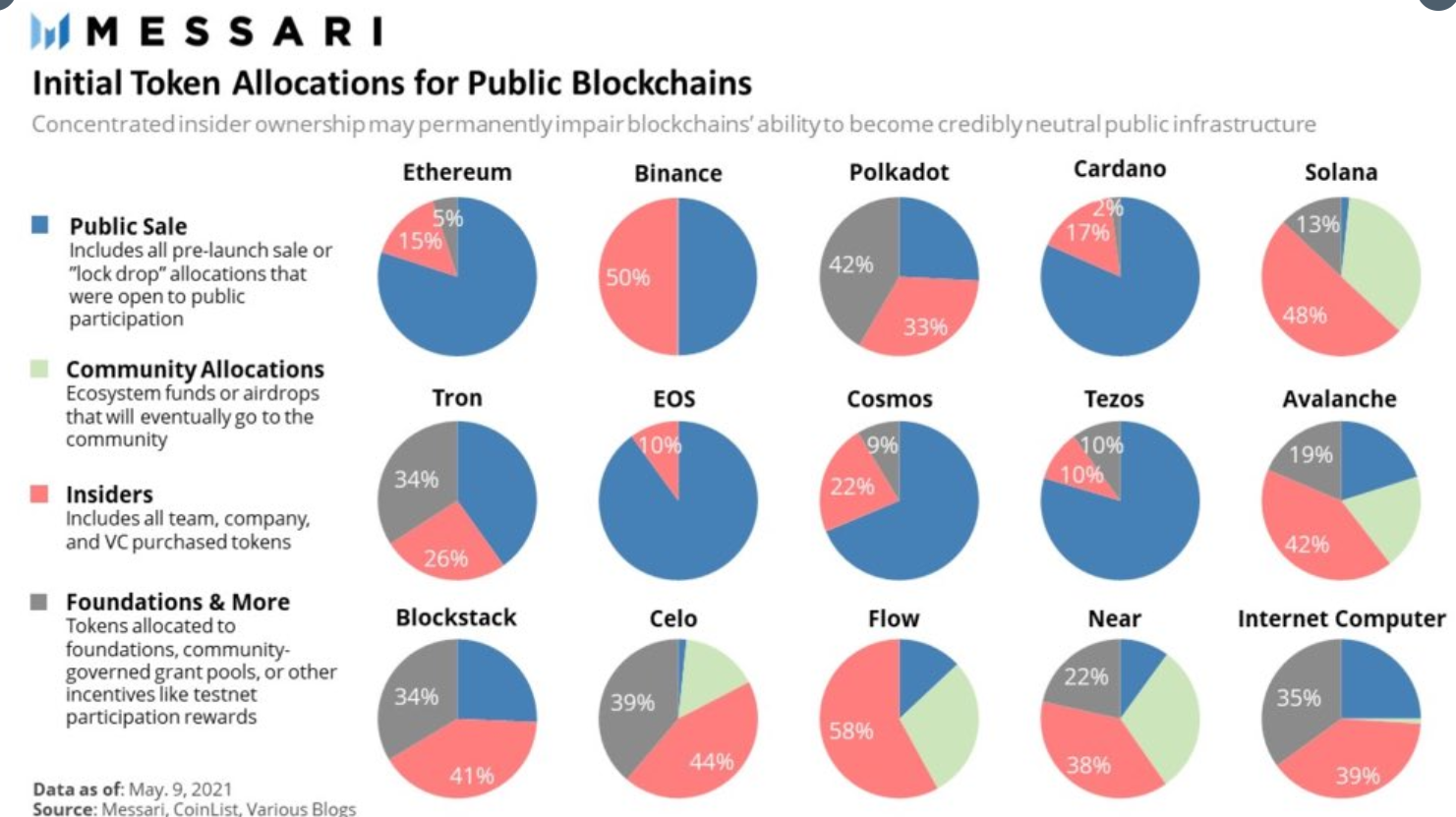

For others, it’s about replicating the Silicon Valley VC world on the blockchain. Whitepapers, tokenomics, investors, influencers—all this forms a crypto startup ocean, where whales and sharks win, and shrimp like you and me get the leftovers.

Take a look at Solana.

You also encounter purists who endlessly build and discuss the tech and do not care about token prices. Their ideas and products may have little use, but the technological aspect is so deep that it attracts people who form cult-like communities.

“Greetings from warm sunny Colorado.”

Then, you have outsiders like governments and people like Peter Schiff. It’s them who coin memes like “Bitcoin is rat poison squared” and “shadowy super coders.”

This tweet didn’t age well.

Finally, it’s us, simple folks who are trying to survive in this madness and hopefully retire on our portfolios. Every day we are directly and indirectly influenced by the market movers I mentioned above.

While pursuing their goals, the participants of the crypto space clash and create wars. Some of these wars take the form of overt confrontation; others are more subtle and often unseen by the majority until the winners and losers are known.

One of my favorite crypto Twitter influencers, DegenSpartan, has a perfect tweet about the best course of action amid crypto wars:

Unlike Pete’s tweet, this one aged well.

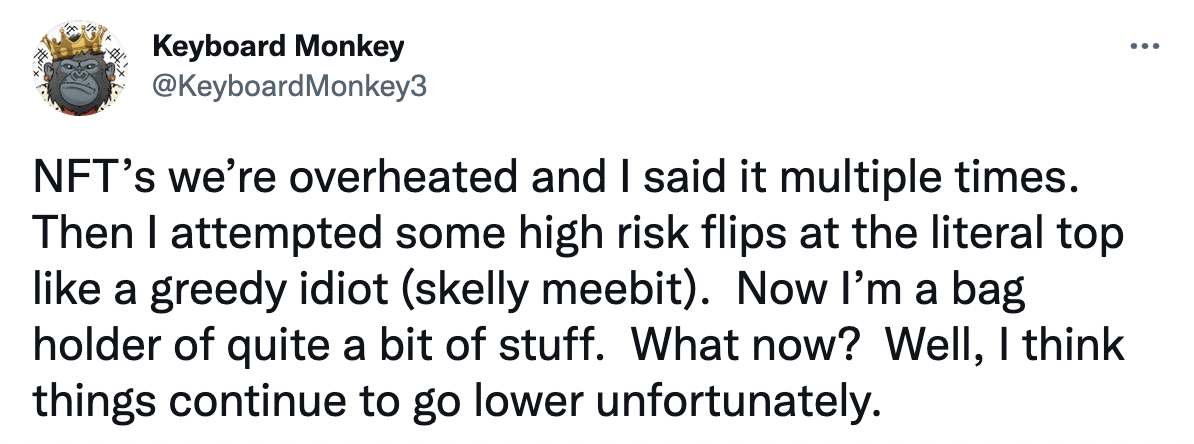

When investing, your goal is to make money and avoid risky situations. When somebody pushes a “JPEGs is the new paradigm” narrative, you don’t need to agree or disagree with them. Better identify that what happens in the NFT space right now is largely a game of musical chairs, and when the music stops, you gotta be in liquid assets.

Flipping JPEGs during the NFT summer could have saved him. But don’t worry, Keyboard Monkey is smart enough and rich enough to win it back.

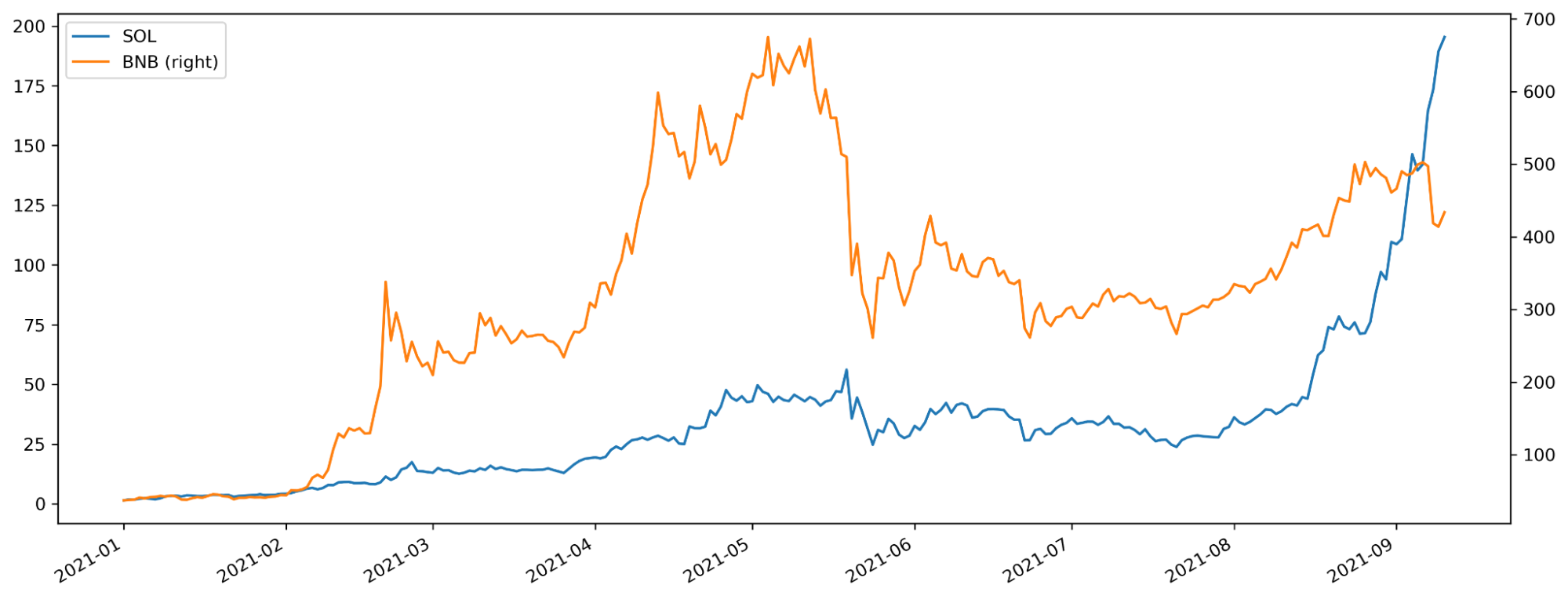

When you see an emerging Ethereum killer with a large exchange attached to it, it may make sense to have some exposure to it. Even if you think Ethereum is 10x better and will remain the market leader.

SOL and BNB prices. ETH holders in disbelief.

When you see government boomers attacking the crypto space, the best bet might be on decentralization. DEXes and yield aggregators don’t keep customer names , so people will most likely go there to make gains and generate passive income.

You don’t need Coinbase to generate a 4% yield on stables, nor do you need to tell boomers that they are wrong. You can just bet on products like Yearn.

I think you get my point. Participate in the battles you have a high chance of winning, and ignore the propaganda. Act as any other party of the crypto-industrial complex and only do what’s beneficial to you. The rest is someone else’s war.

SIMETRI Portfolio – Waiting for the Right Moment

While four of our latest five Picks are in the green, the gains haven’t been outstanding. Part of the reason is that, in general, altcoins are currently overlooked by the market because of NFTs and Layer-1 fever.

However, the market is cyclical, and I expect the money to flow back in the broader altcoin space when BTC stabilizes on a higher time frame. That will likely be the time to fix some of SIMETRI Portfolio positions. Let’s get down to numbers.