Get In Front Of The Line On Ethereum

The NFT wars are here. OpenSea has become the hottest battle arena for crypto warriors this fall as its trading volume surpassed $3 billion in August.

Every day, multiple platforms are launching limited edition jpegs as people rush to mint them. With new combatants flooding into the space, the fight to mint exclusive NFTs keeps getting bloodier.

Since Ethereum can only process 15 transactions per second, it can only accommodate about 900 buyers each minute. Since thousands are waiting in line, everyone is feverishly trying to outbid each other.

I’m a math person, so I put together a few simple equations to understand things:

Savings = Income – Taxes – Spending

Similarly…

NFT Profit = Sale Price + Gas Fees – Purchase Price

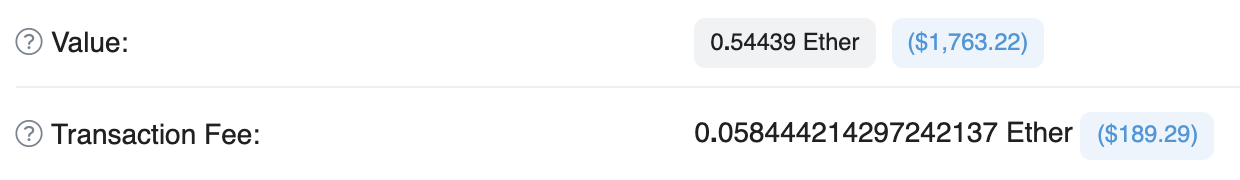

When the adrenaline of rushing into battle to mint an NFT is over, when the dust has settled people can lose a considerable amount in gas fees.

One of the recent sales of Alcabones NFT. The fee is over 4.5-times more than the price of the items. Pretty ridiculous.

To maximize profit, you must keep the total cost of buying an NFT as low as possible. Today, I will share a solution that improves your odds of winning gas wars without spending a fortune in the process.

But before I move on, let me remind you that this newsletter is presented to you by the SIMETRI team. Follow us on Twitter for the latest news and updates.

Every month we search for the best crypto projects with the highest potential to capture growth. And it has been paying off.

Our portfolio has been crushing the market. As of September 1, our portfolio of 31 buy recommendations is up 3,826%.

That includes winners and losers. By using SIMETRI, you can get the insights you need to construct a Bitcoin-beating portfolio.

I believe you’ll enjoy being with us. However, we have limited capacity to ensure that our picks remain profitable for all members.

We only have 34 seats still open for SIMETRI in September, so the best time to subscribe before announcing the next pick may be now. As a final nudge, I give you a 15% discount as a loyal Alphaverse reader.

It’s completely risk-free. If you find that SIMETRI isn’t right for you during the first 30 days of your membership, we’ll give you a full refund.

Now, onto the efficient minting with Eden…

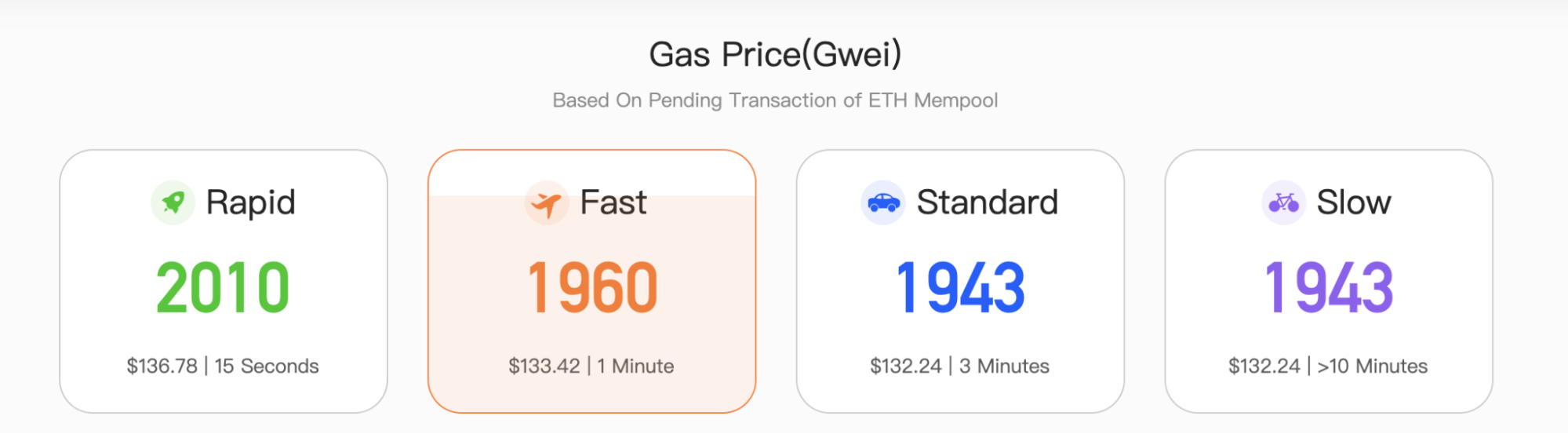

The NFT hype cycle creates excessive demand for “rare collectibles.” However, with limited seats in each block, gas fees tend to reach unreasonable levels.

The mania has burdened the Ethereum network. Currently, a simple swap transaction on decentralized exchange SushiSwap costs $95-$140. Things get worse while minting an NFT competing against tens of thousands of other apes.

Gas prices can surge to 10-20 times the norm during a hot NFT sale. Would you rather buy an NFT or a luxury car with your gas fees?

But there is an escape from the arena. A few people can still pay low fees if they have direct relationships with miners. Some platforms offer direct communication to miners to bypass paying gas fees. However, when it comes to token sales, most buyers have to go the traditional route and overpay.

Fortunately, there’s a way to directly connect to some miners via a project called Eden Network.

Eden is a private club of miners composed of mining pools like Sparkpool, F2Pool, and Hiveon. These miners obey Eden Network rules, prioritizing transactions of EDEN token holders when ordering the transactions. In return, the block producers earn EDEN rewards.

Users pay a one-time membership fee for VIP seats on the Ethereum network by staking 100 EDEN tokens (currently $700). Under current circumstances, this amount sounds acceptable for active apes. Eden protects traders from Miner Extractable Value (MEV) attacks and provides an edge during gas wars in situations like NFT sales.

Imagine an NFT sale starts, and the creators unlock the minting contract. There are thousands of other people like you waiting to mint their precious ERC-721 token. Consequently, people try to outbid each other with high gas fees before the sale ends—sometimes spending tens of thousands in gas for a single transaction. What a rush!

In this scenario, Eden stakeholders have a higher probability of obtaining the NFT with a lower gas price. The key is that if you get into the Eden block, your transactions will be processed before non-EDEN wallets, even if your gas price is lower than theirs.

As I explained in my article about Ethereum’s latest upgrade EIP-1559, the network can now accommodate more transactions for short periods of time. Therefore, it can take a few moments before the network’s absolute minimum gas price increases to an exorbitant level.

With EDEN staked, you can take advantage of this small window of opportunity and send a purchasing transaction before the gas fee jumps. Even if others already start to send expensive transactions, you will still get ahead because Eden miners will prioritize your transaction.

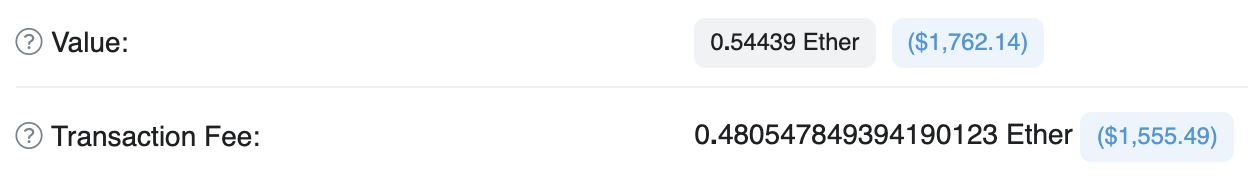

Take a look at the two transactions below. Despite being in the same Sparkpool block, these two ON1 minting transactions paid vastly different fees.

These 0N1 buying transactions were in the same block.

Currently, the Eden project has over 55% of Ethereum’s total hashrate. Thus, there is a strong probability that an Eden block producer mines a block during your target NFT sale.

Moreover, even if you fail to get in before the opportunity vanishes, the cancellation cost will be only around $10-20 because you won’t spend money on a computationally expensive minting process. That makes risk-reward with Eden pretty sweet.

The process of joining the Eden network involves three simple steps.

- First, purchase EDEN on SushiSwap or a centralized exchange like FTX (for non-US users).

- Then, stake the tokens (a minimum of 100 EDEN) on the smart contract here.

With Eden, you’ll have another weapon in your armory in the battle for hyper-scarce NFTs.

When it comes to NFT purchasing strategies, there is no Excalibur to beat the competition. Still, with things like Etherscan mint and Eden, SIMETRI members have a dagger up their sleeve, giving them a sharp edge over the rest of the crowd.

If you liked this newsletter and would like to learn how to make profitable altcoin investments, then check out our top-notch research.

You can get trading signals, reports, and market commentary from our team in an easy-to-digest package. You will become part of a community of like-minded people looking to make smart crypto investments with high upside potential by joining as a member.

Don’t take it from me; we have dozens of satisfied subscribers who love their SIMETRI memberships.

We only have 34 SIMETRI seats for September. If you’ve been waiting for the right time to subscribe, it’s now, especially if you consider a 15% discount I’m giving to loyal Alphaverse readers.

If it’s not right for you, contact me within 30 days, and I’ll make sure you get a full refund.

Now is your chance to learn how to make profitable altcoin investments.

If you’re interested in more insights like this, follow us on Twitter for free reports and tips from the team.

Disclosure: The author of this newsletter holds ETH. Read our trading policy to see how SIMETRI protects its members against insider trading.