Feel the Burn.

The stock market hits record highs, BTC stays above $40,000, NFTs going parabolic—are we positioned for a new ATH?

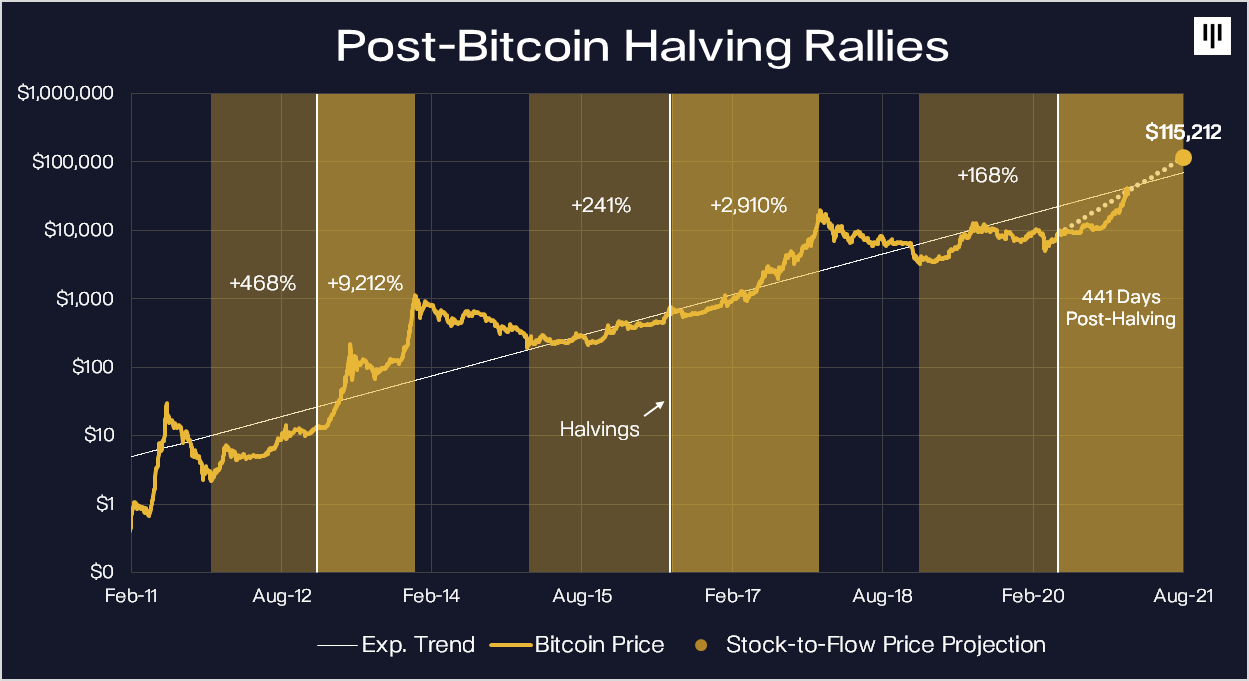

One of the most bullish events this week was Ethereum’s long-awaited EIP-1559 proposal finally coming to life. If you have been living under a rock for the past few months, EIP-1559 is like the Bitcoin halving on steroids.

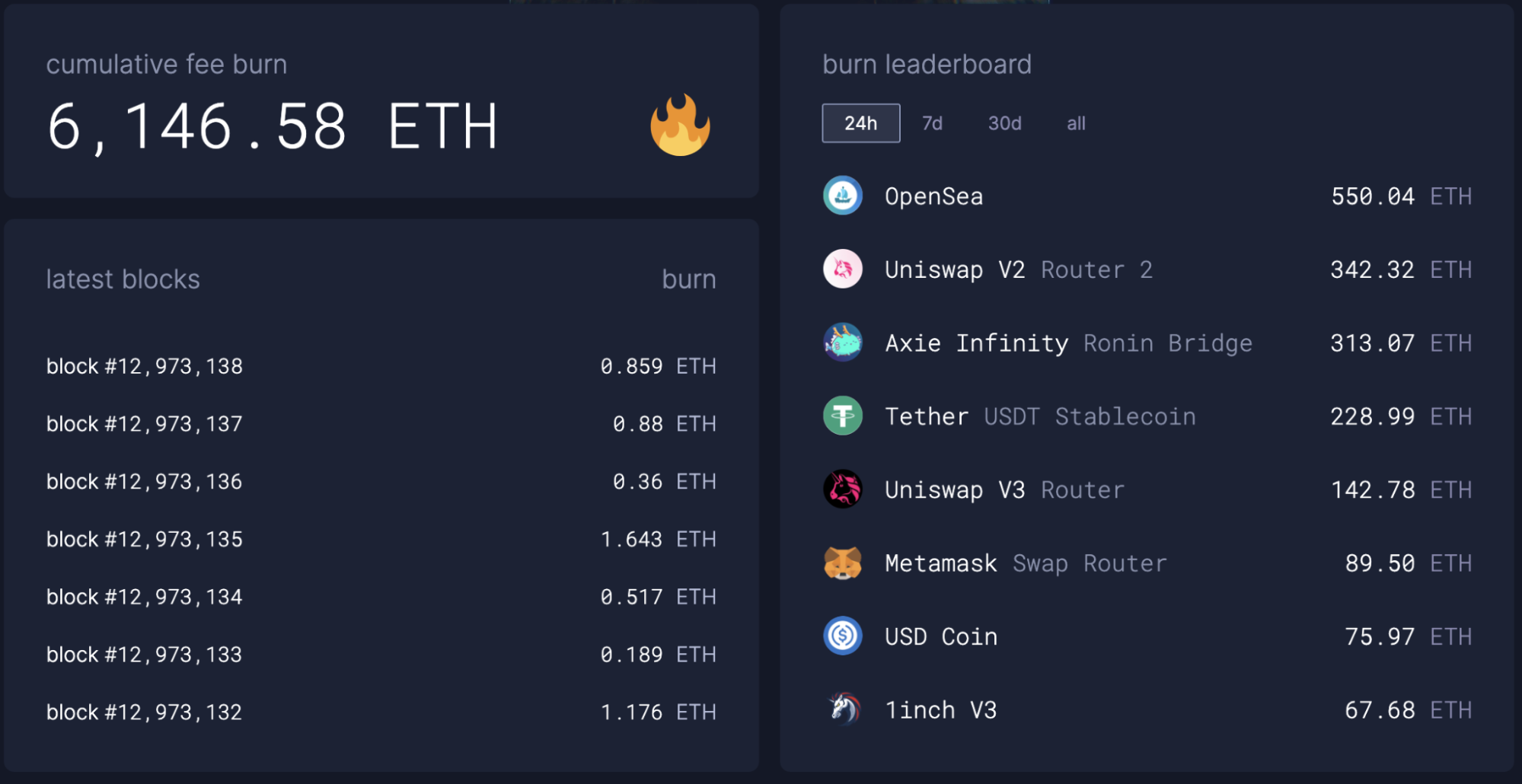

Someone left the stove on, and over 6,000 ETH was cooked in just two days.

Contrary to some expectations, this event wasn’t of “sell the news” type. I won’t lie; this made me even more bullish on Ethereum’s future and instilled optimism about the market in general.

If this Ethereum’s “halving” will resemble Bitcoin’s, we’re set for a surge in ETH in the following months. The most recent Bitcoin halving was in May 2020, but the BTC price started rallying closer to October 2020. That’s a more than three-month lag.

Source: Pantera Capital.

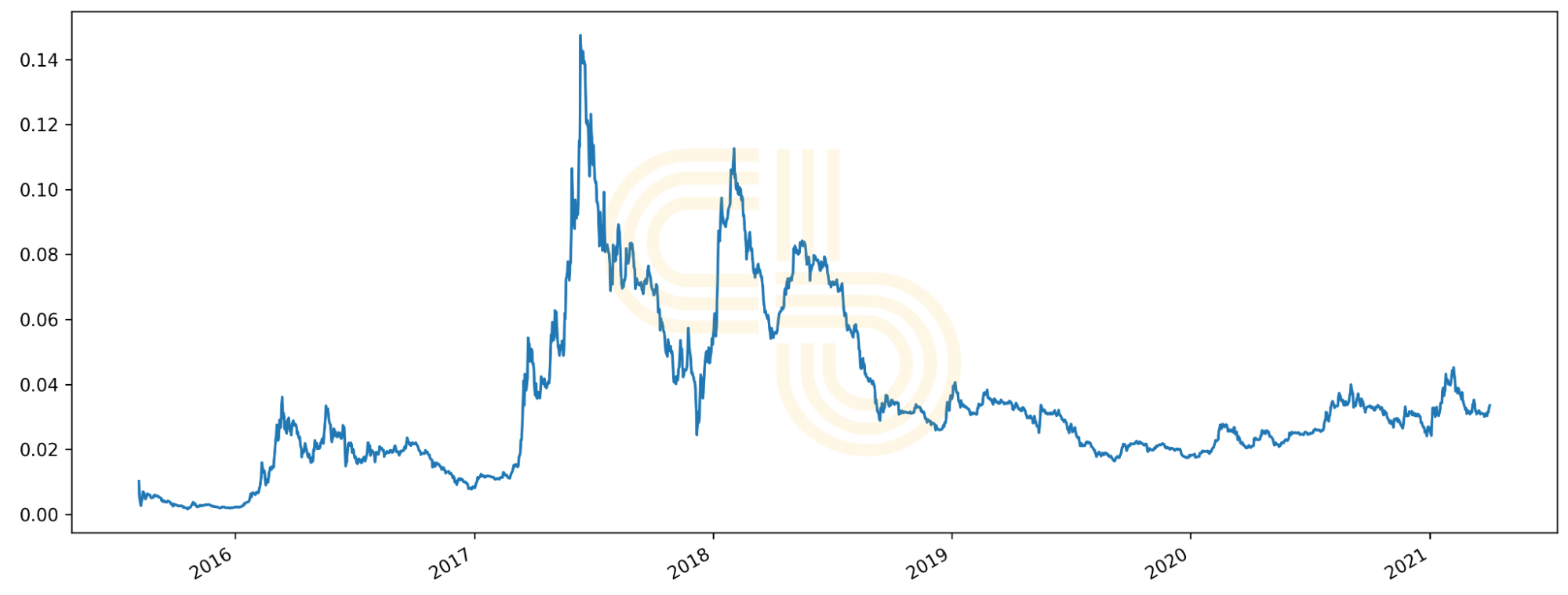

Add the upcoming transition to Proof-of-Stake, and you get a strong bullish thesis for Ethereum for the rest of 2021. This gives me a vibe of early 2018, just after the BTC crash. Here’s a chart I shared in one of the Digests.

ETH/BTC price. Source: CoinGecko.

If the market goes out of the sideways channel and Ethereum leads the run, we may see a replay of the chart above. I remember Three Arrows Capital said they expect 1 ETH to cost $25,000, so I’m hoping to see it there someday.

Still, I’m waiting for the market to get out of its “crab” movement first. If it breaks the resistance and builds new support, then I’m joining the bull camp.

SIMETRI Portfolio – Limits of Diversification

Although the market looks positive, it’s not a reason to give up on risk management. We already discussed the limits of diversification and hedging as protective measures from a potential market crash. Now, let’s take a look at what works better than them.

The strategy I’m about to share is called Constant Proportion Portfolio Insurance (CPPI). I have no idea why the financial jargon sounds so intimidating, but I promise the strategy is simple to understand.

When you buy an asset, you should be prepared to lose money. However, you probably aren’t ready to lose a great chunk of your entire portfolio. Say you wouldn’t feel comfortable losing more than 20% of what you invested. That sets the floor at 80%.

So, you have a 20% cushion. A first guesstimate would be to invest 80% in something low-risk like BTC, ETH, or stablecoins, and the rest into riskier mid- or low-caps. However, that would be inefficient.

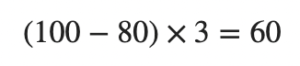

According to CPPI, you should use a multiplier to allocate your risky assets. Say the multiplier is 3, and your initial investment is $100. Then, your allocation into risky assets should be:

That means allocating 60% of your money into risky assets. But, how is that going to work if you want to maintain the 80% safe price floor? Here goes the magic.

The multiplier stays the same, but the cushion decreases. So, if your total portfolio value goes to $90, your cushion goes from 20% to 10%. Multiply it by 3, and you get 30% allocation into risky assets. If the portfolio goes another 5% down to $85, the cushion goes to 5%. 5 times 3 means only 15% allocation into risky assets.

So far, CPPI looks great. You have more exposure to the potential upside while having a contingency plan if the market goes down. However, you aren’t trading daily, right?

What if you recalibrate the portfolio monthly and over one month the portfolio tanks below the floor? That’s called the gap risk. You need to adjust your multiplier according to the maximum potential drawdown over a given period to offset it. We’ll discuss how to do this next week.

Whew, that’s a lot for today. Time to look at SIMETRI Portfolio.