Back to the Bullish Mode?

Over the course of just a few days, the market’s sentiment changed from grim to optimistic. BTC soared to $40,000 level, triggering FOMO across the board.

Some attributed the surge to the rumors of Amazon potentially starting to accept crypto as payments. I think a more reasonable reason is the reduction in maximum leverage on Binance. In my opinion, it’s somehow connected to the BTC/USDT perpetual surge to over $48,000.

Source: DeFi Scam Check.

In any case, bull rejoiced this week, but does it mean we’re on track to new ATH? I’m still not sure.

In one of the previous issues of the Digest, I pointed to the 200-day moving average on Bitcoin. This line has historically been an important support and resistance level. For now, albeit BTC is close to breaking through it, it still hasn’t.

Bitcoin price and 200-day moving average (red). Source: TradingView.

From my point of view, BTC needs to form a support level at the 200-day moving average before moving substantially higher. If you want a more detailed outlook, check what our TA professional, Nathan Batchelor, has to say.

I’m happy that bullishness in BTC positively impacted our recent pick, Perpetual Protocol. It’s 85% in the green, and the dApp hasn’t even launched on Arbitrum yet. Happy days.

To wrap it up, I’m crossing my fingers on BTC breaking through the 200-day moving average and restoring the bullish mode on the market. We suffered enough.

SIMETRI Portfolio – Limits of Diversification

One of the closing questions of this Friday’s Crypto Week In Review was whether it’s a good idea to allocate some capital in riskier assets or it’s better to stick to a safe bet with less upside potential.

Let me derive several questions from this one:

- Is it reasonable to have 100% exposure to PoMs?

- What about 0% exposure to PoMs?

- How reasonable is it to remain in stablecoins for long periods?

If you’ve been reading the latest issues of the Digest, you may want to say that we can allocate some money into stocks, some into BTC, and the rest to PoMs based on the efficient frontier. This will enable us to diversify unrewarded risk away and maximize profit per unit of risk.

Partially, that’s the right answer. But, from our observations, we know that when S&P 500 takes a dive, crypto follows. So, diversification is pretty much useless if the entire market goes down and won’t protect you from the downside.

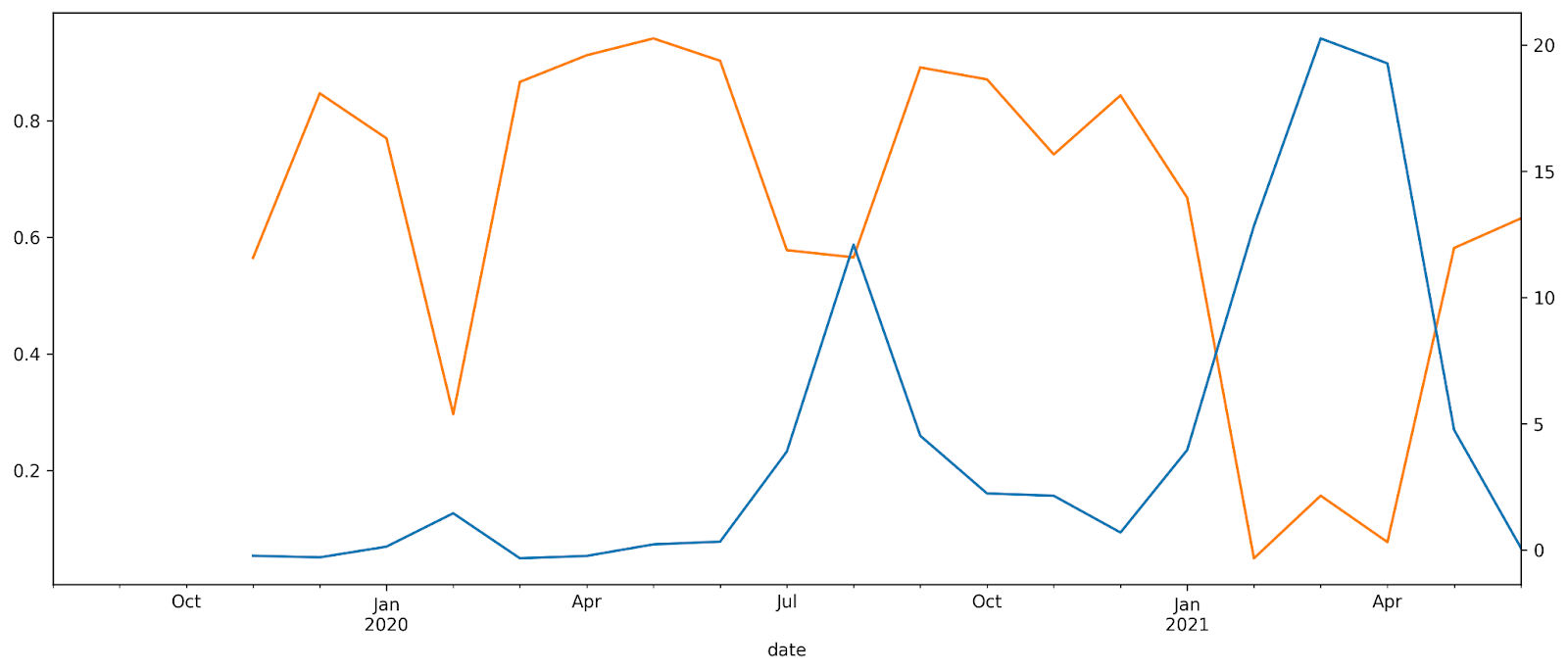

Let’s look at the chart below. The orange line is the rolling 4-month correlation between assets in our fictional portfolio: IVV (S&P 500 ETF), BTC, and PoMs. The blue line is the 4-month moving average of returns of an equally-weighted portfolio composed of these assets.

Take a note that when the returns go down, the correlation jumps up. It’s difficult to see on this chart, but that small blip on the blue line at the beginning of 2020 represents growth before the March flash crash in the stock market. Look how high assets in our portfolio were correlated during that time.

A possible way to prevent losses is to try hedging by exiting into stablecoins/cash when you think the market is about to tank. If you get it right, you won’t suffer losses. However, if you turn out to be wrong, you will lose access to the potential upside.

So, if you can’t effectively protect yourself from the downside by diversification and hedging, what can you do? The answer is insurance.

Imagine you have to drive from New York to New Jersey, and you only have two and a half hours to reach the destination. If you pick constant speed, you will fail. If you drive 20 MPH, you won’t make it time. If you go 120 MPH, you will crash. So, you go 40 MPH when going through turns and 80 MPH when the road is straight.

Portfolio management is similar: you need to adjust allocations according to the environment. The process is called portfolio insurance. When the environment is good and the margin for error is high, you can allocate more to risky assets. Conversely, when the market is shaky, you can reduce your exposure.

Well, that was a lot for today. Next time I’ll show you a technique for ensuring your portfolio. Now, let’s take a look at SIMETRI Portfolio.