NFTs and Gaming: “Rat Poison Squared.”

It’s been a while since I wrote my first take on NFTs. I stepped away from writing on the topic because our chief editor Christian has good coverage in the weekly NFT Briefing, so I felt that my work would be redundant.

However, since blockchain gaming is once again a hot topic, and NFTs are a key part of it, I think it’s a good time to take another look at the metaverse beyond the headlines and shilling.

For me, it’s ironic how I disagree with the U.S. Senator Elizabeth Warren when she compares crypto to drugs while feeling like a boomer when it comes to blockchain gaming. I don’t want to call it “rat poison squared,” like Warren Buffett called Bitcoin, but I do have some concerns to share.

If you’re into crypto, you have probably heard about Axie Infinity. The game features play-to-earn mechanics that, for some, have become a way to earn a living in the Philippines and several other developing countries.

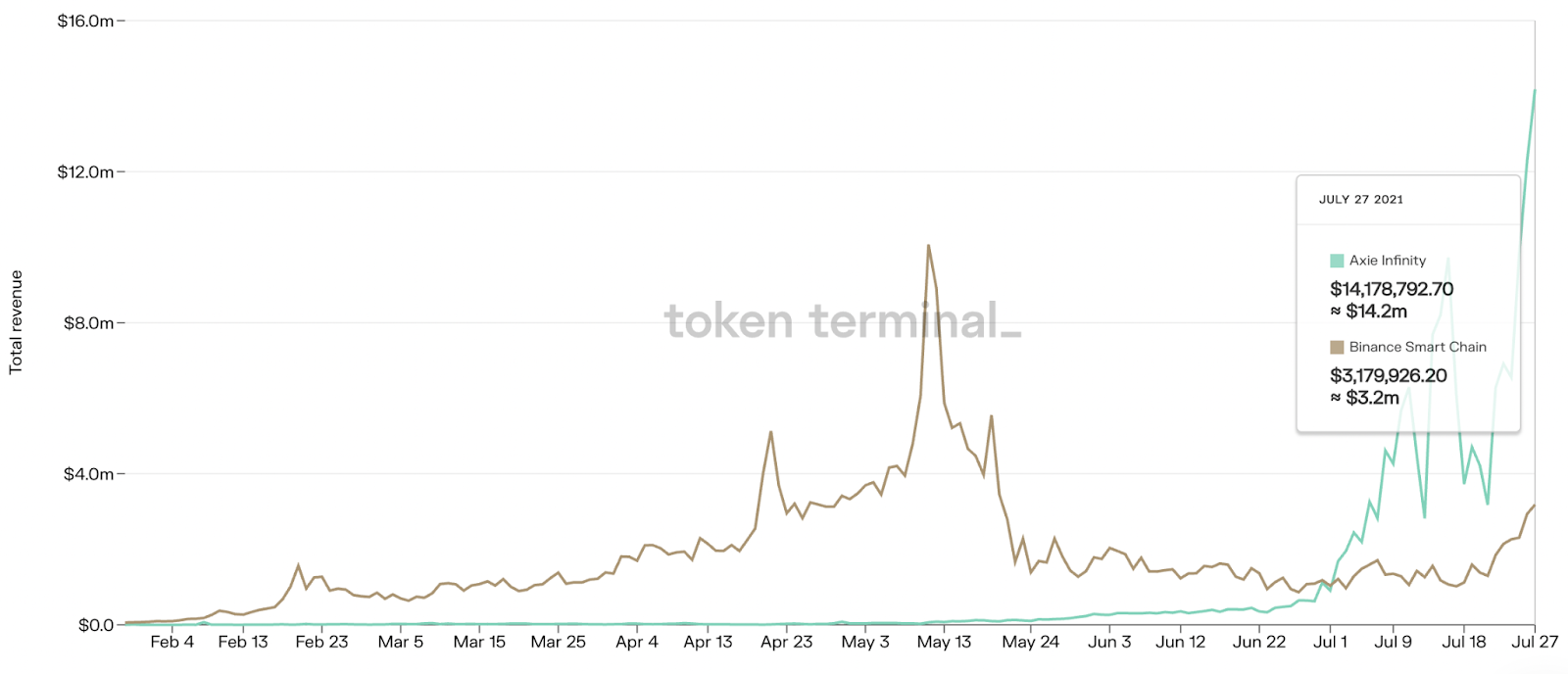

AXS, the project’s token, had a great run recently, going over 10x in about a month. The reason was explosive growth in users and revenue. The numbers look impressive—Axie Infinity outpaces the entire Binance Smart Chain in terms of revenue by a large margin.

Daily revenue of Axie Infinity (green) and Binance Smart Chain (brown). Source: token terminal.

Still, looking at the charts, I can’t help but feel like Warren Buffett, who is a notorious curmudgeon about investing in cutting-edge technology. Similarly, I don’t understand if there’s much substance behind the ongoing hype in NFTs and gaming yet.

Perhaps similar to Buffett, I’m not convinced that the play-to-earn model is sustainable. Who are the people who really benefit from this ‘movement’ towards monetized gaming? I have read many articles and listened to hours of podcasts, but I’m still not convinced.

When tokens like AXS are trending upwards, the usage of the platform grows along with their revenues, but much of that could be attributed to speculation.

From personal experience, the gaming tokens I’ve tried to buy-into have also succumbed to speculative mania. There’s a part of me that feels like speculation, at least the kind that’s rampant in crypto, takes away from the core value proposition of the gaming niche.

Yesterday there was a presale of the Yield Guild project on Sushiswap. Yield Guild’s success is highly correlated with the Axie Infinity trend, at least for the short-to-mid term.

There was a first-come-first-serve type sale without a personal cap. Only 32 people were able to scoop up $12 million worth of YGG tokens, and I was one of them. I only had the stomach to buy $2,000 in tokens, even though I knew the ‘pumpamentals’ were solid.

I’m not trying to brag. What I’m trying to demonstrate is that I couldn’t force myself to invest a large sum of money in something I don’t understand—even if the hype says otherwise. There’s nothing wrong with sentiment-based investing, but I like to invest my money on things I have conviction in; and for me, conviction requires understanding.

Is selling a token on a first-come-first-serve basis without a per-person cap a ‘fair launch’? I won’t judge, but 32 people isn’t a lot for a community that consists of thousands of players. But what really raised eyebrows for me is what followed.

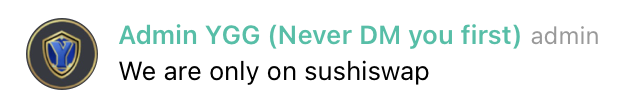

Once I got YGG on my wallet, I went to Sushiswap to see the price. Sushiswap was said to be the only official market at launch.

Source: Yield Guilds official Telegram group.

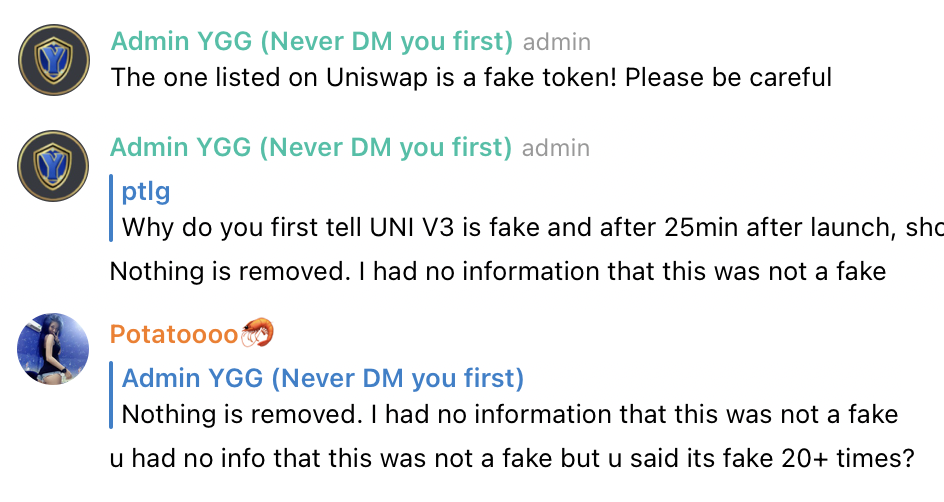

Soon enough, people in the chat started to signal that there was a YGG token on Uniswap. The admin said that it was a fake one, but it turned out to be real. As expected, the community was frustrated by the incompetence and a potentially missed opportunity to trade at better prices.

Was it the admin’s fault, or was it poor internal communication within the team? The good news is that I didn’t find traces of a coordinated buy before everyone realized that the YGG on Uniswap was real.

Highlighted are the USDC amounts used to buy YGG as soon as the liquidity on Uniswap became available. The numbers are very low for whales.

Source: DEX Tools.

Still, some of the people who initially purchased YGG have already sold to the community at multiples. Here’s a wallet, which bought $650,000 worth of YGG tokens (over 5% of the total available YGG) on presale and sold it during the first hours of the token’s release for a nice 3x.

In the sea of the metaverse, small fish get eaten. I’ll show you another example to prove my point.

A few hours after the YGG sale, I participated in the Stoner Cats NFT sale. Stoner Cats is an upcoming cartoon series featuring Vitalik Buterin. If you want more color on this, please read this awesome article by one of our journalists, Nathan VDH, here.

The price for one Stoner Cat was 0.35 ETH (around $800), which is already a hefty price tag. Still, it’s justifiable given that the floor price on Hashmasks are about 1 ETH right now, and Hashmasks don’t have a cartoon series with Vitalik and Hollywood celebrities attached to it.

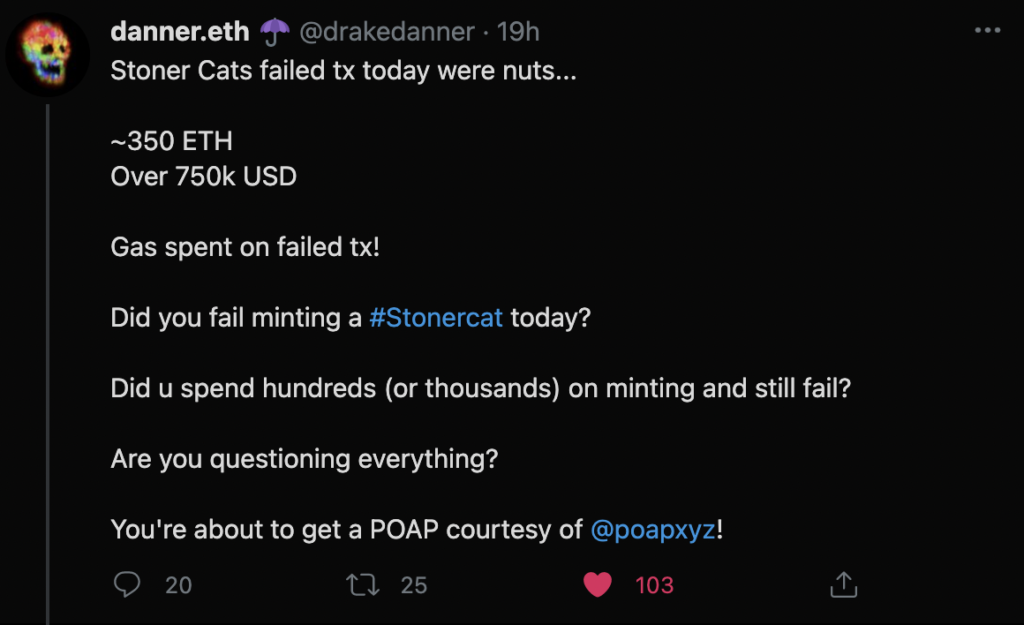

The most interesting thing happened during the sale. The demand for the cats turned out to be so high that gas fees jumped to almost 800 Gwei, something we haven’t seen since Flashbots were introduced a few months ago.

Not only was the gas expensive, but the transactions were computationally intensive and required quite a lot of gas. A transaction for minting three cats cost me $900 and consumed almost 500,000 gas.

It’s a rare occurrence when a transaction consumes more than 300,000 gas. The last time I have seen this kind of gas-guzzling phenomenon was with the Ethereum-based scam project Forsage.

The price floor for Stoner Cats is now around 0.5 ETH, a minimum of 30% profit for buyers. Rare NFTs like Catsington and Ms. Stoner have their floors at more than 7 ETH, which is a good deal for the lucky ones that got them.

However, just to be able to participate in all this, you would have to shell out a thousand dollars on gas alone. Otherwise, your transaction wouldn’t go through, and you would not only miss the sale, but also lose a lot of money. Ironically, the Stoner Cats sale led to heavy losses due to failed transactions. I lost around $750.

All this to say is that NFT and gaming niches remain highly speculative and hardly accessible to the broader community. The rich get richer, and the poor keep breaking their necks to get breadcrumbs from the table. And I’m saying this as a person who got into both sales (and even got a Catsington).

Stoner Cats #4314. That’s one ridiculously overpriced cat.

Still, I don’t think the metaverse is doomed. It’s encouraging to see that Axie Infinity has long-term sustainability in mind, YGG will eventually get to the community via token inflation, and Etherum’s scaling solutions will help make NFT sales more affordable.

Even though I feel like a complete boomer when it comes to NFTs, long-term, I believe in the metaverse. These problems will eventually get solved. Despite my current skepticism, I have a conviction that NFTs will escape from the realm of overpriced curiosity and eventually enable small players to prosper.

If you’re interested in more insights like this, follow us on Twitter for free reports and tips from the team.

Disclosure: The author of this newsletter holds ETH. Read our trading policy to see how SIMETRI protects its members against insider trading.