Gasless Transactions on Ethereum.

Slow and expensive Ethereum is already a meme, and talking about it is like beating a dead horse. Those who didn’t completely migrate to Binance Smart Chain test Polygon and wait for other L2 solutions like Arbitrum and Optimism.

The main issue of using L2s is that most of the DeFi and NFT protocols remain on Ethereum and won’t likely move to other chains anytime soon. As a result, people are stuck with a clunky but vibrant network.

Fortunately, a lot of work is being done to reduce the load on Ethereum and keep gas costs low. One of the recent inventions is sending transactions directly to miners and not paying for gas at all. Let’s talk about it.

If you’ve been in crypto for more than a couple of months, you’ve seen exorbitant gas prices. At times, gas went over 3,000 gwei, which is insane given that before 2020 it was ~1 gwei.

The situation was good for miners but bad for users and dApps. For example, high gas stopped liquidation bots from saving MakerDAO during the infamous flash crash in 2020.

The spikes in gas are often fueled by traders or bots who want to make transactions faster than someone else. It may be necessary to so in things like arbitrage or frontrunning.

One of the people who wrote a paper on such activity back in 2019, founded a project called Flashbots to separate sophisticated traders from the rest of Ethereum users. Flashbots enabled doing fast transactions by sending them directly to miners instead of Ethereum’s mempool.

Other projects embraced this technique to provide an alternative way to swap assets on Ethereum. They are KeeperDAO, ArcherDAO, MistX, and CowSwap.

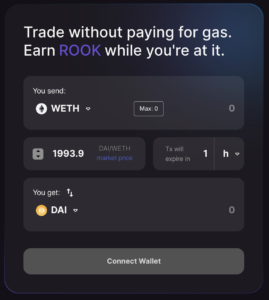

KeeperDAO

KeeperDAO is pretty straightforward. You go to the protocol’s website, select which assets you want to swap, expiration timeframe for a transaction (if it’s not going to be picked up by anyone, it will automatically cancel), price, and swap.

If you have successful transactions on the platform, you will be able to get a nice bonus in the form of the protocol’s token ROOK.

Remember: while transactions are free, you need someone on the other side of the trade. Depending on the transactions’ size and the price, you may get a higher chance that some arbitrageur will pick your order up.

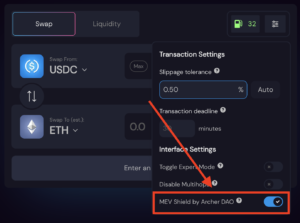

ArcherDAO

The best thing about ArcherDAO is that it’s integrated into Sushiswap. Just go to Sushiswap, open the settings panel and activate the ArcherDAO shield. It’s simple!

The platform will then let you select the tip’s size for a miner, which will determine how fast the transaction will be accepted.

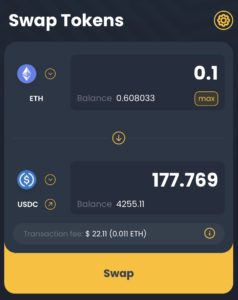

MistX

MistX works similarly to ArcherDAO. You go to the exchange and swap as if it was a Uniswap trade. However, instead of sending a transaction to a mempool, you send it to a miner with a tip.

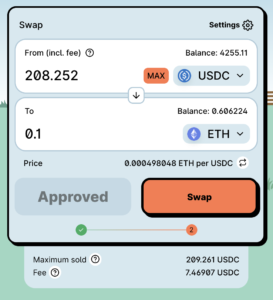

CowSwap

Some people will find CowSwap looks somewhat off-putting. But this exchange has been around for quite a while, and some big brains are working on it.

And there you have it. Gasless exchanges are on the bleeding edge of DeFi, so they aren’t widely used yet. Hence, you may encounter some hiccups along the way.

However, it’s a good alternative for swaps if you don’t want to trade on Uniswap with high slippage with the risk of losing money to a front-running bot.

If you’re interested in more insights like this, follow us on Twitter for free reports and tips from the team.

Disclosure: The author of this newsletter holds ETH. Read our trading policy to see how SIMETRI protects its members against insider trading.