Don’t Force Your Thoughts onto the Market.

As any other analyst, I pay attention to what others say. No one is 100% on top of the market, even analyst teams. It’s just physically impossible. So, listening to others helps to understand more without spending as much time on research.

The primary finding from my reading this week is that you can find solid supportive arguments for both bullish and bearish outlooks. Given that the pieces I read were from people I respect, I once again conclude that there’s little point in predicting where the market is headed while it’s going sideways.

If you do, you should place your bets with a relatively low probability in mind. For example, given the data you rely on, you can have a bullish stance. But, the probability of you being right won’t be 80%, more likely in the ballpark of 60%.

I remember how people in my Twitter feed were declaring the end of the correction when the BTC price was going towards $40,000. The same people were then joking about jobs at McDonald’s on the way to $30,000. I think that illustrates the probabilities quite well.

Like you, I’m crossing my fingers for the bull market to resume. But, I won’t force my thoughts and arguments onto reality to avoid frustration. Will you?

SIMETRI Portfolio – A Free Lunch

Today I’ll share with you something called ‘the only free lunch in finance.’ This concept will help you understand how you can come up with weights for your portfolio.

A quick recap. Over the previous issues of the Digest, I was using three weighted portfolios composed of IVV (S&P 500 ETF), Bitcoin, and PoMs. Here they are:

- Moderate: 50% IVV, 25% BTC, 25% PoM;

- Aggressive: 25% IVV, 25% BTC, 50% PoM;

- Conservative: 80% IVV, 15% BTC, 5% PoM.

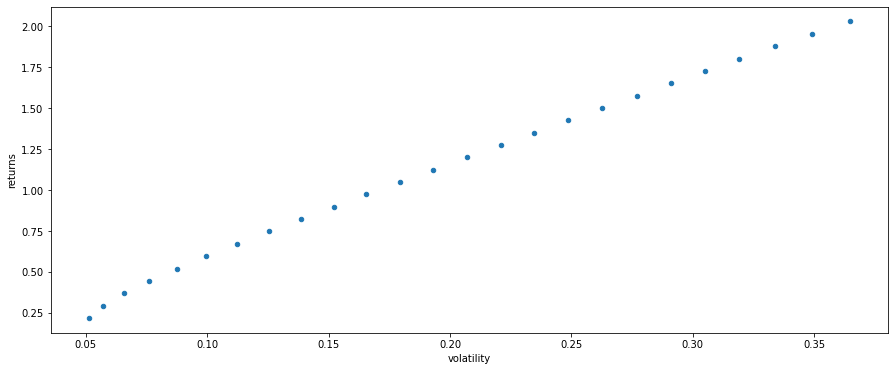

Can we use some methodology to find optimal weights instead of just coming up with them? Yes. And we can also minimize a portfolio’s volatility for different returns!

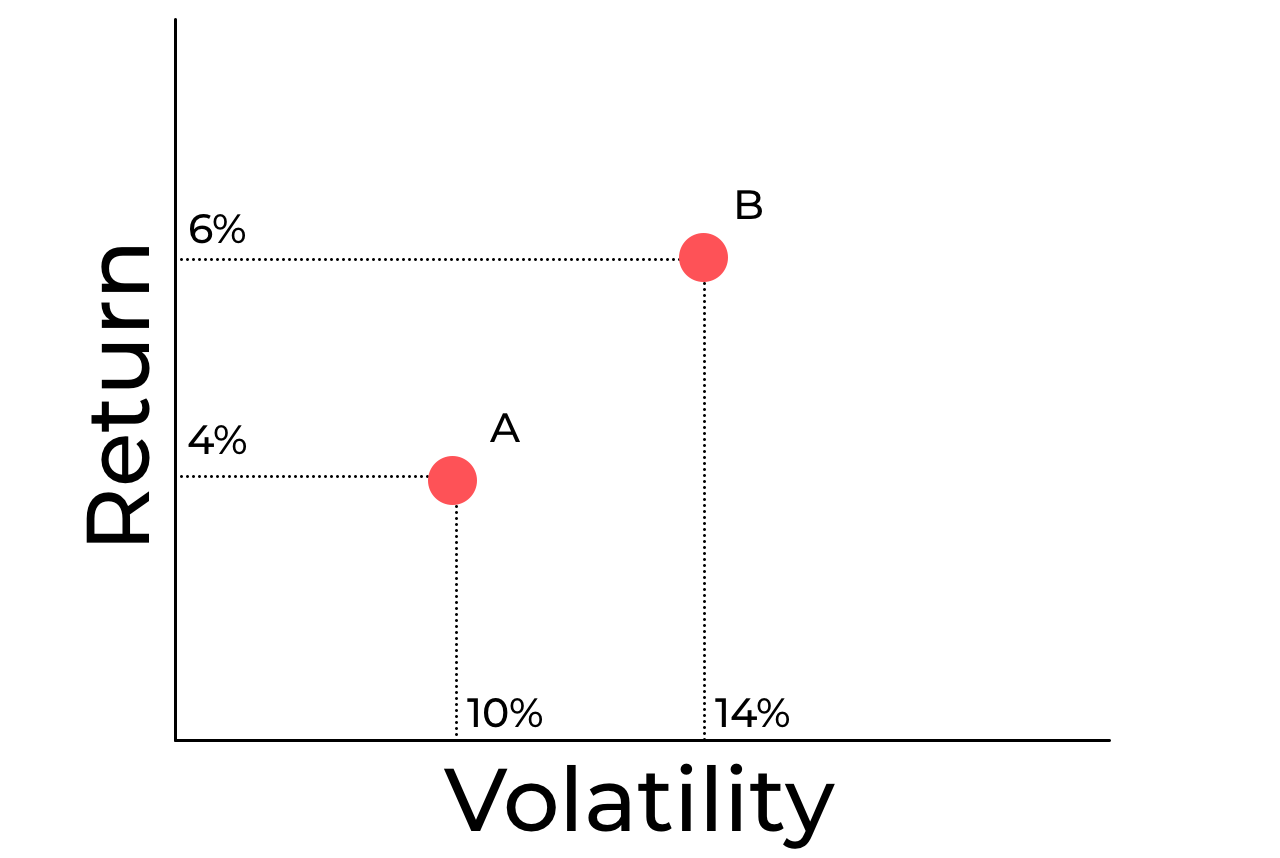

First, let’s look at a simple example. Say we have a portfolio of two assets, A and B. A has 4% return and 10% volatility, while B has 6% return and 14% volatility.

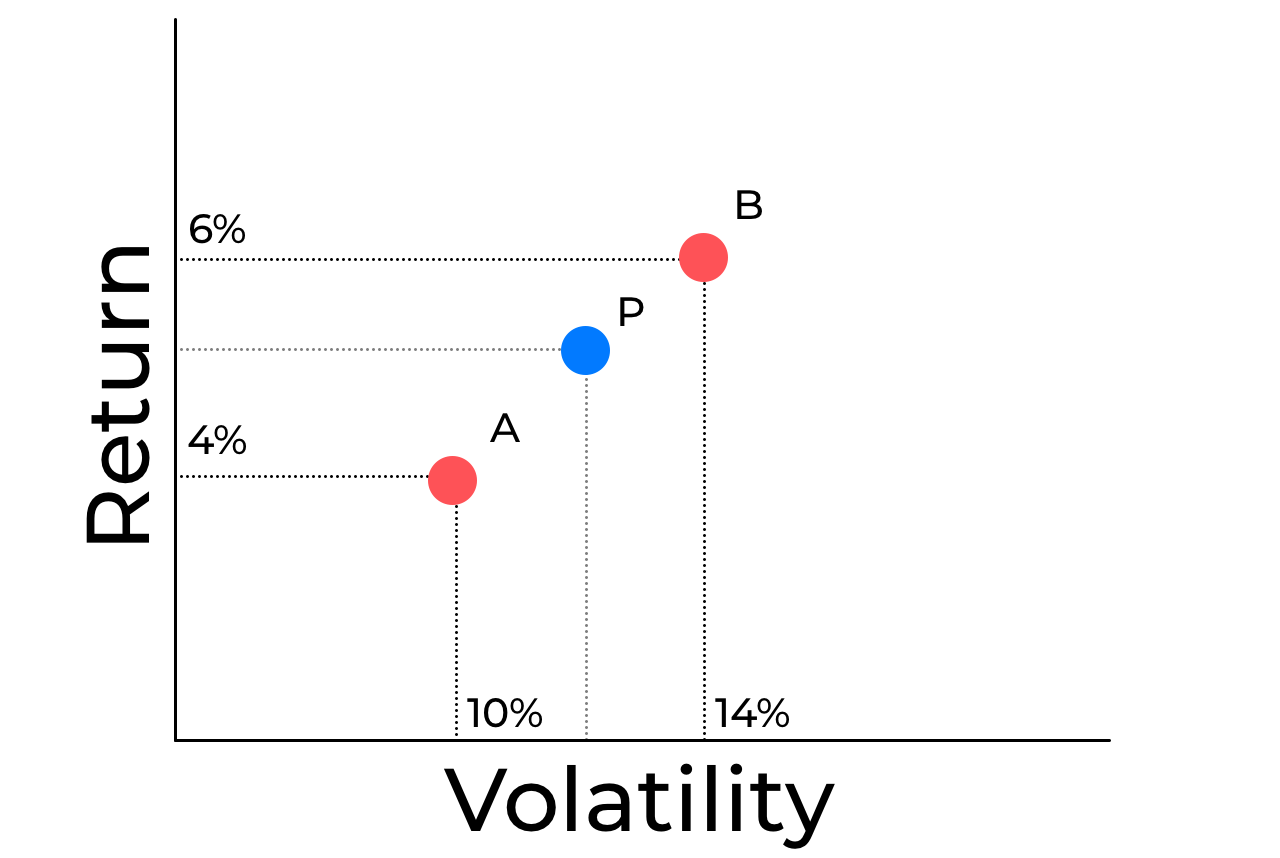

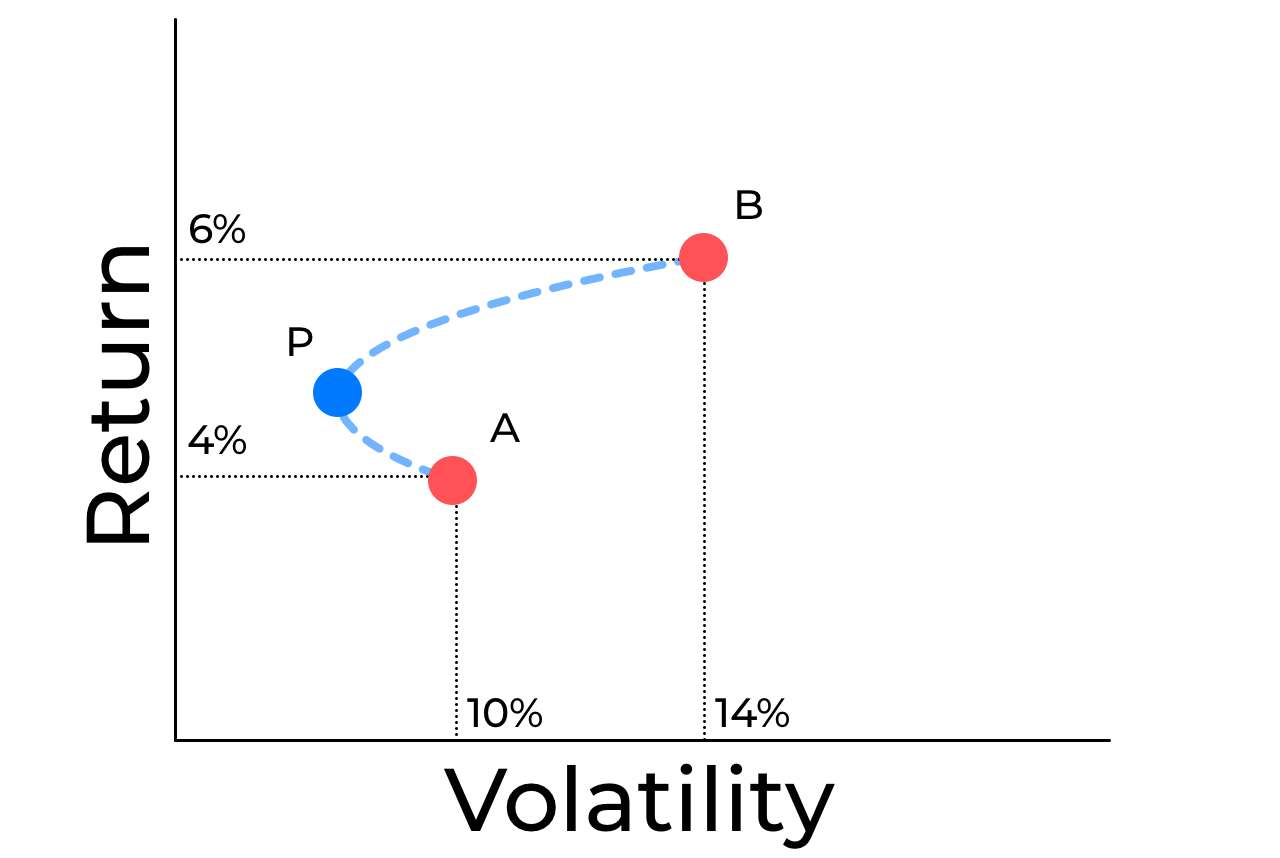

If you construct a portfolio with 50% in A and 50% in B, the first guess is that it will end up somewhere in between A and B. But, that likely won’t be the case.

The returns will be on the same line, but volatility will likely be less. That’s because A and B are likely not perfectly correlated.

The less correlated they are, the lower the volatility of the entire portfolio. In some cases, you can construct a portfolio with volatility lower than that of the lowest volatile asset!

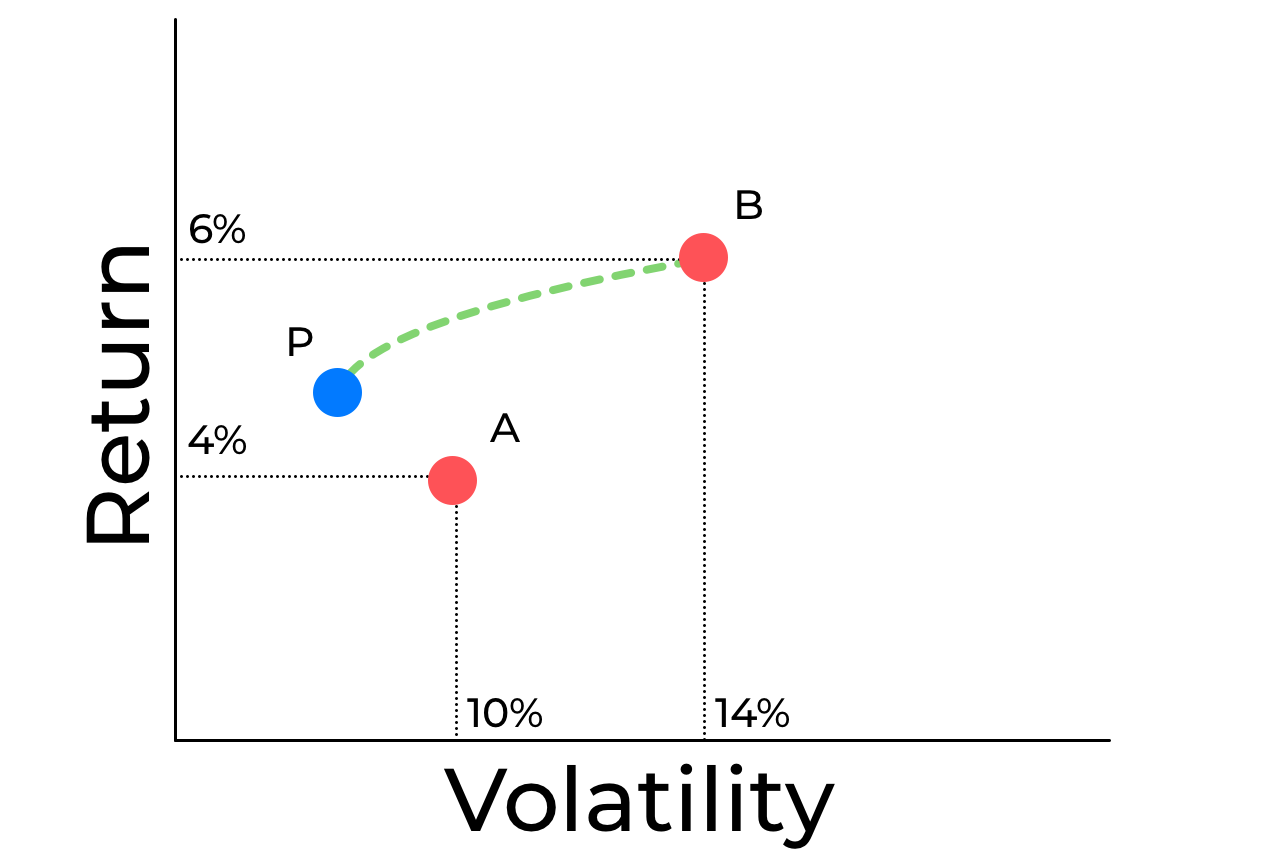

If you add more than two assets to a portfolio, the curve you see becomes an area on this plot. The optimal portfolios lie on the upper bound of that area. This line is called the efficient frontier.

There’s little sense in portfolios that aren’t lying on the efficient frontier because there will always be a portfolio with either better return and the same volatility or lower volatility for the same return.

The efficient frontier is green.

- IVV – 17.7%,

- BTC – 75%,

- PoMs – 126%.

We could get 25% monthly returns with 5.3% volatility. To get such a result, we should have allocated only about 1.7% in PoMs, 0% in BTC, and the rest in IVV.

To get 50% monthly returns with 8.4% volatility, we should have allocated 82.5% in IVV, 14.3% in PoMs, and the rest in BTC.

If we’d want to get 100% monthly returns with 17% volatility, we should have invested 50% in IVV, 39% in PoMs, and 11% in BTC.

Note how the efficient frontier gives us precise weights with respect to given returns and volatility. It provides us with better ideas about portfolio allocations than if we’d come up with them based on intuition.

One limitation of this approach is that it relies on historic data and does not represent future returns. However, it can serve as one of the sources of guidance for your portfolio construction process.

For example, you can see that our efficient frontier shows that historically there was little use in adding a lot of BTC to your portfolio if you invested in PoMs. If you wanted to go more aggressive in crypto, you’d increase the exposure to PoMs, not add BTC.

Next time I will tell you something more about the efficient frontier. Stay tuned.