DeFi for free.

Many of Alphaverse readers liked the issue about LP Royale, a game teaching the basics of liquidity provision. So, I decided to share another platform that lets you learn the DeFi ropes without risking real capital.

Today we’ll talk about InstaDApp, a DeFi aggregator that gathers blue chips like Aave, Compound, and MakerDAO under one convenient user interface. Specifically, we’ll look into the platform’s simulation mode, which is excellent for beginners, much like paper trading.

Platforms like InstaDApp, OctoFi, and Zapper are helpful because they make asset and liquidity position management easier. Without them, you’d have to jump around different websites, trying to keep track of your balances.

On top of that, InstaDApp offers various DeFi strategies, which you can deploy in one click. For example, you can create a leveraged long position, which otherwise would require multiple rounds of borrowing and lending of the same asset.

Jumping between protocols is expensive because of Ethereum’s fees and stressful because you’re always afraid of doing something wrong. Hence, testing things out first is better.

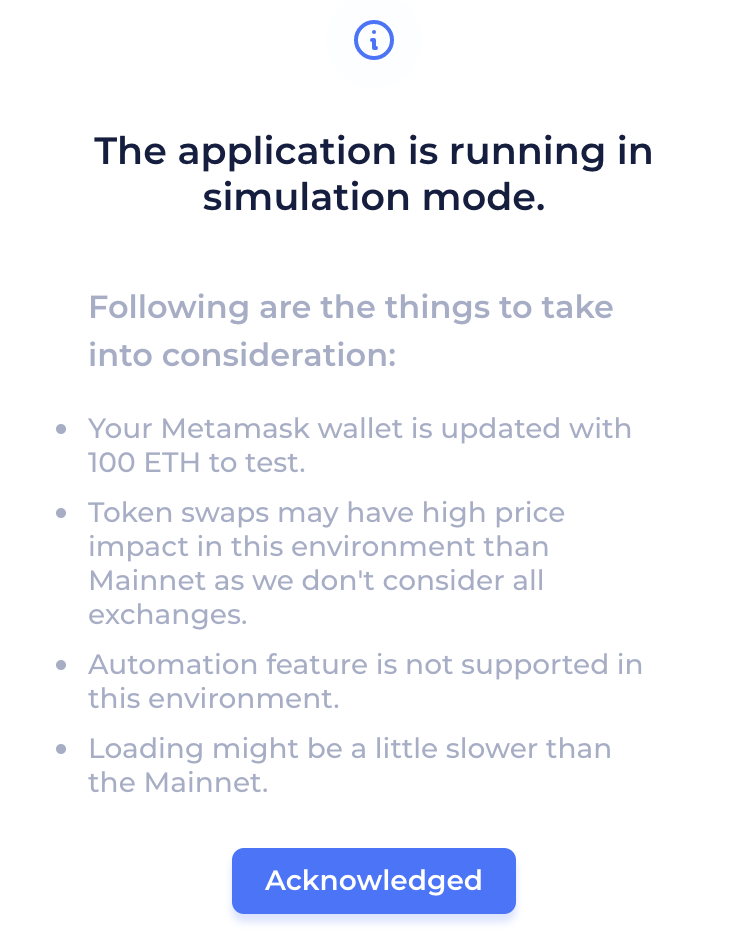

Fortunately, InstaDApp offers ‘simulation mode,’ which creates a local blockchain on your computer and gives you 100 test Ether to try stuff. Simulation mode has some limitations and turns off after 30 minutes, but it’s more than enough to get you going.

To start, make sure you have Metamask installed and head over to InstaDApp. Then, open the dashboard by clicking one of the two buttons on the main page.

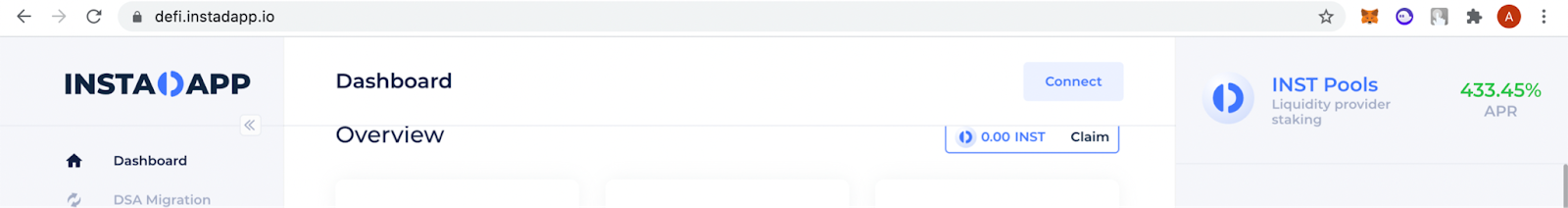

At the top of the dashboard, you will see the ‘Connect’ button. Click on it and connect Metamask to InstaDApp.

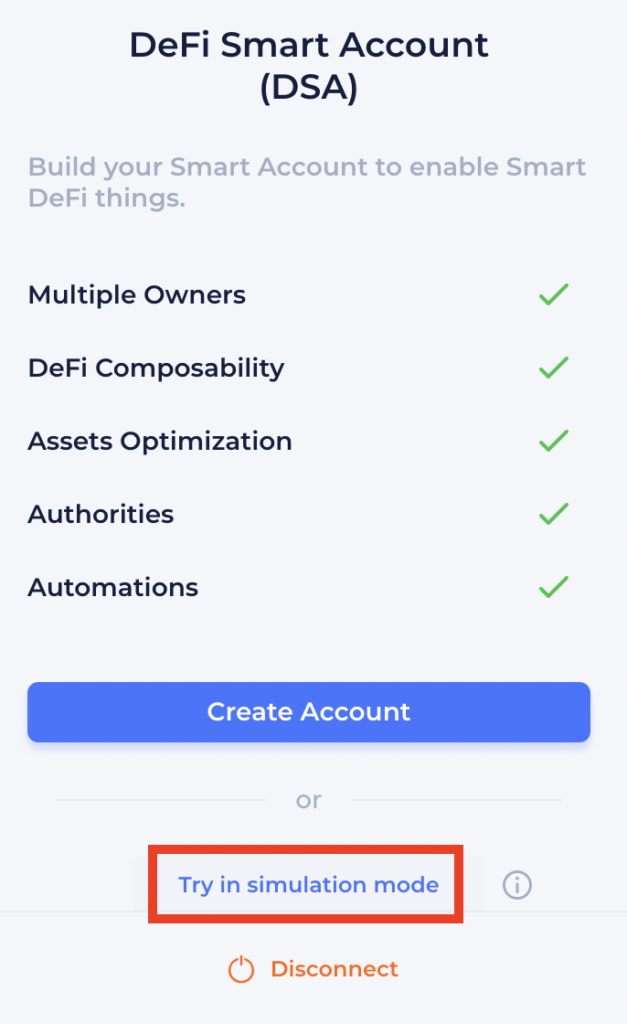

Since you don’t have an account yet, the app will ask you to make one on the right side of the interface. You don’t have to do this for the purpose of this tutorial because it will require a transaction that costs money. We’re interested in the ‘simulation mode.’

When you click on the link, the platform will tell you what will happen during the next 30 minutes.

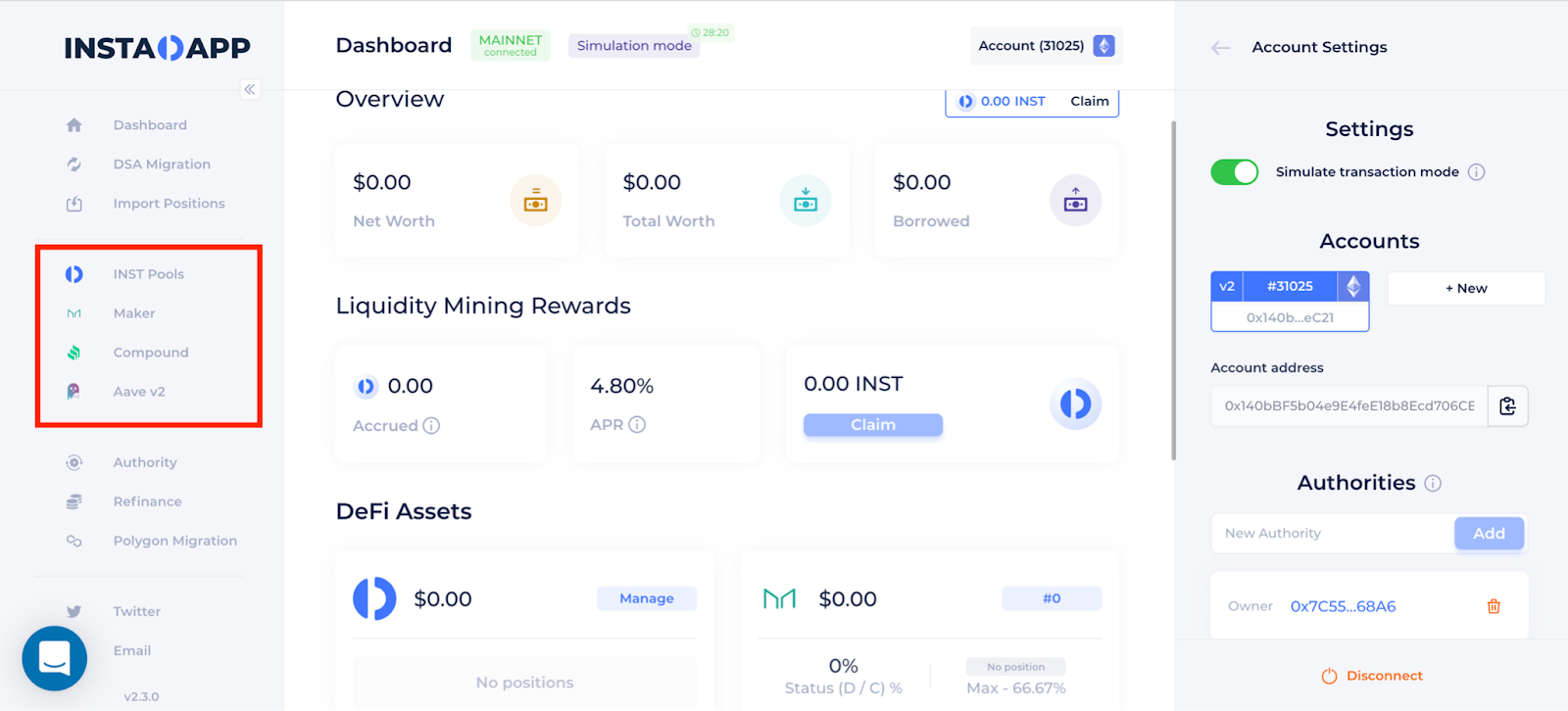

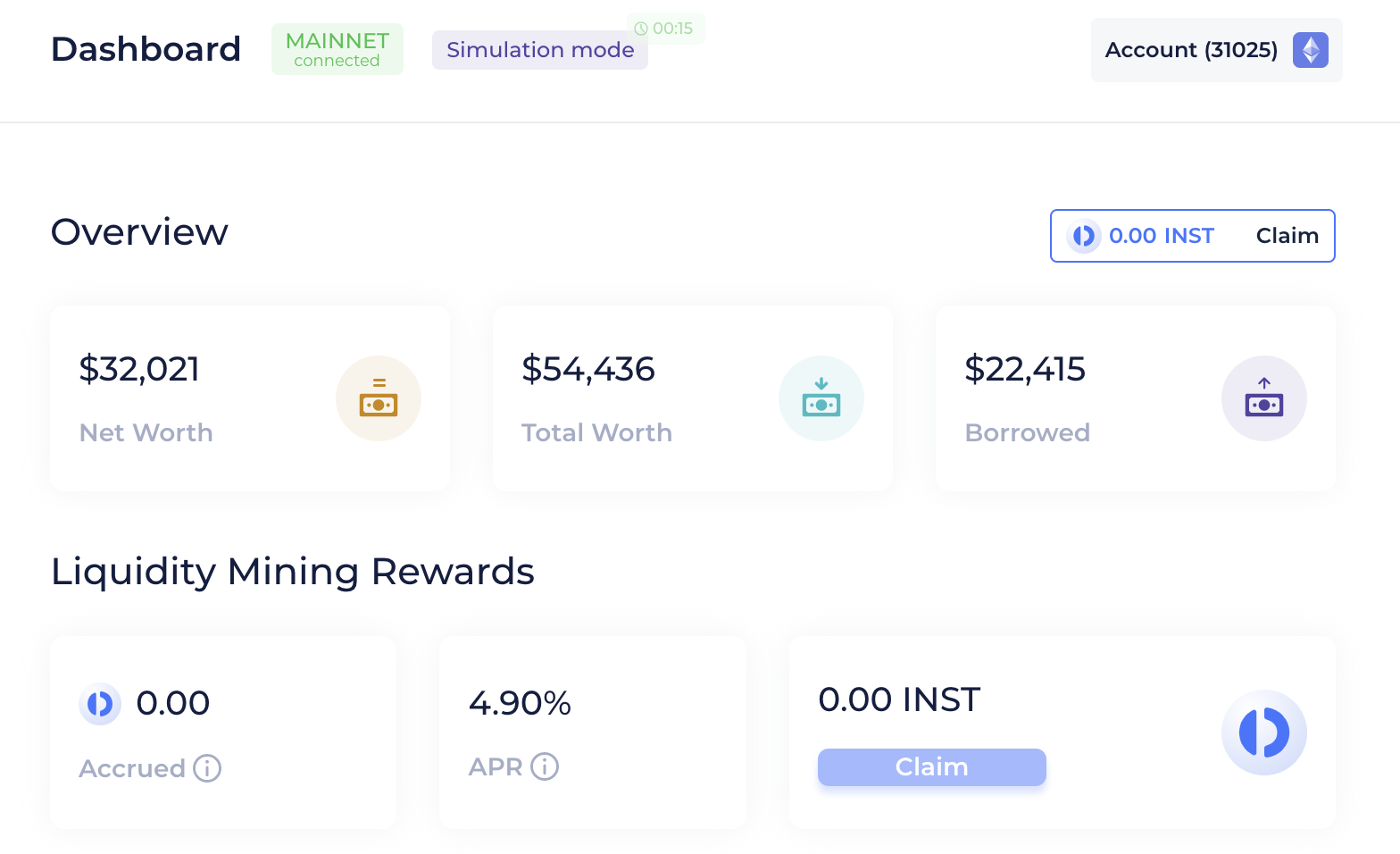

Acknowledge the information, and there you have it: a demo account with 100 ETH on it. Now, you can go to the left side of the screen and select the protocol you want to play with. You can even provide liquidity in pools with the protocol’s native token INST.

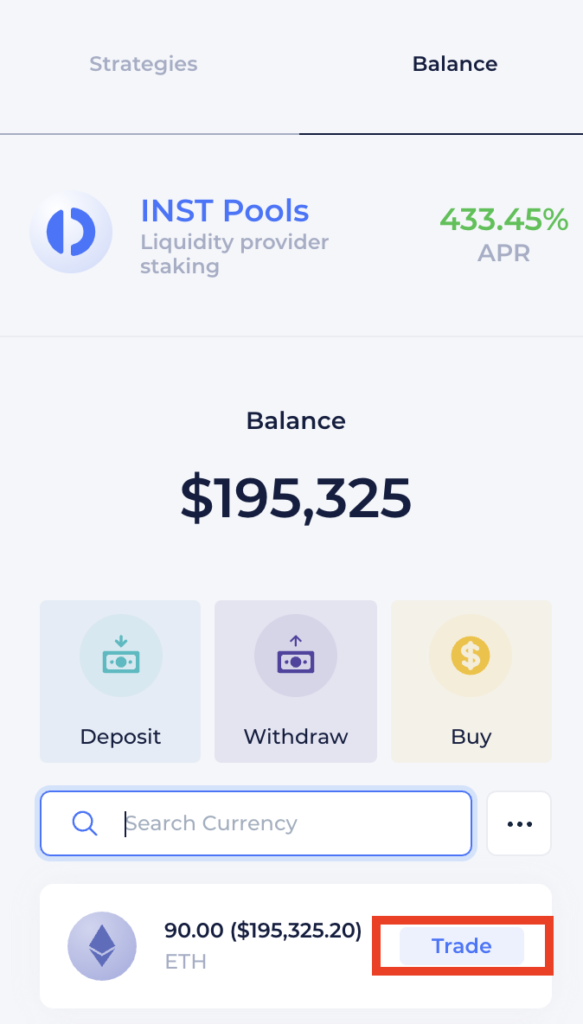

Let’s say you want to create a leveraged long position on YFI and use Aave for that. First, you will need to have YFI. Go to the right side of the screen, and under the ‘Balance’ tab, click on the ‘Trade’ button next to ETH.

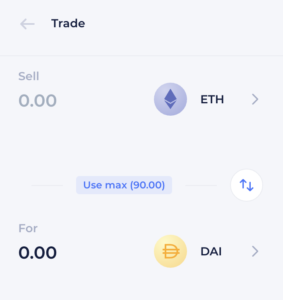

Next to YFI, click on ‘DAI’ and select ‘YFI’ instead. Then, specify the amount of ETH to sell and click on the ‘Trade’ button below.

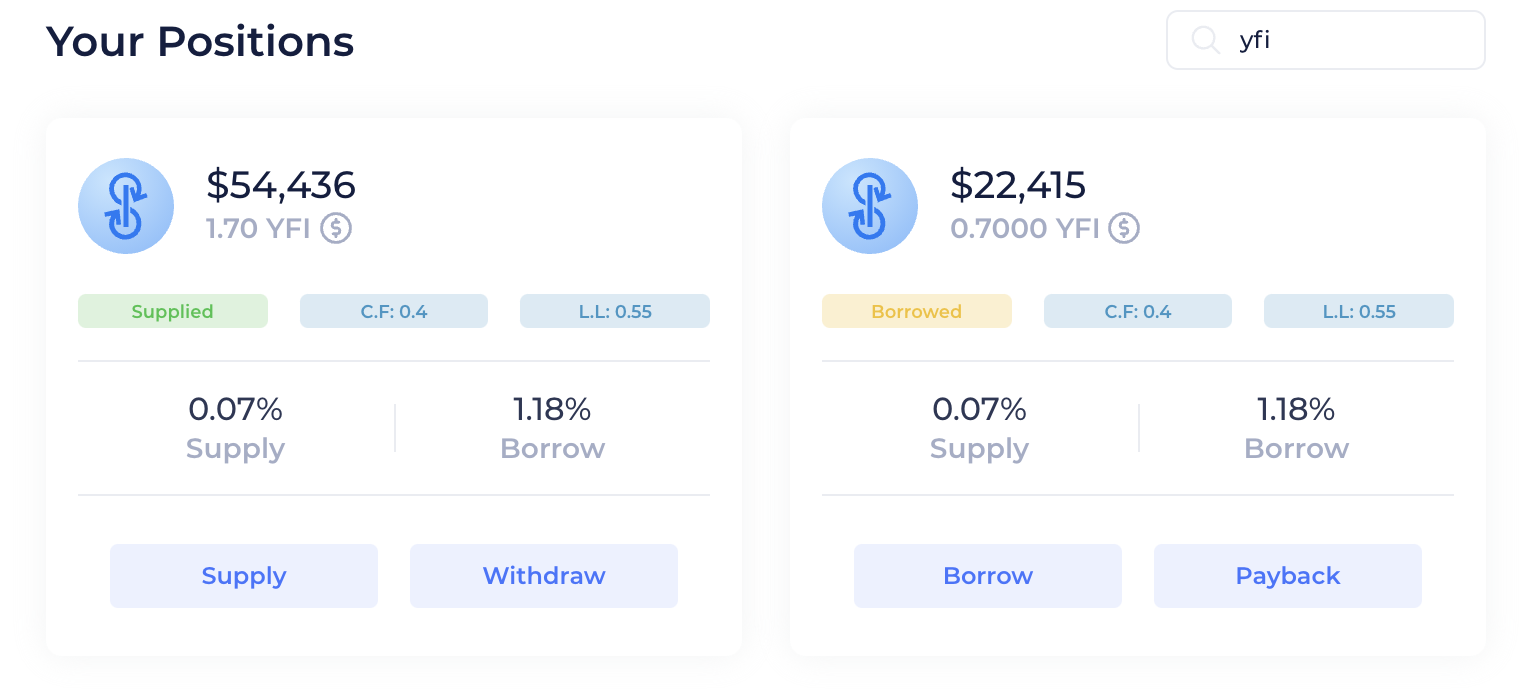

Now that you selected Aave on the app’s left side, time to supply YFI as collateral. There’s a search bar next to ‘Your Positions.’ Use it to find YFI.

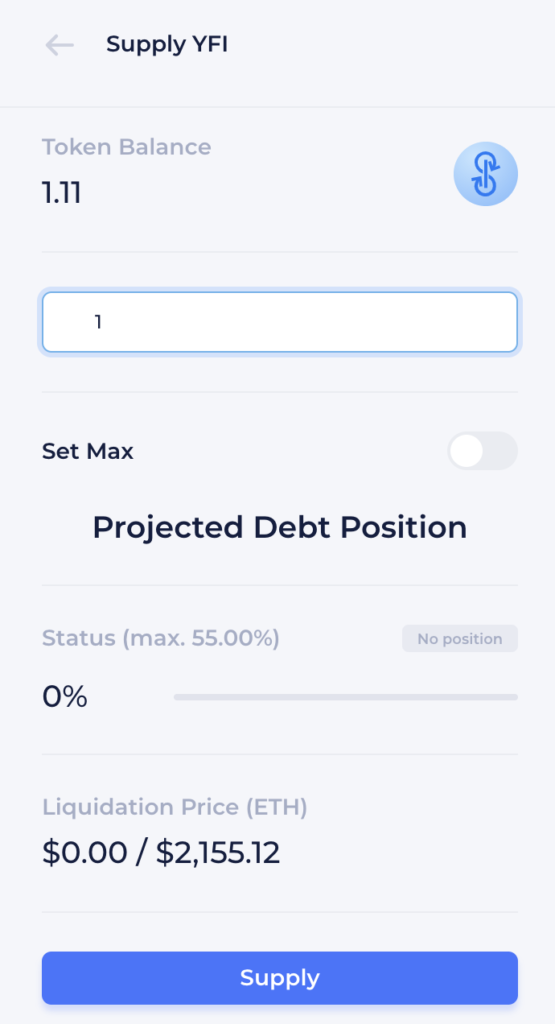

Next, click on the ‘Supply’ button and lend Aave your test YFI. You will be able to specify the amount in the right section of the app.

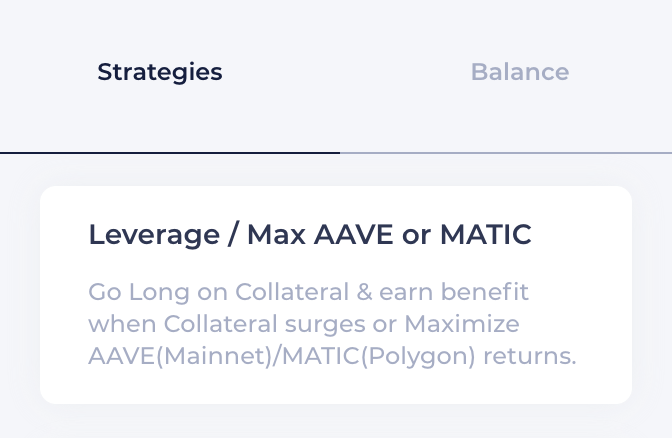

Once you have YFI collateral on Aave, time to get a little crazy. Under the ‘Strategies’ tab on the right side of the app, you will find leverage.

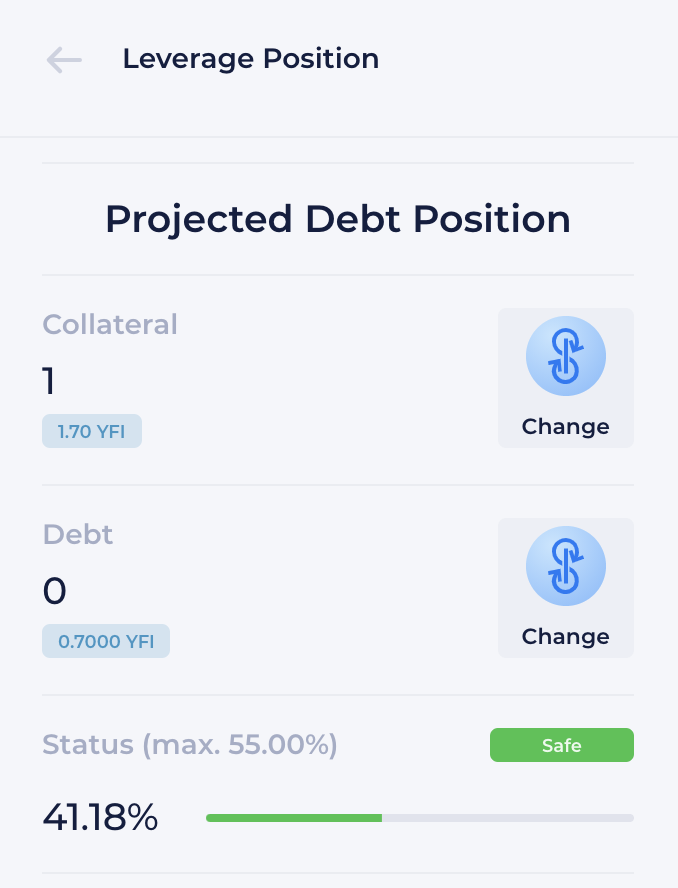

You will need to select an asset to use as collateral and an asset to borrow for leverage. In this case, I’m using YFI for both to go long. Note that I’m not using my entire collateral to keep the liquidation price within safe levels. The ‘Status’ bar is a good indicator—if you risk too much, it will turn red.

Once you’re happy with your projected position, you can execute the strategy by clicking on the ‘Leverage’ button. Now I have 1.7 YFI instead of 1, so I get more upside if the price goes up. However, if the price tanks, I may lose all my test funds through forced liquidation.

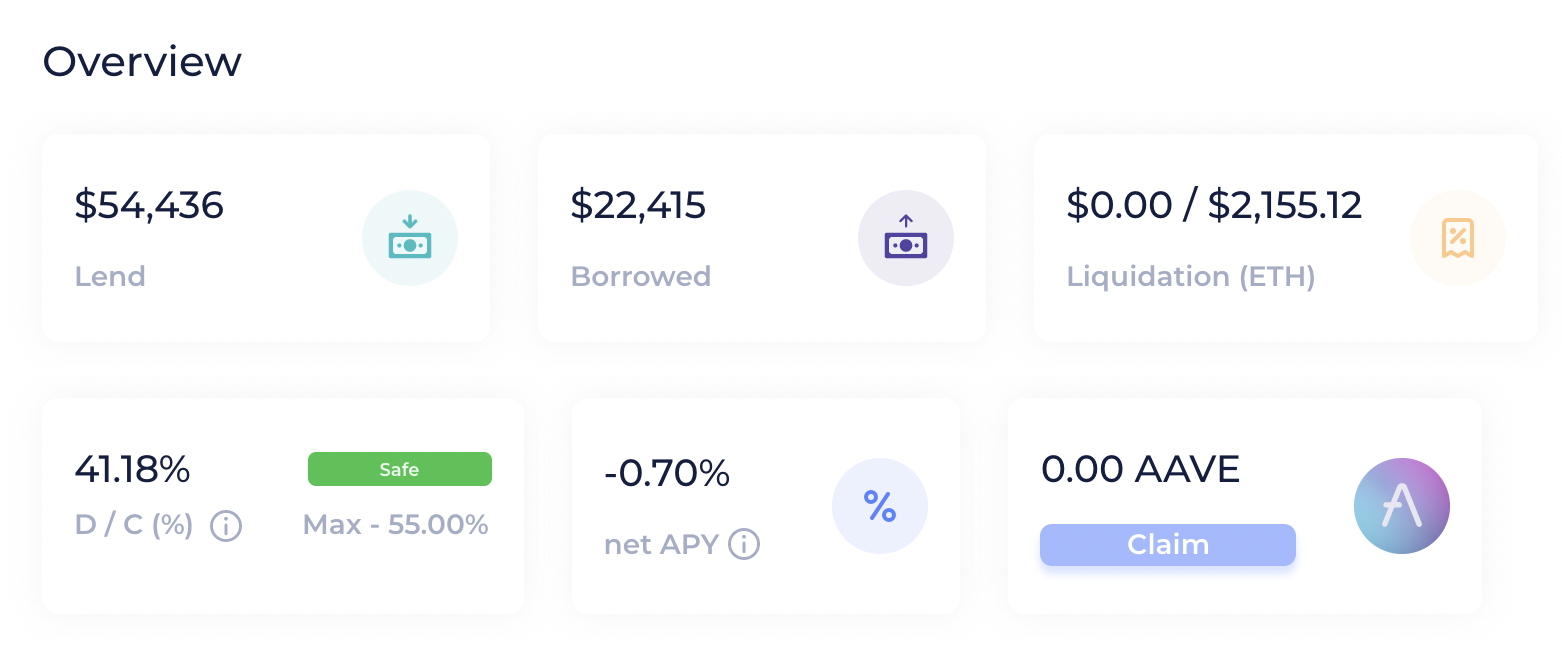

If you go back to the top-level dashboard by clicking a corresponding button on the left side of the screen, you’ll see a summary of your account. Convenient and easy, so you don’t forget what you have and where.

If you go to each individual protocol, you’ll get more detailed stats.

And there you have it. InstaDApp’s ‘simulation mode’ is a good way to try real DeFi protocols without the risk. Using these tools, you can plan your strategy not to waste time and money on bad transactions. Good luck!

If you’re interested in more insights like this, follow us on Twitter for free reports and tips from the team.

Disclosure: The author of this newsletter holds ETH. Read our trading policy to see how SIMETRI protects its members against insider trading.