June 29 Crypto Market Roundup

Bitcoin (BTC) fell to its lowest trading level since late-May 2020 last week, after bears gained momentum below the number one cryptocurrencies key 50-day moving average.

After falling below the psychologically important $9,000 level, the BTC/USD pair quickly fell towards the $8,800 support zone.

BTCUSD 5-Minute Chart

Source: Tradingview

A decline in U.S. equity markets and an increase in BTC miners selling had been seen as possible reasons why Bitcoin came under downside pressure last week.

Traders had also started to become nervous, following reports that the PlusToken ponzi scheme may be about to unleash a raft of selling pressure on the cryptocurrency market.

Furthermore, the crypto whale watcher, Whale Alert, had also telegraphed traders to the fact that ten large BTC transactions of around $288 million had taken place prior to the sell-off.

Source: Twitter

On-chain data from cryptocurrency behavioural analytics firm, Santiment, also showed two notable spikes in BTC Token Age Consumed, which preempted traders that a sizeable directional move in Bitcoin may have been about to happen.

Large spikes in BTC Token Age Consumed have previously proved to be accurate when predicting large incoming directional moves.

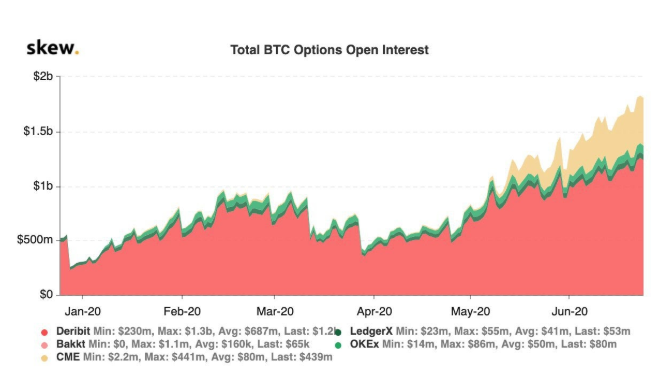

Bitcoin traders also remained cautious due the record amount of BTC options expiration last week. It is believed that a large number of professional traders kept on the sidelines to avoid whipsaw price action.

Data from Skew.com showed that despite the decline in BTC last week, open interest on the CME Bitcoin futures exchange remained healthy.

The total market capitalization of the cryptocurrency market fell towards the $455 billion mark, as a number of top altcoins broke under their previously established medium-term trading ranges as Bitcoin slipped lower.

Ethereum, Bitcoin Cash and Ripple all moved to fresh multi-week trading lows, although the bearish breakout failed to produce the heavy double-digit losses some traders and investors had been fearing.

Crypto Total Market Cap

Source: Tradingview

The Week Ahead

Looking at the week ahead, Bitcoin desperately needs to move price above the $9,225 level to avoid further technical selling pressure.

A sustained break under the $9,000 level would likely cause medium-term selling towards the $8,700 to $8,500 area.

If bulls can anchor price back above Bitcoin’s 50-day moving average, around the $9,400 level, this could mean the downward selling pressure may be over, and BTC/USD could start to climb back towards the $10,000 level.

It is also noteworthy that monthly price close will be happening this week. A monthly price close above the $9,800 level would be extremely positive for the overall BTC bull call. A monthly close under the $9,000 level and BTC may begin to drop back towards the $8,100 area.

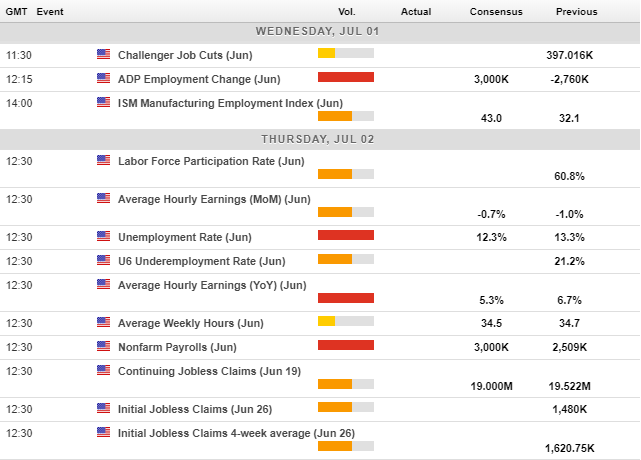

The United States economic calendar is slightly shortened this week, due to the July 4th holiday, however, traders do have some important economic data to look forward to. The June monthly U.S jobs figure and the ISM manufacturing report are set to headline this week.

There are also important speeches from FED Chair Powell, and U.S. Treasury Secretary Mnuchin, and the FOMC meeting minutes this week.

Economic Calendar

Source: Forexlive

The short-term technicals continue to show an ascending wedge pattern on the higher time frames remains valid, despite last weeks price drop under the $9,000 level.

Bitcoin (BTC) would need to fall under the $8,400 level in order to turn technically bearish. However, sellers face strong technical support from the $8,800 and $8,700 levels in the meantime.

A breakout above $10,500 level is currently required to accelerate a medium-term rally in BTC/USD. If this scenario does happen, then I would expect the $11,500 to $11,800 to be tested in rapid fashion.

BTC/USD H4 Chart

Source: Tradingview

Ethereum (ETH) is starting to look more bearish after last weeks heavy reversal, and is on shaky ground while trading below the $230.00 level.

Sellers have failed to gain momentum after breaking under the $220.00 level last week, leaving the ETH/USD pair in limbo at the moment.

Confirmation of a bearish breakout will come if a multi-day price close under the $217.00 level occurs. Then I would expect that the ETH/USD could fall towards the $190.00 and possibly even the $155.00 level.

To the upside, a breakout above the $250.00 level could see the ETH/USD pair quickly rallying towards the $290.00 to $300.00 resistance zone.

ETH/USD H4 Chart

Source: Tradingview