Crypto Retirement.

Early retirement is no more a meme. Retail players learn the ropes of investing and realize that they may leave the workplace at around 35 and enjoy life with the right investment strategies.

Throughout my investment journey, I came across various articles, podcasts, and videos devoted to retirement by investing in crypto. Yet, few of those covered the significant bits.

It’s not enough to build capital. If you want to make it work as a base for retirement, you need to find ways to earn income on your holdings consistently so you don’t run out of money after several years.

Fortunately, the surge of DeFi gave birth to startups that focus on providing fixed income. Today, I’ll briefly introduce them to you.

Retirement Considerations

When you retire, your capital becomes extremely important. If you lose a substantial portion of it, you won’t sustain yourself in the future. Hence, you are looking for a low-risk investment with acceptable returns.

Which returns are acceptable? Let’s say you have $1,000,000 and you decided to say ‘bye-bye’ to your job. Depending on your location, lifestyle, and inflation, the percentage of acceptable returns may vary.

If you want to settle for a moderate lifestyle in a studio apartment in the cheapest U.S. state, Mississippi, you’re looking at about $20,000 a year in living expenses. That’s 2% of your capital.

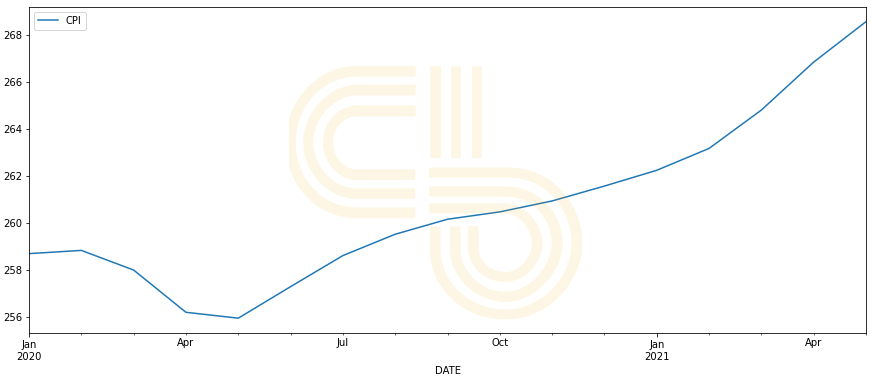

Now, if inflation is going to gravitate to the Fed’s target of 2%, you need to account for another 2% as well. Keep in mind that the more money you have, the larger chunk of it in absolute numbers inflation will eat.

If you earned $20,000 on $1,000,000 in year one, you would need to earn $20,400 in year two to keep up with the inflation.

CPI index shows how goods are becoming more expensive. If you don’t earn enough, inflation will eventually start eating your capital away. Source: FRED.

With interest rates hanging at the floor, finding fixed income instruments in the traditional space becomes a non-trivial task. Yields dried up, and now people have to be creative about constructing fixed income portfolios.

Crypto Solutions

The Cambrian explosion of DeFi protocols hinted at the emergence of fixed income instruments. We spotted the first players back in 2020, but we were looking at possible fixed-income solutions long before that.

Creating fixed-income instruments isn’t easy. Protocols promise consistent returns, and they need to find reliable yield-generating sources.

Crypto fixed income solutions are interesting because they approach yield generation differently. On top of that, the fact that DeFi provides relatively high yields even during hard times, crypto fixed instruments may potentially look more attractive to some people.

Keep in mind that crypto fixed income instruments carry systemic risks. If a protocol fails or gets exploited, you can lose all your money. It’s riskier than buying T-bills or Certificates of Deposits.

BarnBridge and Saffron Finance

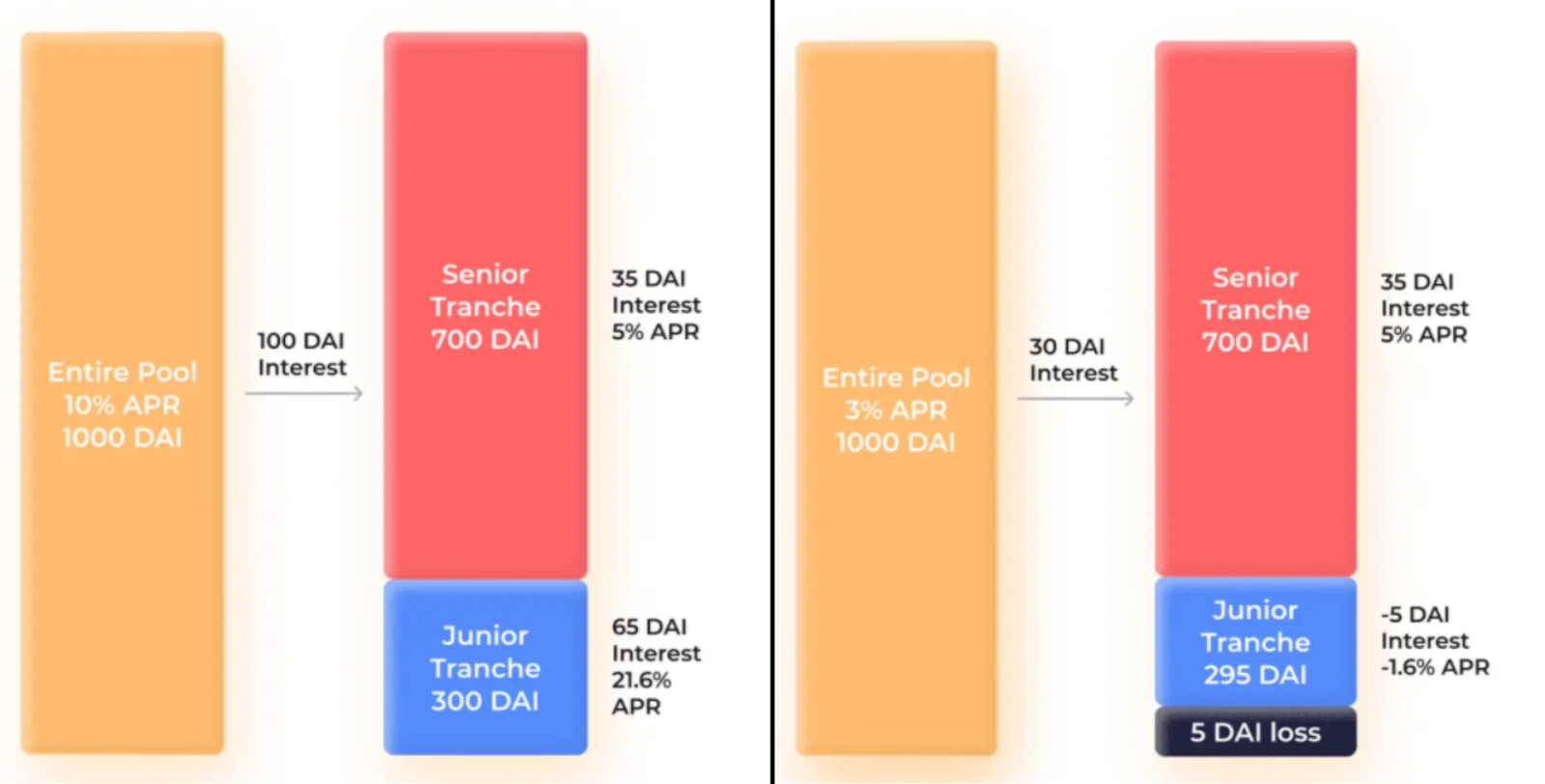

BarnBridge and Saffron Finance bring the ideas of traditional finance to crypto. They achieve fixed yield by splitting the risk between yield earners.

Imagine some yield farming opportunity that generates a 50% return. You can go and participate in it directly, or you can use one of the platforms mentioned above as a proxy.

Let’s say you decided to use BarnBridge. If you’re looking for a fixed 10% APY, you can select a corresponding risk bucket or a tranche. Others will select a more risky tranche.

The key is that if APY then goes to 80%, you give up the upside. However, if it crashes to 8% APY, the holders of riskier tranche will have to pay you the missing 2%.

Difference between pool distribution options depending on its performance. Source: BarnBridge.

Anchor Protocol

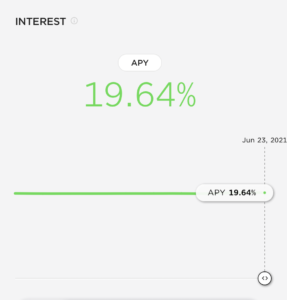

Anchor Protocol is a lending platform on Terra blockchain. It works a lot like Ethereum’s compound: some people provide assets for APY, others borrow and pay interest. The main difference is that Anchor targets 20% fixed APY.

20% APY smokes traditional fixed income instruments. How does the platform get such high performance? By using staking instruments.

To borrow on Anchor, borrowers need to provide assets that can be staked as collateral. This enables Anchor to generate additional yield as collateral and pass it on to the lenders.

One of the spoilers to the whole thing is that right now, the only asset for lenders is UST, Terra’s stablecoin. It recently unpegged from $1 and, while it then came back, it may create additional stress for investors.

A 4% decline of $1,000,000 is a $40,000 loss. Source: CoinGecko.

Overall, crypto fixed instruments are far from perfect. Although they offer relatively high yields, investors incur more risks. That’s because we’re are very early.

Still, I believe that with time risks will go down as well as the profits. The key here is that crypto will likely still be able to offer higher returns than traditional fixed income instruments, and some of us will be able to make crypto retirement a reality.

If you’re interested in more insights like this, follow us on Twitter for free reports and tips from the team.

Disclosure: The author of this newsletter holds ETH, BNB and MATIC. Read our trading policy to see how SIMETRI protects its members against insider trading.