June 15 Crypto Market Roundup

Bitcoin (BTC) fell to its lowest trading level since May 27th 2020 last week, as a return in risk-off trading sentiment in broader financial markets coincided with a decline in the cryptocurrency market.

The BTC/USD pair had suffered another heavy upside rejection, after the number one crypto briefly spiked higher above the psychological $10,000, following the release of the FOMC monetary policy statement.

BTCUSD H1 Chart

Source: Tradingview

Negative market sentiment caused traders and investors to reassess positioning, due to the recent sharp rise in the number of new COVID-19 infections.

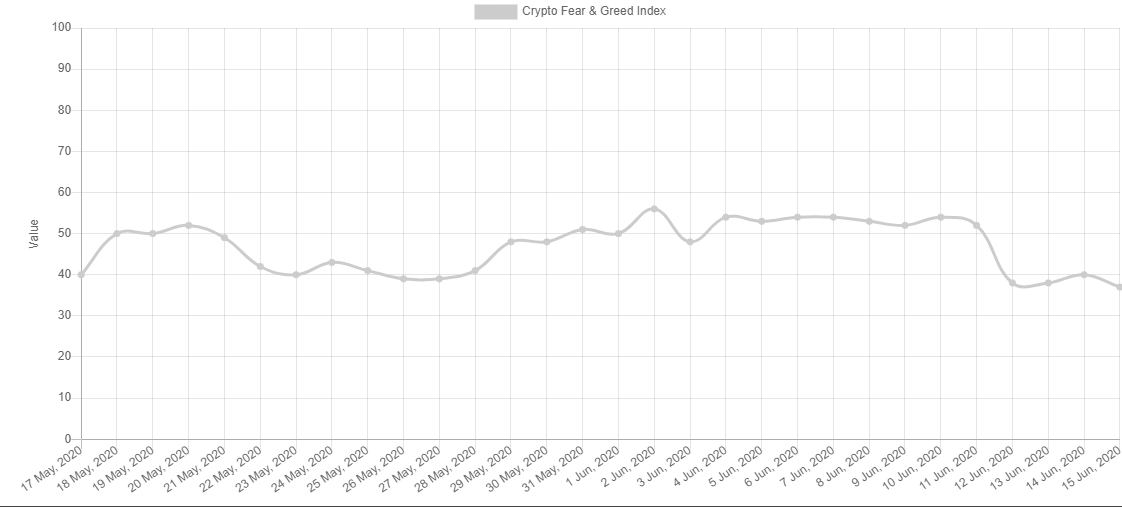

Cryptocurrency sentiment was also dented during Bitcoin’s price plunge, as the Crypto Fear and Greed Index plunged its lowest of the month so far, as traders moved back into “fear” mode.

Crypto Fear & Greed Index

Source: https://alternative.me/crypto/

Bitcoin and a number of top altcoins had consolidated in an extremely narrow price range before the major bearish breakout came.

Crypto participants had suspected that a large directional move in Bitcoin may be coming, due to a $1.3 billion whale transaction, and a large spoke in Token Age Consumed.

BTC Long positions amongst margin retail traders on the Bitfinex cryptocurrency exchanges also showed that over 85% of retail traders were expecting Bitcoin to trade higher.

Data showed that long-term Hodlers remained optimistic towards BTC, despite last weeks sell-off according to IntoTheBlock.

Bitcoin bears also remained cautious after the price plunge, due to Grayscale Investments apparent insatiable hunger to purchase Bitcoins on price dips.

The total market capitalization of the cryptocurrency market fell towards the $250 billion mark, after finding strong selling interest from the $280 billion level.

Bulls continued inability to break above the $300 billion level also provided a bearish warning that a healthy near-term technical correction may be about to take place.

Crypto Total Market Cap

Source: Tradingview

Altcoins followed Bitcoin lower, with Ethereum, Ripple, and Bitcoin Cash some of the biggest losers amongst the top-ten on a weekly basis.

Kyber network staged a powerful rally last week, as the positive fundamentals helped the cryptocurrency stage an upside breakout towards its highest trading level since June 2018.

Maker also staged a major triple digit advance last week, although the rally later, faded and the MKR/USD pair actually ended the week in negative territory.

The Week Ahead

Looking at the week ahead, the downside risks for Bitcoin increase while price trades below the $9,225 level, which is the BTC/USD monthly pivot point.

Another bout of risk-off trading sentiment in broader financial markets could see the BTC/USD pair sold back towards its 200-day moving average, around the $8,200 level.

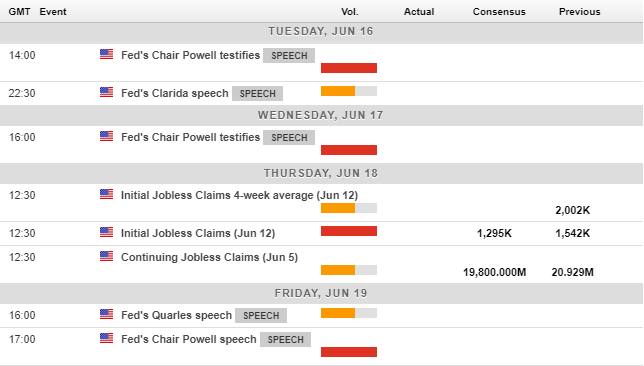

The United States economic calendar will be focused on the FED Chair Jerome Powell this week, as he delivers his semi-annual testimony before Capitol Hill. Traders and investors and will also be fixated on the number of new coronavirus cases.

Economic Calendar

Source: Forexlive

A bearish head and shoulders pattern on the lower time frames is warning of a decline towards the $8,400 level in the short-term. Bulls need to first move price above the $9,225 level, and then break through the $9,450 area to encourage a major push back towards the $10,000 level this week.

Sustained losses below the $9,100 level should be considered bearish in the short-term, and would certainly increase the chances of a prolonged drop towards the $8,400 to $8,200 area.

BTC/USD H1 Chart

Source: Tradingview

Ethereum (ETH) failed to move above critical resistance, around the $250.00 level, last week, placing the emphasis on a correction down towards the $220.00 support area.

Due to its high correlation with Bitcoin, Ethereum could also fall under the $200.00 level if the BTC/USD pair starts to hold below the $9,100 level.

The $150.00 level is seen as a potential medium-term bullish target if the $190.00 support level is broken with conviction. A breakout above the $250.00 level is required to encourage the next major upside push towards the $300.00 level.

ETH/USD DAILY Chart

Source: Tradingview