Retail Frenzy.

I think many expected that the recent drop-off in prices spooked retail players. However, that didn’t happen, and the market is still overreacting to influencers.

Bitcoin was getting closer to breaking past the 200-day moving average before Elon Musk’s tweet sent it a couple of steps back. Let me remind you that the 200-day moving average is an important macro support/resistance level for BTC.

While the move wasn’t dramatic, it still shows that a substantial number of market participants still care about what Musk says.

The impact of Elon Musk’s tweet after it was published (red square). The red line is 200-day MA. Source: TradingView.

Meanwhile, Coinbase added DOGE to Coinbase Pro and now is teasing its audience about adding the coin to Coinbase.

Coinbase listing signaled quality. It’s one of the most reputable exchanges in the space, so it won’t add a meme token. Or will it?

Meanwhile, Yahoo Finance, a news outlet that talks seriously about macroeconomic events, adds a DOGE mask to Instagram. It looks cringe but I think they nailed it in terms of addressing the needs of the target audience.

They say it’s not as dumb as it sounds.

You may have been thinking that TikTokers ran from the market but they didn’t. And they didn’t change their investment thesis either. Just invest in memes.

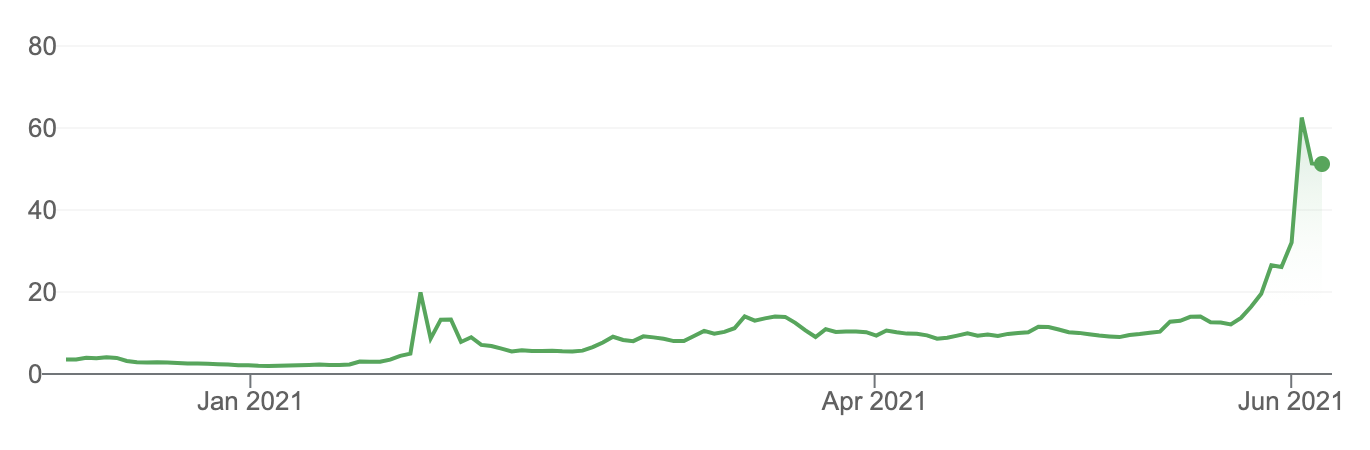

One of the particularly interesting meme tokens I noticed before the dump was CumRocket. I won’t explain what it does but at the time it looked like a perfect play considering the popularity of OnlyFans.

During one of our research calls, I told guys that CumRocket resembles DOGE in terms of its meme power. Soon enough, Musk tweeted about it and the price jumped.

Retail traders don’t act rationally. They don’t reflect on their mistakes and don’t adjust. They didn’t go away after getting rekt (a term for ‘wrecked’ in crypto) on GME stock and Robinhood in February.

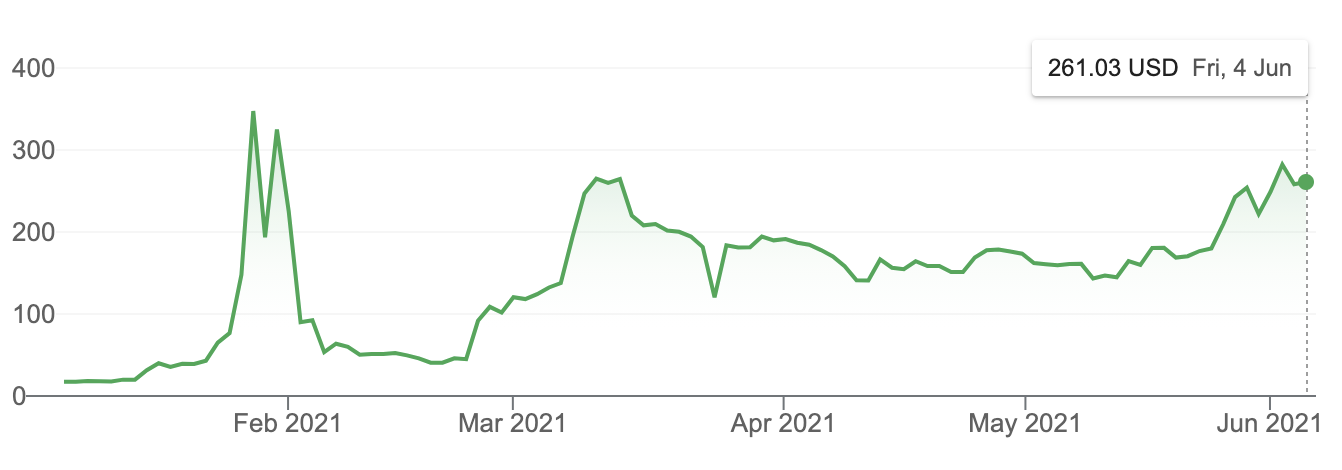

GME stock. Source: Google.

They stayed with Robinhood to get rekt again and found new GMEs.

An update from Robinhood in May about technical issues several months after the GME debacle.

AMC stock. Source: Google.

The retail herd is strong and stubborn but also sensitive to noise like tweets and Reddit posts. It’s difficult to have conviction in something you bought by blindly following people on the Internet, hence emotional sell-offs.

Add margin trading to the picture and you get the perfect recipe for volatility. The price dumps on a random tweet causing liquidations that push the price down even further. It gets worse on weekends when the market is thinner because whales usually don’t trade.

The silver lining is that retail presence is overall bullish for the market. You may not like their investment choices but they bring more money to the market. They are the fuel.

That being said, I believe that it’s where we need to adjust. Like it or not, figures like Musk will move markets going forward. So, it’s better to keep taking notes of what they do and what they talk about, even if it’s CumRocket.

SIMETRI Portfolio – A Slight Bump

Our portfolio continues to grind sideways with the rest of the market. The ROI slightly bumped from ~4,000% to ~4,500% over the week and dropped after Musk’s tweet to 4,146%.