An Overview.

I’m happy that the market bounced since last Friday but I’m still uneasy about where it’s headed. Today I’ll share my main concern about the bullish thesis so far and provide an overview of SIMETRI Portfolio.

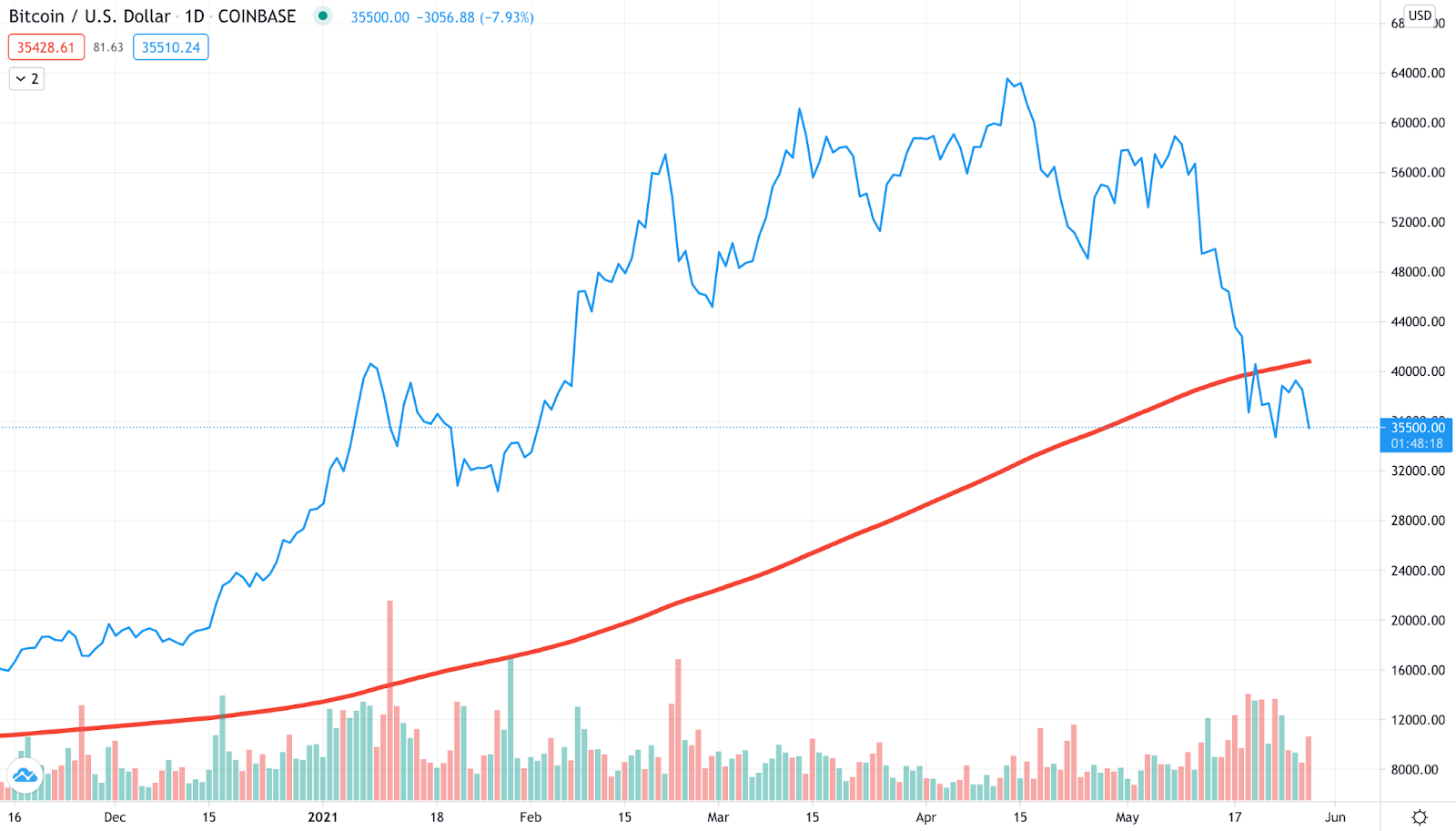

After a continuous flow of negative news, the market dropped below a key support level: 200-day moving average. This is a key support/resistance level on a higher time frame, which means that it can indicate where things are headed long term.

Take a look at the 2016-2018 cycle. The 200-day moving average held key support during pullbacks and once the price failed to hold above it the market finally turned bearish.

Source: TradingView.

Now let’s move to today. BTC just went below the 200-day moving average, which is a red flag. In my opinion, the bull market can continue only if the price breaks back above this line and holds there for a while. I think it’s still a possibility considering the market’s sentiment.

Source: TradingView.

Considering the macro landscape for crypto it’s risky to enter any position at the moment. Still, if the bull market will resume, now is the best time to do so. I saw many people offsetting their losses by buying the recent dip, and that’s on a relatively small price bump.

All this to say is that everything I’ll share from here should be taken with the grain of salt. There’s no opportunity without risk and using the money you can’t afford to lose to double down on something is irresponsible.

The drop-off in the market was surprising for many as the overall sentiment and fundamentals are bullish. I can say the same about SIMETRI Portfolio, nothing changed about our stance about Picks.

Let me go over the project, which went underwater lately. I’ll explain why we’re still bullish on them.

Hegic and Whiteheart

I put Hegic and Whiteheart together because Whiteheart is an extension of Hegic in a sense. Both platforms focus on protecting users from USD losses by using options.

While the total value locked in Hegic has declined since the initial pump, it’s not necessarily a bad sign. The platform didn’t need that much liquidity given its utilization rate of 30% for WBTC and 57% for ETH. In other words, more liquidity would likely be idle.

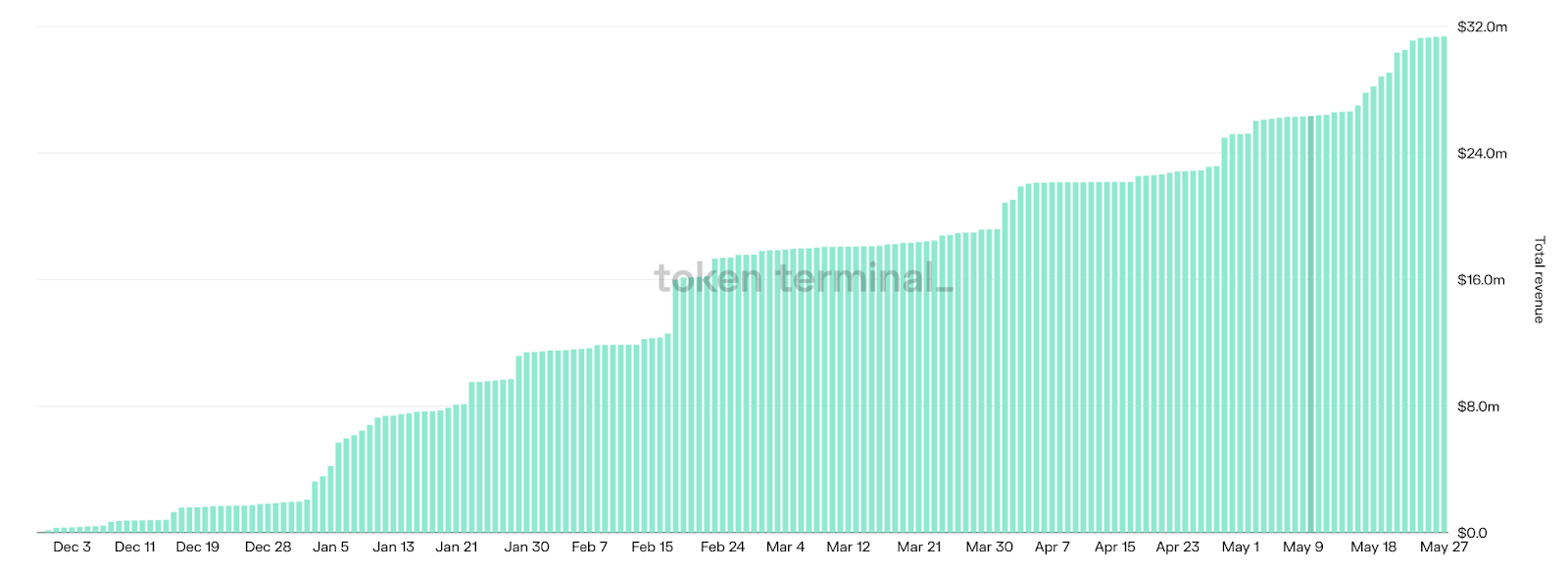

Meanwhile, the total revenue raked by the platform continues to grow. Volatility is good for platforms like Hegic and Whiteheart and it shows.

Cumulative total revenue of Hegic. Source: token terminal.

The growing revenue is the outcome of the growing volume of options trading. Last week it went above $400 million.

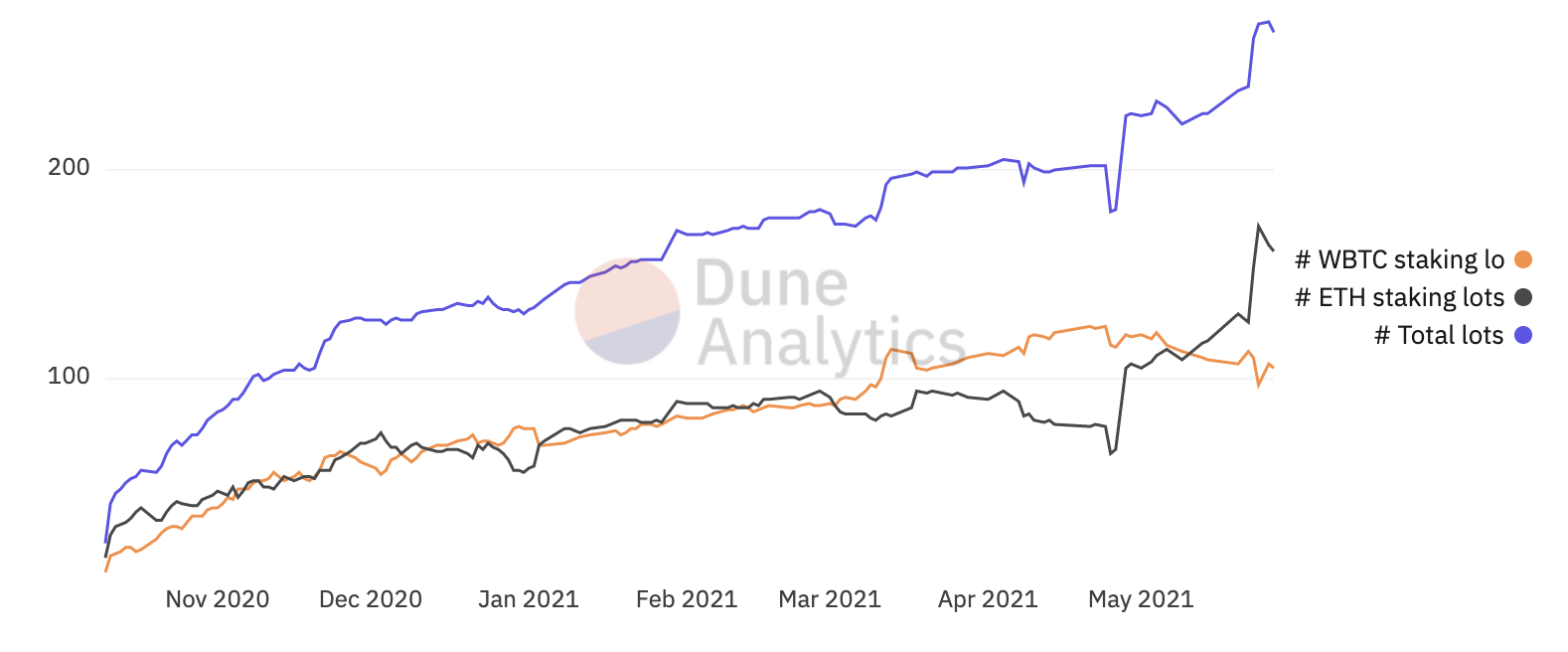

Staking and providing liquidity on the platform is profitable, which is the primary reason why the number of staking lots is growing.

Hegic staking lots. Source: Dune Analytics.

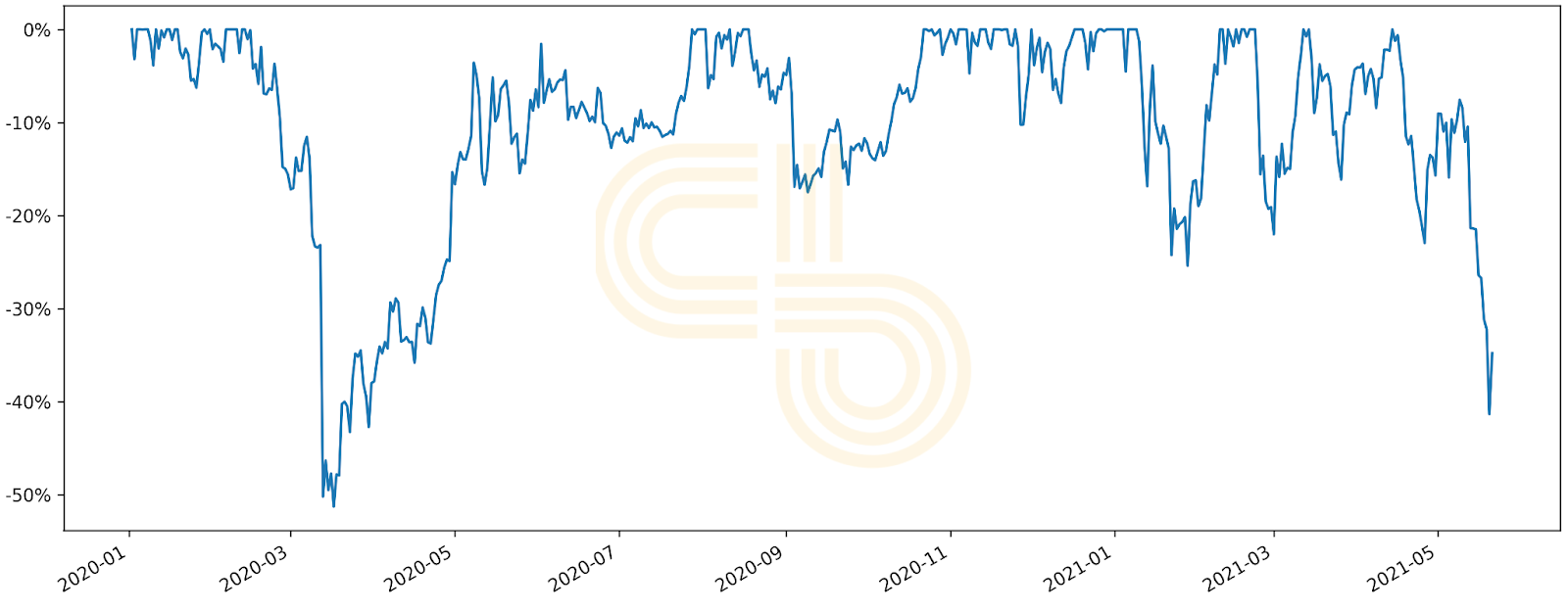

One of the gripes about Whiteheart is about the cost of protection. It’s rather high and can go over 5% monthly. However, the platform is still at the very early stage of development and it still offers value.

It’s probably not the greatest choice during the beginning of bull markets, but it can definitely come in handy when the market gets overheated considering the drawdowns of over 40%.

BTC drawdowns. Source: CoinGecko.

OctoFi

I personally like OctoFi for its community and memes. One thing I learned during this bull run is that you don’t want to shrug memes off.

The quality of the community is high, which I think is one of the primary reasons Doc Octavius, the project’s founder, decided to leave. This is a logical step for every decentralized project.

The community is now off to mature on its own and I have good feelings about it. In my FDAR on Uniswap, I outlined how disorganized and passive Uniswap’s community was when the core team stepped down. That’s not the case for OctoFi.

OctoFi’s key governance body is called Octagon. It was created before Doc Oc left, so people there were prepared to overlook the protocol. Shortly after Doc Oc’s departure, Octagon released the product roadmap for Q2-Q3 2021. For comparison, Uniswap community had trouble performing a simple vote a couple of times.

I understand why Doc Oc’s departure may have spooked some investors but OctoFi looks stronger than it did when we picked it.

NFTX

Although NFTs are unlikely to go anywhere in the following years, it’s still a new niche that will likely be more volatile than the rest of the market. When the market shakes, NFTs will suffer more than everything else because people rush to more liquid assets.

NFTX remains a leading platform when it comes to NFTs, so it’s one of the best places to be when the market is down and you still want to maintain exposure to the niche.

With some NFTs like CryptoPunks selling for millions of dollars on Christie’s, the idea of having NFT indexes makes more sense than ever. Not all of us are ready to deploy another hundred ETH to speculate on some image. With NFTX there’s no need to do it.

NFTX enables speculation on art without understanding its idiosyncrasies. For instance, you don’t have to understand the traits of Hashmasks if you just know the entire collection will grow in value and use NFTX.

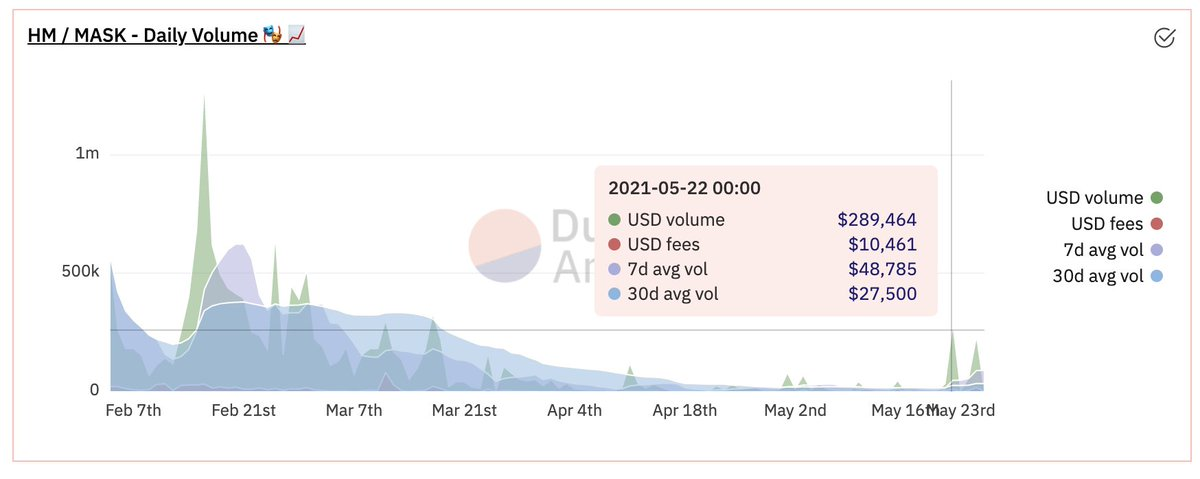

Hashmasks index trading volume. Source: Dune Analytics.

SakeSwap

SakeSwap is packed with products. It offers Uniswap-style AMM exchange, farming, initial exchange offerings, NFTs, and staking. Moreover, it’s multichain and works on Binance Smart Chain and Ethereum.

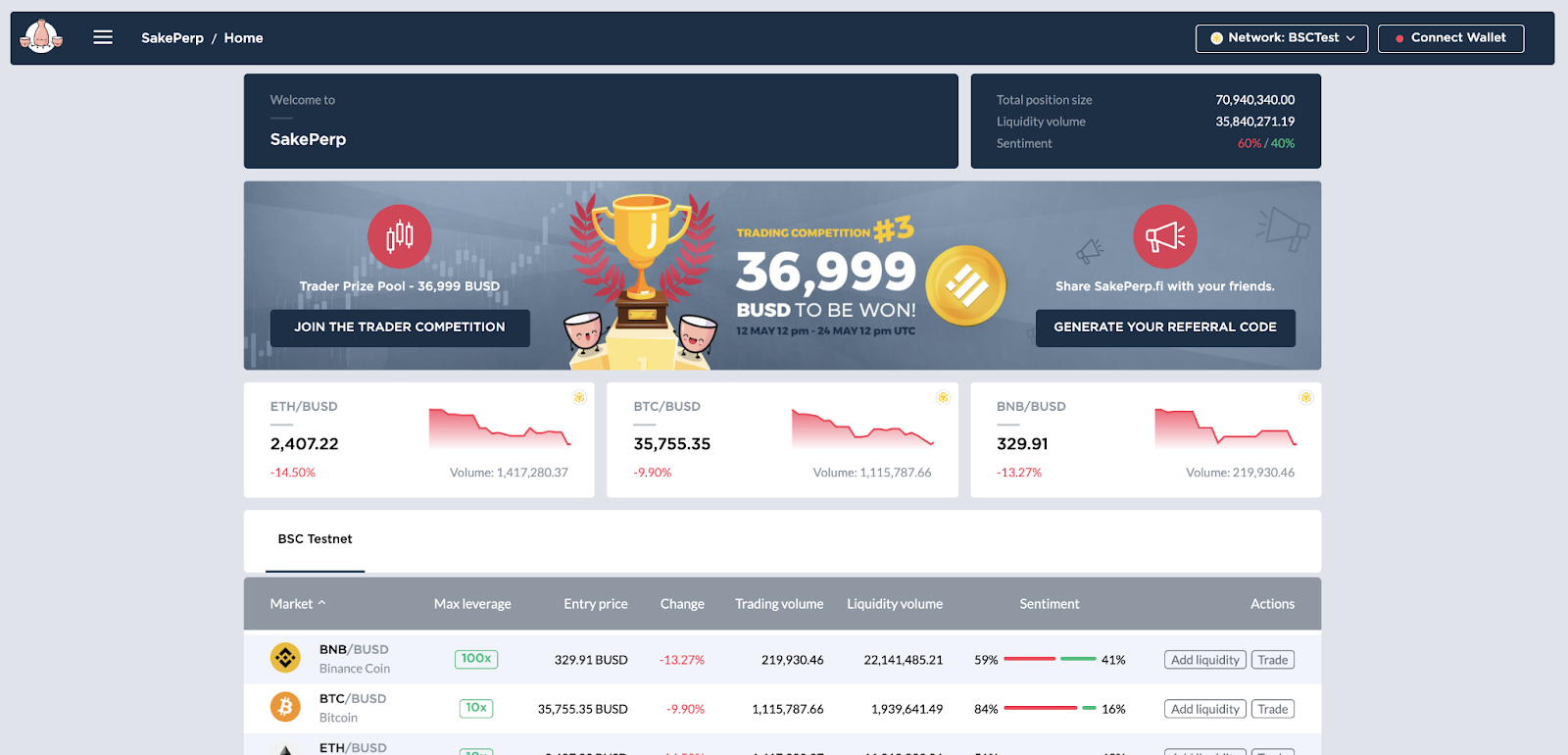

One product coming soon is perpetual futures, which will be the first of its kind on Binance Smart Chain. It’s already being tested on Ethereum and Binance Smart Chain testnets.

The liquidity in SakeSwap is still relatively low but we have all reasons to believe that leveraged trading will attract more people to the ecosystem, especially on Binance Smart Chain where people look for outsized gains on small deposits.

Popsicle Finance

Popsicle was unfortunate to get picked right before the market took a nosedive. Everything we outlined in our Pick of the Month report stands despite the decline in the price.

The main catalyst for ICE in the following weeks is Sorbetto, an automation tool for cross-chain liquidity farming. In a sense, it’s like what Yearn does, but cross-chain.

I strongly recommend reading the report if you haven’t done so yet. If you have, there’s not much I can add as the Pick is fresh.

SIMETRI Portfolio – Back to Square One

Our Portfolio bounced with the rest of the market but as we’re seeing another decline it went down as well. The ROI is currently almost the same as last Friday at 3938%.