Float Arbitrage.

We’ve discussed algorithmic stablecoins in a couple of issues of Alphaverse in the past. One of the protocols I touched upon was Float.

Today I want to show you how you can help FLOAT token’s stability mechanism and make daily gains along the way.

Float is one of the next-gen algorithmic stablecoins. If you want to learn more about algo stables in general and Float in particular, I suggest reading this and this issue of Alphaverse.

In this newsletter, we’re interested in how Float maintains the FLOAT peg and how you can take advantage of this mechanism for arbitrage. You can potentially make up to 10% daily gains arbitraging FLOAT. That said, there is no free lunch—it comes with substantial risk,

FLOAT token’s stability is maintained through expansion or contraction of the circulating supply. If the price deviates too far from the peg, the protocol either mints and sells new tokens or buys tokens from holders. The process is maintained through auctions on the website.

Consider the following example. The target price of FLOAT is $1 but its price on SushiSwap is $1.15. In this case, the protocol will mint and additional tokens to dilute the circulating supply and bring the price on SushiSwap closer to the target.

The tokens are sold at a dutch auction. The initial price is most likely higher than the market’s price but it keeps decreasing. At some point, FLOAT’s auction price goes below SushiSwap’s price, creating an arbitrage opportunity.

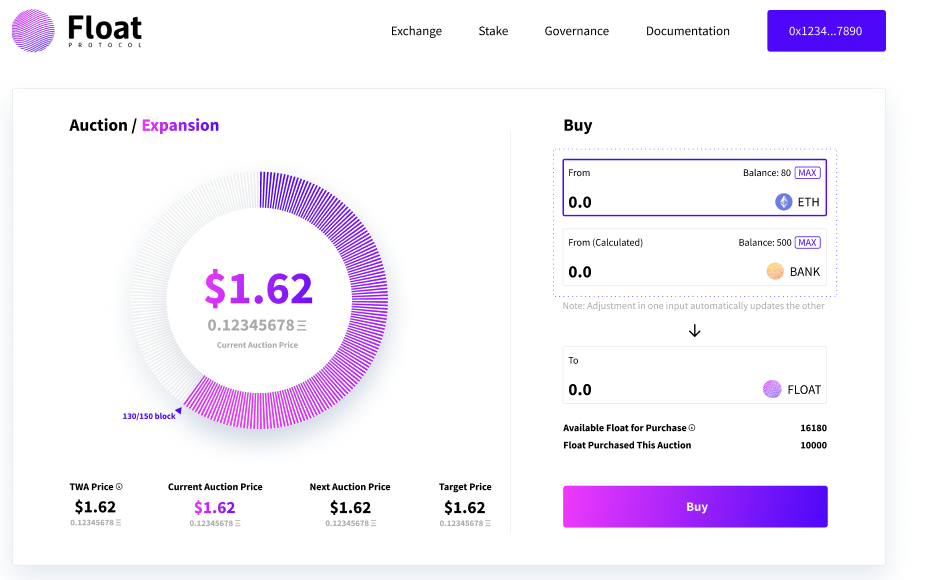

To participate in an auction head over to Float Protocol and select the ‘Auction’ tab. Connect your metamask wallet and you’re ready to go. Make sure not to click on the auction launch button in the center of the circle as launching an auction is expensive.

Importantly, FLOAT isn’t targeted at $1, it’s not like USDC or USDT. The target price is always shown on the auction’s dashboard.

Float protocol auction interface. The auction price goes down and anyone can buy FLOAT when they think it’s at a reasonable price.

As you can imagine, you aren’t the only person participating in the auction. Arbitrageurs like you are looking at the auction price waiting to pull the trigger.

When the auction price keeps decreasing, the potential profit from performing arbitrage increases. However, if you wait for too long, another person may get in front of you and sell FLOAT on SushiSwap, decreasing the price there and diminishing your potential profits.

In a sense, it’s like a cowboy duel, the first to the trigger wins. However, there’s an incentive to wait for the auction price to fall lower and create a better arbitrage opportunity. It’s a dynamic environment and no two auctions look the same.

The number of dynamic variables in the process creates risks. Transactions on Ethereum aren’t instant, so by the time you sell on SushiSwap, the price may have already fallen. From my experience, the price doesn’t fall too much during the auction, so you probably won’t lose too much. Though, you may take a hit from transaction fees.

Speaking of fees, they are still substantial and you will pay for at least two transactions. Hence, you need to deploy a substantial amount of capital to offset the fees. Use Gas Now to get the information about the fees.

Now that you understand the risks let me get to the sweet part: auctions are daily if the price is off it’s peg. This provides you with countless opportunities to exercise arbitrage. That being said, if you don’t think a particular auction will end in your favor you can skip it without missing much.

And there you have it. Be sure to keep SushiSwap and Gas Now tabs next to the tab with Float Auction. Stay safe and feel free to skip auctions, there will always be another one. Good luck.

Disclosure: The author of this newsletter holds ETH and FLOAT. Read our trading policy to see how SIMETRI protects its members against insider trading.