Survival Game.

I hope you’ve slept well over the last 48 hours. If not, it’s a good time to reflect on your outlook on the market.

I devote a lot of time listening to the pulse of the market, especially thought leaders. One opinion by Meltem Demirors, who explained Bitcoin to Congress, caught my attention.

Meltem cited a book by James Carse, ‘Finite and Infinite Games.’ The central idea of the book is that some games have a clear end and a clear winner. A game of football or chess has a clear outcome.

In contrast, infinite games have continuously changing rules, and the people who adapt (and survive) are the winners.

The idea of survival resonates well with me. People outside of crypto often ask me what they should buy. What I say tends to surprise them…

“Move slowly with your investments. The key,” I always say, “is to get experience and not lose it all.”

I entered crypto in late 2017, so I’m not an old-timer like Meltem Demirors. I didn’t get blown up because I was lucky—I was around other smart analysts who helped me avoid deadly mistakes. A TikToker diving into Doge doesn’t have the same luxury.

When the market is bullish, it’s easy to think you’re going to miss out. So you buy in impulsively. Then, when prices start falling, you panic and sell. Usually at the bottom.

People tend to forget survivor bias—while trading on 10x leverage or betting on random shitcoins made a few lucky people rich, thousands of others lost everything.

Success in crypto requires a long-term strategy based on conviction, so if the markets get choppy you don’t panic and hit the evacuate button. It’s hard to have conviction when you buy based on a tweet or a 20-second video clip; that is why retail investors capitulate on pullbacks and sell the bottom.

When you see pullbacks, you might look to history to guide your decision…

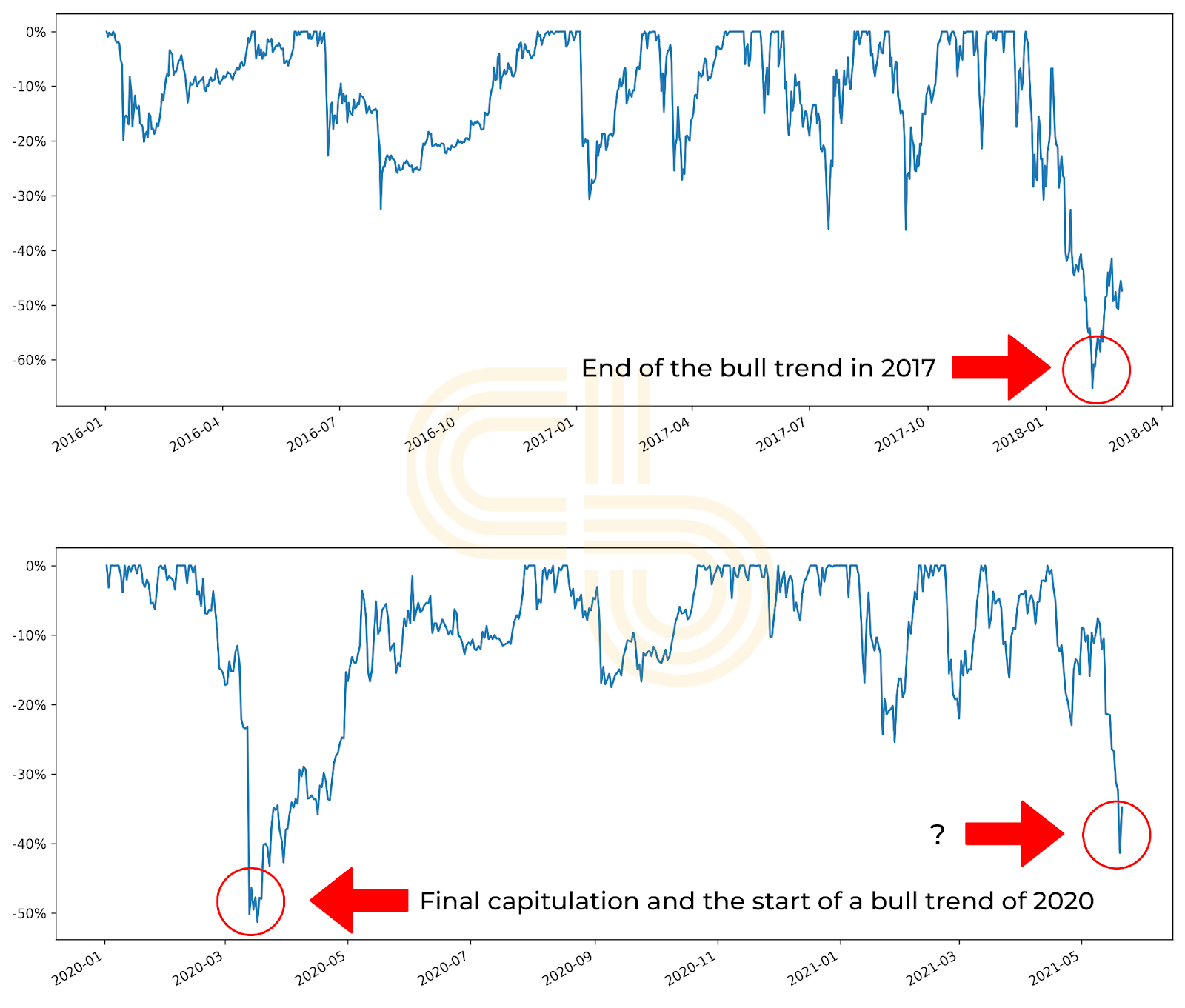

BTC drawdowns. Source: CoinGecko.

But even then, past price action can leave you with more questions than answers. We’ve seen around 40% drawdowns in bitcoin price closer to the end of the cycle. Still, the market recovered and surged to new all-time highs.

This time the drawdown is 41%, not as nasty as at the beginning of 2018, when the price went down over 60% before making a dead cat bounce.

While prices might be down, the market’s fundamentals are the same. The DeFi scene is exploding, EIP-1559 and the launch of Ethereum scaling, and reputable companies are still holding Bitcoin on their balance sheets. I don’t think we are entering a bear market.

But, even if we were entering a bear market, I wouldn’t be too concerned.

If you hold assets that you think—that you believe—are strong fundamentally, you can survive a bear market. You can put these assets into a cold wallet and forget about them until the next cycle. You can’t do that with SHIB or SafeMoon.

Let me remind you that the strongest projects in the space right now, like Aave and Synthetix, were actively building products during the last bear market. So, even if your SNX was underwater, you could still sleep well at night knowing that your investments would shine when the time is right.

Crypto is not a get-rich-quick scheme. It’s only like this for a small handful of people. Famous author and analyst Nassim Taleb calls this being “fooled by randomness.” People are misled into believing that those in crypto become millionaires overnight without putting in any work. What they forget is the pain and grit they needed to hold through the crashes and build on.

For most of us, winning in crypto is a marathon—you learn, endure, and adapt before you can make life-changing gains.

That’s why SIMETRI is a yearly (and soon to be lifetime) subscription. We found our biggest winners in the depth of a bear market, and there’s a good reason for that.

To sum it up, regardless of your philosophy, everyone at SIMETRI wants you to win, no matter what happens in the market. However, if you look for quality and manage your risk, you can sleep easy at night

We’re still early, and there’s plenty of time to win in this infinite game.

SIMETRI Portfolio – The Aftermath

Like the rest of the market, our Portfolio suffered from a severe correction. Still, I’m glad that the drawdown in ROI was only around 43%, which is quite good for a portfolio composed of altcoins.

Overall, the portfolio declined about as much as Bitcoin, and shows a cumulative ROI of 3997%.