A Dip Signal.

I know you’re probably still recovering from today’s price action. But the market has been overdue for a healthy correction, and now is your chance to double down.

One of the pros of the blockchain is that everything is in the open. If you look at the data, you can predict where the market is headed. Exchange flows are one way to anticipate which way prices are going.

Today I’ll give you an overview of what you should pay attention to, whether you should buy the dip, and where you can watch this data.

Bitcoin is the benchmark of the crypto space. If it does well, altcoins will most likely follow. There’s little point in looking at alts if BTC takes a dive.

Hence, our main interest is to know how bitcoin holders behave. If they buy BTC on exchanges and store it on cold wallets, it’s a reassuring sign. On the other hand, if they deposit coins to exchanges, it’s a sign they’re looking to exit.

To get the data I usually use CryptoQuant but Glassnode is also good, albeit limited for its free tier.

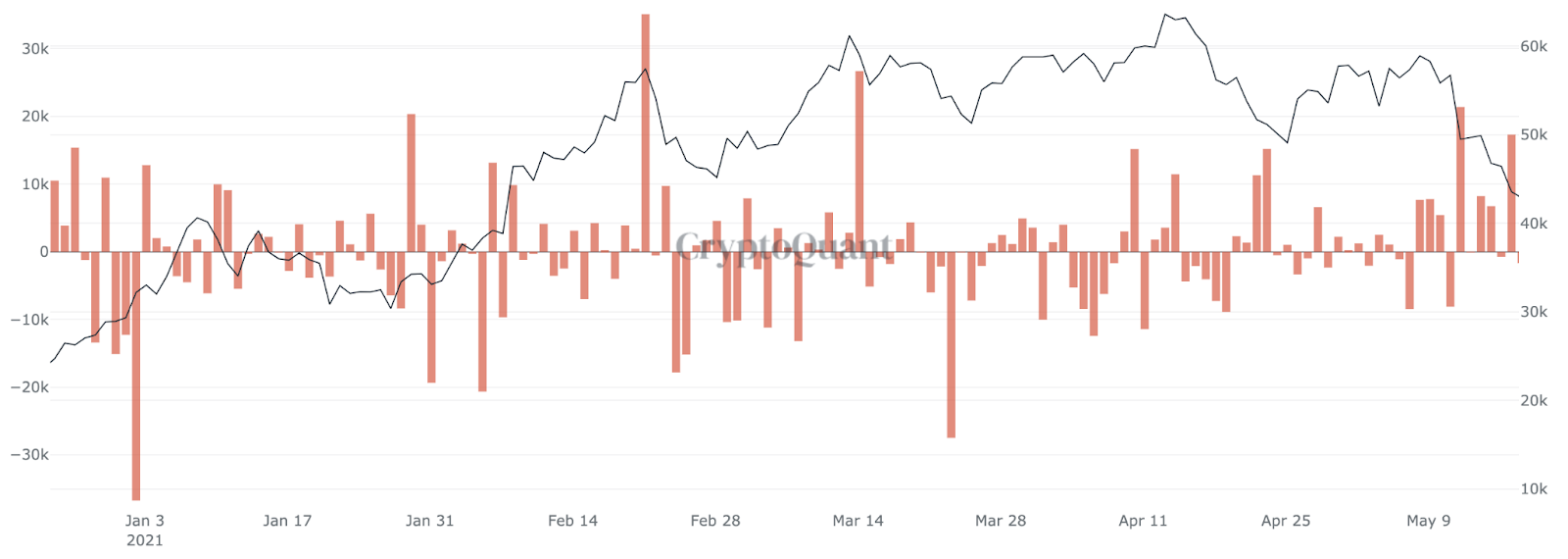

Take a look at the chart below. It shows BTC exchange flows. The red bars represent the difference between exchange deposits and withdrawals. If a bar is above the centerline, there were more deposits, otherwise, there were more withdrawals. The black line is BTC price.

BTC net flow on all exchanges. Source: CryptoQuant.

Note that the largest mass BTC withdrawal this year was at the beginning of January. Since then, we’ve seen several spikes in deposits, which seems to have been a leading indicator of potential price drops.

Since May 8, the number of deposits to exchanges has been increasing, which is rather alarming. On the other hand, the number of stablecoins on exchanges has also been growing.

Many retail traders and institutional investors have been on the fence while crypto was making moves to the upside. A drop in prices is their opportunity to enter the market.

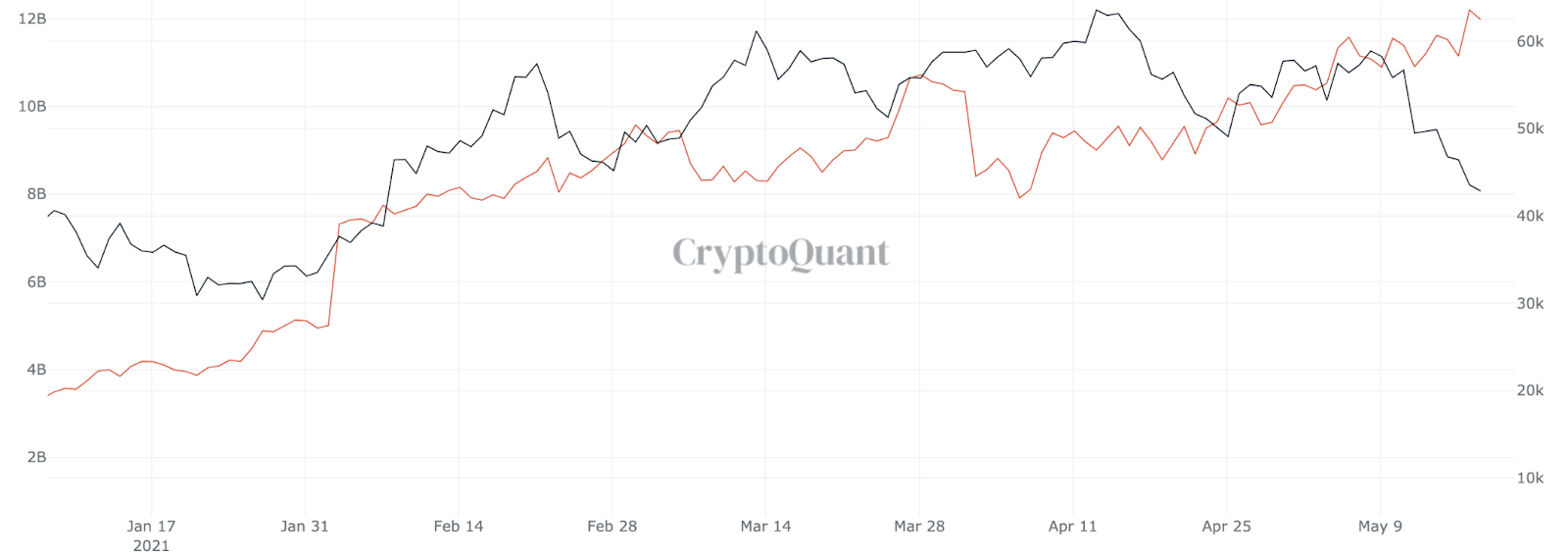

In general, people buy BTC using stablecoins. Thus, stablecoin reserves on exchanges are also a critical indicator.

Notice that on the chart below the amount of stablecoins in exchange reserves has been increasing at an accelerated pace since April of this year. While some of it should be attributed to stablecoin printing, it still shows that people were likely depositing to buy.

Stablecoins on exchanges (red). Source: CryptoQuant.

That is to say, while large inflows of BTC to exchanges should be cause for concern, they are not definitive signals that the prices will tank. The buying power on exchanges may outweigh the sellers.

You may be subscribed to some alert channels which report BTC inflows. CryptoQuant has one. Still, remember that in isolation these alerts are meaningless as not all BTC are deposited for immediate selling and there may be way more buyers than there are sellers.

This time we definitely had more sellers than buyers, but overall I think this dip is over. It was a tough day, but I expect a move to the upside.

All in all, keep an eye on BTC exchange flows and try to confirm substantial deposits as a potential dip signal. Look at the news and the market’s sentiment, they always provide decent guidance. That’s it for today, stay safe.

Disclosure: The author of this newsletter holds Bitcoin, Ethereum, ICP and WOOFY. Read our trading policy to see how SIMETRI protects its members against insider trading.