May 18 Crypto Market Roundup

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Bitcoin (BTC) finished last week with double-digit gains after the cryptocurrency turned resoundingly bullish after the much-anticipated halving event.

The BTC/USD pair started the week under price with the cryptocurrency reversing sharply from the $9,200 level, as volatility heightened just hours before the halving event.

Dip-buyers stepped in from key technical support, as bears once again failed to hold price below the $8,100 level, with the BTC/USD pair’s 200-day moving average holding firm.

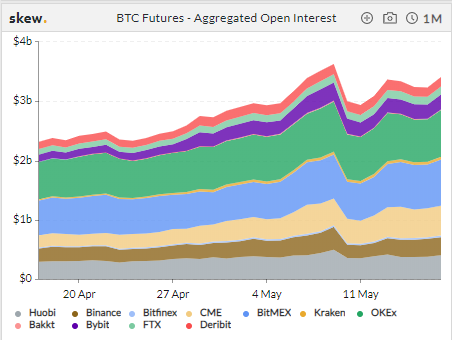

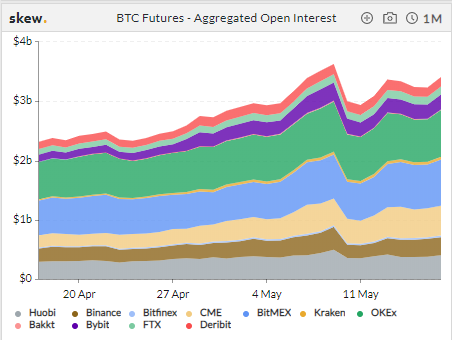

Data showed a record increase in Open Interest for Bitcoin on the CME futures exchange last week. Trading volumes on the CME exchange also continued to surge.

Bitcoin Futures Aggregated Open Interest

Source: Skew.com

Bitcoin eventually went on to close an important price gap that was created on the Bitcoin futures chart during the May 10th price crash, just below the $10,000 level. Bitcoin also went on to perform its strongest weekly price close since Feb 17th, 2020.

Bitcoin CME Futures

Source: Tradingview.com

Bitcoin’s hashrate started to decline after the halving. But not to the extent that market participants had feared. In fact, data showed that Bitcoin’s hashrate was already starting to bounce back again.

On-chain metrics for Bitcoin continued to paint a bullish price picture. Bitcoin exchange outflow remained at extremely low levels, while long-term coin holder data for BTC showed that traders were still expecting higher prices.

The total market capitalization of the cryptocurrency market eventually recovered towards the $270 billion level, and staged a major technical breakout from a triangle pattern on the weekly time frame.

Crypto Total Market Cap

Source: Tradingview.com

The broader crypto market failed to match Bitcoin in terms of weekly performance, although the likes of Ethereum (ETH), Ripple, (EOS), and Litecoin (LTC) posting only marginal weekly gains.

Stellar Lumen (XLM/USD)

Source: Tradingview.com

Stellar Lumen (XLM) was one of the strongest cryptocurrencies inside the top-20 last week. XLM/USD recovered a significant portion of its losses from the May 10th decline.

Retail trading data from a leading London brokerage showed that traders were turning less bullish towards Bitcoin. Long positions declined nearly 10 percent on a weekly basis.

The Week Ahead

Looking at the week ahead, Bitcoin is poised to test the $10,000 level, and quite possibly the current 2020 trading high.

The technicals have seen a big shift since last week after sellers failed to hold price below the $8,100 level. Current price action certainly favors dip-buying towards the $9,000 area.

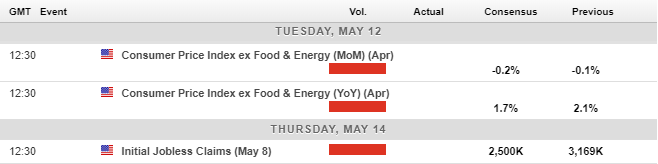

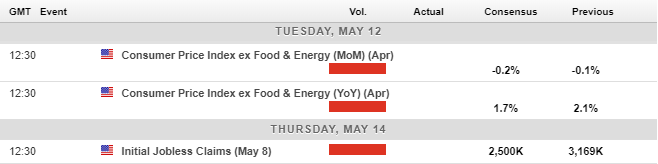

Looking at the U.S. economic calendar this week, traders will be focused on Federal Reserve Chair Jerome Powell’s semi-annual testimony before the U.S. Congress and the minutes from the last FOMC policy meeting.

Economic Calendar

Source: Forexlive.com

From a technical perspective, the short-term technicals are fairly clear for Bitcoin this week. A break above the $10,075 level could spark heavy technical buying, with the current yearly high, around the $10,500 level, coming into focus.

If price moves above the $10,500 level then the BTC/USD could surge towards the $11,100, and possibly even the $11,600 level.

BTC/USD DAILY Chart

Source: Tradingview.com

Ethereum (ETH) certainly has some catching up to do to match the current gains seen in BTC/USD.

Bulls need to anchor price above the $225.00 level this week to encourage technical buying towards the $250.00 and possibly the $260.00 level. Only a move under the $190.00 support level would cause traders to turn bearish towards ETH/USD.

It is noteworthy that the top of a symmetrical triangle pattern is located around the $260.00 level, if price breaks above this level technical buying towards ETH/USD could ramp up considerably.

Market Cap: $263,918,783,799 | 24h Vol: $140,546,781,922 | BTC Dominance: 66.9%

We are seeing truly unprecedented events unfolding across the world on a daily basis. With this in mind, I would like to reflect on the week that was, and look ahead to what the new trading week may bring for the cryptocurrency market.

Crypto Market Roundup

Bitcoin (BTC) finished last week with double-digit gains after the cryptocurrency turned resoundingly bullish after the much-anticipated halving event.

The BTC/USD pair started the week under price with the cryptocurrency reversing sharply from the $9,200 level, as volatility heightened just hours before the halving event.

Dip-buyers stepped in from key technical support, as bears once again failed to hold price below the $8,100 level, with the BTC/USD pair’s 200-day moving average holding firm.

Data showed a record increase in Open Interest for Bitcoin on the CME futures exchange last week. Trading volumes on the CME exchange also continued to surge.

Bitcoin Futures Aggregated Open Interest

Source: Skew.com

Bitcoin eventually went on to close an important price gap that was created on the Bitcoin futures chart during the May 10th price crash, just below the $10,000 level. Bitcoin also went on to perform its strongest weekly price close since Feb 17th, 2020.

Bitcoin CME Futures

Source: Tradingview.com

Bitcoin’s hashrate started to decline after the halving. But not to the extent that market participants had feared. In fact, data showed that Bitcoin’s hashrate was already starting to bounce back again.

On-chain metrics for Bitcoin continued to paint a bullish price picture. Bitcoin exchange outflow remained at extremely low levels, while long-term coin holder data for BTC showed that traders were still expecting higher prices.

The total market capitalization of the cryptocurrency market eventually recovered towards the $270 billion level, and staged a major technical breakout from a triangle pattern on the weekly time frame.

Crypto Total Market Cap

Source: Tradingview.com

The broader crypto market failed to match Bitcoin in terms of weekly performance, although the likes of Ethereum (ETH), Ripple, (EOS), and Litecoin (LTC) posting only marginal weekly gains.

Stellar Lumen (XLM/USD)

Source: Tradingview.com

Stellar Lumen (XLM) was one of the strongest cryptocurrencies inside the top-20 last week. XLM/USD recovered a significant portion of its losses from the May 10th decline.

Retail trading data from a leading London brokerage showed that traders were turning less bullish towards Bitcoin. Long positions declined nearly 10 percent on a weekly basis.

The Week Ahead

Looking at the week ahead, Bitcoin is poised to test the $10,000 level, and quite possibly the current 2020 trading high.

The technicals have seen a big shift since last week after sellers failed to hold price below the $8,100 level. Current price action certainly favors dip-buying towards the $9,000 area.

Looking at the U.S. economic calendar this week, traders will be focused on Federal Reserve Chair Jerome Powell’s semi-annual testimony before the U.S. Congress and the minutes from the last FOMC policy meeting.

Economic Calendar

Source: Forexlive.com

From a technical perspective, the short-term technicals are fairly clear for Bitcoin this week. A break above the $10,075 level could spark heavy technical buying, with the current yearly high, around the $10,500 level, coming into focus.

If price moves above the $10,500 level then the BTC/USD could surge towards the $11,100, and possibly even the $11,600 level.

BTC/USD DAILY Chart

Source: Tradingview.com

Ethereum (ETH) certainly has some catching up to do to match the current gains seen in BTC/USD.

Bulls need to anchor price above the $225.00 level this week to encourage technical buying towards the $250.00 and possibly the $260.00 level. Only a move under the $190.00 support level would cause traders to turn bearish towards ETH/USD.

It is noteworthy that the top of a symmetrical triangle pattern is located around the $260.00 level, if price breaks above this level technical buying towards ETH/USD could ramp up considerably.

ETH/USD DAILY Chart

Source: Tradingview.com