Turbulence.

The market has been bumpy lately. Some attribute it to the macro factors, others to the actions of Elon Musk or Vitalik Buterin. Both are correct.

I like to think about crypto as a layered structure. At the top, you have the macroeconomic environment and major indices, at the bottom TikTok shitcoins. It only makes sense to go down the market structure if each superior element looks healthy.

Back of a napkin representation of the market.

If indices like S&P 500 and NASDAQ are climbing and there’s no fear on Wall Street, crypto’s top-100 will likely do well. Then you look at various sectors like DeFi, NFT, memes. The ones with a lot of attention will likely have outperformer low-caps.

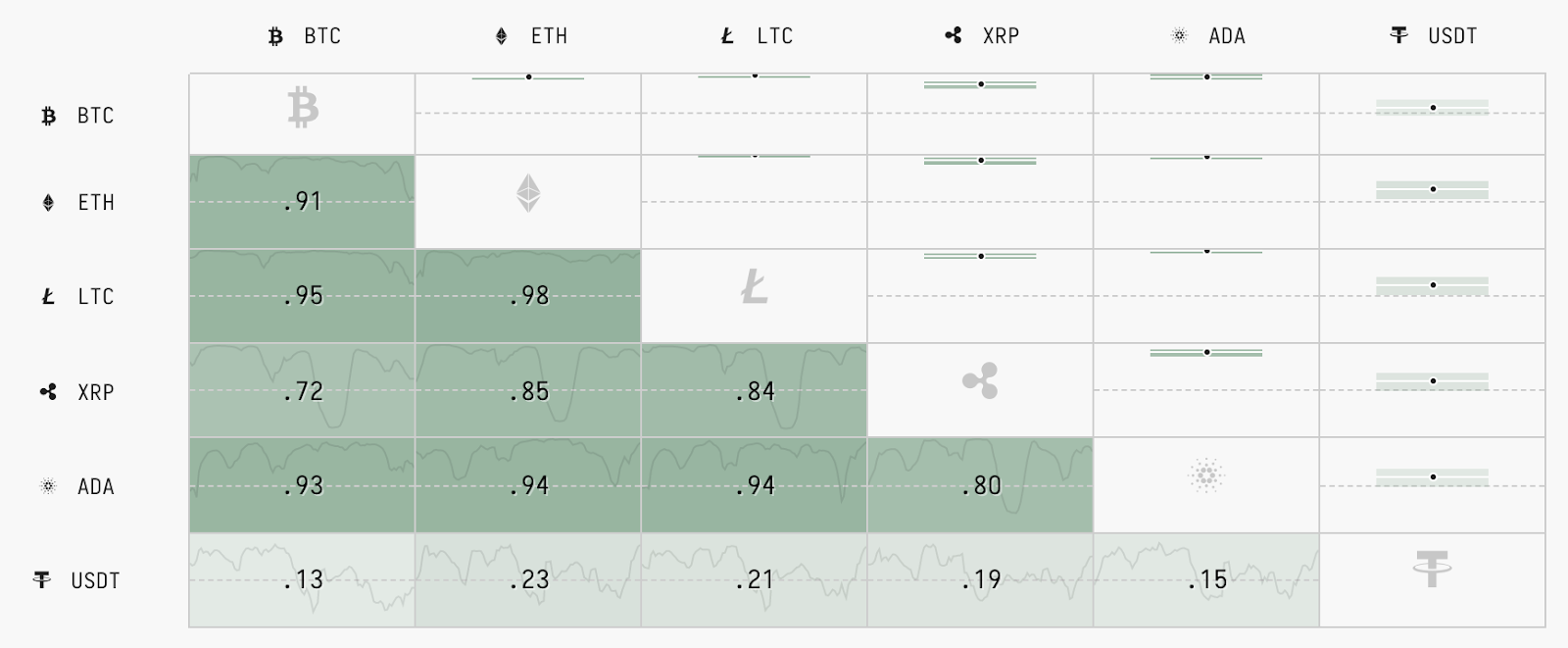

On the other hand, if there’s uncertainty around inflation and Consumer Price Index jumps, even the large-cap cryptos are in trouble. The crypto assets are still highly correlated with each other, so alts are even more in trouble. The liquidity is flowing back to the large caps as people try to minimize potential downside.

Cryptocurrency correlation matrix. Source: Cryptowatch.

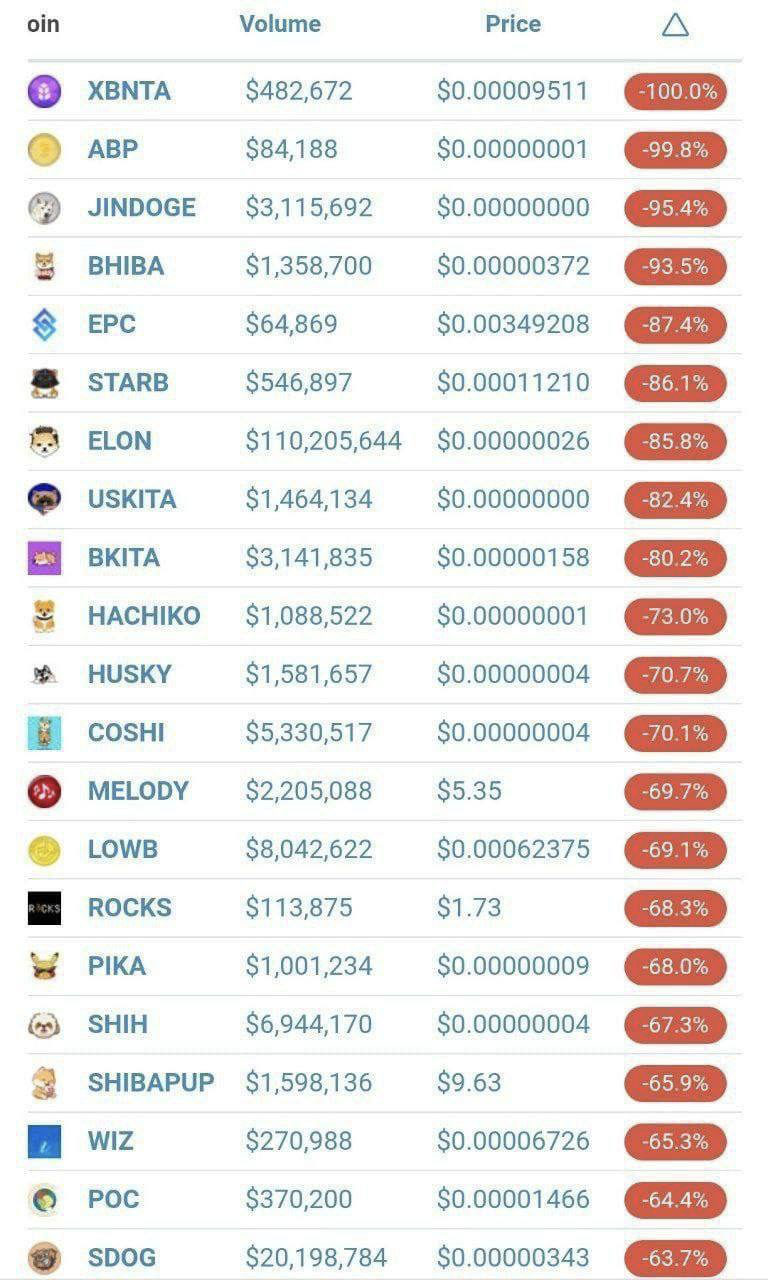

While the state of the traditional economy gets crypto investors spooked, some famous personas take actions that accelerate some downward trends. Tesla stops accepting BTC as payment and Vitalik sells his SHIB tokens to help Indians fight COVID.

Pet coins take heat after Vitalik’s move.

All this to say is to remind you that the macro is in the driver’s seat right now. People fear that the inflation will not be “transitory”, or in other words temporary like the Fed expects. This fear may make things worse as people hoard goods driving prices even higher. It may become a self-fulfilling prophecy, which damages the global economy.

Surely, Vitalik and Elon made some impact on the market, but in my opinion, that wasn’t the root cause of the market taking a dive. On bull markets, the bad news is usually shrugged off.

The best outcome for crypto is that Wall Street and Main Street calm down. Until then, crypto will be in turbulence. Fortunately, major indices started recovery this Friday.

SIMETRI Portfolio – Staying Resilient

In the previous issue of Digest, we celebrated SIMETRI Portfolio ROI going over 7,000%. I’m glad to say that despite the market’s adverse conditions our Portfolio’s ROI remains at 6,954%. This shows that people don’t abandon our Picks when the market shakes.

We’re also happy to provide the alpha version of SIMETRI Portfolio Tracker. The link that usually got you to the Google Sheets will now get you there.

Please note that this is an alpha version and it provides limited functionality. Make sure not to reload the app more than 1 time a minute or you will be banned by the data provider for 1 minute. We will mitigate this in future releases.