DeFi Summer V2.

Last year’s ‘DeFi summer’ ignited a macro bullish trend in crypto. Following the launch of Compound’s governance token, the development of DeFi building blocks exploded.

There’s hints of another DeFi wave developing for 2021. Here’s how you can be prepared to make the most of it.

Compound’s governance token COMP made yield farming fashionable. Many other DeFi projects followed Compound’s lead, releasing their own yield farming channels. Crypto traders and degenerates jumped head-first chasing these yields, causing DeFi to explode in popularity.

The developer community quickly picked up the new trend and we saw dozens of farming-oriented projects of various quality. Back then, even legit projects like Curve offered over 100% annual percentage yield, while shady projects provided tens of thousands of percent APY.

The high yields were the result of inefficiencies in the space, which got fixed after almost a year of relentless building. Currently, it’s difficult to find an Ethereum-based farm with more than 100% APY without exposing yourself to a substantial risk.

The other blockchains, however, are still largely inefficient. In the previous issue of Alphaverse, I outlined how bad my experience was on Solana. Yet, projects there have pretty high APYs.

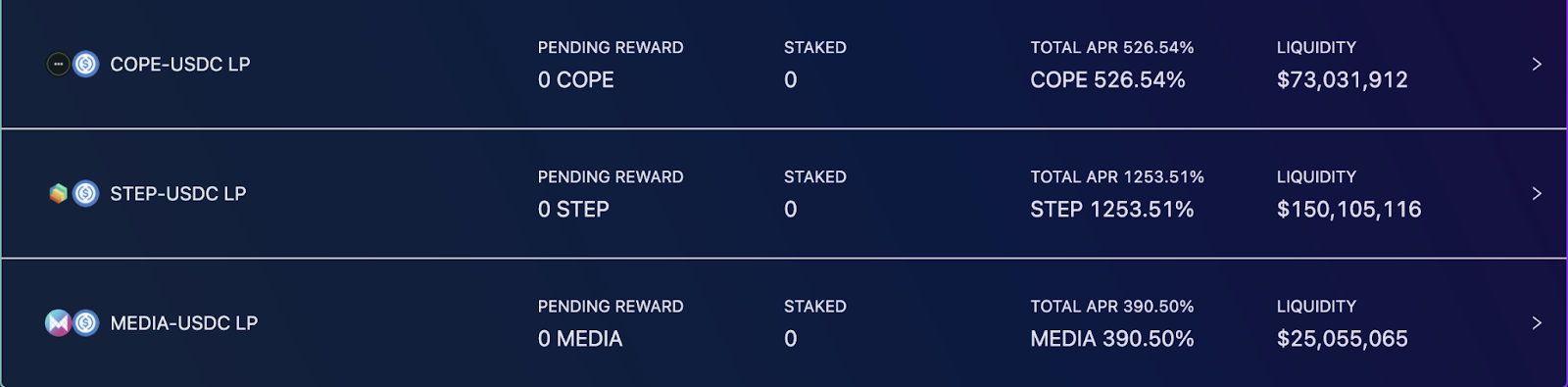

Yields on some Solana-based projects. Source: Raydium.

This week I visited another network, Fantom. From a user experience standpoint, it’s a mile ahead of Solana, but it still has issues.

My original goal was to capture abnormally high APY on Hyperswap, a Uniswap-like exchange with smart-contracts on Binance Smart Chain and Fantom. Initially, the APY on one pair was around 30,000%. In other words, you could’ve made 80% of your principal in a single day.

Now that’s important to understand that such APYs are not normal and they will go down. If you’re lucky, they will go down because of new people coming to the farm. Otherwise, you may get scammed in a maneuver called a ‘rug pull’.

So, I only risked what I was willing to lose. I bridged my assets to Fantom using the official tool from the Fantom Foundation.

I sent FTM tokens to the bridge only to find out that it doesn’t work. It turned out that the liquidity on the bridge dried up and my FTM will remain stuck there because the transaction couldn’t be finished.

Lesson learned: check a bridge’s liquidity before using it. However, it also got me to thinking that the APY is likely so high because others have their FTM stuck on bridges too.

After a while of looking for a solution, I figured out that USDC liquidity on Fantom bridges was still available. I quickly transferred USDC there and jumped on the bandwagon.

Over 22,000% APY on Hyperswap. It didn’t hold for too long.

Like Binance Chain, Fantom uses Ethereum tools, such as Metamask. So, after I managed to get USDC on the network, the experience was pretty smooth. The bridge turned out to be the major spoiler for me and hundreds of others.

Since people couldn’t transfer FTM to Fantom, they couldn’t enter Hyperswap’s farms and compete for that astronomically high APY. Not everyone had the spare dough to try another bridge and not many people looked for the possibility of transferring USDC or other tokens. That was my edge.

Through superior knowledge, you too can develop an edge that allows you to make a killing in the crypto market.

All this to say that I think we’re likely to see more projects with extremely high APYs this summer as we did in 2020. However, they will be on Ethereum layer-2 chains or other blockchains.

The inefficiencies in inter-blockchain communications or in the underlying projects (like in Solana’s case) will weed out lazy or inexperienced people, giving blockchain OGs like you an advantage. It will all be extremely risky, but that’s realistically the only way someone can consistently make market-beating returns.sized returns.

I think we are about to see DeFi summer v2, so I hope you’re prepared.Like Binance Chain, Fantom uses Ethereum tools, such as Metamask. So, after I managed to get USDC on the network, the experience was pretty smooth. The bridge turned out to be the major spoiler for me and hundreds of others.

Since people couldn’t transfer FTM to Fantom, they couldn’t enter Hyperswap’s farms and compete for that astronomically high APY. Not everyone had the spare dough to try another bridge and not many people looked for the possibility of transferring USDC or other tokens. That was my edge.

Through superior knowledge, you too can develop an edge that allows you to make a killing in the crypto market.

All this to say that I think we’re likely to see more projects with extremely high APYs this summer as we did in 2020. However, they will be on Ethereum layer-2 chains or other blockchains.

The inefficiencies in inter-blockchain communications or in the underlying projects (like in Solana’s case) will weed out lazy or inexperienced people, giving blockchain OGs like you an advantage. It will all be extremely risky, but that’s realistically the only way someone can consistently make market-beating returns.sized returns.

I think we are about to see DeFi summer v2, so I hope you’re prepared.

Disclosure: The author of this newsletter holds Bitcoin, Ethereum, ORI and FTM. Read our trading policy to see how SIMETRI protects its members against insider trading.