Bad Time to Be a BTC Maxi.

Over the past week, not much has happened in the macroeconomic environment. The Fed is pushing the printer to the limit, which adds more uncertainty to the crypto space.

“UpOnly” is one of my favorite videocasts about Bitcoin. One of the recent episodes features two of the biggest Bitcoin maximalists: Peter McCormack and Udi Wertheimer. Surprisingly, it turned out to be a pretty intelligent and funny discussion.

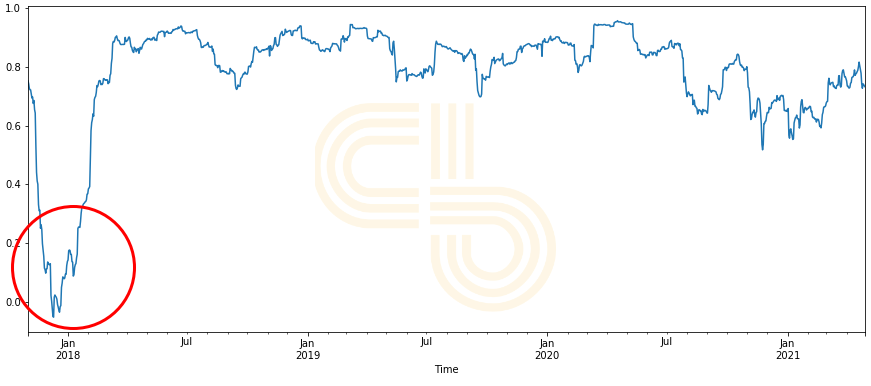

I particularly liked the point Udi made about investing in bitcoin. He said BTC isn’t the only asset on Earth, and if you put it in your portfolio, you should expect higher returns compared to all other assets.

He brought up lumber as an example of a good alternative investment. While everyone shrugged it off with a laugh, I thought Udi hit the nail on the head.

Chicago lumber futures. Source: Trading Economics.

Although I’m not a commodities trader, you can see that lumber went up less than Bitcoin did over the same timespan. Nevertheless, the point is still valid: you don’t win by going all-in on Bitcoin. On the contrary, you actually lose.

Sure, bitcoin has a lot going for it. And, if its future materializes as many anticipate, it may reach prices in the hundreds of thousands of dollars. But alts will bring substantially better gains, especially during bull markets.

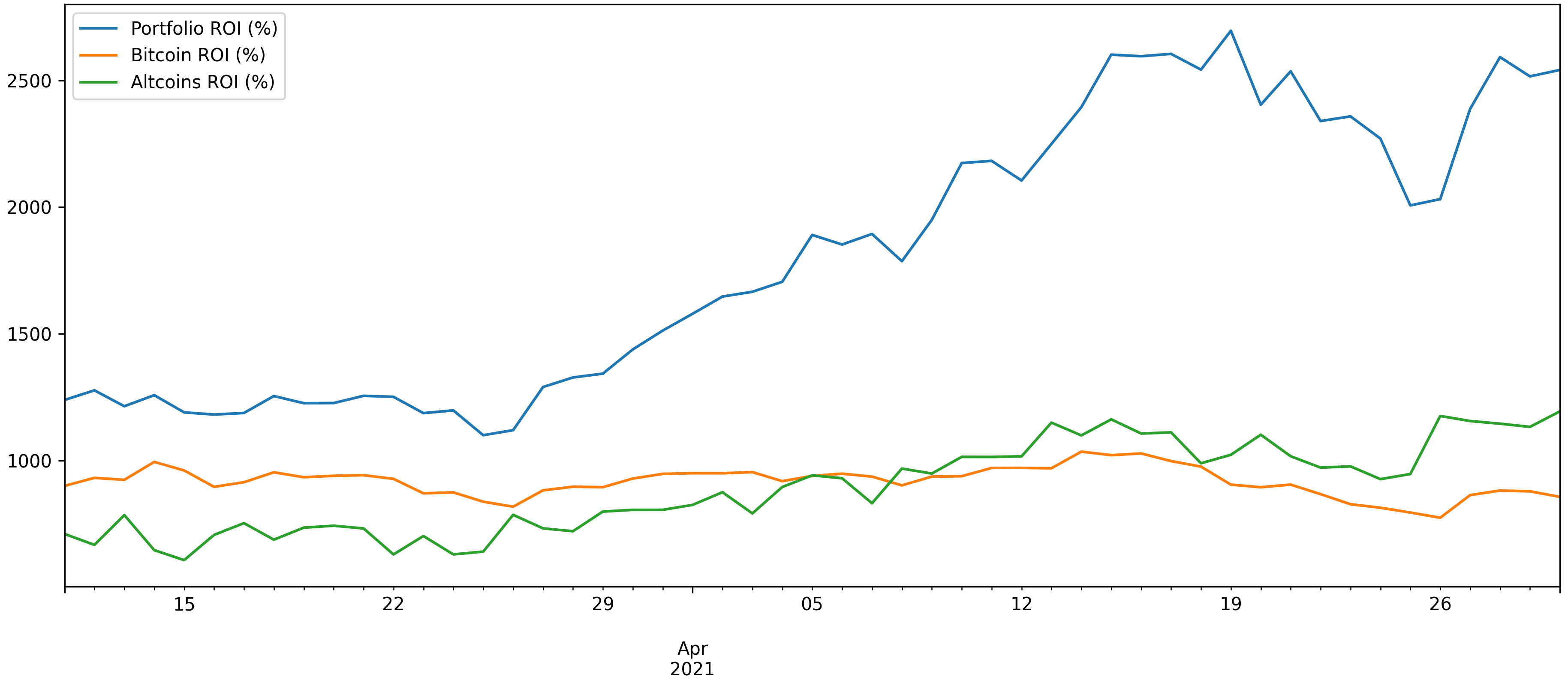

Let me bring up the BTC dominance chart to illustrate why it’s a bad time to be a bitcoin maxi during this part of the market cycle.

Bitcoin dominance. Source: CoinGecko.

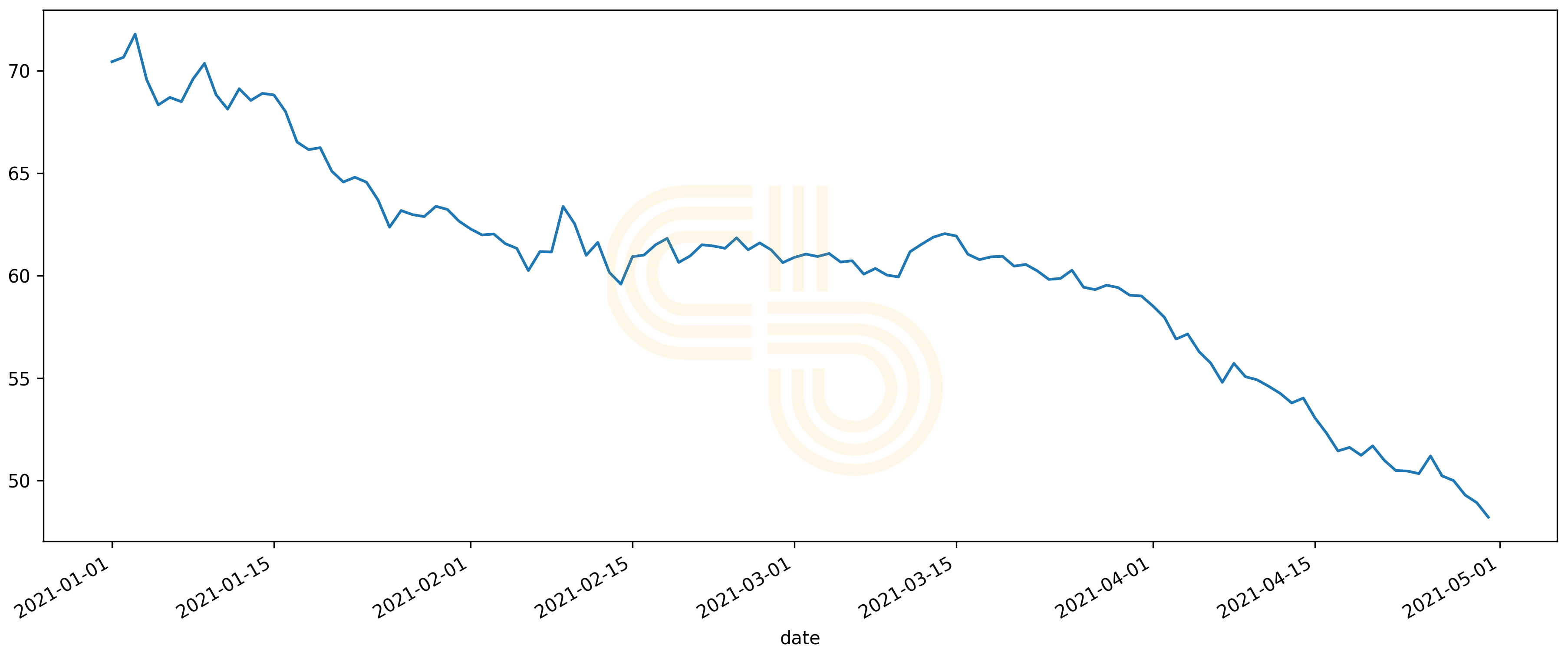

Before I switch to the Portfolio review, let me bring up one more chart. As Ethereum continues to grow while BTC stagnates, many crypto twitter personas speak about ETH decoupling. One thing they forget is we already saw such an event back in 2017-18.

BTC/ETH correlation. Source: CoinMetrics.

Although the correlation between BTC and ETH has declined since the DeFi summer, it still remains relatively high. If we are to see it decouple again while BTC dominance falls, it will be the time for alts to really shine.

SIMETRI Portfolio – Back on Track

After being suppressed by the recent market drop, SIMETRI portfolio is back on track, showing 6134% ROI.