Solana’s Pumpamentals.

One particular science completely changed my outlook on investing: behaviorism. Books like ‘Irrational exuberance’ by Robert J. Shiller, ‘Misbehaving’ by Richard Thaler, and ‘The Undoing Project’ by Michael Lewis turn the idea of “rational markets” on its head.

In short, behavioral economics challenges the academic assumptions about market rationality. It’s compelling to think that everyone makes decisions on a thorough analysis of the available options, but it’s not realistic. The science of behaviorism tries to put our assumptions in line with reality.

Today I want to show why you should account for irrationality on the crypto market using Solana and its ecosystem as an example.

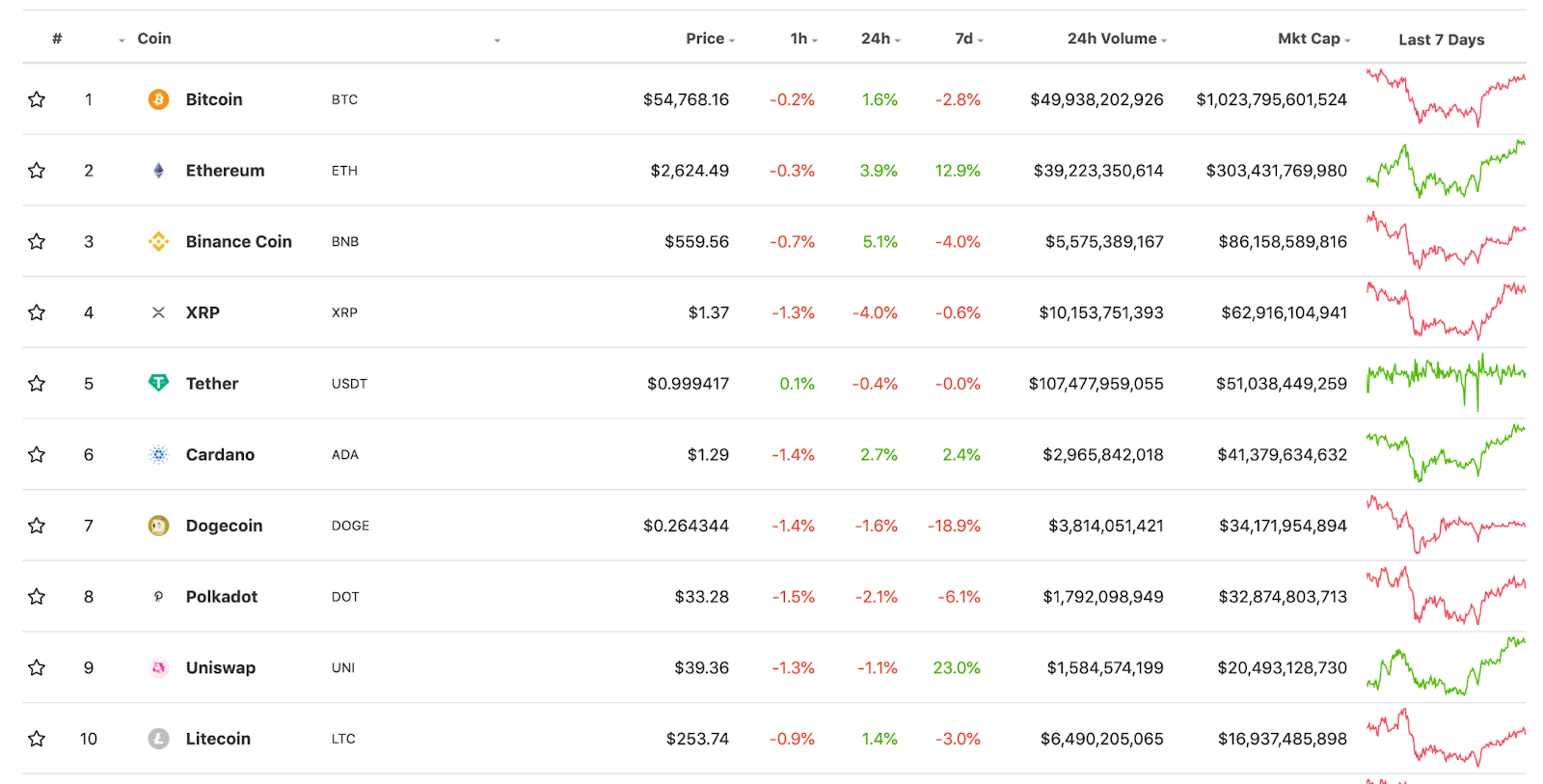

Crypto is a perfect field for learning about behavioral economics. Let’s look at the top-10 projects by the market cap. XRP, Cardano, and Dogecoin are still there, despite questionable fundamentals.

Source: CoinGecko.

One of my team members asked me, “do you wanna be right, or do you wanna make money?” Since then, the phrase has stuck with me like a nail in my skull. I missed many opportunities in this market because I didn’t like what I was looking at.

I ignored Chainlink, Pancake Swap, Chiliz, and dozens of smaller projects because I didn’t take them seriously. From a fundamental standpoint, they still don’t make much sense to me, but lately, I keep looking at them through the lens of pumpamentals.

In his recent article “Bull market, bear development,” Andre Cronje perfectly summarized how most investors see this market. They largely don’t care about projects, except that they have to have tokens.

Reddit and TikTok investors don’t use products they invest in. Sometimes, there is no product, and people are making serious gains off of memes. You can laugh at this, but as a crypto publication Rekt pointed out, you’re not the one to have the last laugh in this case.

Maren’s astrology-based trading signal. Spoiler: she nailed it.

I’ve been dipping my toes into Solana’s ecosystem for the last few days, and all I can say at this point is: “It’s bad.” Yet, it doesn’t make Solana and its projects bad speculative plays.

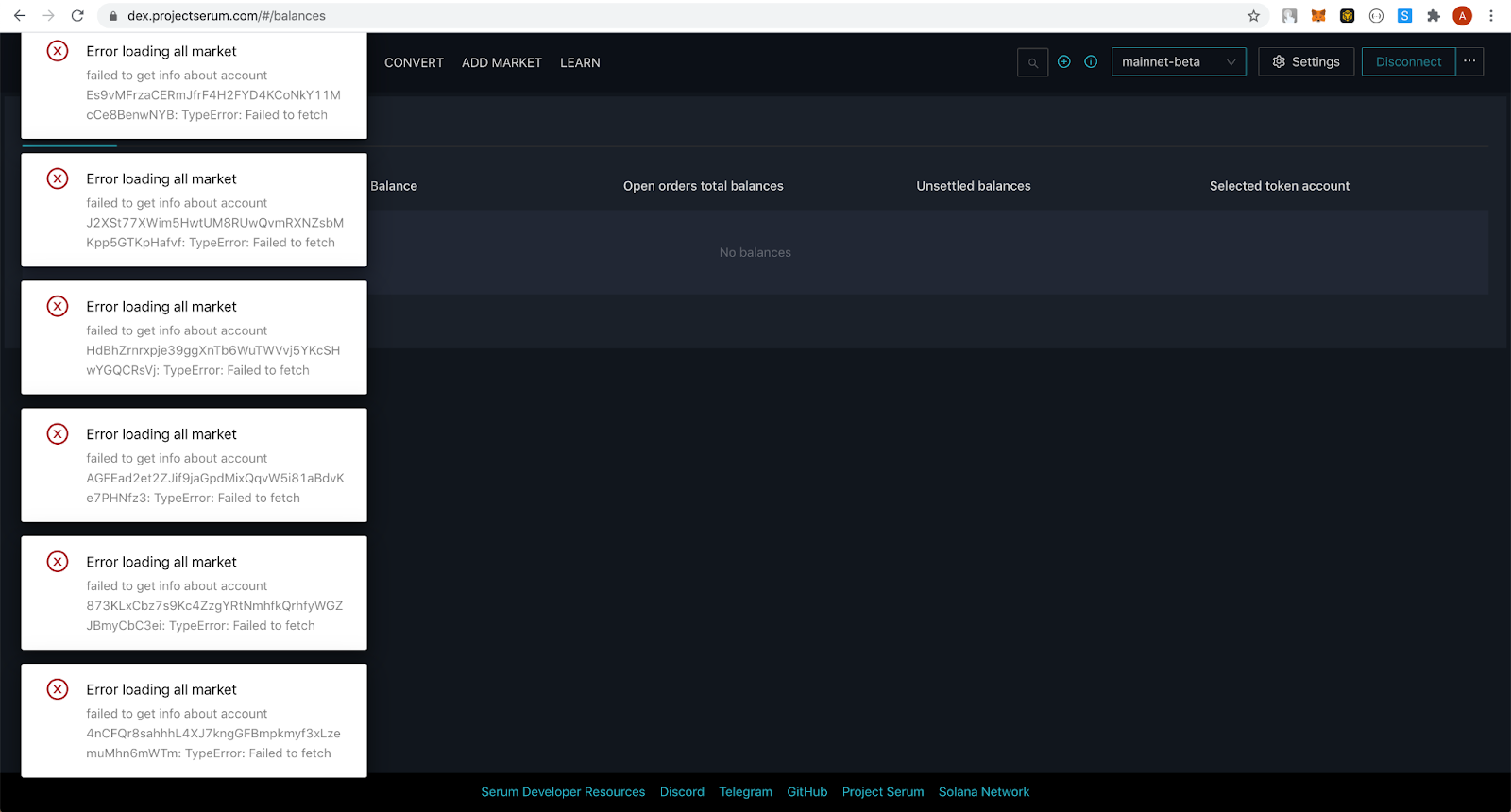

So far, I have used Serum DEX, Bonfida, and Raydium, three Solana-based exchanges. All of them had clunky user interfaces and horrible user experiences. All three displayed numerous errors, sometimes failing to work completely.

Me trying to use Serum DEX.

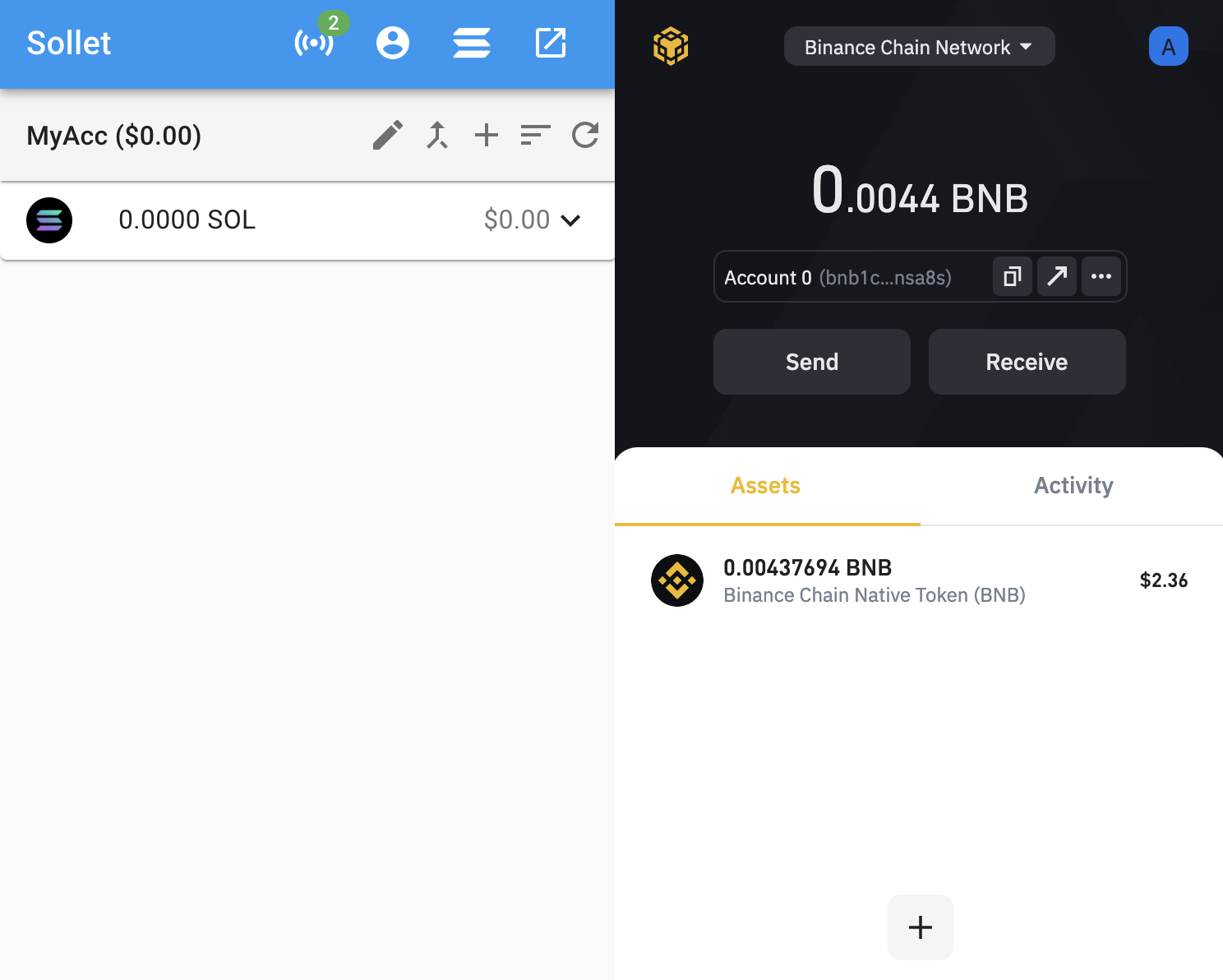

Solana wallets are poorly designed, and their connection across apps is inconsistent. You can register a SolFlare wallet, but you may be redirected to the Sollet wallet when you press ‘Connect.’

I’ll let you compare the user interfaces of the Sollet wallet and Binance Chain wallet. Note that Binance Chain is not even widely used (don’t confuse it with Binance Smart chain).

Why do I think Solana and its projects will likely perform well during the upcoming months? Because it has strong pumpamentals.

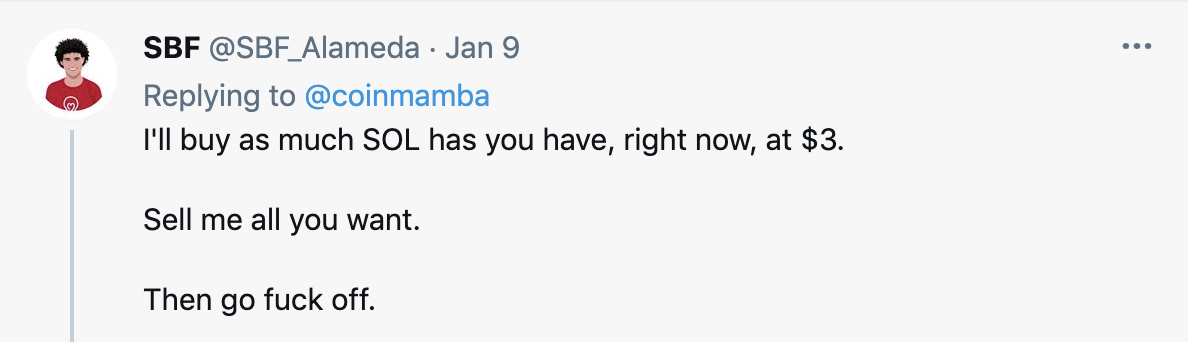

Solana is associated with FTX, Sam Bankman-Fried’s exchange. Sam is one of the crypto’s celebrities and users often publicly appraise his dedication.

Sam is an ambitious person with millions of dollars at hand. He saw the success of Polkadot’s ecosystem and that of Binance Smart Chain (at least in terms of money inflows), so my bet is that he wants the same for SOL.

Note: at the time of the dialogue above, SOL price was around $3.

Polkastarter launched a trend of crypto incubators, which turned out to be extremely popular and profitable for some, especially for the holders of the project’s token POLS. Well, Solana has an upcoming incubator called Solstarter with a token SOS.

Given the quality of the existing projects on Solana and its core tools like wallets, I’m sсeptical about the project coming off of Solstarter’s conveyor. However, it doesn’t matter because somebody will make money on the hype, increasing interest in Solana from others.

And the hype will likely be strong. Solstarter has support from DeFiance Capital, Alameda Research, and The Spartan Group. These are very powerful people with a strong presence in the crypto corners of social media. Just a couple of tweets from them can send some token to the moon.

After a couple of tweets about 10x listings, people will rush to Solana to hunt for the same returns. Discords channels will appear en masse and, maybe, some Tik-Tokers will come along the way. At such a point, no one would care about the quality of their investments.

To close it off, I don’t want to say that fundamentals don’t matter. Building your conviction on top of fundamentals can help you maintain a position in a project at rough times and not sell too early on the way up. It’s easy to be invested in a good product that is extensively used.

However, it’s also important to keep track of what the crowd is thinking about. It’s not about ‘aping’ into everything you see but things like Twitter and Discord can give you hints about the next market’s move.

Disclosure: The author of this newsletter holds Bitcoin, Ethereum and BNB. Read our trading policy to see how SIMETRI protects its members against insider trading.