DeFi Fixes Taxes.

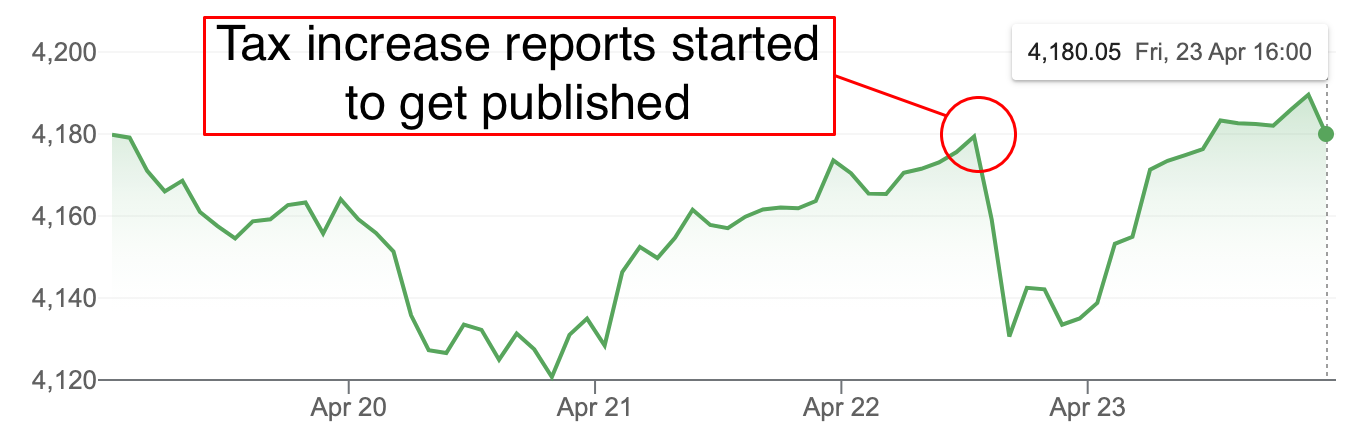

This week the markets quivered after President Joe Biden announced his plan to increase taxes for the wealthy. While such changes were to be anticipated considering Biden’s campaign, it was likely the size of the new taxes that spooked investors.

S&P 500. Source: Google.

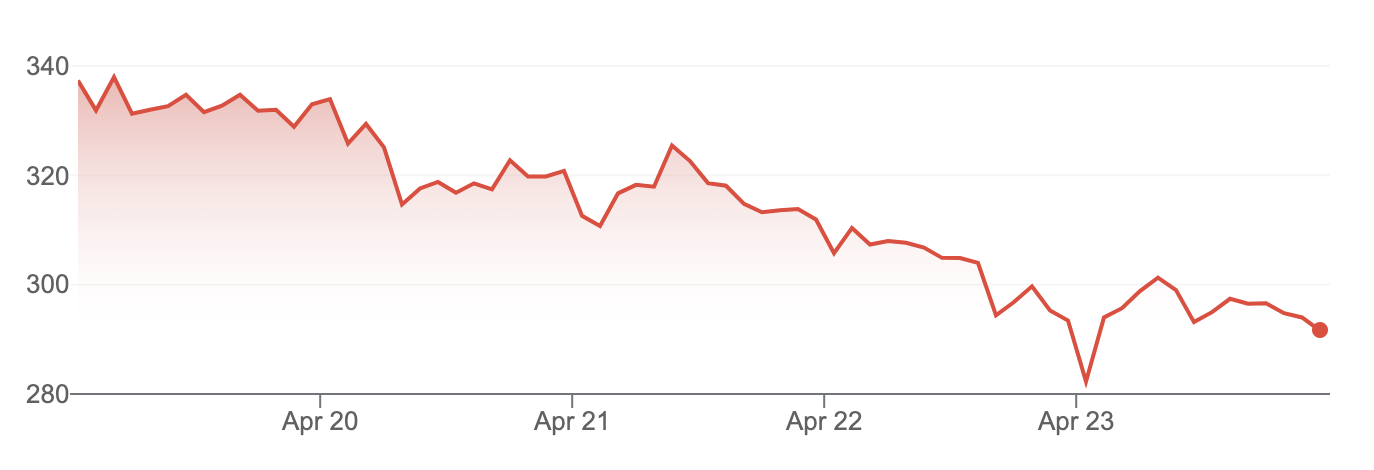

The plunge in the traditional market triggered a dump in crypto—as expected. As I’ve said in other issues of the Digest: Bitcoin and other cryptocurrencies are risk-on assets. Moreover, crypto is substantially correlated with the traditional markets and with each passing year correlation only increases.

Bitcoin price. Source: CoinGecko.

Besides, it seems that crypto traders were excited about Coinbase’s direct listing on the Nasdaq. Combine that with too much leverage, and you get the BTC almost reaching $65,000, from where it dumped due to unfulfilled expectations and recent tax news.

COIN performance since listing. Source: Google.

Although the charts are grim, there’s still a bright side.

First, increased taxes won’t affect high net worth investors in crypto. At least not too much. The reason? DeFi.

The two main taxable events in crypto are interest and capital gains. The first type doesn’t change much, since people will continue to lend their crypto to chase yield. However, avoiding the second is both easy and legal.

If you don’t sell your assets, you don’t trigger a taxable event. But then, how do you turn your crypto into sweet spendable dollars?

That’s where some fancy DeFi instruments come into play, from battle-tested ones like Compound and MakerDAO to fintech experiments like Alchemix.

The concept of unlocking liquidity by borrowing is well-known in the crypto space, so the recent reports aren’t too bad for crypto investors.

Second, Coinbase’s market cap is $60 billion, which is twice that of Nasdaq’s market cap. That’s absurd.

Subpar stock performance after the listing was in part determined by a mind-boggling initial valuation, which exceeded $80 billion. On the crypto market, Coinbase would be the 3rd most valuable project after Ethereum.

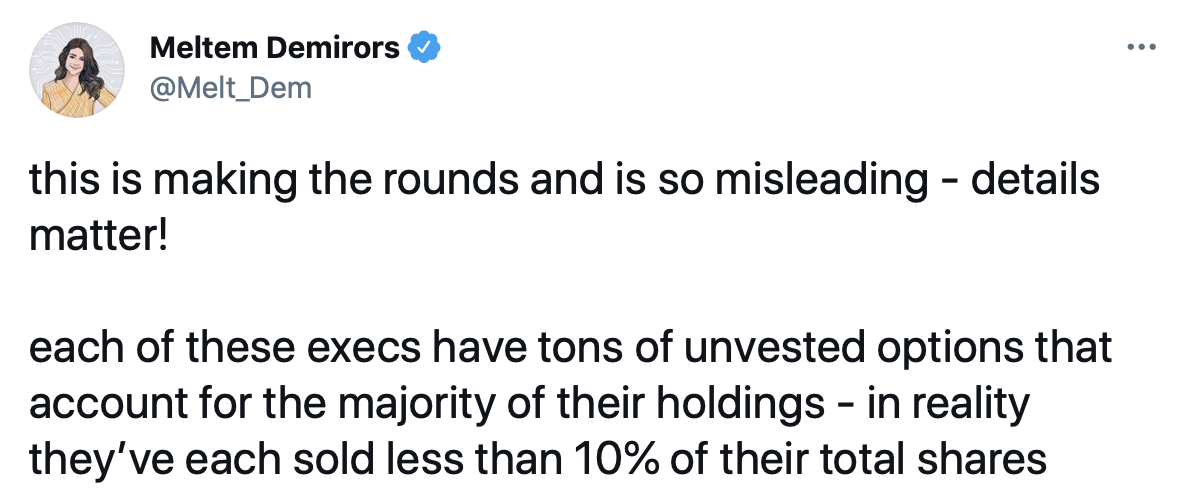

Such high valuation is a perfect spot to juice some gains (precisely what the top chalk at Coinbase did). I see nothing wrong with exiting the market at unreasonably high prices. Buy low, sell high. Take some money off the table and let the people jumping into Dogecoin and Safemoon lighten the load.

That said, the sell-off from Coinbase staff didn’t mean they no longer have skin in the game. These people still have a lot of equity locked up, which makes their recent move look even more rational.

Meltem Demirors commenting on Coinbase execs sell-off. Source: Twitter.

All this is to say that the recent news wasn’t destructive for the crypto space. While all of us are staying alert, nothing has broken the bullish trend. A cool-off was long overdue, and it created some good re-entry points.

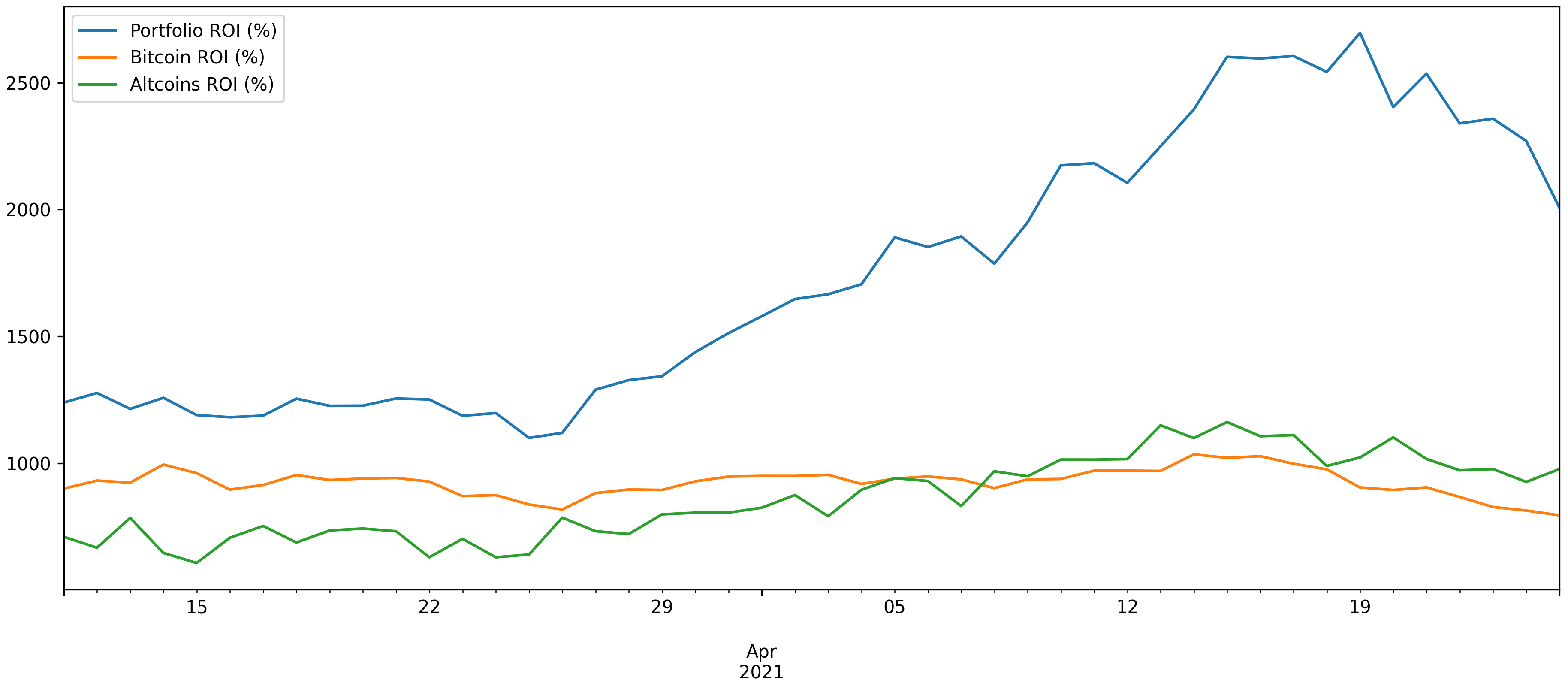

SIMETRI Portfolio – A Cool-Off

In April, Simetri’s Portfolio ROI was over 6,500%, which is impressive considering that at the beginning of the year it was around 2,000%. That was an astronomical run fueled by the market’s optimism, during which our portfolio demonstrated its aptitude in capturing gains.

Still, the number doesn’t always go up. External factors suppressed the Portfolio’s ROI but it still remains at a high level of 4,723%.