CZ, We Have a Problem.

When Binance Smart Chain started gaining traction a couple of months ago, I wrote an article about Crypto’s Ethereum Killers.

My conclusion? High transactions-per-second won’t solve all problems of general purpose blockchains. Not alone, at least.

Importantly, high speed may even create additional issues. Today, we’re going to dig into the nuts and bolts of blockchain storage, the meaning of ‘state,’ and discuss what CZ and his team got wrong about Ethereum.

CZ, We Have a Problem

Let’s start with the basics. A blockchain is a decentralized database. Imagine storing an Excel spreadsheet duplicated over thousands of computers. These copies of the spreadsheet are periodically synced up, and it costs a little bit of money each time you need to change a cell.

However, old versions of these spreadsheets don’t disappear. At least not entirely. At minimum, a history of all the changes made to the spreadsheets are also stored on every computer. That way, you can see information that happened a week, month, or even a few years ago.

Among blockchains, there are different ways these spreadsheets can be set up. On Bitcoin, the ledger is a simple list of transactions. On Ethereum, it’s slightly more complicated.

Ethereum is Turing complete, which is a fancy way of saying it can run any kind of computer program. In comparison, Bitcoin can only send transactions and do a few other simple operations.

Since Ethereum is Turing complete, it has to take a snapshot of the entire network before each transaction takes place. The last updated snapshot of Ethereum at that one point in time is called a ‘state.’

Just like water can have three states: solid, liquid, and gas, Ethereum enters a new state every time a change takes place. These snapshots have to get stored somewhere, like the change history in the spreadsheet metaphor earlier.

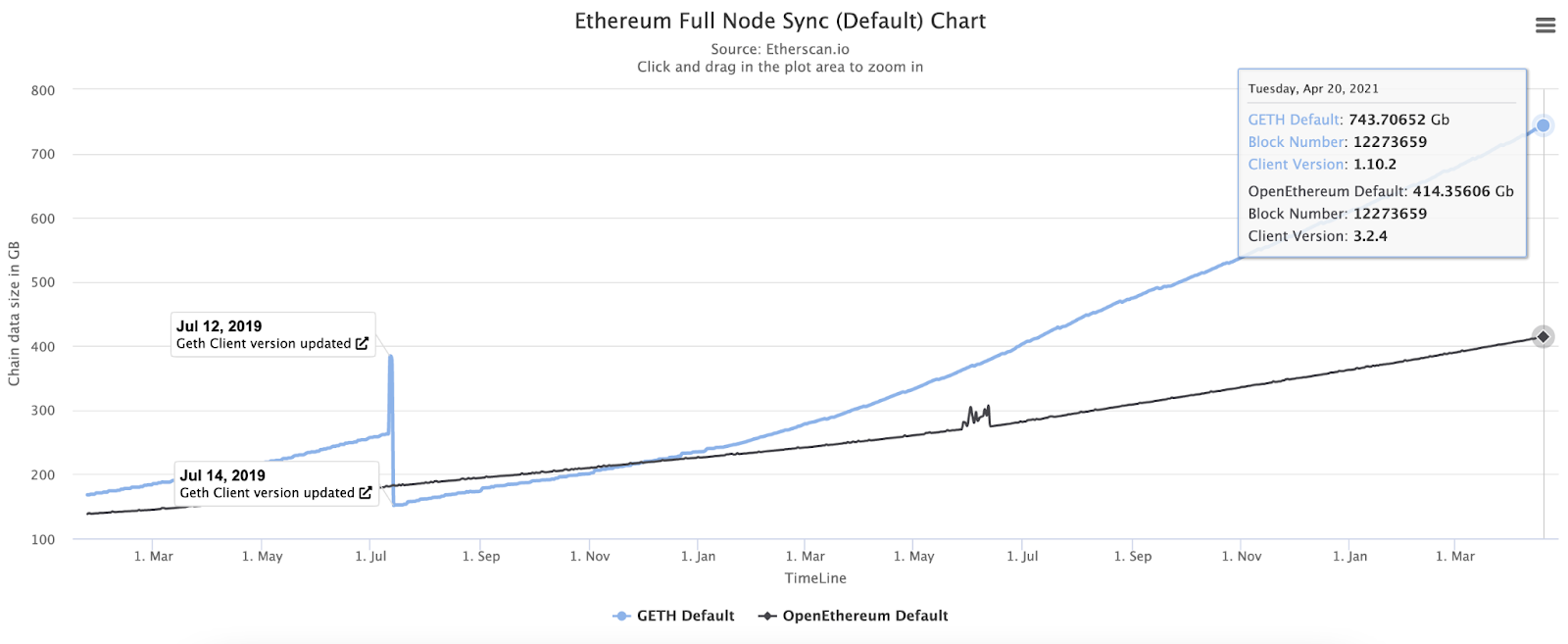

Imagine a state as an ever-growing file that Ethereum has to drag along with it. Full nodes have to keep hundreds of gigabytes of data. The cost of doing so keeps going up every year, pricing node operators out of the network. If this trend goes too fast, the network becomes less decentralized.

The size of Ethereum’s state for the Default type of Ethereum node. Note that an Archive node with the full blockchain history requires much more space.

Remember, Ethereum only has 20 transactions per second, at best. So the cost of providing storage goes up relatively slowly. For now, it’s still manageable to be anode operator. Ethereum devs are even thinking of possible solutions to compress the total size of the state.

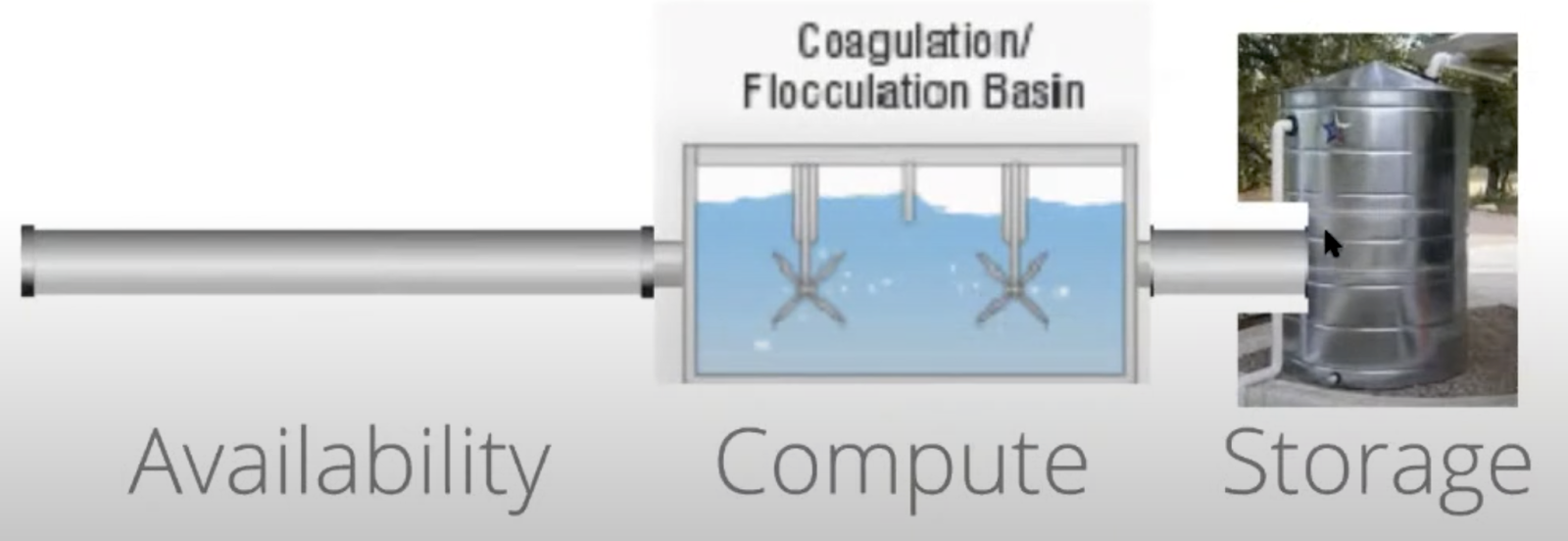

Karl Floersch, a dev working on Optimism, the scaling solution for Ethereum, provided a great example of what comprises a blockchain: transaction speed, computation, and storage. The metaphor he uses is a watering system—which needs pipes, a water processing unit, and a storage container.

Blockchain resources according to Karl Floersch. Source: YouTube.

When Binance copied Ethereum and increased its transaction speed, it was like building the same watering system but installing wider pipers.

Instead of making things more efficient, it simply crams more water into the system, causing malfunctions or even a potential rupture.

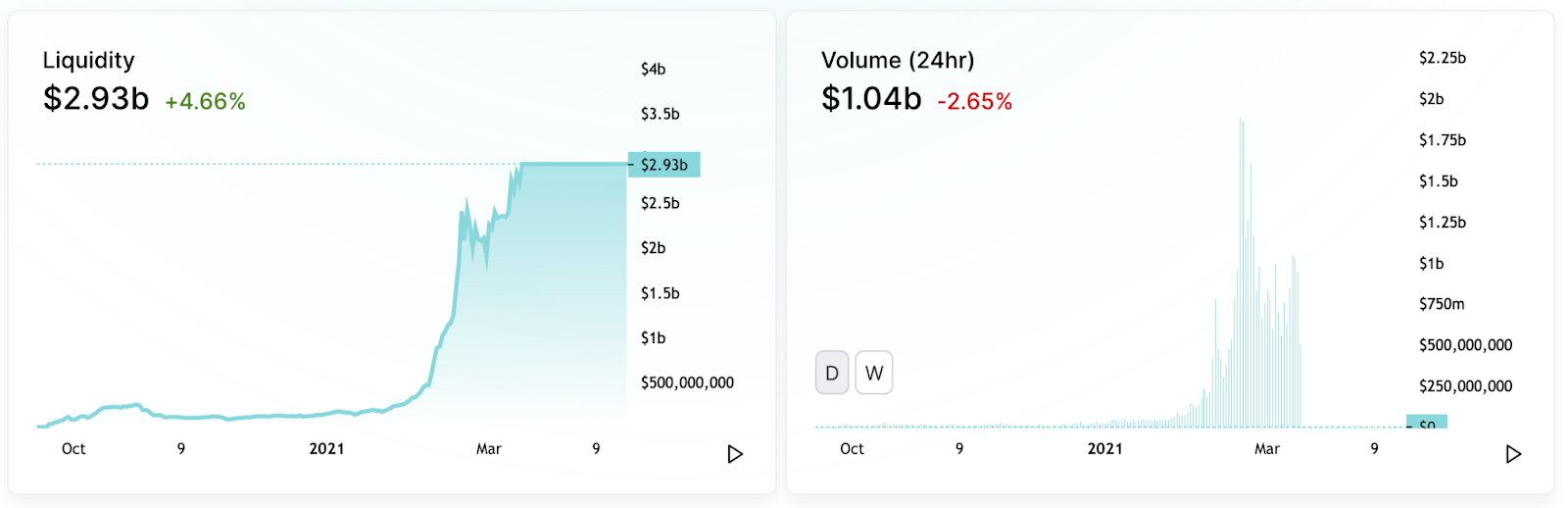

Let’s look at Pancake swap, the go-to automated-market-maker provider on Binance Smart Chain. When you go to its analytics dashboard, you see the following message: “The data on this site has only synced to Binance Smart Chain block 5649627 (out of 6722175).” The data there is more than a month old.

Month-old liquidity and volume data. Source: PancakeSwap.

If you don’t have recent data about the transactions on the network, how can you make charts for traders?

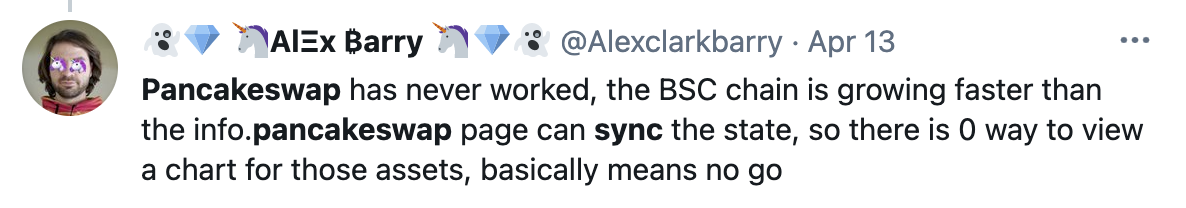

Source: Twitter.

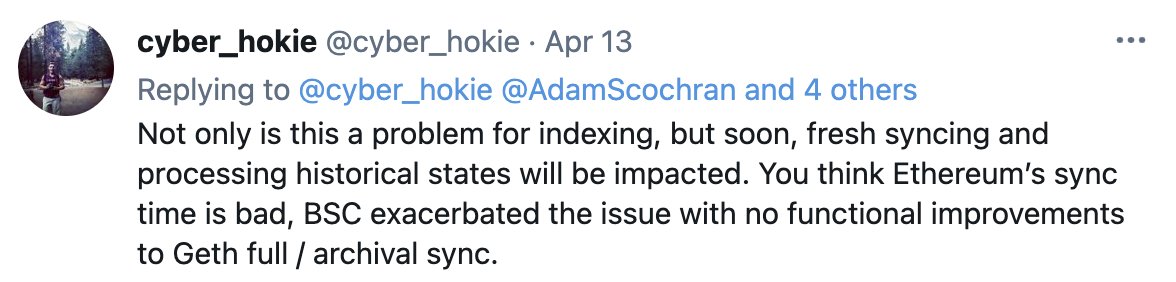

If you are going to challenge Ethereum in the long term, how will you keep the network in sync?

Source: Twitter.

That’s not all. Remember, at the end of Karl’s water chain is limited storage. What happens if the water comes too fast? The storage container bursts.

Well, it doesn’t literally burst, but a large state substantially increases storage costs for nodes. As a result, fewer node operators can work on Binance Smart Chain, limiting Binance’s blockchain decentralization prospects.

We saw the same problem with EOS, another overhyped “Ethereum killer,” but that didn’t matter in 2019. Hardly anybody was using EOS so it was manageable. Even then, the size of its blockchain was already several times larger than Ethereum is today.

Combined with Proof-of-Stake consensus with only 21 validators, high transaction speeds resulted in a dysfunctional level of centralization.

As you can see, building bigger pipes doesn’t solve the problem. To beat Ethereum, Binance Smart Chain has to improve the entire system: availability, compute, and storage—not just one piece of it. Otherwise, it will go down in the history books as a second EOS.

Disclosure: The author of this newsletter holds Bitcoin, Ethereum and BNB. Read our trading policy to see how SIMETRI protects its members against insider trading.