“Popcorn Season.”

We are at the stage of the trend when retail traders flow into the market en masse. But remember, these people are different from crypto’s veterans. They’re not “in it for the tech.”

Source: Reddit

All jokes aside, the newcomers to the crypto market don’t understand the field. They don’t care about things like decentralization, scalability, and composability. All they care about are memes and money.

One person I’ve followed since 2017 is Chris Dunn. He called what’s currently happening in the market “popcorn season.” I think you can’t say it better: random coins are popping like popcorn on a skillet.

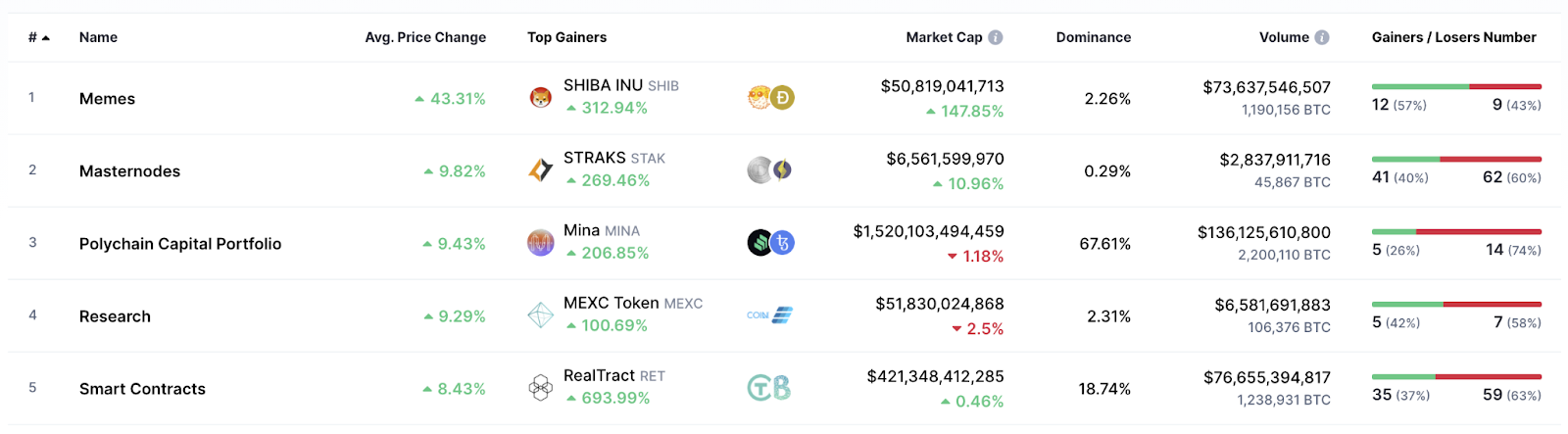

I believe that “Popcorn Season” is mainly driven by the new blood in the market. The easiest narrative to sell to zoomers with “stimmies” (a term they use for stimulus checks) is memes. The Shiba Inu is the most memeable dog breed on the Internet. No wonder DOGE and similar coins surged.

Top gainers on the crypto market by category. Source: CoinMaketCap.

The rest of the random gainers are most likely the product of various Discord and Telegram groups for “crypto investors.” Ninety-nine percent of these groups are nothing more than dressed-up pump and dump clubs. Their owners accumulate some low-cap coin, then publish a “recommendation” for their “members” and cash out on a pump.

All of this is nothing new. We saw the same activity in 2016-2017. Yours truly was buying DOGE back then (and no, I have no regrets for selling). This is a solid indicator that the herd has come.

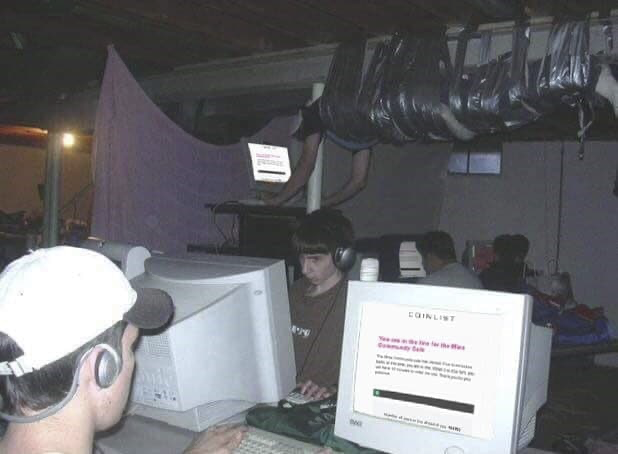

Looking at the primary market, you can see that the platforms like Coinlist and Republic, which conduct public sales for crypto projects, have seen an immense inflow of users. The latest sale on Coinlist, Mina, saw more than 250,000 people piling in just for an opportunity to invest $500.

A meme found in some Telegram group, which is very close to reality

As you probably can tell, the market gets more frothy by the day. Does it mean the top is in?

In my opinion, not yet. If we take into account the 2017-18 example, there should be a mass obsession over crypto and a “new paradigm” accompanied by a substantial leg up in BTC in the coming months.

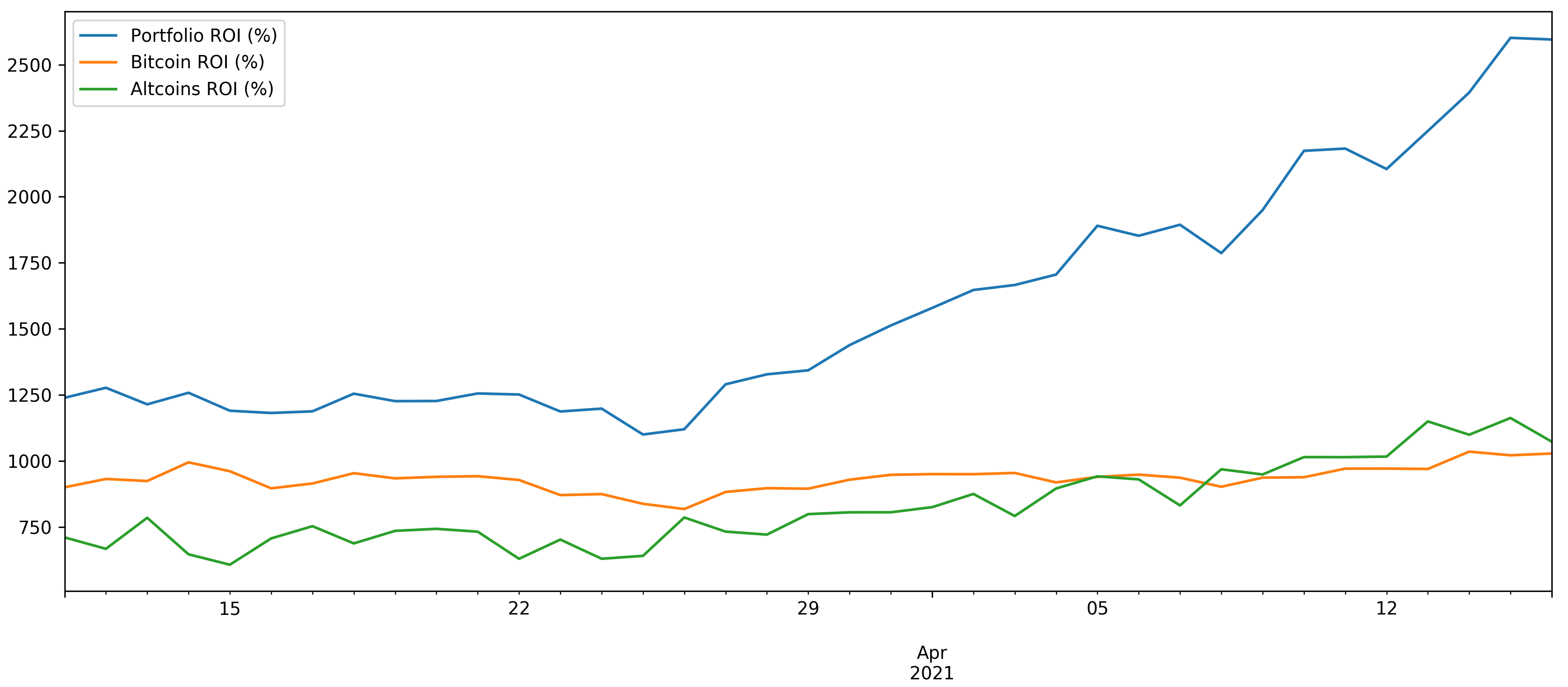

SIMETRI Portfolio – Flying