On Importance of Cash Flows.

The crypto market has been driven by various trading narratives for years. I dare say that the most popular one—HODL—is also about trading, albeit with a long time horizon.

As the space evolves, however, we are getting new financial primitives to help build one’s wealth. DeFi protocols brought us tools that can be used to generate predictable cash flows, which are important for keeping you afloat if your trading bets go underwater.

It’s also important to keep your focus on crypto startups’ cash flows because the investment landscape changed from what we saw in 2016-18.

Today’s listing of COIN is a perfect example of the importance of cash flows. Coinbase didn’t have to fundraise through an IPO because it already is a profitable company. It didn’t need to prove that its business is viable; the public knew it and generated the demand.

Now, the crypto space is more demanding to builders. The DeFi summer of 2020 proved that decentralized applications could generate usage and create value. This value is in the form of cash flows that platforms generate by charging users for their services.

If you look at some DeFi protocol from an investment perspective, you first look at the usage. Then, you check if you can somehow have a share of the platform’s fees. That’s like holding a dividend stock, which makes you benefit from the platform’s cash flows.

Today I’ll show you a couple of platforms that can help you generate cash flows.

Anyone familiar with traditional finance knows about the classic 60/40 portfolio. The idea is to keep 60% of the portfolio in stocks to capture growth and 40% in fixed income instruments to dampen the volatility and risk of the stock portion.

Let’s translate this concept to the crypto market. Until recently, you could only hold money in speculative crypto currencies or stablecoins. This means that at best, your classic crypto portfolio could have 60% in something like BTC or ETH and 40% in stablecoins.

This is not an ideal situation as you want your money to grow, not suffer from inflation. Let’s see what decentralized apps you can try now to generate cash flows on that 40% instead.

BarnBridge 88mph

BarnBridge and 88Mph focus on providing bond-like products. A bond is like you are giving a loan to someone with a fixed interest rate.

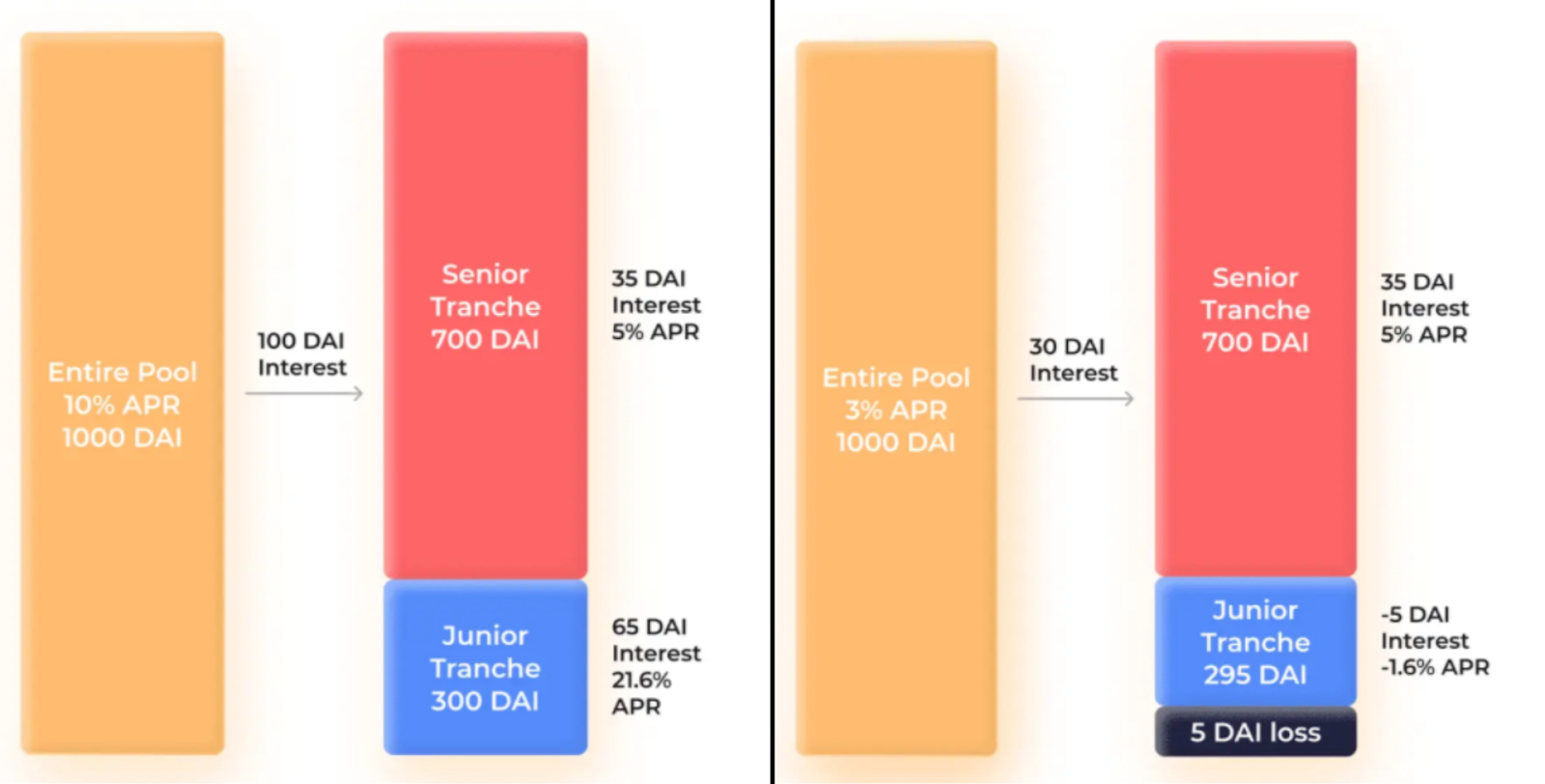

BarnBridge is based on tranches, a well-known concept to financial giants like Morgan Stanley and Goldman Sachs. Tranches are risk buckets for some interest-yielding opportunity.

Let’s say a DAI vault on Yearn yields 15% APY. This APY is not fixed, so it may be 10% or 20% in a week. BarnBridge can split this APY into tranches, one with the fixed APY and another with a variable one. The fixed APY will be relatively small, let’s say 5%, so any excess will go to those who took more risk. If you want to learn more, read Crypto Briefing’s Project Spotlight.

Senior tranche owners are guaranteed to get a 5% fixed income. Source: BarnBridge.

88mph revolves around a similar idea. The platform either lets you lock your tokens for fixed interest products or buy zero-coupon bonds.

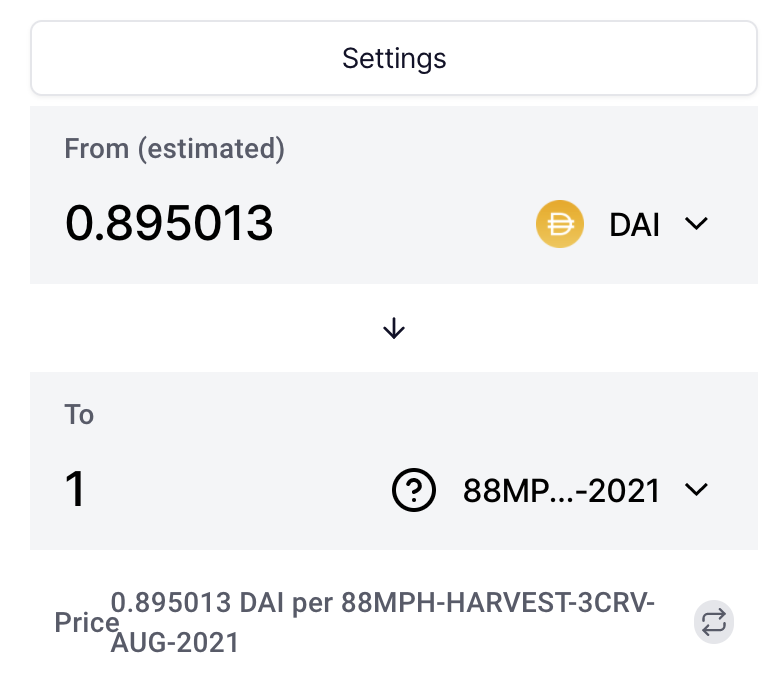

“Zero-coupon” is a fancy way of saying that interest on a bond is paid once at the time of maturity. The U.S. government treasury bills are zero-coupon bonds: they are sold at a discount and bought back at face value.

You buy 1 3CRV zero-coupon bond for 0.895 DAI and can redeem it for $1 on maturity. Source: SushiSwap.

Imagine you have $1,000, and you think ETH will go up in price by the end of 2021. You can use $900 to buy a zero-coupon bond on 3CRV stablecoin on 88mph and $100 to buy a call option for ETH. If the market goes your way, you get both fixed interest and premium on ETH. Otherwise, your fixed income will cover a $100 loss.

If you go with 88mph fixed-interest product, you will get coupons in MPH tokens. You can then stake MPH and have a piece of the protocol’s cash flows as an additional reward.

Surely, projects like BarnBridge and 88mph aren’t the same as corporate or government bonds. Buying such products carries significant systematic risks, so does any other crypto investment. However, if you already are in crypto, that may be a better option than being 100% exposed to shitcoins.