Ignorant and Defensive.

Although cryptocurrencies have seen a lot since Bitcoin’s inception, it’s still a very young asset class. BTC is the oldest crypto out there, and it’s been around for only twelve years, which is nothing compared to the three-billion-year history of gold and 240 years of the greenback.

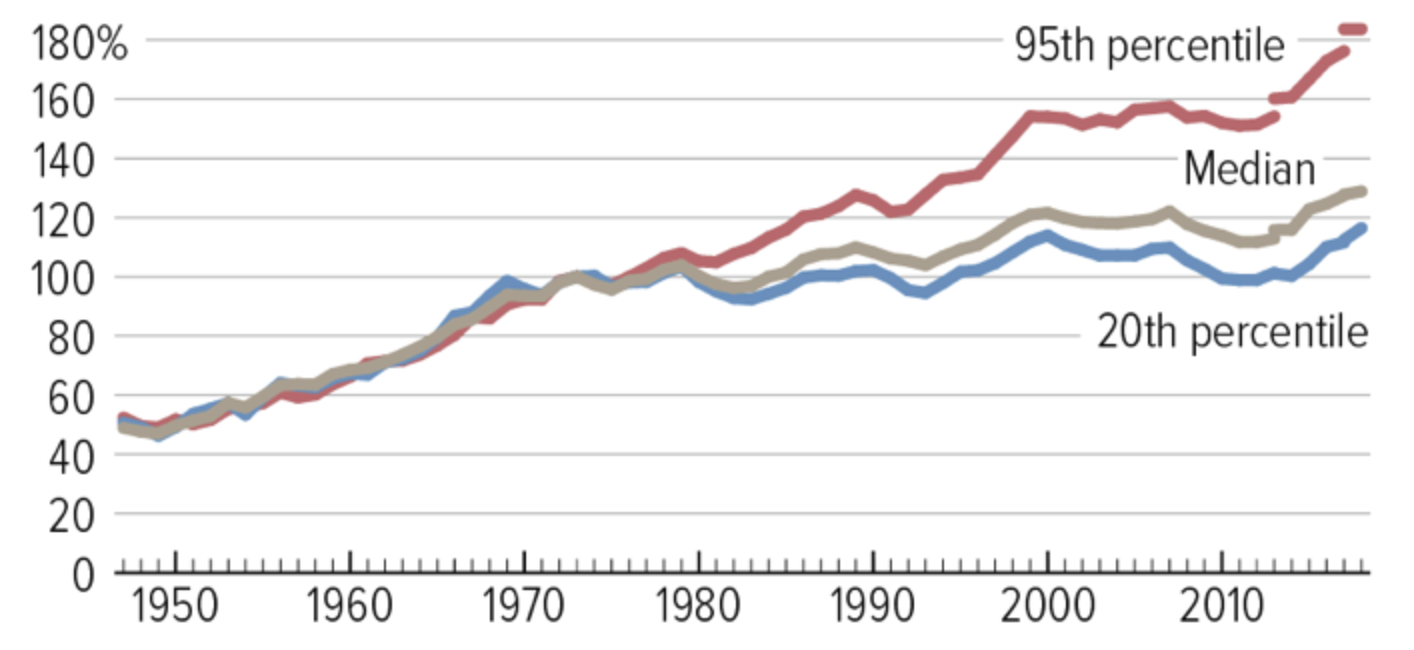

Some people and organizations had plenty of time to take advantage of the traditional financial system. Now that the rich are getting richer, why would they be excited about the new type of money that doesn’t benefit them exclusively?

The real family income of America’s top 5% wealthiest families (red) has been growing since Nixon’s shock in 1971. Meanwhile, this metric stagnated for lower-income families (blue). Source: Center on Budget and Policy Priorities.

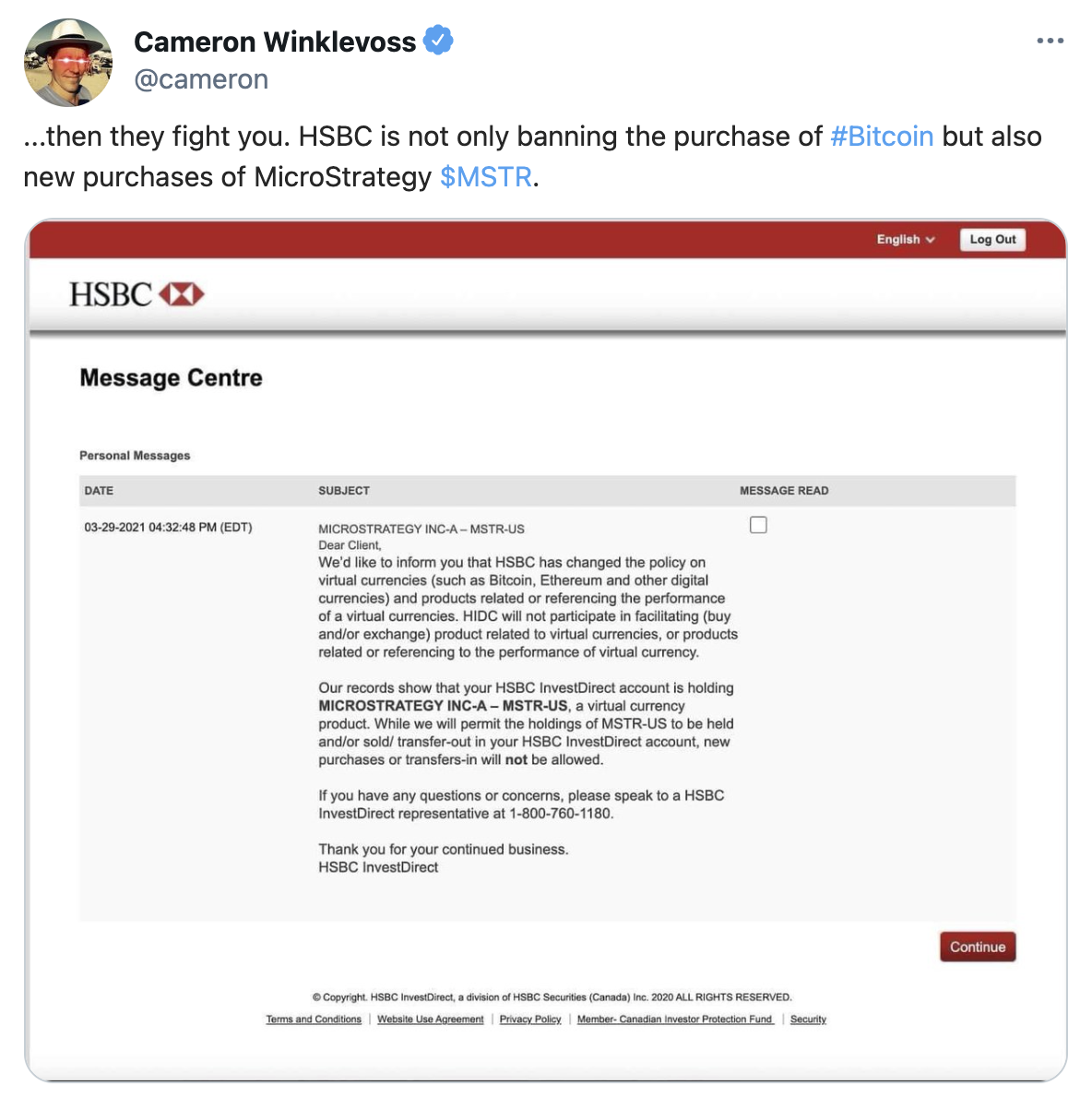

Why endanger your existence by providing access to crypto or to companies that hold crypto? Just blanket ban everything.

The famous investment bank HSBC prohibits purchases of MicroStrategy stock. Note: MicroStrategy has over 90,000 on its balance sheet. Source: Twitter.

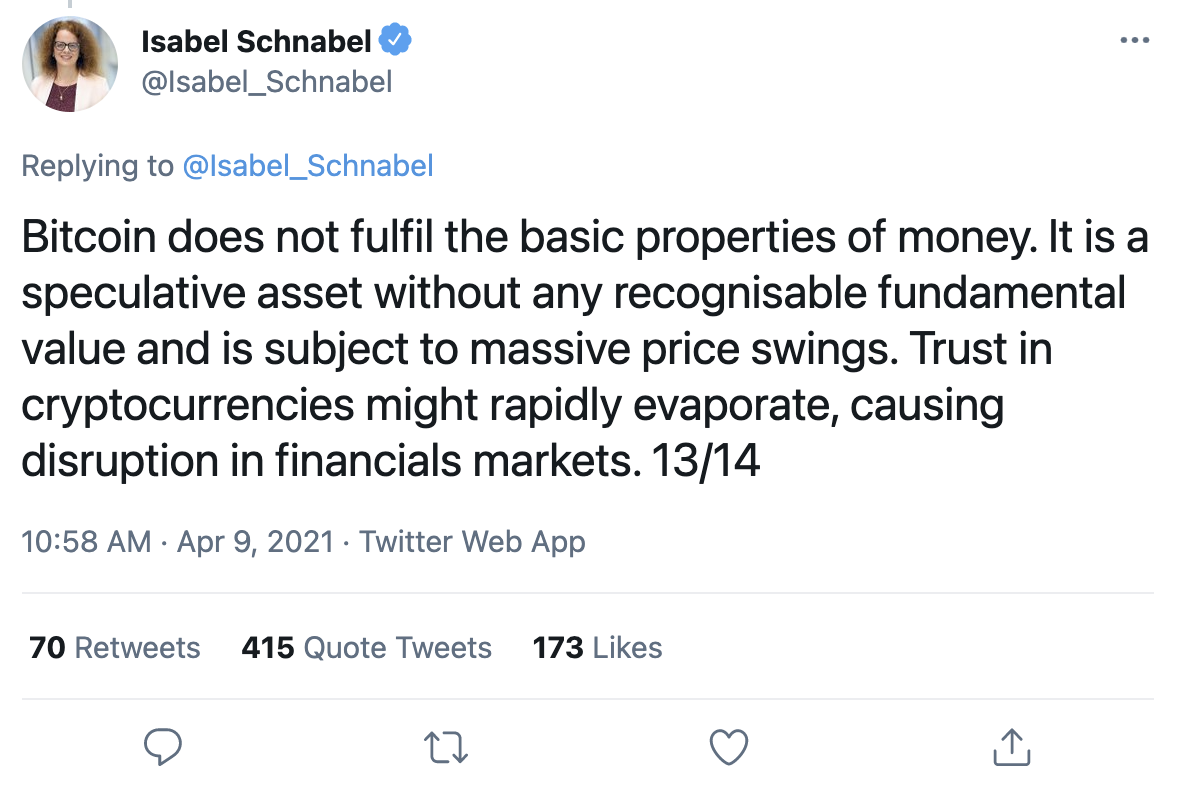

Why analyze something you or your peers didn’t create? Just say that the new asset class doesn’t have any fundamental value without presenting any supporting arguments. Don’t forget to promote your creation in the meantime.

Isabel Schnabel, an executive board member of the European Central Bank, doesn’t see any fundamental value in bitcoin. Source: Twitter.

An excerpt from the interview with Isabel Schnabel. Source: ECB.

Why learn about the advancements in the financial space if traditional institutions didn’t foster them? If your favorite talking head didn’t validate it, why dive deep into how DeFi works and understand potential use cases?

The executive editor of news for Bloomberg Digital, Joe Weisenthal, shares his summary of the DeFi space. Source: Twitter.

Yes, bitcoin is likely still largely a risk-on speculative asset, which hasn’t yet proven itself as an inflation hedge. It’s also true that DeFi is at very early stages and carries severe system risks. However, it doesn’t mean that they are scams or have almost no practical use cases.

As BTC crosses the $60,000 mark, the traditional financial world is cringing. The suits are late to the party, and now they have to learn from those weird-looking 18-year-olds. Young people don’t dream about getting into JP Morgan anymore; they want to join the likes of Aave.

Whether we are in a crypto supercycle or not, crypto will eventually go through a bear market at some point. However, this asset class is here to stay no matter what traditional finance thinks.

If you are reading this, you are still early. Your conviction is everything, don’t lose it.

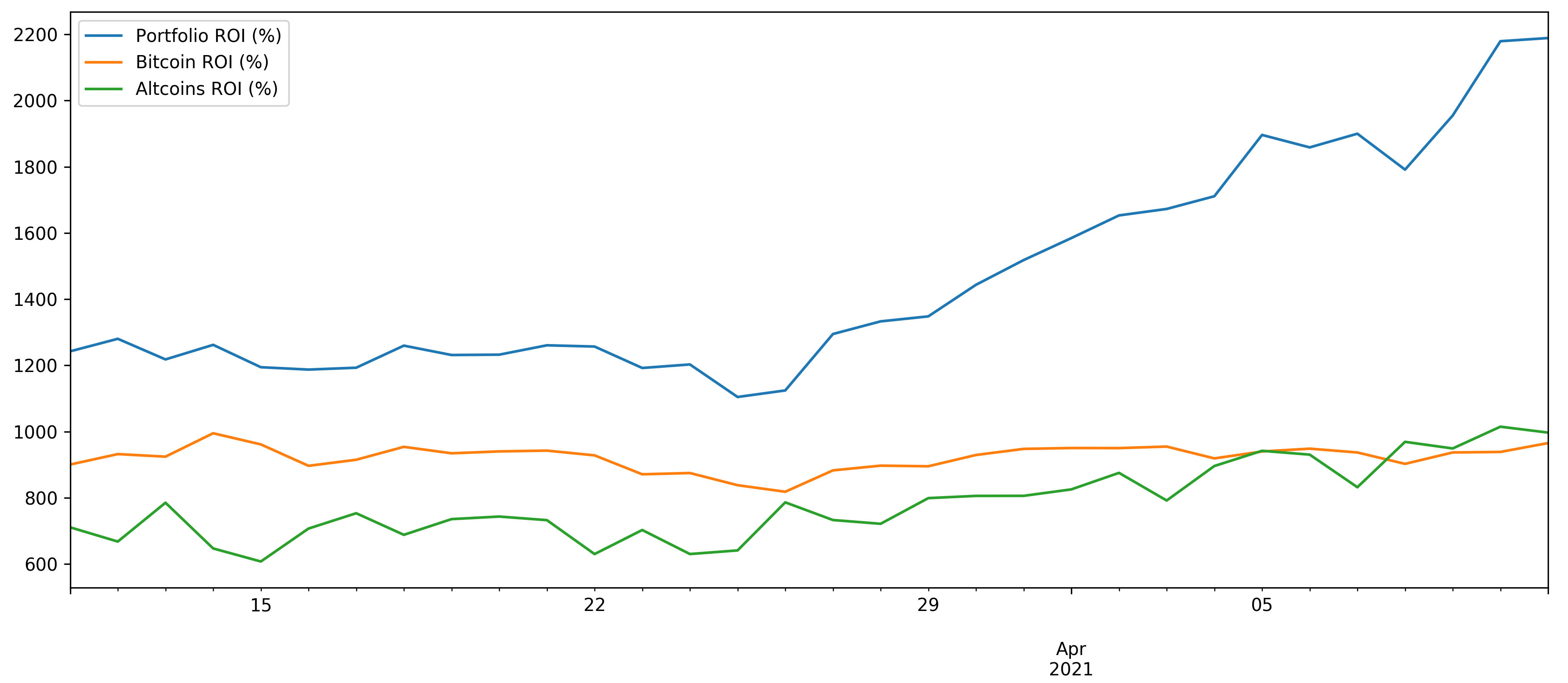

SIMETRI Portfolio – Faster Than Altcoins