The Only ETH Chart to Watch.

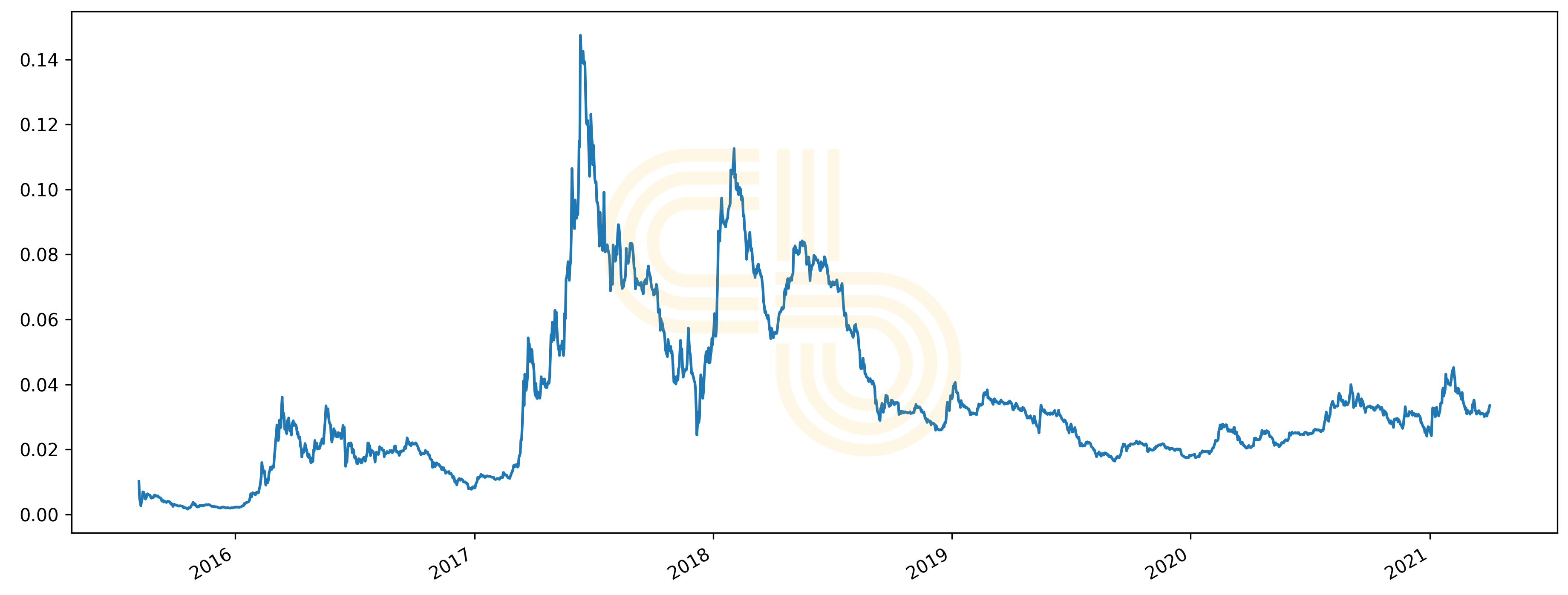

In one of the previous issues of Digest, I talked about Ethereum’s potential in the context of how much has been going on in its ecosystem. My point was that ETH is substantially undervalued, and today I want to concentrate on the only chart that will put the price into perspective.

ETH/BTC price. Source: CoinGecko.

Since summer 2020, the spirit of the alt season has been in the air. However, looking at the chart above, you can tell that it might not have even started yet.

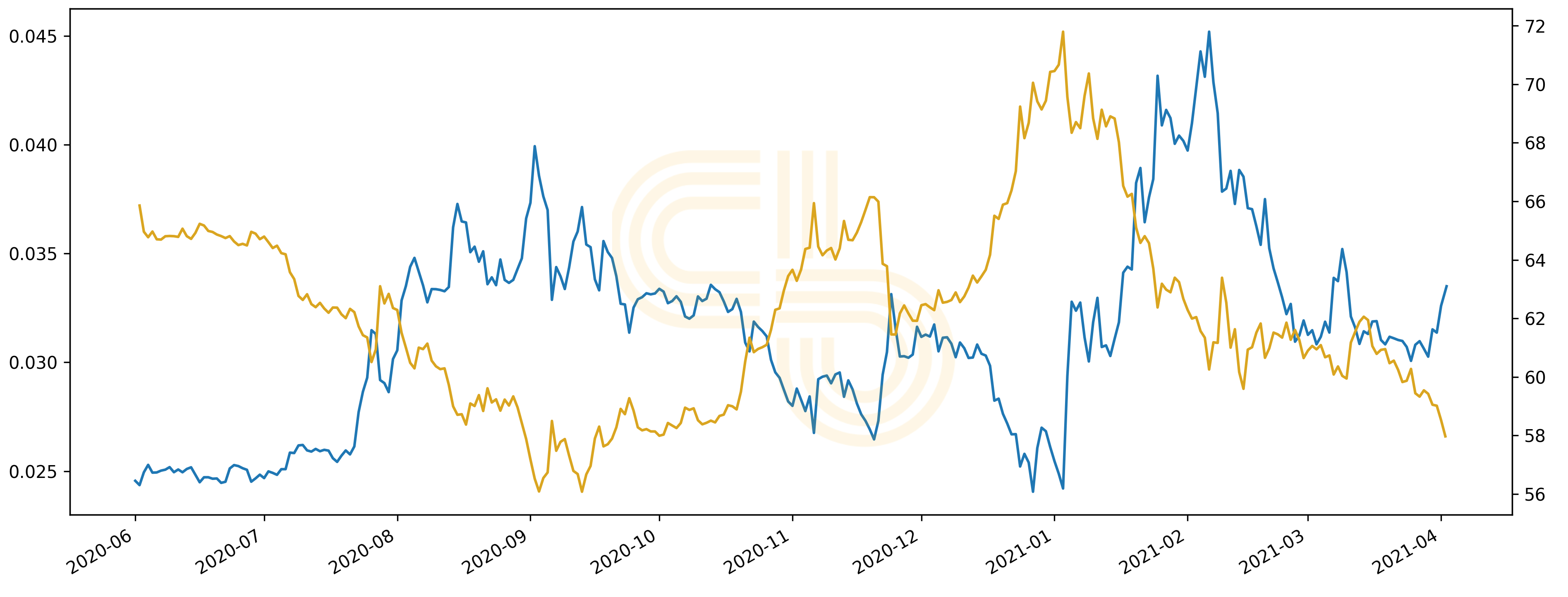

Although Bitcoin was suppressing ats in Q4, its dominance has been declining since 2021 kicked in. notice that shortly after BTC dominance topped, ETH valuation in BTC surged. Generally, BTC dominance and ETH price have a reverse correlation.

BTC dominance (golden) vs. ETH price in BTC. Source: CoinGecko.

With bullish fundamentals like the acceptance of EIP-1559, an improvement proposal to burn some ETH, and the upcoming launch of the universal scaling solution called Optimism, ETH would likely have an uptick in demand in the near future. But what about the supply?

Since autumn 2020, ETH reserves on exchanges have been depleting. Yesterday, 400,000 ETH left Coinbase, which hints at institutional buying.

ETH reserves major exchanges. Source: CryptoQuant.

Institutional interest doesn’t come as a surprise at this point. With platforms like Visa integrating Ethereum as a settlement layer and regulatory clarity that ETH is a commodity, the appetite for ETH is only likely to increase if the market doesn’t experience a black swan.

The only spoiler to all of this is Ethereum’s scalability. If Ethereum goes 5x from here to $10,000, a fee for a trade on Uniswap will be around $200, which sounds surreal. Growth of ETH price with Ethereum this slow means only one thing – all activity there can stall.

Even high net worth players in the ecosystem may feel put off by very high transaction fees. And even if gas remains in the same ranges, its USD valuation will grow with ETH price.

Until Ethereum’s scalability gets improved, I wouldn’t expect ETH to jump even to $5,000, albeit all charts appear extremely bullish. Still, with the looming solution in the form of Optimism, ETH may melt faces this summer, which will push BTC dominance down even further and kickstart a new wave of the alt season. Fingers crossed.

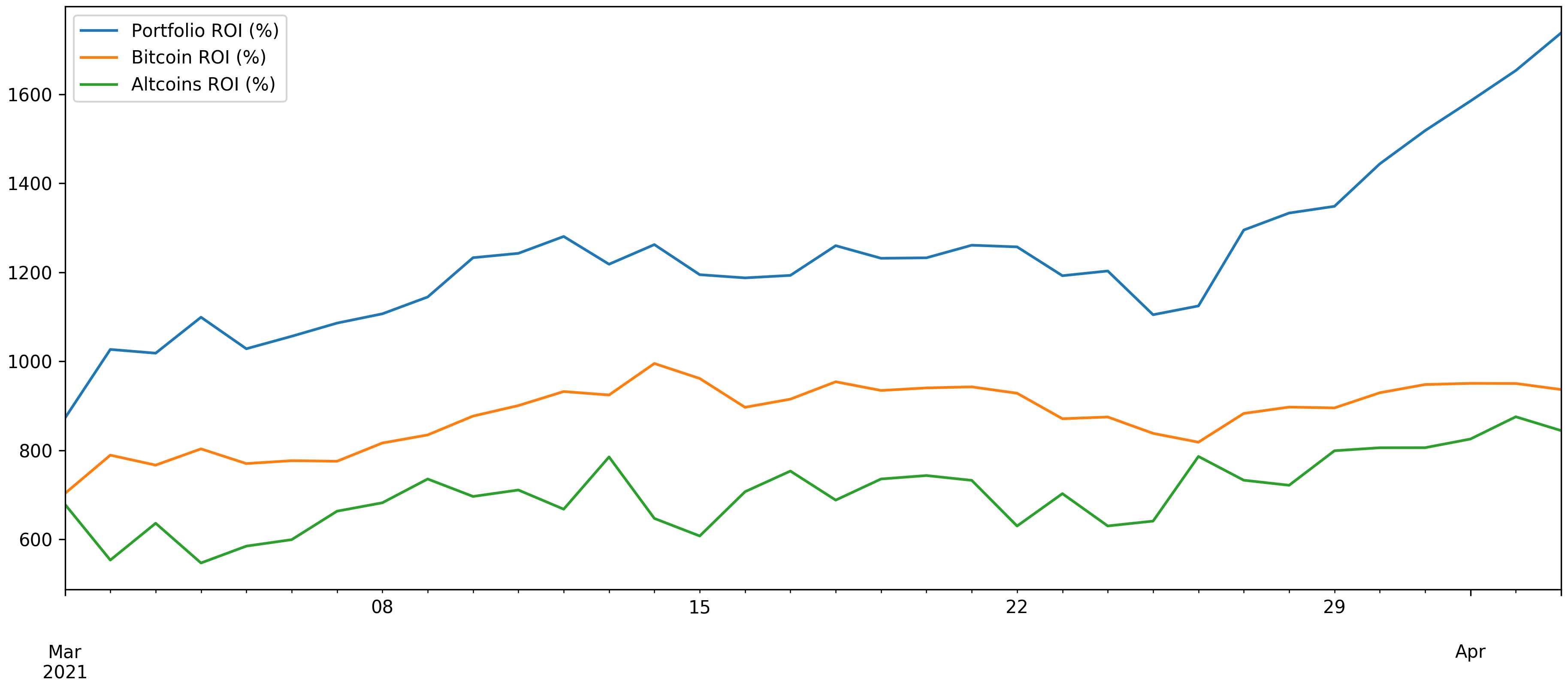

SIMETRI Portfolio – Shooting Up