Next-Gen Stablecoins.

In one of the Alphaverse’ previous issues, I overviewed algorithmic stablecoins and their potential to replace the classic custodial ones like USDT and USDC. The conclusion in that article was that algo stables aren’t safe or reliable—yet.

Crypto, however, doesn’t stand still, and we may be looking at the genesis of a new type of algorithmic stablecoins that may actually be useful. The next generation of algo-stablecoin has better stability mechanisms and focuses on integrating with the DeFi ecosystem.

Today I want to bring to your attention a couple of such stablecoins: RAI and FLOAT. We’ll discuss how they work and where someone might want to use them.

How RAI and FLOAT Work

If you haven’t read the issue of insights about algorithmic stablecoins like Empty Set Dollar and Ampleforth, I strongly recommend doing so prior to reading this section for better understanding.

The underlying principle for algorithmic stablecoins is dynamic supply. Protocols mint or burn tokens depending on the supply and demand balance for the token.

The earlier versions of algorithmic stablecoins have a rather simplistic price stability mechanisms. Hence, they can’t adequately react to the rapidly changing market conditions, which leads to them losing their pegs. For instance, the price of Ampleforth is ~$0.85 now, while the peg is $1.

New stablecoins have more advanced price stability mechanisms. FLOAT and RAI don’t even have a peg, which may sound strange, but actually makes them more resilient to changes in the market. Let’s dig in.

RAI

RAI is based on one of the original ideas of MakerDAO. If you are not familiar with MakerDAO, it’s an app that enables you to borrow stablecoins DAI against collateral.

On MakerDAO, borrowers pay an interest rate called the stability fee. The protocol’s users can increase or decrease the stability fee, but they can’t push it below 0%, which somewhat limits control over minting new DAI. RAI improves on that by removing the stability fee and allowing RAI price to fluctuate.

As you can see, RAI is partially collateralized. Users provide ETH and get RAI in return. Then they repay loans with RAI, which the protocol accepts at the so-called redemption price.

The protocol continuously adjusts the redemption price according to the price of RAI. If the market price goes lower than the redemption price, the protocol makes borrowing more expensive, which pushes borrowers to buy RAI off the market while it’s still cheap and repay loans.

RAI is volatile in the short term but rather stable in the long term. Moreover, it ignores the volatility of the underlying collateral, which is crucial for borrowers in DeFi.

RAI can be used to protect collateral owners from liquidations. Source: Reflexer Labs.

By locking RAI instead of ETH in a DeFi protocol, borrowers can protect against substantial price drops that may lead to liquidation of their collateral. Theoretically, by using RAI, a borrower avoids potential catastrophes.

For example… something like massive liquidations on MakerDAO that happened a year ago. Due to its slow and inefficient liquidation process, MakerDAO lost millions of dollars when Ethereum had a flash crash. An overwhelming number of liquidations stalled the system.

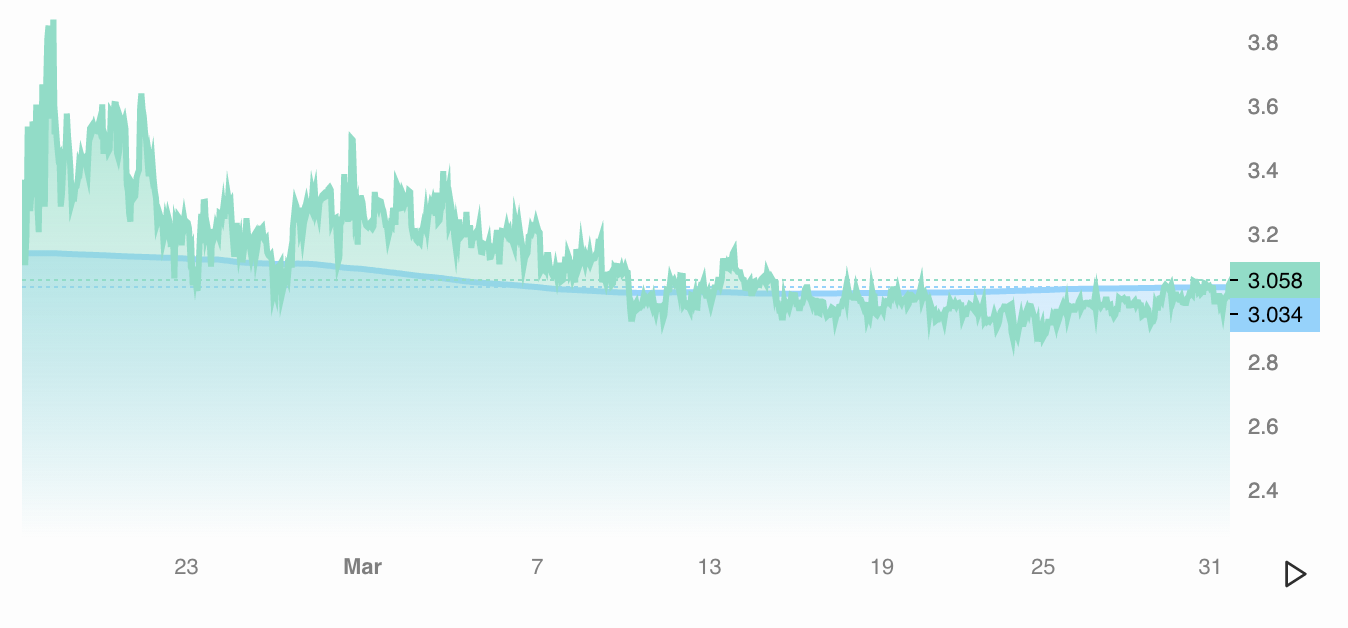

For now, the protocol does a good job of keeping the redemption price close to its market price.

RAI redemption price (blue) vs. the market price. Source: Reflexer Finance.

FLOAT

Like RAI, FLOAT isn’t pegged to anything and has a target price. The main difference between them is that Float Protocol uses auctions and a second token BANK to control FLOAT’s price.

Without getting into the technicalities, the Float protocol either buys or sells FLOAT depending on how the market price deviates from the target price. This reduces the price volatility in the short-term but creates pressures on the target price in the long term.

The team behind FLOAT thinks that USD-pegged stablecoins aren’t optimal because the purchasing power of the US dollar is eroded by the Fed’s extensive money printing.

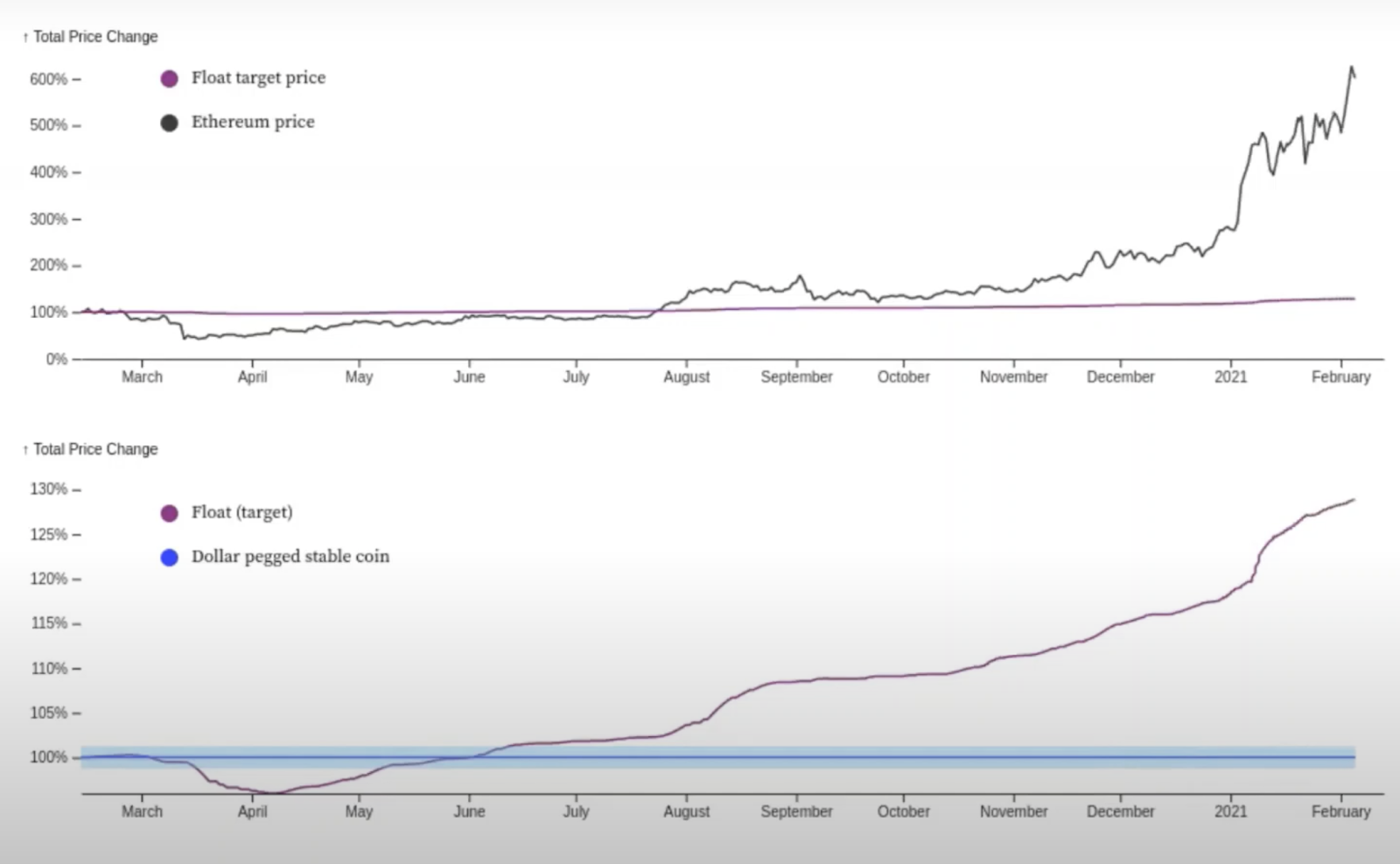

FLOAT, on the other hand, should reflect how the demand for crypto in general fluctuates. This happens because the target price slowly adjusts to the collateral price, which can be ETH, wrapped BTC or any other crypto currency.

In other words, if crypto expands further and the prices skyrocket, FLOAT will slowly climb too. A 7x increase in ETH will cause a 20% increase in FLOAT. It may not appear like a lot, but remember—this is where you park your money, it is not meant to be a speculative investment.

FLOAT target price simulations. Source: Float Protocol.

Both systems don’t come without risks and, as their predecessors like Ampleforth show, may not work as intended under certain circumstances. However, these protocols make much more sense when it comes to ensuring stability.

Surely, it’s good to have a familiar USD denominator when trading and investing in the crypto space. However, we should look more broadly at what stability means on this market.

After all, cryptocurrencies have the potential to replace many aspects of the traditional financial system. So, why should we rely on traditional stability metrics?

Disclosure: The author of this newsletter holds Bitcoin and Ethereum. Read our trading policy to see how SIMETRI protects its members against insider trading.