The Fed Ain’t Scared.

Over the past few months, the Fed’s unprecedented printing has been a central point of macroeconomic discussion. As we’ve discussed in the earlier issues of the Digest, injecting vast amounts of money into the economy can accelerate inflation.

Investors across the globe are closely watching the Fed. Even small policy changes can have ripple effects across the world economy. It is possible to measure the bank’s impact on inflation by watching indicators such as the growth of long-term yields on government bonds. The recent statements by Jerome Powell, for example, brought clarity about the Fed’s strategy.

As Powell recently said, the Fed isn’t going to raise rates unless the U.S. reaches maximum employment and average inflation remains above 2% consistently. Given the current economic landscape, reaching these two conditions may take a while.

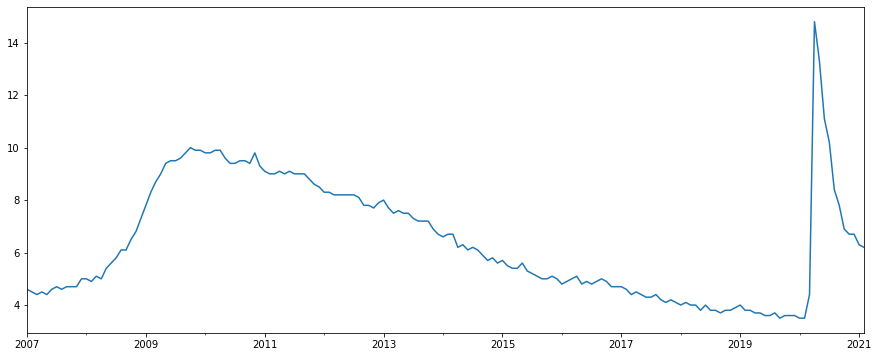

Although the unemployment rate has dropped tremendously since last year’s spike, it remains at a relatively high level of 6.2%. This number won’t fall to pre-2020 levels overnight.

U.S. unemployment rate. Source: FRED.

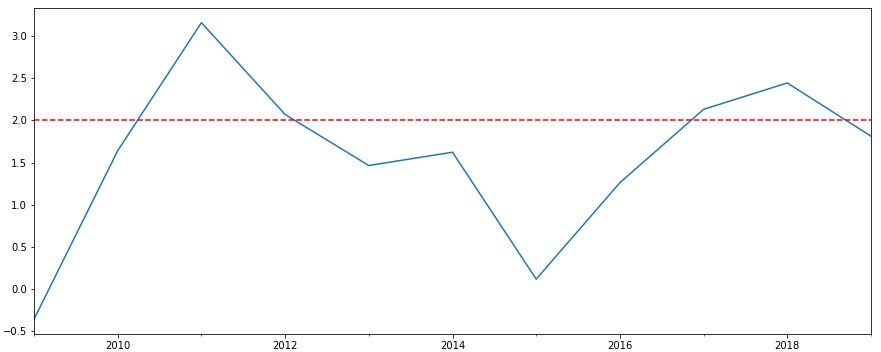

Inflation has also been below 2%, and pushing it over this threshold will take some time. The economy has to get back up to speed, and people need to start spending for inflation to manifest itself.

U.S. Annual Inflation. Source: FRED.

Still, some economists and market participants are concerned about whether the Fed will be able to remain on the sidelines for that long. Inflation is difficult to control if it goes out of bounds, and with that much new money in the economy right now, it may happen more quickly than the Fed expects.

The most effective method of restraining inflation is through interest rates. Raising these rates hurts speculative markets like equities and crypto. For now, we are safe, but that depends on whether things go according to the Fed’s scenario.

Given that the macroeconomic environment is somewhat positive let’s look more closely at Bitcoin.

The market has been under pressure this week. One of the main reasons is the expiration of over $5 billion in BTC options today. The point of the most pain for these options was $44,000.

Deribit summary on BTC options. Source: Twitter.

Now that the options have expired, there’s not much pressure on Bitcoin, so we’re likely to see some growth for the market in the coming weeks.

Moreover, as our lead Bitcoin analyst, Nathan Batchelor, mentioned in his latest newsletter, CME reveals some solid bets being placed for $65,500 next month and $70,000 in May. It’s bullish in the mid-term since the options market has provided a very reliable indication of Bitcoin’s future price path since October last week.

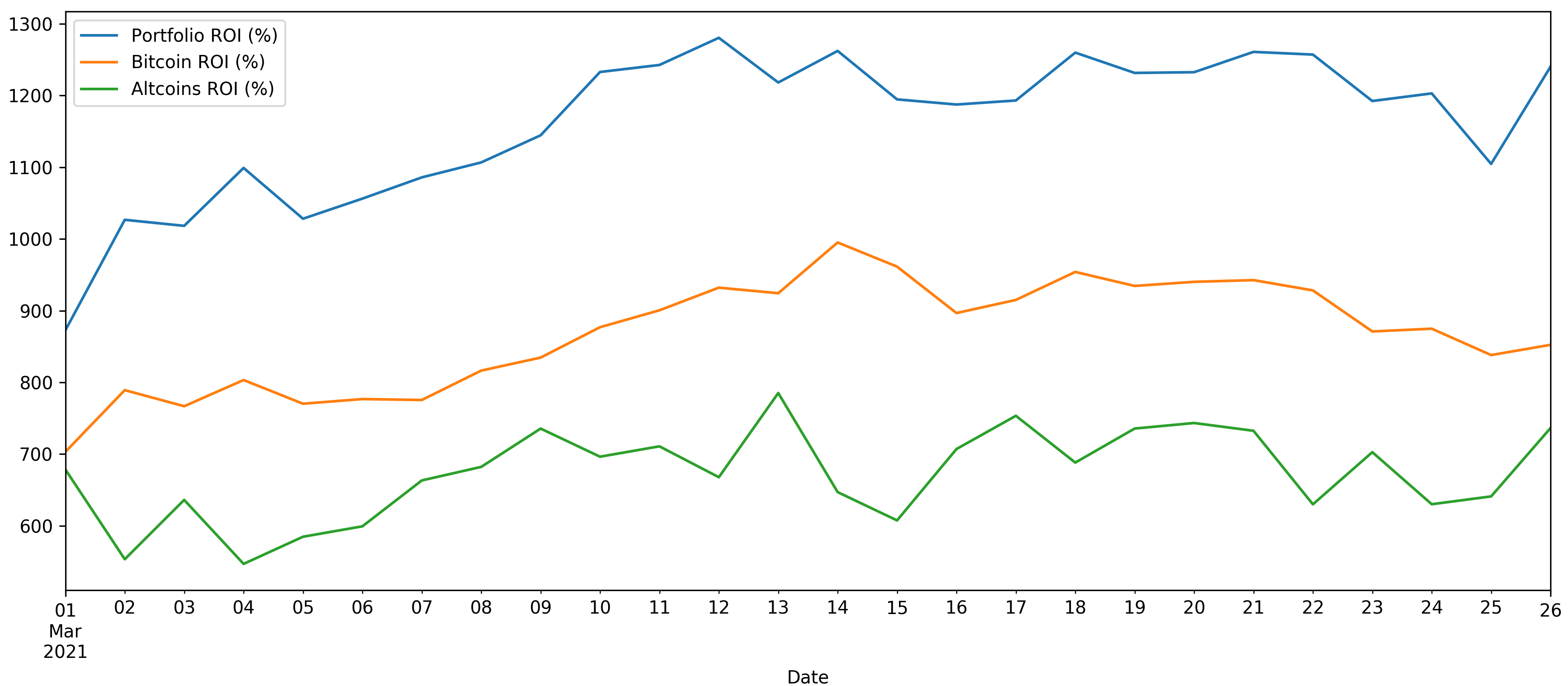

SIMETRI Portfolio – Faster than the Market

SIMETRI Portfolio consistently shows better performance than the rest of the market. As altcoins start to bounce, our portfolio shows a stronger leg up. Currently, our ROI is 3303%.